Finance

How To Use Quicken For Tax Planning

Published: January 20, 2024

Learn how to maximize your tax planning with Quicken. Take control of your finances and make informed decisions with this powerful finance tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances and preparing for tax season, having the right tools is crucial. Quicken is a powerful financial software that can help you stay organized, track your income and expenses, and maximize your tax deductions. In this article, we will explore how you can use Quicken for tax planning and make the most out of this versatile tool.

Quicken is a popular personal finance management software that allows you to track your income, expenses, investments, and more. With its comprehensive features, it provides you with the necessary tools to effectively manage your finances and plan for your taxes. Whether you are a freelancer, small business owner, or a salaried individual, Quicken can simplify the tax planning process and help you save both time and money.

By using Quicken for tax planning, you can have all your financial information in one place, making it easier to organize and analyze. The software allows you to categorize your income and expenses, track your deductions and credits, and even generate tax reports. This level of organization not only ensures accuracy but also provides valuable insights into your financial picture.

One of the main advantages of using Quicken for tax planning is the ability to efficiently manage your financial transactions. It enables you to take control of your income and expenses, ensuring that you have a clear record of your financial activities throughout the year. This makes it easier to identify tax-deductible expenses and maximize your deductions.

Additionally, Quicken allows you to track your investment transactions, which can be highly beneficial for tax planning purposes. By monitoring and categorizing your investment income, dividends, and capital gains, you can accurately calculate your tax liability and take advantage of any available investment-related tax benefits.

Furthermore, Quicken offers a range of built-in tax tools that can simplify the tax planning process. From estimating your tax liability to checking for tax errors and inconsistencies, these tools can help you identify potential issues and make necessary adjustments before filing your return.

In addition to its feature-rich interface, Quicken also allows you to import your tax data from external sources, such as tax preparation software. This seamless integration ensures that all your financial information is up-to-date and easily accessible in one place, eliminating the hassle of manual data entry and potential errors.

Whether you are an individual taxpayer or a business owner, effective tax planning is essential for optimizing your financial situation. By utilizing the powerful tools and features of Quicken, you can streamline your tax planning process, ensure accuracy, and potentially find opportunities for additional savings.

In the following sections, we will delve into the specific steps for setting up Quicken for tax planning, tracking income and expenses, monitoring deductions and credits, generating tax reports, and utilizing the built-in tax tools. Additionally, we will provide some tips for maximizing your tax planning efforts with Quicken. So let’s get started and take your tax planning to the next level with Quicken!

Overview of Quicken

Quicken is a comprehensive financial management software that helps individuals and businesses track and analyze their finances. It offers a wide array of features to help you manage your income, expenses, investments, and budgets. With its user-friendly interface and robust functionality, Quicken has become a go-to tool for many people seeking to take control of their financial lives.

One of the key benefits of using Quicken is its ability to gather all your financial information in one place. By syncing with your bank accounts, credit cards, and investment portfolios, Quicken can automatically import your transactions and update your balances. This not only saves you time and effort but also provides an up-to-date snapshot of your financial situation.

Quicken offers various versions to cater to different needs, including Quicken Starter, Deluxe, Premier, and Home & Business. Each version comes with specific features and capabilities to meet individual and business requirements.

Here are some of the standout features of Quicken:

Expense Tracking:

Quicken allows you to effortlessly track your income and expenses by categorizing them appropriately. By assigning categories to your transactions, you can easily monitor your spending habits, identify areas where you can cut costs, and create a budget that aligns with your financial goals.

Investment Management:

If you have investments, Quicken’s investment management features will come in handy. It enables you to track your investment portfolio’s performance, analyze historical data, and keep an eye on your asset allocation. Additionally, it can generate investment reports that provide insights into your investments’ growth and potential tax implications.

Budgeting:

Quicken’s budgeting tools empower you to set financial goals and monitor your progress towards them. By creating a budget, you can plan your spending, track your expenses against your budgeted amounts, and identify areas of overspending. Quicken’s budgeting feature also allows you to categorize and track your expenses and income based on different time frames, such as monthly, quarterly, or annually.

Bill Management:

Never miss a bill payment again with Quicken’s bill management functionality. It can help you track and schedule your bills, set reminders, and ensure that you stay on top of your financial obligations. With this feature, you can avoid late fees and maintain a good credit score.

Tax Planning:

Quicken offers tools and features specifically designed to assist with tax planning. You can track tax-deductible expenses, monitor your charitable contributions, and generate tax reports that provide a detailed breakdown of your financial activity. These features can simplify the tax preparation process and help you maximize your tax deductions.

Mobile App:

Quicken also has a mobile app that allows you to access your financial information on the go. Whether you’re checking your account balances, reviewing transactions, or updating your budget, the mobile app provides the flexibility and convenience of managing your finances anytime, anywhere.

Overall, Quicken provides a comprehensive suite of financial management tools that can help individuals and businesses stay organized, make informed financial decisions, and achieve their monetary goals. From tracking expenses to planning for taxes and managing investments, Quicken offers the functionality and flexibility needed to take control of your financial life.

Setting Up Quicken for Tax Planning

Before you can start using Quicken for tax planning, you need to ensure that it is properly set up to meet your tax-related needs. Here are the essential steps to get started:

1. Choose the Right Quicken Version:

Make sure you have the correct version of Quicken that includes tax planning features. The Deluxe, Premier, and Home & Business versions are typically suitable for tax planning purposes.

2. Set Up Your Accounts:

Start by setting up your financial accounts in Quicken. This includes linking your bank accounts, credit cards, investment accounts, and any other relevant accounts. By connecting these accounts, Quicken can automatically import your transactions and keep them up to date.

3. Customize Categories:

Review and customize the default categories in Quicken to match your specific tax needs. This will help you track expenses and deductions accurately. Consider creating categories for common tax deductions such as mortgage interest, medical expenses, and charitable contributions.

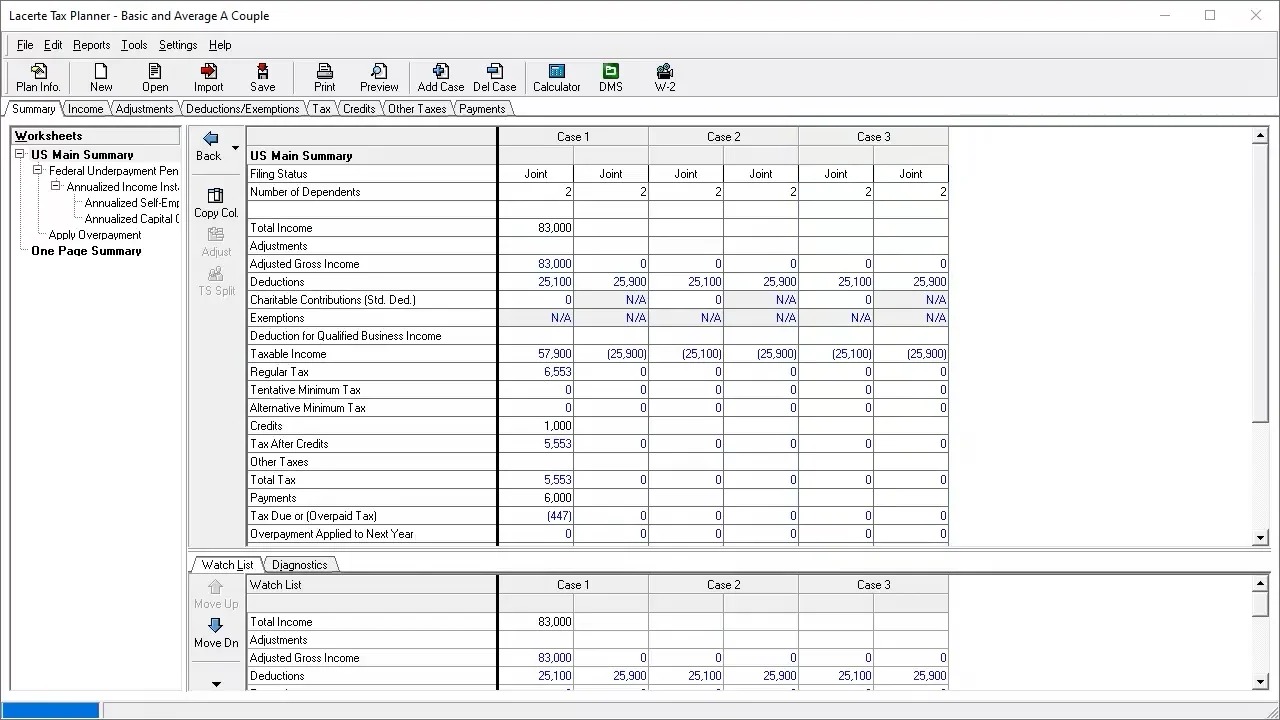

4. Configure Tax Settings:

Go to the Tax Planner section in Quicken and configure the tax settings according to your tax situation. Enter your filing status, deductions, and any other relevant information. Quicken will use this information to calculate your estimated taxes and provide you with accurate tax reports.

5. Update Tax Rates:

Ensure that the tax rates in Quicken are up to date. You can usually find updated tax rates online or consult with a tax professional to obtain accurate tax rate information for your jurisdiction.

6. Adjust Paycheck Withholding:

If you are employed and receive a paycheck, you may need to adjust your withholding to align with your tax planning goals. Quicken can help you estimate your tax liability and guide you on adjusting your withholding to optimize your tax situation.

7. Enable Tax Tools:

Take advantage of Quicken’s built-in tax tools. These tools can help you identify potential tax deductions and errors, suggest strategies for better tax planning, and provide valuable insights into your financial situation.

By following these steps and customizing Quicken to align with your tax planning needs, you will be well-equipped to use the software effectively for your tax-related activities. With Quicken’s powerful features and comprehensive functionality, you can streamline your tax planning process, reduce errors, and maximize your tax deductions.

Adding Income and Expenses

One of the core features of Quicken is its ability to track your income and expenses, providing you with a clear picture of your financial standing. When it comes to tax planning, accurately recording your income and expenses is crucial. Here’s how you can effectively add income and expenses in Quicken:

Add Income:

To add income in Quicken, start by accessing the “Income” section within the software. Here, you can manually enter your income details, such as salary, freelance earnings, rental income, and any other sources of income you have. Ensure that you categorize each income transaction appropriately to better track and analyze your earnings for tax purposes.

Alternatively, you can set up direct connections to your bank accounts, credit cards, and other financial institutions within Quicken. This allows for automatic import of income transactions, saving you time and ensuring accuracy in recording your income. Be sure to review and categorize any newly imported income transactions to keep your records organized.

Add Expenses:

Tracking and categorizing your expenses accurately is essential for effective tax planning. Quicken provides various methods to add your expenses:

Manual Entry:

You can manually enter your expenses into Quicken by accessing the “Expenses” section. Make sure to include all relevant transaction details, such as the date of the expense, the vendor or payee, and the payment method. Additionally, assign the appropriate expense category to each transaction, such as utilities, travel, office supplies, or any other relevant categories for tax deductions.

Importing Transactions:

If you have connected your financial accounts to Quicken, you can easily import your expenses from these accounts. Quicken will automatically download and categorize transactions, saving you from the hassle of manual data entry. However, it is still important to review and categorize imported transactions to ensure accuracy and proper organization.

Receipt Capture:

Quicken also offers receipt capture functionality. Using your smartphone or scanner, you can capture images of your receipts and attach them to respective transactions within Quicken. This helps in keeping an organized record of your expenses, making it easier to substantiate and validate your deductions come tax time.

Regardless of the method you choose, remember to categorize your expenses accurately and consistently. This will allow you to track your spending habits, identify tax-deductible expenses, and generate accurate reports for tax planning purposes.

By diligently adding your income and expenses in Quicken, you not only ensure accurate financial records but also lay the groundwork for effective tax planning. With Quicken’s robust tracking features, you can easily monitor your cash flow, identify potential deductions, and make informed financial decisions to optimize your tax situation.

Tracking Deductions and Credits

When it comes to tax planning, tracking deductions and credits is essential. Quicken provides robust tools to help you accurately monitor and maximize these tax benefits. Here’s how you can effectively track deductions and credits in Quicken:

Categorize Expenses:

Start by categorizing your expenses properly in Quicken. Assign categories that align with the IRS guidelines for deductions. Common categories include medical expenses, business expenses, charitable contributions, and mortgage interest. By categorizing your expenses, you can easily identify and track eligible deductions.

Tag and Label Transactions:

In addition to categorizing expenses, use tags or labels to further organize your transactions. You can create specific tags for deductions, such as “Tax-Deductible” or “Potential Deduction.” This will make it easy to filter and locate relevant expenses when it’s time to claim deductions for tax purposes.

Attach Receipts:

To substantiate your deductions, it’s important to keep a record of supporting documents, such as receipts and invoices. Quicken allows you to attach scanned or digital copies of receipts to respective transactions. By doing so, you can maintain a digital filing system that simplifies the process of verifying deductions during tax preparation.

Utilize Tax Reports:

Quicken offers a range of tax reports that provide a comprehensive overview of your financial activities. These reports can help you identify potential deductions and tax credits. The Tax Summary report, for example, highlights your total income, deductions, and credits. The Tax Schedule report provides details on specific deductions and expenses. Regularly generate and review these reports to stay informed and make strategic decisions regarding your tax planning.

Track Charitable Contributions:

If you make charitable contributions, utilize Quicken’s Charitable Contribution Tracker. Enter details of your donations, such as the organization, date, and amount. Quicken can calculate the total amount of your charitable contributions, making it easier to claim deductions during tax season.

Monitor Home Office Expenses:

If you have a home office and qualify for the home office deduction, Quicken can help you monitor expenses related to your home office. Track mortgage or rent payments, utilities, maintenance costs, and other eligible expenses. Properly categorize and record these expenses to accurately claim the deduction when filing your taxes.

Stay Informed on Tax Law Changes:

Tax laws and regulations can change from year to year. Stay updated on the latest tax law changes and ensure that Quicken’s deduction and credit categories align with the current regulations. This will help you accurately track deductions and credits based on the most recent tax rules.

By effectively tracking your deductions and credits in Quicken, you can ensure a streamlined and organized tax planning process. Utilize the software’s categorization, tagging, and reporting features to monitor your expenses, maximize your tax benefits, and make informed decisions to optimize your tax situation.

Monitoring Investment Transactions

For individuals with investment portfolios, monitoring investment transactions is crucial for both financial management and tax planning. Quicken offers robust tools that allow you to stay on top of your investments and accurately track investment-related activities. Here’s how you can effectively monitor investment transactions in Quicken:

Connect Investment Accounts:

Start by connecting your investment accounts to Quicken. This includes brokerage accounts, retirement accounts, and any other investment platforms you utilize. By doing so, Quicken can automatically import your investment transactions, including purchases, sales, dividends, and capital gains.

Categorize Investment Transactions:

Once your investment transactions are imported, ensure you categorize them appropriately. Quicken provides pre-defined categories for different types of investment activities, such as buying or selling stocks, receiving dividends, and reinvesting dividends. Assign the correct categories to each transaction to accurately track your investment-related income and expenses.

Track Cost Basis:

Tracking the cost basis of your investments is essential for accurate tax reporting and capital gains calculations. Quicken allows you to enter the cost basis of each investment when recording transactions. Keeping this information updated ensures that you have the correct basis for calculating capital gains or losses when you sell investments.

Monitor Investment Performance:

Quicken’s investment tracking features allow you to analyze your investment performance over time. You can view performance metrics, such as overall return, annualized return, and investment growth. Monitoring your investment performance can help you make informed decisions, assess the tax implications of different investments, and adjust your portfolio strategy, if needed.

Generate Investment Reports:

Quicken offers various investment reports that provide insights into your investment activity, holdings, and performance. Utilize these reports to gain a comprehensive view of your investments, analyze historical data, and identify potential tax implications. The Capital Gains report, for example, can help you assess your taxable gains and losses for tax planning purposes.

Pay Attention to Reinvestment:

If your investments offer dividend reinvestment or capital gains reinvestment options, accurately record these transactions in Quicken. Documenting the reinvestment ensures that your cost basis and overall investment performance are properly tracked. This information is crucial when it comes to calculating taxes and assessing the profitability of your investments.

Stay Informed About Tax Rules:

Tax rules regarding investments can be complex and subject to change. Stay informed about current tax rules and ensure that your investment transactions in Quicken align with the latest regulations. This will help you accurately report investment income, losses, and capital gains when preparing your taxes.

By diligently monitoring your investment transactions in Quicken, you can gain valuable insights into your investment performance, accurately report investment income, and make informed decisions. Utilize the software’s investment tracking features, generate investment reports, and stay updated on tax rules to optimize your investment strategy and tax planning.

Generating Tax Reports

Generating tax reports is an essential step in tax planning and preparation. Quicken offers a range of tax reports that provide a comprehensive breakdown of your financial activities, deductions, and credits. These reports can assist you in accurately reporting your income, identifying potential tax savings, and streamlining the tax filing process. Here’s how you can effectively generate tax reports in Quicken:

Access the Tax Center:

Start by accessing the Tax Center in Quicken. This dedicated section contains all the tools and reports you need for tax planning and preparation.

Run the Tax Summary Report:

The Tax Summary report is a comprehensive overview of your financial activity for the tax year. It displays your total income, deductions, and credits, providing you with a clear snapshot of your tax situation. The report breaks down each category, making it easy to identify potential areas for tax savings and ensure accurate reporting.

Review Transaction Detail Reports:

Transaction Detail reports provide a more granular view of your financial activity. These reports list all the transactions within specific categories, such as medical expenses, charitable contributions, or business expenses. Reviewing these reports allows you to verify the accuracy of your deductions and ensure you have the necessary documentation to support them.

Generate Investment Reports:

If you have investment accounts, generating investment reports can provide valuable insights for tax planning purposes. Quicken offers reports such as Capital Gains and Unrealized Gains/Losses. These reports help you assess your taxable gains, losses, and potential tax implications when it comes to selling investments.

Run Tax Schedule Reports:

Tax Schedule reports allow you to view your financial activity based on specific tax schedules or forms. This includes reports for Schedule C (self-employment income and expenses), Schedule D (capital gains and losses), and Schedule E (rental income and expenses). These reports provide a detailed breakdown of income, expenses, and deductions related to each tax schedule, simplifying the tax filing process.

Export Reports for Tax Preparation:

Quicken enables you to export your tax reports to popular tax preparation software such as TurboTax or H&R Block. This seamless integration saves you time and reduces the chance of manual data entry errors when it’s time to prepare and file your taxes.

Save and Archive Reports:

It’s important to save and archive your tax reports for record keeping and future reference. Quicken allows you to save reports in various formats, such as PDF or Excel, making it easy to access and share them when needed. Archiving these reports ensures that you have historical tax data readily available for audit purposes or future tax planning.

By generating tax reports in Quicken, you can gain a comprehensive understanding of your financial activity, identify potential tax savings, and ensure accurate reporting. Utilize the software’s tax reporting features to streamline the tax preparation process, save time, and maximize your tax planning efforts.

Utilizing Quicken Tax Tools

Quicken offers a range of built-in tax tools that can simplify the tax planning process and help you optimize your tax situation. These tools provide valuable insights, identify potential errors or inconsistencies, and offer suggestions for better tax planning. Here’s how you can effectively utilize Quicken’s tax tools:

Tax Planner:

The Tax Planner tool in Quicken allows you to estimate your tax liability based on your financial information. It takes into account your income, deductions, and credits to provide an estimate of your tax obligation for the year. By utilizing the Tax Planner, you can assess how different scenarios or changes in your financial situation may impact your taxes and make informed decisions accordingly.

Tax Estimator:

Quicken’s Tax Estimator tool helps you estimate your federal and state income tax liability. It takes into account your income, deductions, and credits to provide an estimate of what you may owe in taxes. The Tax Estimator allows you to explore various tax planning strategies, analyze the impact of specific transactions or events on your taxes, and make informed decisions to minimize your tax burden.

Tax Errors and Alerts:

Quicken’s tax tools can alert you to potential errors or inconsistencies in your tax data. It can identify missing information, duplicate entries, or inaccurate calculations that may affect your tax return. By addressing these errors before filing your taxes, you can ensure the accuracy and integrity of your return, avoiding potential penalties or audits.

Tax Deduction Finder:

Quicken’s Tax Deduction Finder helps you identify potential deductions based on your financial transactions and categorization. It can highlight expenses that may be eligible for tax deductions based on IRS guidelines. By utilizing this tool, you can uncover deductions you may have overlooked, maximizing your tax savings and reducing your tax liability.

Tax Payment Reminders:

Quicken features tax payment reminders to help you stay organized and ensure timely payment of your estimated taxes. By setting up reminders, you can avoid penalties and interest charges associated with late or underpayment of taxes.

Tax Resources and Guidance:

Quicken provides access to various tax resources and guidance within the software. This includes information on tax strategies, tax law changes, and general tax planning advice. By utilizing these resources, you can stay informed about current tax rules and regulations, make informed decisions, and optimize your tax planning efforts.

By effectively utilizing Quicken’s tax tools, you can streamline your tax planning process, ensure accurate calculations, and maximize your tax savings. These tools provide valuable insights, identify potential errors or deductions, and guide you on making informed decisions to optimize your tax situation.

Importing Tax Data into Quicken

Quicken offers the convenience of importing tax data from external sources, such as tax preparation software or tax documents received from employers or financial institutions. Importing tax data into Quicken streamlines the process of organizing financial information and ensures accuracy in tracking your income, expenses, and deductions. Here’s how you can effectively import tax data into Quicken:

Tax Document Import:

If you receive tax documents, such as W-2s, 1099s, or other tax forms from your employer or financial institutions, Quicken allows you to easily import these documents. The software typically supports common tax document file formats, such as PDF or digital files provided by tax-preparation software. By importing these documents, you can seamlessly incorporate the relevant tax information into Quicken, reducing manual data entry and potential errors.

Connect with Tax Preparation Software:

Quicken offers integration with popular tax preparation software, such as TurboTax or H&R Block. By linking your Quicken account with these software programs, you can import tax data directly into Quicken. This integration saves time by eliminating the need to manually enter data, ensuring accuracy and consistency between your financial records and the tax software.

Sync with Accounting Software:

If you use accounting software to manage your financial transactions, Quicken can often sync with these programs. By syncing your accounting software with Quicken, you can seamlessly transfer tax-related data, such as income and expense records, into Quicken. This process helps maintain consistency between your accounting records and tax planning activities.

Importing Investment Tax Information:

For individuals with investment portfolios, Quicken provides the ability to import investment-related tax information. This includes importing transaction data, cost basis information, and dividend or interest income earned from various investments. By importing this data, you ensure accuracy in tracking investment-related income and deductions, streamlining tax reporting and planning processes.

Review and Categorize Imported Data:

After importing tax data into Quicken, it’s essential to review and categorize the imported transactions. Ensure that each transaction is appropriately categorized to reflect the nature of the income, expense, or deduction accurately. Take the time to verify the imported data against your own records, making any necessary adjustments or corrections to ensure accuracy in your financial records and tax preparation.

Regularly Update Imported Data:

It’s important to regularly update imported tax data in Quicken, especially if you receive ongoing tax documentation throughout the tax year. By regularly updating the imported data, you maintain the accuracy and completeness of your financial records, allowing you to effectively track your income, expenses, and deductions for tax planning purposes.

By importing tax data into Quicken, you can streamline the process of organizing your financial information for tax planning and reporting. The software’s integration capabilities allow for seamless transfer of information, reducing manual data entry, saving time, and ensuring accuracy in your financial records and tax planning efforts.

Tips for Effective Tax Planning with Quicken

While Quicken offers powerful tools and features for tax planning, utilizing the software effectively can enhance your tax planning efforts even further. Here are some tips to make the most out of Quicken for effective tax planning:

1. Keep Your Quicken Data Up to Date:

Maintaining accurate and up-to-date financial records in Quicken is essential for effective tax planning. Regularly reconcile your accounts, categorize transactions promptly, and import tax-related data in a timely manner. This ensures that you have a complete and accurate snapshot of your financial situation, making it easier to identify deductions, track income, and estimate tax liability.

2. Use Quicken’s Budgeting Tools:

Quicken offers robust budgeting features that can assist with tax planning. Create a budget that aligns with your financial goals and tax planning strategies. Monitor your expenses against your budget to identify areas where you can reduce spending or increase tax-deductible expenses. Adjust your budget as needed to optimize your tax situation and stay on track with your financial objectives.

3. Leverage Quicken’s Reports:

Utilize Quicken’s reporting capabilities to gain insights into your financial activity and assess your tax situation. Generate Tax Summary reports, Transaction Detail reports, and Investment reports to understand your income, deductions, and potential tax liabilities. Regularly review these reports to identify tax-saving opportunities, track performance against goals, and validate the accuracy of your financial records.

4. Take Advantage of Automation:

Quicken offers automation features that can save you time and effort in your tax planning. Set up automatic transaction categorization, recurring bills, and investment updates. This ensures that your financial information is consistently and accurately recorded, making tax planning more efficient and reducing the chance of missing deductions or errors.

5. Stay Informed about Tax Laws and Changes:

Tax laws and regulations can change from year to year. Stay updated on new tax rules and guidelines that may affect your tax planning. Educate yourself about potential deductions, credits, and strategies that align with your financial situation. Quicken provides resources and guidance within the software, but it’s always beneficial to stay informed through additional sources.

6. Consult a Tax Professional:

While Quicken can provide valuable insights and tools for tax planning, it’s always wise to consult a tax professional for complex tax matters. They can help you navigate specific tax rules, assess the impact of different transactions on your taxes, and maximize your tax savings. A tax professional can work closely with your Quicken data to provide personalized advice and ensure compliance with tax regulations.

7. Regularly Back Up Your Quicken Data:

To protect your financial information and tax records, regularly back up your Quicken data. Create backups on separate storage devices or utilize cloud storage solutions. A backup ensures that you have a secure copy of your financial records in case of data loss or system failures, allowing you to restore your Quicken data and continue your tax planning seamlessly.

By following these tips, you can leverage Quicken to its fullest potential for effective tax planning. Quicken’s tools and features, coupled with proactive financial management practices, can help you maximize tax deductions, make informed decisions, and optimize your tax situation to achieve your financial goals.

Conclusion

Quicken is a powerful tool that can greatly simplify and enhance your tax planning efforts. By utilizing its comprehensive features, you can effectively track income, expenses, investments, and deductions, ultimately optimizing your tax situation. Whether you are an individual taxpayer or a small business owner, Quicken provides the necessary tools to organize your financial information, generate accurate tax reports, and make informed decisions.

Setting up Quicken for tax planning is the first step, ensuring that your accounts are properly connected, and tax settings are configured to reflect your specific tax situation. Categorizing income and expenses accurately allows for better tracking and analysis, while tagging and labeling transactions help in identifying potential deductions.

When it comes to investment transactions, Quicken provides the means to monitor and categorize them, track cost basis, and generate investment reports. These features empower you to assess your investment performance, calculate taxable gains or losses, and make informed decisions about your investment strategy.

Quicken’s tax tools offer valuable features to estimate tax liability, identify deductions and credits, and detect potential errors. By utilizing these tools, you can ensure accuracy in your tax planning and improve your overall financial management.

Importing tax data into Quicken streamlines the process of organizing financial information and ensures consistency between your financial records and tax software or tax documents received. Regularly updating imported data and categorizing it accurately ensures the integrity of your financial records and eases tax reporting.

To make the most out of Quicken for tax planning, leverage its reporting capabilities, use the budgeting tools to track expenses and align your financial goals, and stay informed about tax laws and changes. Consulting a tax professional can provide additional guidance and personalized advice to optimize your tax planning strategy.

In conclusion, Quicken is a versatile and comprehensive financial management software that can be a valuable asset in your tax planning journey. By organizing your financial information, tracking income and expenses, monitoring investments, and utilizing the built-in tax tools, you can streamline your tax planning process, maximize deductions, and make more informed financial decisions. With Quicken by your side, you can navigate the complexities of tax planning with greater ease and confidence.