Finance

Why Are Common Size Financial Statements Used

Published: December 23, 2023

Common Size Financial Statements are widely used in finance to analyze and compare financial data, helping businesses gain insights into their performance and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to analyzing financial data, businesses and investors often rely on various tools and techniques to gain valuable insights. One such tool that is widely used in the world of finance is the common size financial statement. Common size financial statements provide a helpful way to compare and analyze financial data by expressing each item as a percentage of a base figure.

In simple terms, common size financial statements present financial data in a standardized format that allows for easy comparison across different time periods or companies. By expressing each line item as a percentage of a common base, financial analysts can identify trends, patterns, and relationships that might not be as apparent when examining raw data. This analysis technique is especially useful for uncovering key insights about a company’s financial health and performance.

The main purpose of utilizing common size financial statements is to provide a clearer picture of the relative proportions of different components within a financial statement. It enables financial analysts to identify areas of strength or weakness, evaluate changes over time, and make informed decisions based on the analysis.

Common size financial statements are generally used in tandem with other financial analysis techniques to provide a more comprehensive view of a company’s financial situation. While they may not be the sole determinant of a company’s performance, they offer valuable insights when combined with other financial metrics and ratios.

In this article, we will explore the definition of common size financial statements, explain how common size analysis is conducted, highlight the benefits of using common size financial statements, discuss the limitations of common size analysis, and provide an example to demonstrate the practical application of this technique. By the end of this article, you will have a solid understanding of why common size financial statements are an essential tool in financial analysis.

Definition of Common Size Financial Statements

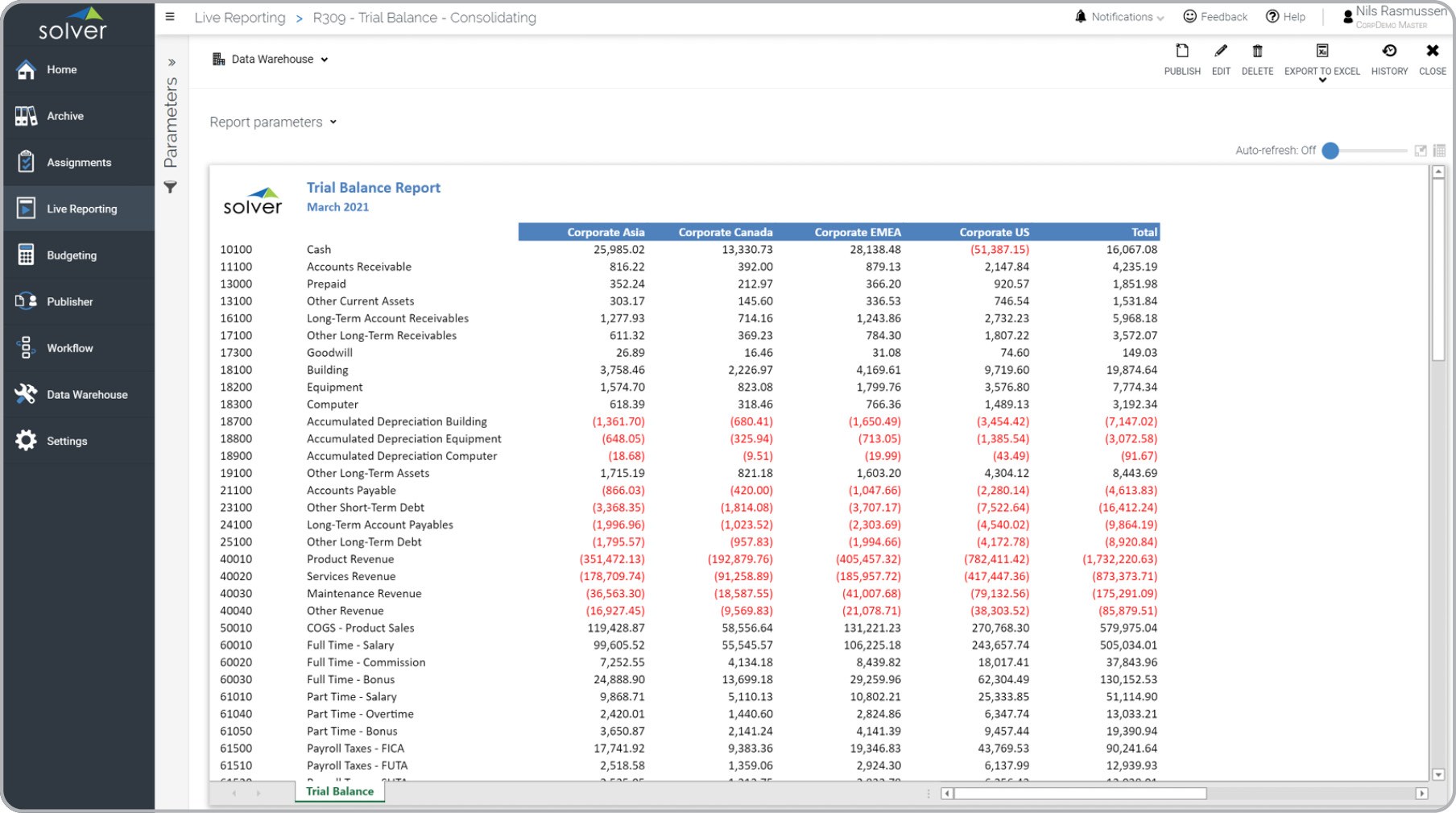

Common size financial statements, also known as vertical analysis, are a type of financial report that presents the financial data of a company in a standardized format. In common size financial statements, each line item is expressed as a percentage of a common base, usually total assets in the balance sheet or net sales in the income statement.

The objective of common size financial statements is to provide a proportional breakdown of each item within a financial statement, allowing for easier comparison and analysis. By expressing the values as percentages, common size financial statements remove the effect of scale and allow for a more meaningful evaluation of the financial data.

For example, in a common size balance sheet, each asset and liability item is expressed as a percentage of total assets, while in a common size income statement, each line item is expressed as a percentage of net sales.

Common size financial statements are useful in comparing financial data across different time periods for the same company, as well as between different companies operating within the same industry. They help identify trends, patterns, and anomalies in a company’s financial position.

By using common size financial statements, financial analysts can easily identify if certain items have grown or declined in proportion to a base figure. This information can shed light on a company’s financial structure, profitability, efficiency, and risk exposure.

It is important to note that common size financial statements do not provide absolute values or monetary amounts. Instead, they focus on the relative proportions and relationships between different components of a financial statement. This allows for a more standardized and systematic way of comparing companies and evaluating their financial performance.

Common size financial statements are widely used in financial analysis, including by investment analysts, credit rating agencies, and internal corporate finance teams. They are a powerful tool for assessing a company’s financial health, conducting industry comparisons, and making informed decisions based on the findings.

Explanation of Common Size Analysis

Common size analysis is a method of financial statement analysis that involves the use of common size financial statements to examine the relative proportions and relationships between different line items. By expressing each item as a percentage of a base figure, common size analysis helps to identify trends, patterns, and anomalies in a company’s financial data.

The process of conducting common size analysis involves the following steps:

- Prepare the common size financial statements: The first step is to convert the raw financial statements into common size financial statements. This involves expressing each line item as a percentage of a common base, such as total assets in the balance sheet or net sales in the income statement.

- Analyze the common size financial statements: Once the common size financial statements are prepared, financial analysts can begin the analysis. They examine the percentage breakdown of each line item to identify any significant changes or trends over time. This analysis can be done for multiple time periods to track the company’s performance.

- Compare the common size financial statements: Common size analysis is most powerful when used to compare financial statements of the same company across different time periods or against industry peers. By comparing the common size financial statements, analysts can identify areas of strength or weakness and measure the company’s performance against benchmarks.

- Interpret the findings: The next step is to interpret the findings of the common size analysis. Analysts look for any notable patterns, such as a consistent increase in a particular expense item or a declining trend in profitability. These insights can help identify areas that require further investigation or improvement.

- Make informed decisions: Finally, based on the findings of the common size analysis, financial analysts can make more informed decisions. They can use the insights gained from the analysis to assess the financial health and performance of the company and make strategic decisions related to budgeting, forecasting, investments, or risk management.

Common size analysis is a valuable tool in financial statement analysis as it provides a standardized and systematic way to evaluate a company’s financial data. It allows for meaningful comparisons, highlights trends, and offers insights into a company’s financial structure and performance. By conducting common size analysis, businesses and investors can make more informed decisions and navigate the complexities of the financial landscape.

Benefits of Using Common Size Financial Statements

Common size financial statements offer several benefits to financial analysts, investors, and businesses. By presenting financial data in a standardized format and expressing each line item as a percentage of a common base, common size financial statements provide valuable insights and facilitate a more accurate comparison of data. Here are some of the key benefits of using common size financial statements:

- Easy Comparison: Common size financial statements allow for straightforward comparison of financial data across different time periods or companies. By expressing each line item as a percentage of a common base, it becomes easier to identify trends, patterns, and changes over time.

- Focus on Relative Proportions: Common size financial statements focus on the relative proportions and relationships between different components of a financial statement. This removes the effect of scale and allows for a more meaningful analysis of a company’s financial structure and performance.

- Identification of Trends and Anomalies: Common size analysis enables financial analysts to identify trends and patterns that may not be apparent when examining raw financial data. By examining the percentage breakdown of each line item, analysts can pinpoint areas of growth, decline, or potential anomalies.

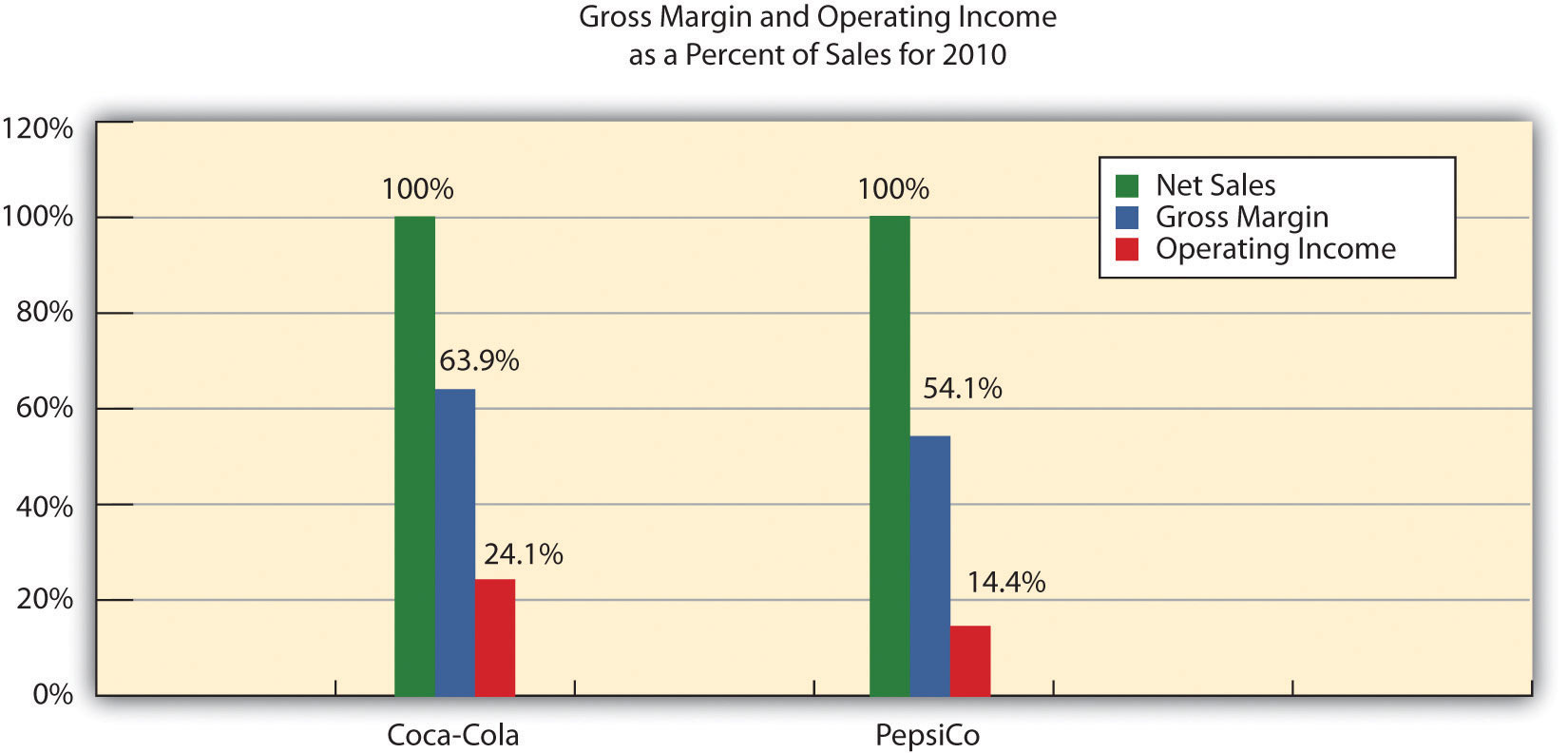

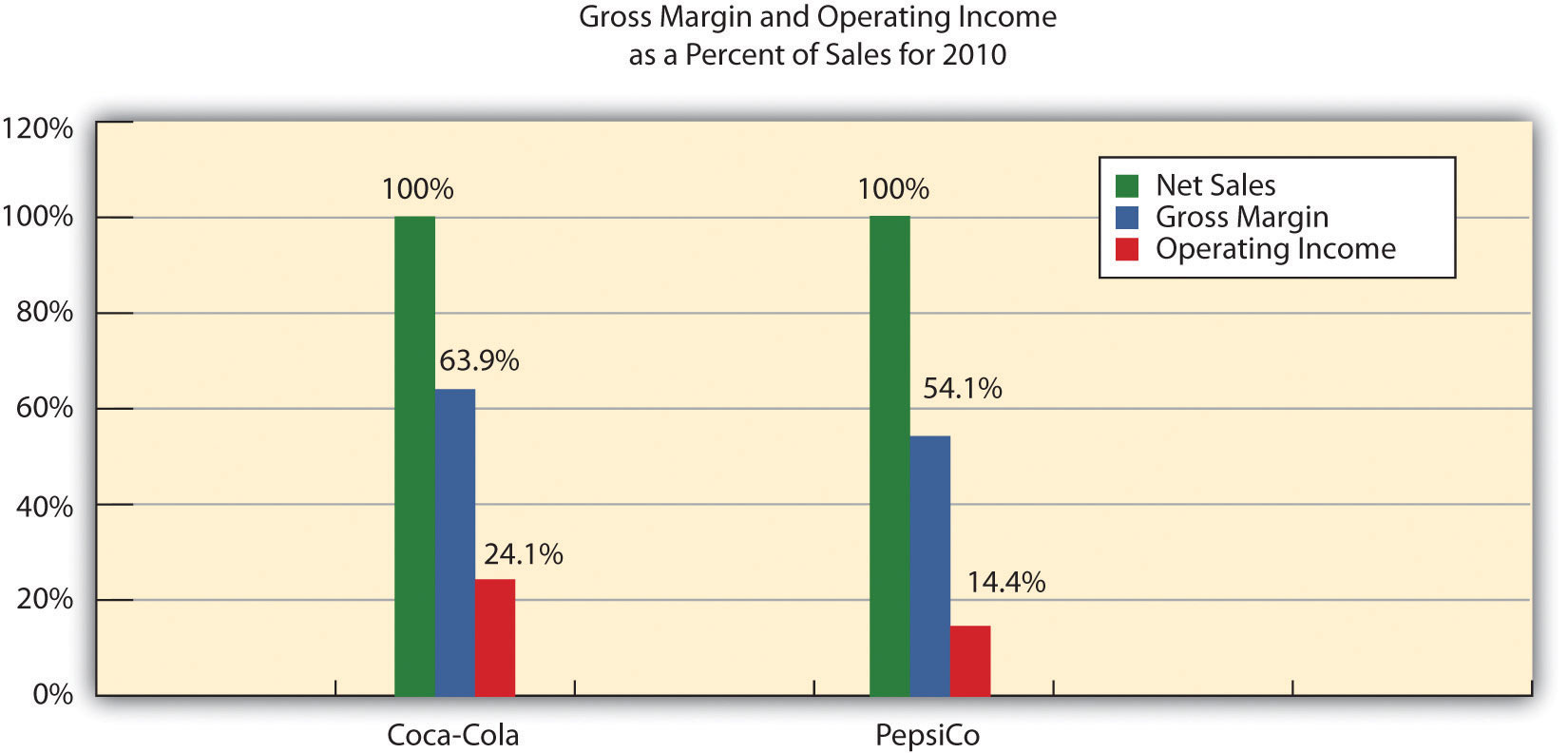

- Industry Comparisons: Common size financial statements are particularly useful in comparing the financial performance of companies operating within the same industry. By using a standardized format, analysts can easily compare the financial ratios and proportions of various companies to gain insights into their relative positions.

- Highlighting Strengths and Weaknesses: Common size analysis helps to highlight the strengths and weaknesses of a company’s financial position. By identifying areas with a higher or lower proportion compared to the base figure, analysts can determine where a company may excel or require improvement.

- Supporting Decision-Making: Common size financial statements provide valuable information for decision-making. By analyzing the common size financial statements, businesses and investors can make more informed decisions regarding budgeting, forecasting, investments, and strategic planning.

- Standardized Reporting: Common size financial statements provide a standardized format for reporting financial data, which facilitates consistency and comparability across different companies and industries. This enhances transparency and helps stakeholders easily interpret and interpret financial information.

Overall, common size financial statements offer a powerful analytical tool that enables financial analysts to gain valuable insights into a company’s financial performance. By utilizing this analysis technique, businesses and investors can make more informed decisions, assess the financial health of a company, and have a clearer understanding of the relative proportions and relationships within a financial statement.

Comparison of Financial Statements

When analyzing financial data, comparing financial statements is a crucial step in understanding a company’s performance and financial health. Common size financial statements play a significant role in facilitating this comparison by presenting financial information in a standardized format. Here are some key points to consider when comparing financial statements:

- Year-over-Year Comparison: Comparing financial statements across different time periods for the same company provides insights into the company’s performance over time. By analyzing the common size financial statements, changes in proportions and trends can be identified, allowing for a better understanding of the company’s growth, profitability, and efficiency.

- Industry Comparisons: Comparing financial statements of different companies within the same industry can reveal valuable insights about a company’s position in the market. Common size financial statements allow for a standardized comparison, helping to determine how a company’s financial ratios and proportions stack up against its peers.

- Benchmarking: By comparing a company’s common size financial statements to industry benchmarks, financial analysts can assess the company’s performance in relation to industry standards. This analysis helps in understanding where the company stands in terms of key financial metrics and can highlight areas where improvements may be needed.

- Identifying Outliers: Comparing financial statements can help identify outliers or anomalies in a company’s financial data. Unusual fluctuations in proportions or ratios can indicate potential issues or opportunities that require further investigation. By analyzing common size financial statements, these outliers become more apparent.

- Trend Analysis: Financial statement comparison facilitates trend analysis, allowing for the identification of patterns or changes in a company’s financial performance over time. By examining the percentage breakdown of each line item, financial analysts can identify whether certain proportions are consistently rising or declining, which can signal underlying changes in the company’s operations.

- Performance Evaluation: Comparing financial statements aids in evaluating a company’s financial performance. By comparing key financial ratios and proportions in common size financial statements, analysts can gauge the company’s profitability, liquidity, solvency, and efficiency. This analysis provides a comprehensive view of the company’s financial standing.

- Decision-Making: Comparative analysis of financial statements supports decision-making processes. By understanding the differences and similarities in financial performance between different companies or time periods, management can make informed decisions regarding investing, budgeting, cost management, and overall business strategy.

Overall, comparing financial statements, especially using common size analysis, is essential for understanding a company’s financial performance and position. It allows for meaningful comparisons within the company’s historical data and against industry benchmarks, providing insights to guide decision-making and strategic planning.

Limitations of Common Size Analysis

While common size analysis offers valuable insights into a company’s financial data, it is important to recognize its limitations. Understanding these limitations helps financial analysts and decision-makers to use common size analysis appropriately and interpret the results accurately. Here are some of the key limitations of common size analysis:

- Loss of Absolute Values: Common size analysis focuses on relative proportions and percentages, which means that the absolute values of line items are not considered. This can limit the understanding of the actual monetary amounts associated with each line item. It is crucial to use common size analysis in conjunction with other financial analysis methods to gain a comprehensive view of the company’s financial position.

- Limited Context: Common size analysis provides insights into the relative proportions within a financial statement, but it may not capture the complete context or underlying factors influencing those proportions. For a thorough analysis, it is essential to consider the specific circumstances of the company, industry trends, and macroeconomic factors.

- Uniform Base Figure: Common size analysis requires selecting a base figure for expressing each line item as a percentage. However, the choice of the base figure can impact the interpretation of the results. Different base figures can yield different percentages and ratios, potentially leading to inconsistent comparisons. Careful consideration should be given to selecting the most appropriate base figure for meaningful analysis.

- Omission of Non-Financial Factors: Common size analysis focuses solely on financial data and does not consider non-financial factors that may be equally important in understanding a company’s performance. Factors like market share, customer satisfaction, and employee engagement, among others, can significantly impact a company’s overall success and should be taken into account alongside financial metrics.

- Reliance on Accurate Financial Statements: Common size analysis relies on the accuracy and integrity of the financial statements. If the financial statements contain errors or are manipulated, the results of the common size analysis will be skewed and may not reflect the company’s true financial position. It is crucial to ensure the accuracy and reliability of the financial statements before conducting any analysis.

- Lack of External Benchmarking: While common size analysis allows for industry comparisons, it may not provide a comprehensive view of a company’s performance relative to external benchmarks, such as market trends or competitor analysis. Incorporating external benchmarking alongside common size analysis can provide a more holistic assessment of a company’s financial performance.

- Static Analysis: Common size analysis provides a snapshot of a company’s financial position at a specific point in time, but it does not capture the dynamic nature of businesses. It is important to consider the historical trends and potential future changes to accurately assess a company’s performance and prospects.

Despite these limitations, common size analysis remains a valuable tool in financial analysis when used in conjunction with other methods and with proper consideration of the specific context and circumstances surrounding a company. It helps reveal important insights into a company’s financial structure and performance, but should be complemented with a comprehensive approach to gain a more accurate and comprehensive understanding of the company’s overall health.

Example of Common Size Financial Statements

To understand how common size financial statements work in practice, let’s consider an example using a fictional company, XYZ Inc. We will focus on their income statement and balance sheet.

Income Statement:

| Amount (USD) | Percentage | |

|---|---|---|

| Net Sales | 1,000,000 | 100% |

| Cost of Goods Sold | 600,000 | 60% |

| Gross Profit | 400,000 | 40% |

| Operating Expenses | 200,000 | 20% |

| Net Income | 100,000 | 10% |

Balance Sheet:

| Amount (USD) | Percentage | |

|---|---|---|

| Assets | ||

| Cash and Cash Equivalents | 200,000 | 20% |

| Accounts Receivable | 100,000 | 10% |

| Inventory | 150,000 | 15% |

| Property, Plant, and Equipment | 500,000 | 50% |

| Total Assets | 1,000,000 | 100% |

| Liabilities and Equity | ||

| Accounts Payable | 100,000 | 10% |

| Short-term Debt | 50,000 | 5% |

| Long-term Debt | 200,000 | 20% |

| Equity | 650,000 | 65% |

| Total Liabilities and Equity | 1,000,000 | 100% |

In the income statement example above, each line item is expressed as a percentage of net sales. This allows us to see the proportional breakdown of each expense and profit margin. For instance, cost of goods sold represents 60% of the net sales, while the gross profit margin is 40%.

In the balance sheet example, we express each asset and liability as a percentage of total assets or total liabilities and equity, respectively. This helps us understand the composition of the company’s assets and liabilities. For example, cash and cash equivalents represent 20% of total assets, while long-term debt accounts for 20% of total liabilities and equity.

By using common size financial statements, analysts can easily identify trends, spot areas of strength or weakness in a company’s financial position, and make meaningful comparisons over time or against industry benchmarks. This analysis technique enhances insights into the company’s financial health and aids in decision-making.

Conclusion

Common size financial statements are powerful tools in financial analysis, allowing for a standardized and systematic evaluation of a company’s financial data. By expressing each line item as a percentage of a common base, common size financial statements provide valuable insights into the relative proportions and relationships within a financial statement. This analysis technique offers several benefits, including easy comparison of financial data, identification of trends and anomalies, industry comparisons, and highlighting strengths and weaknesses.

However, it is important to recognize the limitations of common size analysis. It focuses on relative proportions and may overlook non-financial factors, relies on accurate financial statements, and has limitations in terms of context and external benchmarking. Understanding these limitations helps in using common size analysis effectively and interpreting the results in the proper context.

In conclusion, common size financial statements are an essential tool for financial analysts, investors, and businesses. They provide a standardized format for presenting financial data, enabling meaningful comparisons and analysis. When used in conjunction with other financial analysis techniques, common size analysis contributes to a comprehensive understanding of a company’s financial health and performance. By leveraging the insights gained from common size financial statements, businesses and investors can make informed decisions, identify areas for improvement, and navigate the complexities of the financial landscape with greater confidence.