Finance

How To Use Zola Credit

Modified: March 1, 2024

Learn how to use Zola Credit to manage your finances effectively and gain control over your financial future. Practical tips and expert advice await!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Zola Credit?

- How to Apply for Zola Credit

- Eligibility Requirements

- Documents Needed

- Application Process

- Approval and Disbursement

- Repayment Options

- Using Zola Credit

- Making Purchases

- Paying Off the Balance

- Monitoring Credit Score

- Managing Account Settings

- Contacting Zola Credit Customer Support

- Tips for Using Zola Credit Responsibly

- Conclusion

Introduction

Welcome to the world of Zola Credit, a convenient and flexible financial solution that can help you manage your expenses and make purchases with ease. Whether you’re looking to fund a large purchase or simply need some extra cash flow, Zola Credit offers a hassle-free way to access the funds you need.

Zola Credit is a reputable online lending platform that provides individuals with a line of credit that they can use for various purposes. It is designed to offer financial support to individuals who may not have access to traditional bank loans or credit cards.

With Zola Credit, you can enjoy the convenience of a virtual credit card that you can use for online and in-store purchases. The application process is quick and straightforward, and funds can be disbursed within a matter of days, making it a popular choice for those looking for immediate financing options.

But before we dive into the application process and how to best utilize Zola Credit, let’s take a closer look at what exactly it is and how it can benefit you.

What is Zola Credit?

Zola Credit is a financial service that offers individuals a line of credit which they can use for various purposes. It operates through an online platform, making it convenient and easily accessible to users. Zola Credit provides an alternative to traditional bank loans and credit cards, offering flexible financing options to individuals who may not qualify for or prefer not to use those traditional methods.

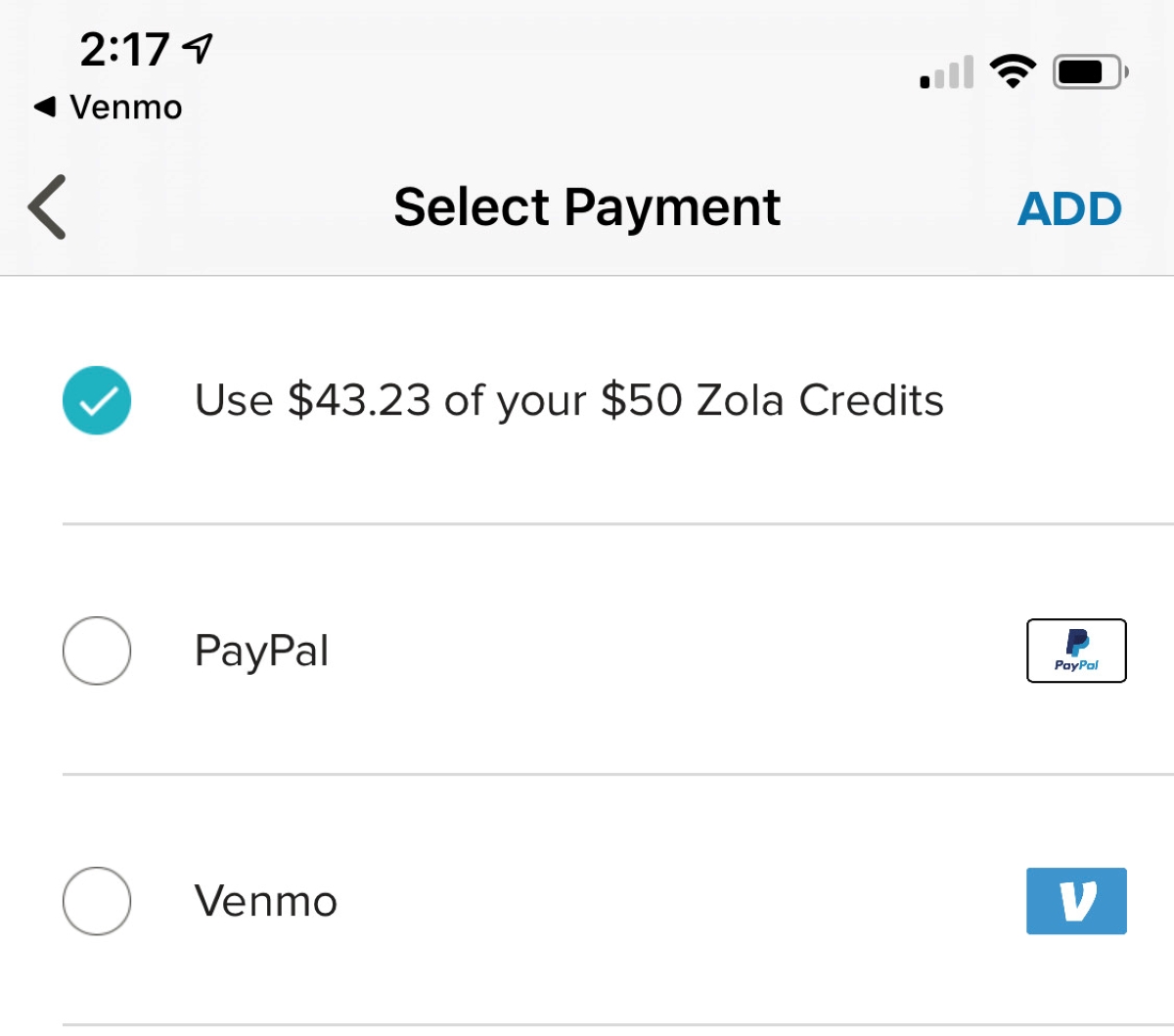

One of the key advantages of using Zola Credit is that it provides a virtual credit card that can be used for both online and in-store purchases. This means that you can enjoy the benefits of a credit card without the need for a physical card. Additionally, Zola Credit offers competitive interest rates, making it an affordable option for those in need of financial assistance.

Another notable feature of Zola Credit is its credit limit. Once approved, you will be granted a specific credit limit that you can utilize as needed. This provides you with the flexibility to manage your expenses and make purchases without the restrictions of a fixed loan amount.

Zola Credit also offers a user-friendly mobile app and online portal, allowing you to monitor your account, make payments, and access important information at your convenience. This level of convenience and accessibility sets Zola Credit apart from traditional lending institutions.

With Zola Credit, you can effectively manage your financial needs, whether it’s for emergency expenses, home improvements, or simply bridging the gap between paychecks. It is designed to provide individuals with a responsible and convenient way to access credit, helping them meet their financial goals and improve their overall financial well-being.

How to Apply for Zola Credit

Applying for Zola Credit is a simple and straightforward process. To get started, you’ll need to visit the Zola Credit website or download the mobile app from either the App Store or Google Play Store. From there, follow these steps:

- Sign up for an account: Provide your personal information such as your name, contact details, and social security number. This information is necessary for identity verification and to determine your eligibility for a line of credit.

- Complete the application: Once you’ve created an account, you’ll need to fill out the application form. This will require you to provide additional details about your employment, income, and other financial information. Zola Credit may also perform a soft credit check to assess your creditworthiness.

- Review and submit your application: Before submitting your application, take the time to review all the information you’ve provided to ensure its accuracy. Double-check that you’ve included all the necessary supporting documents and information to expedite the approval process.

- Wait for approval: After submitting your application, you’ll need to wait for Zola Credit to review and approve your request. This typically takes a few business days, but you may receive a decision sooner in some cases.

- Access your line of credit: If approved, you’ll receive notification of your approved credit limit. You can then access your line of credit through the Zola Credit mobile app or online portal. Zola Credit provides a virtual credit card that you can use for purchases.

It’s important to note that meeting the eligibility requirements and providing accurate information greatly increases your chances of approval. Additionally, keep in mind that Zola Credit may require additional documentation or information to verify your identity or financial situation during the application process.

Once you have been approved and have access to your line of credit, you can start using Zola Credit for your financial needs. However, it’s essential to use your credit responsibly and make timely payments to maintain a positive credit history and avoid any late fees or penalties.

Eligibility Requirements

In order to apply for Zola Credit, you must meet certain eligibility requirements. While specific criteria may vary, here are some general guidelines to consider:

- Age: You must be at least 18 years old to apply for Zola Credit.

- Residency: Zola Credit is currently available to residents of the United States.

- Income: Zola Credit may require a minimum income level to determine your ability to repay the credit. This ensures that you can manage the financial responsibility that comes with accessing a line of credit.

- Bank Account: You must have an active bank account in order to qualify for Zola Credit. This allows for loan disbursements and repayment transactions to be facilitated.

- Identification: You will need to provide a valid form of identification, such as a driver’s license or passport, to verify your identity.

- Creditworthiness: While Zola Credit is designed to provide financing options to individuals with varying credit profiles, your credit history and score may still be taken into consideration during the approval process. However, even individuals with less than perfect credit may still be eligible to apply and receive approval.

Meeting these eligibility requirements does not guarantee approval for a line of credit with Zola Credit. The final decision is based on a combination of factors, including income, creditworthiness, and other internal underwriting criteria.

It’s important to note that Zola Credit is committed to responsible lending practices and encourages users to borrow within their means and manage their credit responsibly. By doing so, you can build a positive credit history and improve your financial well-being over time.

Documents Needed

When applying for Zola Credit, you will typically be required to provide certain documents to support your application. These documents help verify your identity, income, and other relevant information. While specific document requirements may vary, common documents include:

- Valid Identification: You will need to provide a copy of a valid form of identification, such as a driver’s license, passport, or state-issued ID.

- Proof of Address: Zola Credit may require proof of your residential address. This can be accomplished by providing a recent utility bill, bank statement, or any official document that clearly displays your name and address.

- Proof of Income: To assess your ability to repay the line of credit, Zola Credit typically asks for proof of income. This can include recent pay stubs, bank statements, or tax documents.

- Bank Account Information: You will need to provide your bank account details, including the account number and routing number. This information is necessary for loan disbursements and repayment transactions.

- Additional Information: Depending on your specific circumstances, Zola Credit may request additional documents or information to support your application. This could include documents related to employment, assets, or any other relevant financial information.

It’s important to ensure that all the documents you provide are accurate and up-to-date. Inaccurate or incomplete documentation could delay the approval process or potentially lead to a rejection of your application.

Remember, the specific document requirements may vary based on your location, credit history, and other factors. Be sure to carefully review the application instructions provided by Zola Credit and contact their customer support if you have any questions or need clarification regarding the required documents.

Application Process

The application process for Zola Credit is designed to be quick and convenient. Here’s an overview of the typical steps involved:

- Create an account: Start by visiting the Zola Credit website or downloading the mobile app. Sign up for an account by providing your personal information, such as your name, contact details, and social security number. This information is necessary for identity verification.

- Fill out the application form: Once you’ve created an account, you will be prompted to fill out the application form. This will require you to provide details about your employment, income, and other financial information. The application form may also include questions about your desired line of credit, such as the amount you’re seeking.

- Submit supporting documents: After completing the application form, you may be required to submit supporting documents to verify the information provided. This can include documents such as identification, proof of address, proof of income, and bank account information. Make sure to gather and submit all the required documents accurately and completely.

- Review and submit: Before submitting your application, carefully review all the information you’ve provided to ensure its accuracy. Double-check that you’ve included all the necessary documents to support your application. Once you’re confident in the accuracy and completeness of your application, submit it for review.

- Wait for approval: After submitting your application, you will need to wait for Zola Credit to review and assess your application. The approval process typically takes a few business days, although some applicants may receive a decision sooner. Zola Credit may perform a soft credit check as part of the review process, but this will not impact your credit score.

- Receive your credit limit: If your application is approved, you will receive notification of your approved credit limit. This is the maximum amount that you can borrow from your line of credit. Your credit limit will depend on various factors, including your income, creditworthiness, and other internal underwriting criteria.

- Access your line of credit: Once you have been approved and have your credit limit, you can start accessing your line of credit. Zola Credit provides a virtual credit card that you can use for online and in-store purchases. You can access your credit card details and make payments through the Zola Credit mobile app or online portal.

It’s important to note that while the application process for Zola Credit is typically straightforward, meeting the eligibility requirements and providing accurate information greatly increases your chances of approval. Additionally, keep in mind that Zola Credit may require additional documentation or information during the application process to verify your identity or financial situation.

Should you have any questions or encounter any issues during the application process, don’t hesitate to reach out to Zola Credit’s customer support for assistance. They will be happy to guide you through the process and address any concerns you may have.

Approval and Disbursement

Once you have completed the application process for Zola Credit and have been approved for a line of credit, the next steps involve the approval and disbursement of funds. Here’s what you can expect:

Approval Process:

After you submit your application, Zola Credit will review your information and assess your creditworthiness. This process typically takes a few business days, although some applicants may receive a decision sooner. Zola Credit takes into consideration factors such as your income, employment history, and credit score, among other factors. It’s important to note that Zola Credit may perform a soft credit check during this process, which does not impact your credit score.

Once your application is approved, you will receive notification of your approved credit limit. This limit represents the maximum amount you can borrow from your line of credit.

Disbursement of Funds:

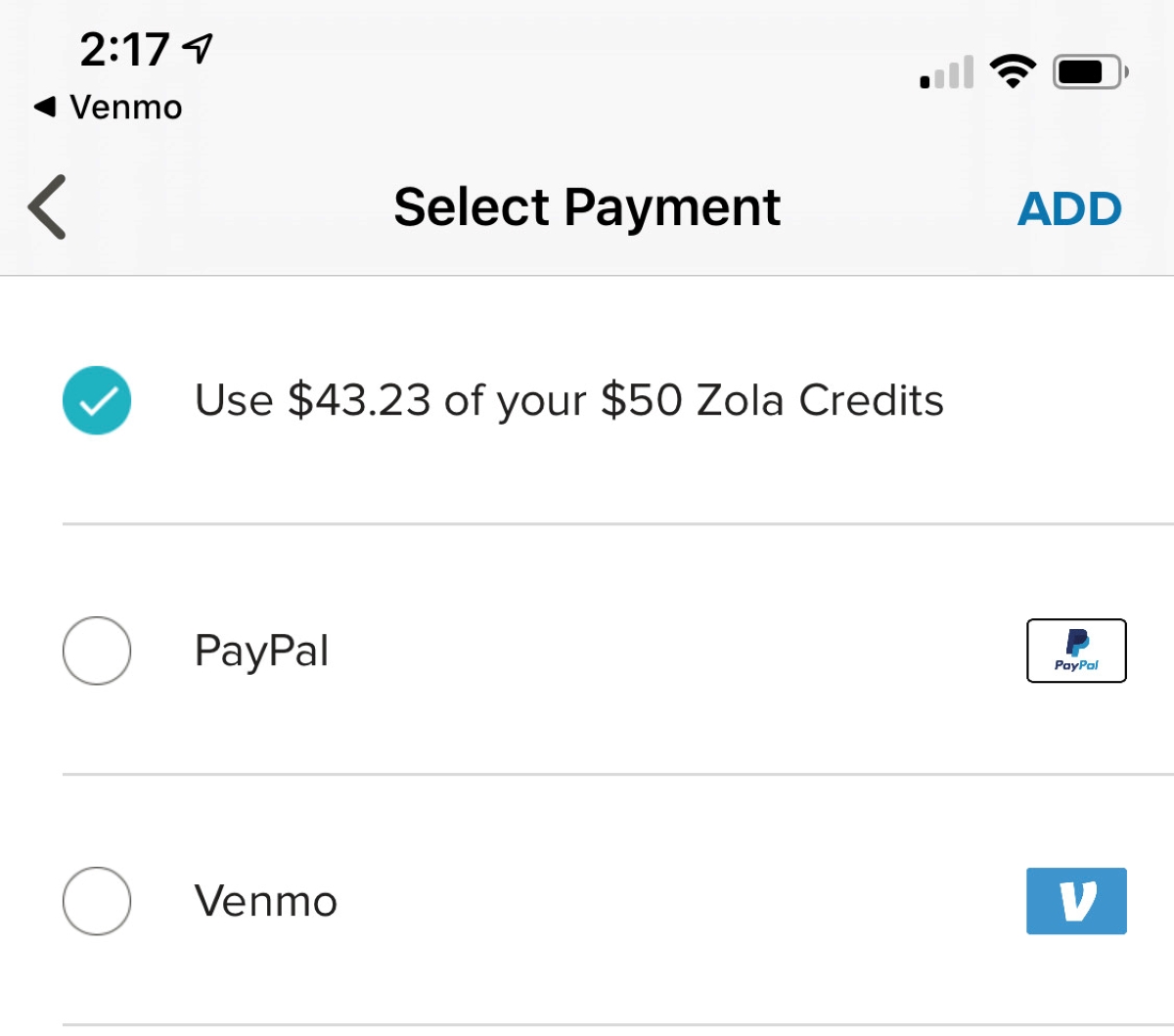

Once approved, you can access your funds through the Zola Credit mobile app or online portal. Zola Credit provides a virtual credit card that you can use for online and in-store purchases. You will be able to view your credit card details and make payments directly from the app.

You can use your Zola Credit line of credit to make purchases or withdraw cash, up to your approved credit limit. The funds can be disbursed to your designated bank account or used for payment directly through the virtual credit card.

It’s important to note that Zola Credit may charge fees for certain transactions or services, such as cash advances or late payment fees. Make sure to review and understand the terms and conditions associated with your Zola Credit line of credit to avoid any unexpected charges.

Repayment of Funds:

Repayment of your Zola Credit line of credit is flexible and convenient. You will receive monthly statements outlining your outstanding balance, minimum payment due, and due date. You can make manual payments directly from your bank account, or set up automated payments to ensure timely repayment.

Keep in mind that making timely payments is crucial to maintaining a positive credit history. It can also help you avoid any late fees or penalties associated with missed payments.

If you have any questions or concerns regarding your approval status, disbursement of funds, or repayment process, don’t hesitate to reach out to Zola Credit’s customer support. They will be able to provide further guidance and address any inquiries you may have.

Repayment Options

Zola Credit offers flexible repayment options to help you manage your line of credit effectively. Here are some key features and options available for repaying your Zola Credit balance:

Minimum Payment:

Each month, you will receive a statement that outlines your outstanding balance, minimum payment due, and due date. The minimum payment is the smallest amount you can pay to keep your account in good standing. It’s important to make at least the minimum payment by the due date to avoid any late fees or penalties.

Automatic Payments:

Zola Credit allows you to set up automatic payments. This can help ensure that your payments are made on time without the need for manual intervention. You can link your bank account to your Zola Credit account and authorize automatic withdrawals for the minimum payment or a fixed amount each month.

Pay in Full:

If you prefer to pay off your Zola Credit balance in full, you have the option to do so. Making the full payment allows you to avoid accruing interest on your outstanding balance and can help you maintain financial discipline.

Additional Payments:

In addition to the minimum payment, you can make additional payments towards your Zola Credit balance. Paying more than the minimum can help you reduce your outstanding balance faster and save on interest charges.

Early Repayment:

Zola Credit does not charge any prepayment penalties, so you have the flexibility to repay your line of credit early without any additional fees. Early repayment can help you save on interest and potentially improve your credit score by reducing your overall debt.

It’s important to note that Zola Credit charges interest on the outstanding balance of your line of credit. The interest rate and terms will vary depending on your approved credit limit, creditworthiness, and other factors. Make sure to review the terms and conditions associated with your Zola Credit account to understand the interest rates and any applicable fees.

Managing your repayment options responsibly is crucial to maintaining a positive credit history and improving your overall financial well-being. By making timely payments and keeping your credit utilization low, you can effectively manage your Zola Credit account while also potentially increasing your credit score over time.

If you have any questions or need assistance regarding your repayment options, don’t hesitate to contact Zola Credit’s customer support. They can provide guidance and answer any inquiries you may have.

Using Zola Credit

Once you’ve been approved for a line of credit with Zola Credit, you can start using it for various financial needs. Here are some key aspects to consider when using your Zola Credit:

Making Purchases:

Zola Credit provides a virtual credit card that can be used for both online and in-store purchases. You can access your virtual credit card details through the Zola Credit mobile app or online portal. Simply enter the card information at the checkout page for online purchases, or use the card for in-store payments wherever major credit cards are accepted.

When making purchases, it’s important to keep track of your spending and stay within your approved credit limit. Be mindful of your available credit and ensure that you can comfortably manage the repayment of any purchases made with Zola Credit.

Paying Off the Balance:

To maintain a healthy credit profile and avoid unnecessary interest charges, it’s important to make timely payments towards your Zola Credit balance. Zola Credit provides monthly statements with details on your minimum payment and due date. Set reminders or establish automatic payments to ensure you never miss a payment.

Monitoring Credit Score:

Using Zola Credit responsibly and making timely payments can help improve your credit score over time. Regularly monitor your credit score through credit monitoring services or obtain a copy of your credit report to keep track of your progress. As your credit score improves, you may become eligible for better loan rates and credit opportunities in the future.

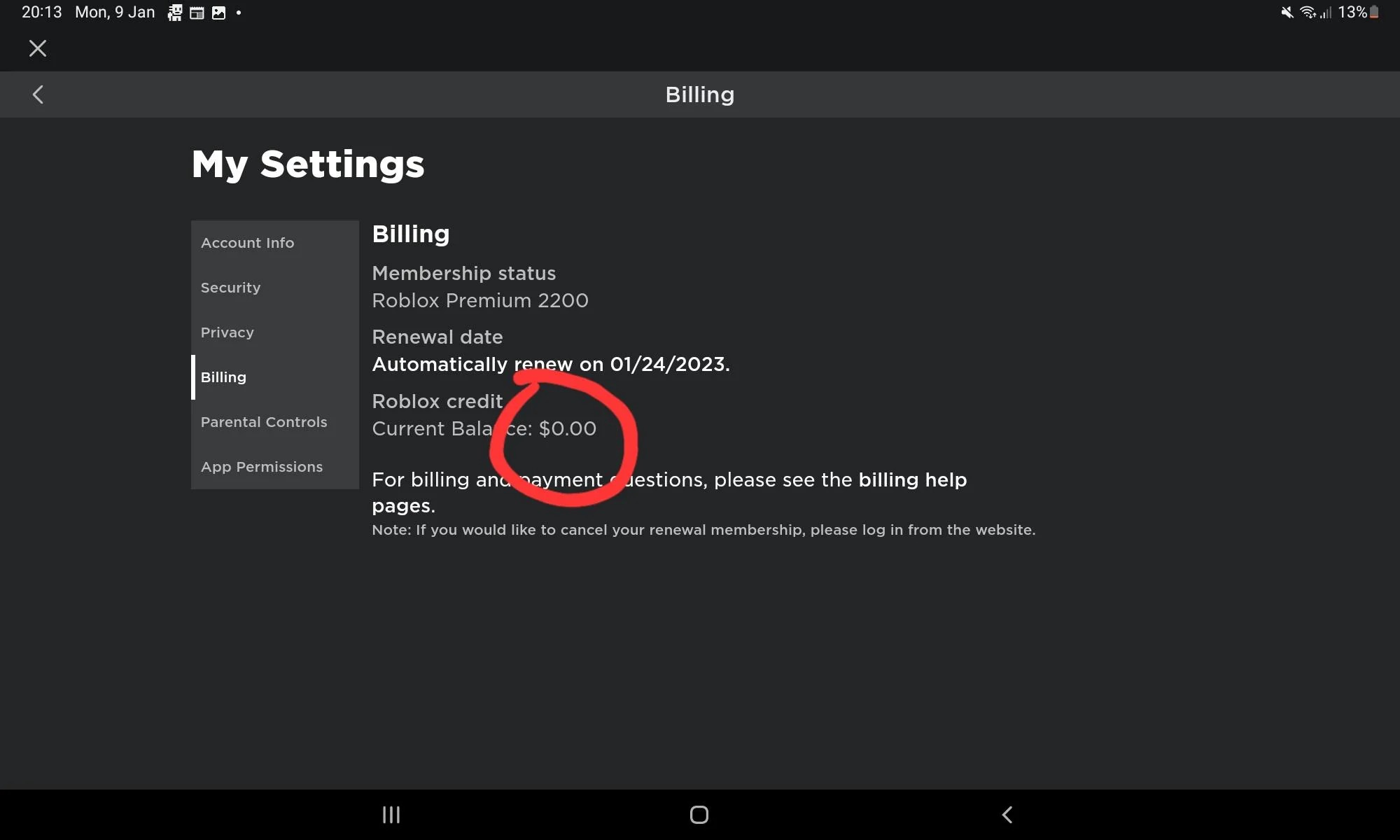

Managing Account Settings:

Zola Credit offers a user-friendly mobile app and online portal that allows you to manage your account settings. Utilize these platforms to update your personal information, view transaction history, set up payment preferences, and access important account information.

By staying on top of your Zola Credit account and regularly reviewing your account settings, you can ensure a smooth and efficient experience with the platform.

Contacting Zola Credit Customer Support:

If you have any questions, concerns, or need assistance while using Zola Credit, their customer support team is available to help. Whether you need clarification on transactions, have inquiries about payments, or require guidance on using the platform, reach out to their customer support channels for prompt assistance.

It’s important to use Zola Credit responsibly and manage your spending within your means. Utilize the resources provided by Zola Credit to monitor your credit usage, payments, and account activity to maintain a healthy financial profile.

Remember, responsible use of Zola Credit can contribute to your financial well-being and help you achieve your financial goals.

Making Purchases

When it comes to using Zola Credit for making purchases, you have the flexibility to use your virtual credit card for both online and in-store transactions. Here’s what you need to know:

Online Purchases:

When making online purchases, simply enter your Zola Credit virtual credit card details at the checkout page, just like you would with any other credit card. This includes providing the card number, expiration date, and security code. By doing so, you can conveniently complete your online transactions and enjoy the benefits of using a line of credit for your purchases.

In-Store Purchases:

Zola Credit provides a virtual credit card that can also be used for in-store purchases. The virtual credit card information can be accessed through the Zola Credit mobile app or online portal. To use it in-store, provide the cashier with the necessary card information, typically by showing them the card details on the mobile app or by manually entering the information at the payment terminal. This allows you to use your Zola Credit line of credit for in-person transactions, providing you with added convenience and flexibility.

Keep Track of Your Spending:

It’s important to keep track of your spending and stay within your approved credit limit when using Zola Credit. Regularly monitor your transactions through the Zola Credit mobile app or online portal to ensure that you are aware of your available credit and can manage your repayment obligations effectively.

By maintaining a clear understanding of your spending habits and being mindful of your credit limit, you can make informed purchasing decisions and avoid exceeding your means.

Utilize Payment Notifications:

Zola Credit offers payment notifications through their mobile app or online portal. You can set up custom notifications to receive alerts about upcoming payment due dates or reminders to track your spending. These notifications can serve as helpful reminders to ensure that you stay on top of your payments and maintain a healthy credit profile.

Regularly Review Your Statements:

Zola Credit provides monthly statements that outline your outstanding balance, minimum payment due, and due date. Take the time to review these statements and ensure their accuracy. Familiarize yourself with the terms and conditions of your Zola Credit account to understand any interest charges or fees associated with your purchases.

By staying proactive and monitoring your statements, you can stay on track with your payments and avoid any unexpected surprises.

Remember, responsible use of your Zola Credit line of credit is key. By making purchases within your means, staying within your approved credit limit, and making timely payments, you can effectively manage your account and enjoy the convenience and flexibility that Zola Credit offers.

Paying Off the Balance

Once you start using Zola Credit for your purchases, it’s important to have a plan in place to pay off your balance. Paying off the balance in a timely manner not only helps you avoid accumulating excessive interest charges, but it also allows you to maintain a healthy credit profile. Here are some tips for effectively paying off your Zola Credit balance:

Review Your Monthly Statement:

Zola Credit provides you with a monthly statement that details your outstanding balance, minimum payment due, and payment due date. Take the time to carefully review this statement to understand the amount you owe and the timeline for making your payment.

Make Timely Payments:

It’s crucial to make your payments on time to avoid late fees and penalties. Set reminders or automate your payments to ensure that you never miss a due date. By making timely payments, you can avoid unnecessary charges and maintain a positive payment history.

Pay More Than the Minimum:

While the minimum payment is the lowest amount you need to pay to keep your account in good standing, it’s advisable to pay more than the minimum whenever possible. By paying more, you can reduce your outstanding balance faster and potentially save on interest charges.

Create a Repayment Plan:

To effectively pay off your Zola Credit balance, it can be helpful to create a repayment plan. Determine how much you can comfortably afford to pay each month and set a goal to pay off your balance within a specific timeframe. Stick to your plan and adjust it as needed to accommodate any changes in your financial circumstances.

Avoid Additional Charges:

To keep your balance in check, avoid unnecessary fees or charges. This includes avoiding cash advances, which often come with higher interest rates and fees. Additionally, avoid exceeding your approved credit limit, as this can result in over-limit fees and potential damage to your credit score.

Monitor Your Account Activity:

Regularly monitor your Zola Credit account activity to ensure accuracy and identify any discrepancies. By staying vigilant, you can quickly address any issues and maintain the integrity of your account. Report any unauthorized transactions promptly to Zola Credit’s customer support for resolution.

Remember, responsible repayment is key to using Zola Credit effectively. By making timely payments, paying more than the minimum, and creating a repayment plan, you can successfully pay off your balance and maintain a positive credit history.

If you have any questions or need assistance regarding your payment options or repayment plan, don’t hesitate to reach out to Zola Credit’s customer support team. They can provide guidance and address any concerns you may have.

Monitoring Credit Score

Monitoring your credit score is an essential aspect of managing your financial health and making informed decisions. When using Zola Credit, it’s important to keep an eye on your credit score to gauge your progress and identify areas for improvement. Here’s how you can effectively monitor your credit score:

Check Your Credit Reports:

Regularly obtain copies of your credit reports from major credit bureaus such as Experian, Equifax, and TransUnion. Review these reports to ensure that the information is accurate and up-to-date. Look for any discrepancies, incorrect information, or suspicious activity that may impact your credit score.

Monitor Credit Monitoring Services:

Consider using credit monitoring services that provide real-time updates on changes to your credit profile. These services can alert you to any changes, such as new inquiries, account openings, or potential identity theft. Stay informed with these updates to proactively address any issues that may arise.

Track Credit Utilization:

Keep a close eye on your credit utilization ratio, which is the percentage of your available credit that you are using. With Zola Credit, it’s important to stay within your approved credit limit to maintain a healthy credit utilization. A high credit utilization ratio can negatively impact your credit score, so aim to keep it at a manageable level.

Make Timely Payments:

Consistently making your Zola Credit payments on time is crucial for maintaining a positive credit history. Late or missed payments can significantly impact your credit score. Keep track of your payment due dates and set reminders to ensure that you never miss a payment.

Pay Down Debt:

If you have other outstanding debts in addition to your Zola Credit balance, work towards paying them down. Reducing your overall debt can improve your credit utilization and show lenders that you are responsible in managing your finances.

Monitor Credit Score Changes:

Regularly check your credit score to track your progress. Most credit monitoring services provide access to your credit score, allowing you to see any changes and identify areas for improvement. Celebrate improvements in your credit score and use setbacks as motivation to continue practicing responsible financial habits.

Address Errors Promptly:

If you notice any errors or discrepancies on your credit reports or credit score, take immediate action to correct them. Contact the respective credit bureau to dispute inaccurate information or report any fraudulent activity. Promptly resolving these issues can prevent long-term damage to your credit profile.

By actively monitoring your credit score and taking steps to improve it, you can establish a solid foundation for your financial future. Regularly reviewing your credit reports, tracking credit utilization, making timely payments, and addressing any errors or discrepancies will help you maintain a healthy credit profile and improve your overall financial well-being.

Remember, building and maintaining good credit takes time and consistent effort. Be patient, stay disciplined, and make informed decisions when using credit, including your Zola Credit line of credit.

Managing Account Settings

Managing your account settings with Zola Credit is essential for staying on top of your financial responsibilities and maximizing the benefits of your line of credit. Here are some key aspects to consider when managing your Zola Credit account settings:

Personal Information:

Keep your personal information accurate and up-to-date. If any changes occur, such as a new address or contact number, ensure that you update your account settings accordingly. This helps ensure that you receive important notifications and correspondence from Zola Credit without any interruptions.

Notification Preferences:

Take advantage of Zola Credit’s notification settings to stay informed about your account activity. Customize your notification preferences to receive alerts for upcoming payment due dates, account updates, and transaction notifications. These notifications can help you stay on track with your payments and monitor your account for any suspicious activity.

Payment Preferences:

Manage your payment preferences to ensure that your payments are made in a way that works best for you. You may have the option to choose between manual payments or set up automatic payments from your bank account. Set reminders to ensure that you make timely payments and avoid any late fees or penalties.

Statement Access:

Choose how you want to receive your monthly statements from Zola Credit. You may have the option to receive statements electronically via email or access them through the Zola Credit mobile app or online portal. Select the method that is most convenient and fits your preferences.

Transaction History:

Regularly review your transaction history through the Zola Credit mobile app or online portal. This allows you to monitor your spending, track your purchases, and reconcile your account. By staying proactive, you can quickly identify any unauthorized transactions or discrepancies and report them to Zola Credit’s customer support.

Security Measures:

Take measures to keep your Zola Credit account secure. Create a strong, unique password for your account and avoid sharing your login credentials with anyone. Enable any additional security features provided by Zola Credit, such as two-factor authentication, to add an extra layer of protection to your account.

Understanding your account settings and taking the time to manage them effectively ensures a smooth experience with Zola Credit. It allows you to stay organized, informed, and in control of your financial obligations.

If you have any questions or need assistance with your account settings, reach out to Zola Credit’s customer support. They can guide you through the process and address any concerns you may have.

Remember to regularly review and update your account settings as needed to ensure that your Zola Credit experience aligns with your financial goals and preferences.

Contacting Zola Credit Customer Support

When using any financial service, it’s important to have reliable customer support in case you have questions or encounter issues. Here’s how you can easily reach out to Zola Credit’s customer support for assistance:

Customer Support Channels:

Zola Credit provides multiple channels through which you can contact their customer support team. These include:

- Phone: Look for the customer support phone number on the Zola Credit website or mobile app. Call the designated number to speak directly with a customer support representative who can assist you with any inquiries or concerns you may have.

- Email: Send an email to the designated customer support email address provided by Zola Credit. Make sure to include your account details and clearly state the nature of your inquiry to ensure a prompt and accurate response.

- Online Chat: Some financial service providers, including Zola Credit, offer online chat support. Check the Zola Credit website or mobile app to see if they have a live chat feature available. This allows you to engage in real-time conversations with a customer support representative without the need for a phone call or email.

- FAQs and Help Center: Explore the Zola Credit website or mobile app for their FAQs and help center. Often, you can find answers to common questions and concerns in these resources, saving you time and effort. If you can’t find the information you’re looking for, customer support channels are available for further assistance.

Tips for Contacting Customer Support:

When reaching out to Zola Credit customer support, keep the following tips in mind:

- Be Prepared: Before contacting customer support, gather any relevant information or documentation related to your inquiry. Having this information readily available can help expedite the process and ensure that the representative can address your concerns effectively.

- Stay Calm and Patient: Approach the conversation with a calm and patient demeanor. Clearly explain your issue or question, and allow the customer support representative to gather the necessary information and provide a solution or answer.

- Keep Records: Maintain a record of your interactions with customer support, including dates, times, names of representatives, and summaries of the conversations. This can be useful for future reference and to ensure that any issues or inquiries are properly documented.

Whether you have questions about your account, need help with transaction inquiries, or require clarification on Zola Credit’s terms and policies, their customer support team is there to assist you. Reach out to them through the available channels and trust that they will provide the necessary guidance and resolutions.

Remember, timely and effective communication with customer support can help ensure a positive experience with Zola Credit and address any concerns that may arise during your usage of their service.

Tips for Using Zola Credit Responsibly

Using Zola Credit responsibly is key to maintaining financial stability and maximizing the benefits of your line of credit. Here are some important tips to keep in mind:

1. Understand Your Finances:

Before using Zola Credit, take a close look at your financial situation. Assess your income, expenses, and other financial obligations to determine how much credit you can responsibly manage. It’s essential to borrow within your means and avoid overextending yourself.

2. Borrow Only What You Need:

While Zola Credit may offer you a specific credit limit, it’s important to borrow only what you need. Carefully consider your purchases and avoid unnecessary expenses that may strain your financial situation. Borrowing only what you need reduces the risk of accumulating excessive debt.

3. Make Timely Payments:

Always make your Zola Credit payments on time. Set reminders or establish automatic payments to avoid late fees and penalties. Making timely payments not only helps you maintain a positive credit history but also avoids any negative impact on your credit score.

4. Pay More Than the Minimum:

Whenever possible, pay more than the minimum payment required by Zola Credit. By paying more, you can reduce your outstanding balance faster, save on interest charges, and potentially improve your credit utilization ratio.

5. Monitor Your Credit:

Regularly monitor your credit reports and credit score. Keep an eye on any changes, inaccuracies, or suspicious activity. Monitoring your credit helps you identify any potential issues early on and enables you to take appropriate action to protect your financial well-being.

6. Keep Credit Utilization in Check:

Strive to keep your credit utilization ratio—the percentage of your available credit that you use—low. A high credit utilization can negatively impact your credit score. Aim to use only a portion of your approved credit limit and avoid maxing out your Zola Credit balance.

7. Use Zola Credit for Necessary Expenses:

While Zola Credit offers the convenience of a line of credit, make sure to use it for necessary expenses. Avoid using credit for frivolous purchases or luxury items that may lead to unnecessary debt. Prioritize using Zola Credit for emergencies or essential purchases.

8. Establish a Repayment Plan:

Create a repayment plan to systematically pay off your Zola Credit balance. Determine how much you can afford to pay each month and set a goal to pay off your balance within a specific timeframe. Stick to your plan and adjust it as needed, considering changes in your financial circumstances.

9. Avoid Overusing Credit:

While Zola Credit provides a convenient line of credit, it’s important not to overly rely on it. Overusing credit can lead to a cycle of debt that becomes challenging to manage. Consider other financial options, such as saving for purchases or exploring alternative sources of funding, before consistently relying on credit.

10. Seek Financial Guidance if Needed:

If you’re facing difficulty managing your finances or find yourself struggling with debt, consider seeking the guidance of a financial advisor or credit counselor. They can provide personalized advice and assistance to help you regain control of your financial situation.

By following these tips, you can use Zola Credit responsibly and pave the way for a healthy financial future. Remember, responsible credit usage is key to maintaining financial well-being and achieving your long-term financial goals.

Conclusion

Zola Credit offers individuals a convenient and flexible financial solution through its line of credit. By understanding how to use Zola Credit effectively and responsibly, you can harness its benefits while maintaining control over your financial well-being.

Throughout this guide, we explored the application process, eligibility requirements, and the necessary documentation needed to apply for Zola Credit. We discussed the importance of making purchases wisely, paying off the balance in a timely manner, and monitoring your credit score regularly.

Additionally, we discussed the significance of managing your account settings and contacting Zola Credit’s customer support when needed. By utilizing these resources, you can navigate your Zola Credit experience with confidence and address any concerns along the way.

Remember, responsible credit usage is crucial. Use Zola Credit for necessary expenses, make payments on time, and avoid overusing credit. By doing so, you can build a positive credit history, maintain a healthy credit score, and work towards achieving your financial goals.

Always monitor your credit reports and stay vigilant against potential errors or fraudulent activity. Being proactive in managing your financial health allows you to address any issues promptly and protect yourself from potential harm.

As you utilize Zola Credit, keep in mind the importance of thoughtful financial decision-making. Borrow within your means, set a repayment plan, and prioritize responsible credit usage. By adhering to these principles, you can make the most of your relationship with Zola Credit and set yourself up for long-term financial success.

Remember that financial circumstances can change, so regular evaluation and adjustments to your financial strategies may be necessary. Stay informed about updates to Zola Credit’s terms and conditions and seek professional advice when needed.

In conclusion, Zola Credit provides a convenient and reliable option for individuals in need of financial support. By using it responsibly, you can leverage its benefits to meet your financial needs and improve your overall financial well-being.

Make informed decisions, stay diligent in managing your account and payments, and take advantage of the resources available to you. With these guidelines in mind, you can navigate the world of Zola Credit confidently and responsibly for a brighter financial future.