Finance

How To Read Your Credit Card Statement

Modified: September 6, 2023

Part of being a responsible credit cardholder is learning how to read your credit card statement. Here’s a breakdown of each part.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

If you have ever received a credit card statement, you have probably been met with a several terms and long strings of numbers that can be quite confusing. These terms and numbers are all important to understand, as they play a role in the calculation of your total credit card balance.

Whether you are receiving a credit card statement for the first time, or decided to up your credit score game, here is a breakdown of what’s in the credit card statement.

What Is A Credit Card Statement?

Photo by Blake Wisz on Unsplash

A credit card statement contains a summary and record of the charges you have made on your card in one billing cycle.

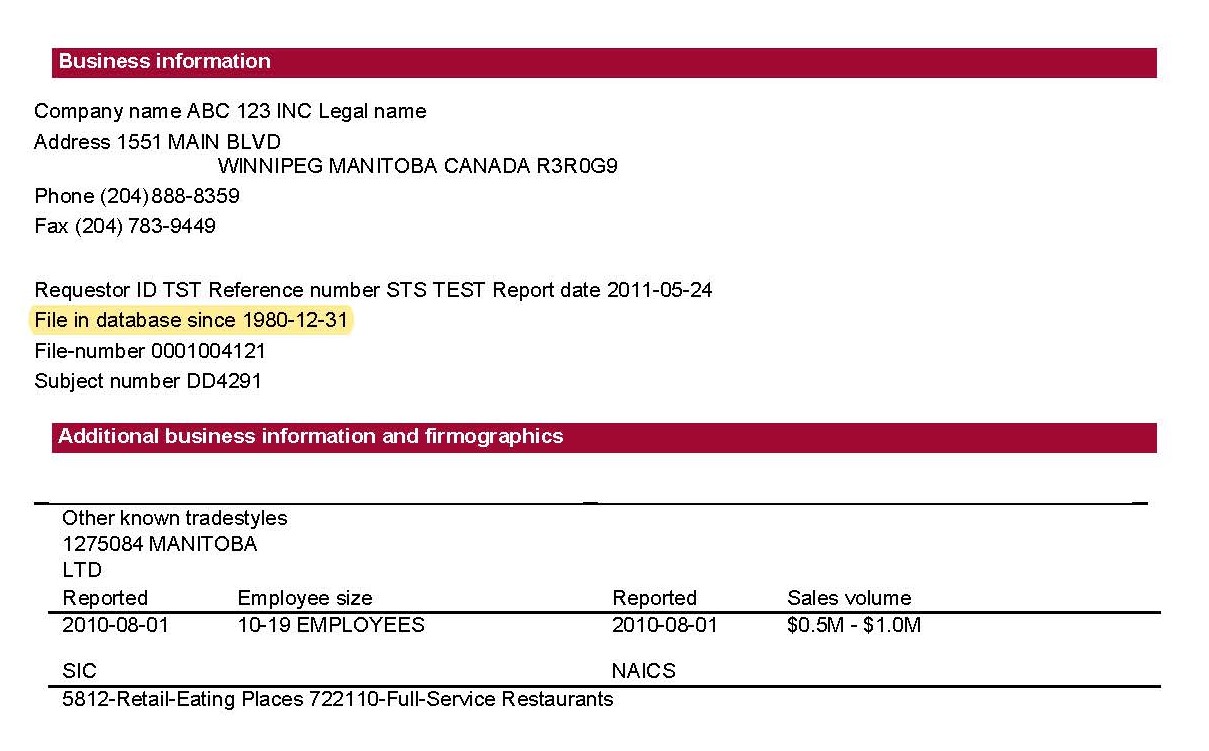

Account Summary

The account summary contains your credit card status and balances. This includes payment due dates, minimum amount due, and any other applicable other fees.

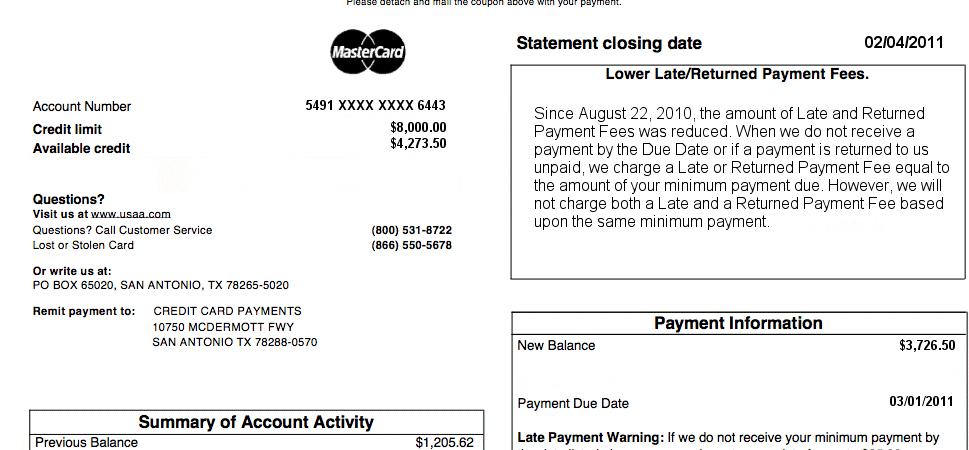

Photo from Wikimedia Commons

PAYMENT DUE DATE

It’s worth looking first at the payment due date, which doesn’t always fall on the same day of the month. Sometimes, even if you’ve settled the payment on the same day as the payment due date, there is a cutoff time to follow. They will process payments after the cutoff on the following business day.

MINIMUM AMOUNT DUE

The minimum amount due is the minimum amount that you need to pay by the payment due date. If you pay the minimum amount due, you will not be subject to any late fees.

However, as long as there is an unpaid balance in your credit card account, you are still subject to interest. Which is important to note as interest can rack up a substantial amount!

STATEMENT BALANCE (OR NEW BALANCE)

A statement balance is a full amount that you owe the credit card company, minus the payments you made on one billing cycle. A statement balance is also the amount reported to the credit bureaus.

CURRENT BALANCE (OR OUTSTANDING BALANCE)

The current balance is the amount you owe on one billing cycle. Since billing statements show one billing cycle, the changes you make after the billing may not reflect in the statement balance, but the current balance.

UNBILLED INSTALLMENT AMOUNT

When you make a big purchase, some stores will offer a zero-interest when you reach a certain amount. Usually, they allow you to pay a minimum amount within 3-6 months without adding interest. You will see the remaining amount that you need to pay in this section.

Photo by Austin Distel on Unsplash

Late Payment Warning

The late payment warning section shows you the additional fee and the higher interest rates if you have paid after the due date. It shows you the impact of your late payment, including a penalty increase.

Minimum Payment Warning

The idea is, when you pay the minimum payment each period, it will take you longer to settle the full amount. You also end up paying more interest than you should have.

Credit card issuers are now required to include a minimum payment warning on your statement. Including how long it will take you to pay the amount in full if you’re only paying the minimum.

While the bank warns you to pay at least the minimum, always settle your credit every month, or at least settle your current balance.

Notice Of Changes To Your Interest Rates

There are two scenarios where your interest increases. The first one being if you go over your credit limit. The second occurs should you be late making payment. Your bank should be able to inform you before the rate changes.

Important Changes To Your Account Terms

The issuing company should relay any significant changes made to your account to you at least 45 days before it takes effect. You will find any changes in your account terms in this section.

Transactions In One Credit Card Statement Cycle

The transaction contains the breakdown of all your expenses. You should be able to identify all the expenses. Otherwise, file a dispute as there may be an unauthorized transaction made to your account.

Fees, Interest Charge, Year-To-Date Totals

This section includes the total interest and other fees incurred for the whole year. Credit card issuers aren’t as rigid in adding fees. With a good credit history and with the right approach, you can negotiate with the bank to lower your account fees.

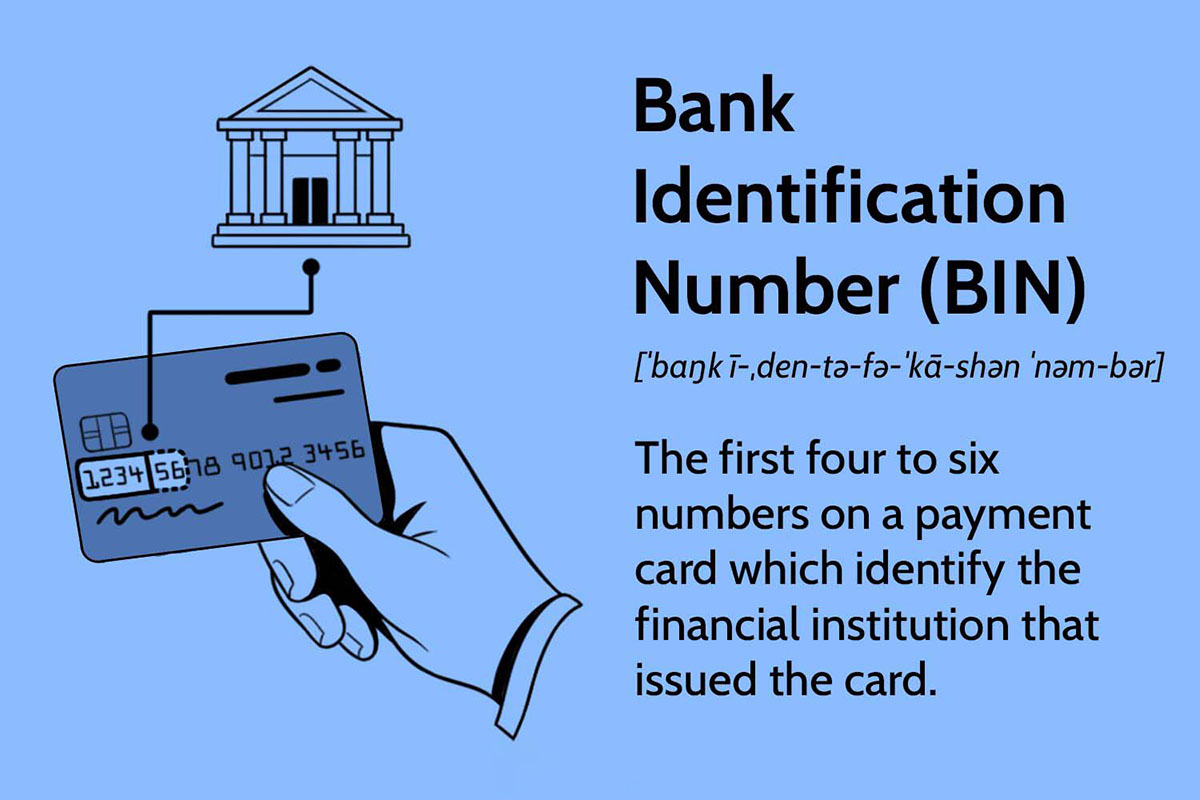

Interest Charge Calculation

You will also see a separate section for the monthly interest calculation for each type of transaction. While you know the issuing bank’s annual percentage rate (APR), they calculate not annually but daily. With that in mind, try making payments at least once or twice a month to lower interests charged on your card.

Payment Instructions

There should also be information on how and where you can pay your fees. In the worst case, your payment ends up in the wrong address.

Payment Address & Contact

The contact address is also useful for reporting any unauthorized transactions in your credit card account. If you suspect an unauthorized transaction in your card or see any errors in your billing statement, report it immediately to the credit card issuer.

In most banks, they require you to file a dispute within 60 days of getting the billing statement. Your bank should include a number or email address to contact in case this happens.

The Fair Credit Billing Act protects you in case the bank wasn’t able to resolve the dispute. The best way to do is to make a phone call and follow up with an official letter with proof that the bank has received it.

Rewards Summary

Photo by freestocks.org on Unsplash

Some banks offer a reward program to cardholders with a good credit score. This usually comes in the form of points, miles, or cashback. These rewards can usually be redeemed at supporting retailers!

Check with you credit card company which particular ones they offer promotions with, you could end up saving a substantial sum of money.

Some Additional Notes About Your Credit Card Statement

It’s another question on which credit card offers the best deals and lowest interest. You can find a comparison of the two most common credit cards issued by banks in this article.

In the case of receiving credit card statements, you should be able to receive them at least 21 days before the payment due. The law dictates this for cardholders to have enough time to make payments for your card and avoid changes.

A lot of credit card issuers, nowadays, automatically register you to receive online billing statements. You can even opt-out of receiving the actual statement and go paperless – save the environment. Just make sure that your credit card company or bank knows your current email address and/or physical address.

Where your account gets closed, you are still likely to receive your credit card statement until you paid off your debt. Even when you close your account because of the inability to make payments on time, you are still liable to make the payments together with the interest incurred.

In Conclusion…

Knowing how to read your credit card statement allows you to keep track of your expenses each month. Knowing how to use the information on your credit card statement, you can control debt, avoid fees, and even strategize how you can aim for a higher credit score. It also helps you spot fraudulent activities and unauthorized charges.