Finance

Which Degree Is Ideal For Stock Market

Published: November 24, 2023

Discover which degree is ideal for a career in the stock market. Uncover the benefits of studying finance and its relevance to the financial world.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Education in the Stock Market

- Choosing the Right Degree for the Stock Market

- Finance and Economics Degrees

- Business Administration and Management Degrees

- Mathematics and Statistics Degrees

- Computer Science and Programming Degrees

- Accounting and Financial Analysis Degrees

- Conclusion

Introduction

Investing in the stock market can be an exciting and potentially lucrative endeavor. However, it requires a deep understanding of the market, its dynamics, and the ability to make informed decisions. While some individuals may have a natural aptitude for the stock market, most need to acquire the necessary knowledge and skills through education.

Education plays a crucial role in developing the expertise and confidence needed to navigate the complexities of the stock market. It provides individuals with a solid foundation, enabling them to analyze data, understand market trends, and make intelligent investment decisions.

When it comes to pursuing a degree that will help establish a successful career in the stock market, there are various options available. The ideal degree will provide a comprehensive understanding of financial markets, risk management strategies, and analytical tools necessary to thrive in the competitive world of stocks and investments.

Choosing the right degree for the stock market can be a critical decision, as it can significantly impact one’s career trajectory and potential for success. In this article, we will explore different degree options that are well-suited for a career in the stock market, highlighting their unique benefits and potential career paths.

Importance of Education in the Stock Market

Education is essential for anyone looking to excel in the stock market. While it is true that anyone with money can invest, having a solid educational background can make a significant difference in your ability to make informed decisions and manage risks effectively. Here are a few reasons why education in the stock market is crucial:

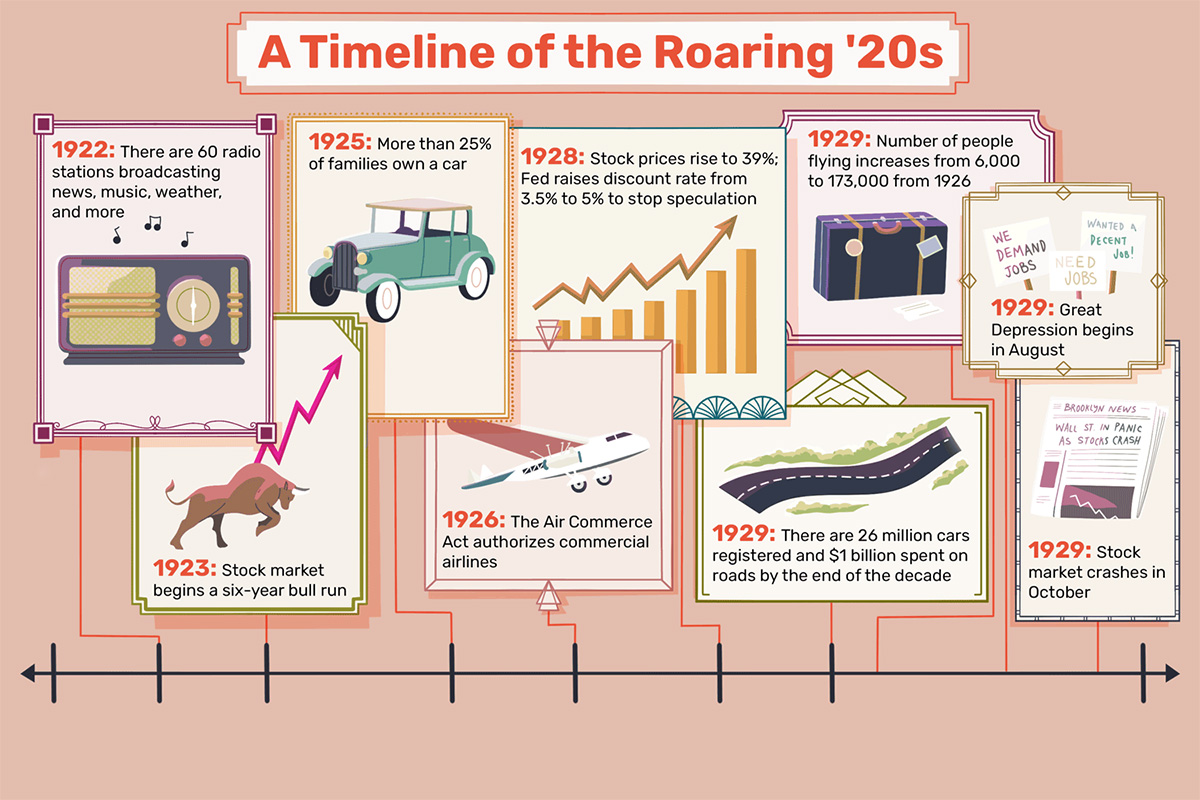

- Understanding Market Fundamentals: Education provides a comprehensive understanding of the fundamental principles of the stock market. This includes concepts like supply and demand, market cycles, and pricing techniques. A solid grasp of these fundamentals allows investors to make well-informed decisions.

- Technical Analysis: Education equips investors with the tools to perform technical analysis, which involves analyzing historical price data and identifying patterns to predict future price movements. Technical analysis helps investors identify entry and exit points, minimizing risk and maximizing returns.

- Fundamental Analysis: Education teaches investors how to conduct fundamental analysis, which involves evaluating a company’s financial health, management team, industry trends, and competitive landscape. This analysis helps investors identify undervalued stocks and make sound investment decisions based on a company’s intrinsic value.

- Risk Management: Education in the stock market emphasizes the importance of risk management. It equips investors with strategies to mitigate risks, such as diversification, stop-loss orders, and portfolio rebalancing. By understanding and implementing risk management techniques, investors can protect their capital and minimize losses.

- Staying Updated: The stock market is dynamic and constantly evolving. Education helps investors stay updated with the latest market trends, news, and regulatory changes. This knowledge allows investors to adapt their investment strategies and seize opportunities as they arise.

Investing in the stock market without proper education is akin to driving blindfolded. While luck may play a role in short-term gains, educated investors have a higher probability of long-term success and the ability to navigate through market fluctuations.

Next, we will discuss the different degree options that can provide a strong educational foundation for a successful career in the stock market.

Choosing the Right Degree for the Stock Market

When it comes to pursuing a degree that will prepare you for a career in the stock market, there are several options to consider. Each degree offers unique benefits and focuses on different aspects of finance, economics, and business. Here are some of the key factors to consider when choosing the right degree for the stock market:

- Interest and Aptitude: Consider your interests and aptitude in various subjects. Do you have a passion for mathematics and analysis? Are you more interested in understanding the economic forces that influence the market? Assessing your natural inclination can help identify the degree that aligns with your strengths and passions.

- Career Goals: Clarify your career goals in the stock market. Are you interested in becoming a stockbroker, financial analyst, portfolio manager, or investment banker? Different careers may require specific areas of expertise, so understanding your desired career path can guide your degree selection.

- Curriculum: Review the curriculum of each degree program. Look for courses that cover subjects such as financial markets, investment analysis, portfolio management, risk management, and financial modeling. A well-rounded curriculum that offers a strong foundation in these areas is essential for success in the stock market.

- Internship and Networking Opportunities: Check if the degree program provides opportunities for internships and networking. Internships allow you to gain hands-on experience and establish valuable connections in the industry. These experiences can significantly enhance your employability and open doors to future career opportunities.

- Reputation and Accreditation: Consider the reputation and accreditation of the university or college offering the degree program. A degree from a reputable institution can carry more weight in the job market and demonstrate your commitment to excellence in the field.

Ultimately, selecting the right degree for the stock market is a personal choice that should align with your interests, career aspirations, and educational goals. It’s important to take the time to research and consider all the factors discussed above before making a decision.

Next, we will delve into specific degree options that are highly relevant and beneficial for a career in the stock market.

Finance and Economics Degrees

Finance and economics degrees are among the most common and popular choices for individuals pursuing a career in the stock market. These degrees provide a solid foundation in financial theory, economic principles, and market analysis. Here’s why finance and economics degrees are well-suited for the stock market:

- Understanding Financial Markets: Finance degrees focus on topics such as financial markets, investment analysis, and financial management. This knowledge is crucial for evaluating stocks, understanding market trends, and making informed investment decisions.

- Economic Analysis: Economics degrees delve into macroeconomics and microeconomics, enabling individuals to grasp the economic forces that influence markets. This understanding helps investors analyze market fluctuations and make predictions based on economic indicators.

- Financial Modeling: Both finance and economics degrees emphasize quantitative skills and often include courses in financial modeling. This involves using mathematical and statistical techniques to create models that evaluate investment opportunities and assess risks.

- Valuation Techniques: Finance degrees provide extensive knowledge about valuation techniques, such as discounted cash flow (DCF) analysis and ratio analysis. These tools help investors assess the intrinsic value of stocks and identify potential investment opportunities.

- Risk Management Strategies: Courses in finance and economics teach students about risk management strategies, including diversification, asset allocation, and hedging. This knowledge is vital for minimizing risks and protecting investments in a volatile market.

Graduates with finance and economics degrees can pursue various careers in the stock market, such as financial analysts, investment managers, risk analysts, and quantitative traders. These degrees also provide a solid foundation for individuals interested in pursuing further certifications such as the Chartered Financial Analyst (CFA) designation.

Finance and economics degrees offer a well-rounded education that equips individuals with the essential skills and knowledge to thrive in the dynamic and competitive world of the stock market.

Next, we will explore another degree option that can be valuable for a career in the stock market: Business Administration and Management degrees.

Business Administration and Management Degrees

Business administration and management degrees provide a comprehensive education in business principles, leadership, and strategic decision-making. While not directly focused on finance or economics, these degrees can still be highly beneficial for individuals pursuing a career in the stock market. Here’s why business administration and management degrees are well-suited for the stock market:

- Leadership and Management Skills: Business administration degrees emphasize the development of leadership and management skills. These skills are invaluable in the stock market, where individuals often work in teams, manage portfolios, and make critical investment decisions.

- Strategic Decision-making: Business administration degrees teach individuals how to analyze market trends, assess risks, and make strategic decisions. This skillset is essential for investors who need to evaluate potential investment opportunities and allocate their resources effectively.

- Financial Management: While not as finance-focused as other degrees, business administration degrees still cover financial management topics. This includes studying financial statements, analyzing cash flows, and understanding the financial implications of business strategies.

- Entrepreneurial Mindset: Business administration degrees foster an entrepreneurial mindset, encouraging individuals to think creatively, adapt to market changes, and identify emerging opportunities. This mindset can be valuable in the stock market, where investors need to constantly adapt to evolving market conditions.

- Networking Opportunities: Business administration programs often provide ample networking opportunities, allowing students to connect with industry professionals, alumni, and potential employers. These connections can open doors to internships, job opportunities, and mentorships in the field of stock market investing.

Graduates with business administration and management degrees can pursue various roles in the stock market, such as investment managers, financial consultants, portfolio analysts, and business development managers. The combination of business acumen, leadership skills, and financial knowledge positions these individuals for success in the stock market.

While a business administration or management degree may not focus solely on the intricacies of the stock market, its broader skillset and strategic mindset can be highly valuable and adaptable in the dynamic and competitive world of investing.

Next, we will explore another degree option that emphasizes strong quantitative and analytical skills: Mathematics and Statistics degrees.

Mathematics and Statistics Degrees

Mathematics and statistics degrees are excellent options for individuals looking to pursue a career in the stock market, especially for those who excel in quantitative analysis. These degrees focus on building strong analytical and problem-solving skills, which are invaluable in the world of investments. Here’s why mathematics and statistics degrees are well-suited for the stock market:

- Quantitative Analysis: Mathematics and statistics degrees provide a solid foundation in quantitative analysis, which is essential for interpreting data, identifying patterns, and making data-driven investment decisions in the stock market.

- Financial Modeling: These degrees often include courses in financial modeling, where students learn to construct mathematical models to evaluate investment opportunities, calculate risks, and optimize portfolio performance.

- Statistical Analysis: Statistics is a crucial discipline in the stock market. Graduates with mathematics and statistics degrees possess the skills to analyze market data, perform regression analysis, and test hypotheses, enabling them to make informed investment strategies based on statistical evidence.

- Risk Assessment: Mathematics and statistics graduates are skilled in assessing and quantifying risks. They understand probability theory, statistical distributions, and risk management techniques. These skills are crucial for managing portfolio risks and making investment decisions with a clear understanding of potential outcomes.

- Algorithmic Trading: With the increasing utilization of algorithmic trading in the stock market, mathematics and statistics graduates have the expertise to develop and implement trading strategies based on mathematical models and statistical analysis.

Career opportunities for mathematics and statistics graduates in the stock market include quantitative analysts, data scientists, risk analysts, and algorithmic traders. These roles demand strong analytical skills and a deep understanding of mathematical and statistical concepts, making mathematics and statistics degrees highly valuable in the field.

Next, we will explore another degree option that combines technical skills with financial knowledge: Computer Science and Programming degrees.

Computer Science and Programming Degrees

In today’s digital age, computer science and programming degrees have become increasingly relevant in the stock market. These degrees equip individuals with the technical skills necessary to leverage technology and data analysis in the investment process. Here’s why computer science and programming degrees are well-suited for the stock market:

- Data Analysis and Visualization: Computer science and programming degrees provide expertise in data analysis and visualization techniques. This enables individuals to process large datasets, extract meaningful insights, and present data in a visually compelling manner, aiding in investment analysis and decision-making.

- Algorithmic Trading: The stock market has witnessed a rise in algorithmic trading, where computer algorithms execute trades based on predetermined rules. Graduates with computer science and programming degrees possess the skills to develop and implement these algorithms, facilitating automated and efficient trading strategies.

- Machine Learning and Artificial Intelligence: These degrees often include courses in machine learning and artificial intelligence (AI). These technologies have transformed the stock market by enabling pattern recognition, predictive modeling, and risk assessment, providing valuable insights for investors.

- Financial Technology (Fintech): Financial technology has revolutionized the stock market, with advancements in areas such as robo-advisory services, online trading platforms, and cryptocurrency. Computer science and programming degrees offer the necessary skills to design, develop, and implement these technological innovations in the stock market.

- Quantitative Analysis: Programming skills are instrumental in implementing quantitative models and conducting data-driven analysis in the stock market. Graduates with computer science and programming degrees can apply their skills to conduct research, backtesting trading strategies, and analyzing market patterns.

Career opportunities for computer science and programming graduates in the stock market include financial analysts, quantitative traders, data analysts, and fintech specialists. These roles require a strong blend of technical skills and financial knowledge to succeed in the dynamic and data-intensive environment of the stock market.

Next, we will explore another degree option that emphasizes financial analysis and accounting: Accounting and Financial Analysis degrees.

Accounting and Financial Analysis Degrees

Accounting and financial analysis degrees are highly relevant for individuals looking to pursue a career in the stock market. These degrees provide a comprehensive understanding of financial statements, financial analysis techniques, and accounting principles. Here’s why accounting and financial analysis degrees are well-suited for the stock market:

- Financial Statement Analysis: Accounting and financial analysis degrees focus on analyzing financial statements to evaluate a company’s financial health, profitability, and cash flow. This skill is invaluable when assessing the financial performance of companies and making investment decisions in the stock market.

- Valuation Techniques: These degrees cover various valuation techniques used in the stock market, such as discounted cash flow (DCF) analysis, comparable company analysis, and ratio analysis. Understanding these techniques helps investors assess the fair value of stocks and identify potential investment opportunities.

- Corporate Reporting: Accounting knowledge is essential for understanding corporate reporting standards and regulations. This knowledge is crucial in assessing a company’s compliance, governance, and transparency, factors that can greatly influence investment decisions in the stock market.

- Financial Modeling: Financial analysis degrees often include courses in financial modeling, enabling individuals to construct sophisticated models that simulate investment scenarios, analyze risks, and optimize portfolio performance.

- Auditing and Risk Assessment: Accounting and financial analysis degrees emphasize risk assessment and auditing skills. These skills are essential for understanding the potential risks associated with investments, assessing internal control systems, and conducting due diligence on companies before making investment decisions.

Career opportunities for accounting and financial analysis graduates in the stock market include financial analysts, equity research analysts, investment bankers, and portfolio managers. These roles require a strong foundation in financial analysis, accounting principles, and the ability to interpret financial data accurately.

Accounting and financial analysis degrees offer a comprehensive education in financial analysis techniques and accounting principles, equipping individuals with the skills necessary to make sound investment decisions in the stock market.

Next, we will conclude the article by summarizing the importance of choosing the right degree for a successful career in the stock market.

Conclusion

Choosing the right degree is a crucial step towards building a successful career in the stock market. Education provides the necessary knowledge, skills, and confidence to navigate the complexities of the market and make informed investment decisions. While there are various degree options available, it is important to select a program that aligns with your interests, career goals, and educational aspirations.

Finance and economics degrees offer a deep understanding of financial markets, economic principles, and analytical tools, making them highly suitable for the stock market. Business administration and management degrees provide leadership skills, strategic decision-making abilities, and a broader business perspective that can be invaluable in the investment realm. Mathematics and statistics degrees equip individuals with quantitative analysis skills, financial modeling expertise, and risk management techniques that are instrumental in the stock market.

Computer science and programming degrees offer technical skills, data analysis capabilities, and algorithmic trading expertise that are increasingly relevant in today’s digital stock market. Accounting and financial analysis degrees provide a thorough understanding of financial statements, valuation techniques, and risk assessment, enabling individuals to conduct detailed financial analysis and make informed investment decisions.

Ultimately, the ideal degree for the stock market depends on your individual strengths, interests, and career aspirations. It is essential to thoroughly research and consider factors such as curriculum, networking opportunities, and reputation when making a decision.

Remember, a degree alone is not a guarantee of success in the stock market. Continual learning, staying updated with market trends, and gaining practical experience through internships or entry-level positions are equally important. So, choose a degree that sparks your passion, and be prepared to put in the effort to continuously develop your skills and knowledge throughout your career.

With the right education and dedication, you can build a rewarding and fulfilling career in the exciting and dynamic world of the stock market.