Finance

Where Is Minority Interest On Balance Sheet

Published: December 27, 2023

Discover the importance of minority interest in finance and learn where it is presented on a balance sheet. Gain insights into this crucial aspect of financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on minority interest on the balance sheet. In the world of finance, understanding various aspects of a company’s balance sheet is crucial for investors, analysts, and stakeholders. One key element that deserves attention is minority interest, which plays a significant role in understanding the financial position of a company, particularly in cases where it has subsidiaries or joint ventures.

Minority interest is a term used to describe the ownership interest investors hold in a subsidiary company that is not fully owned by the parent company. In other words, it represents the portion of a subsidiary’s equity that is not owned by the parent company, but rather by external investors or non-controlling interests. This concept is particularly relevant when a company holds a controlling interest, but not 100%, in one or more subsidiaries.

The calculation and reporting of minority interest on the balance sheet are essential for providing a comprehensive picture of a company’s financial health. It allows stakeholders to understand the proportion of a subsidiary’s profits or losses that belong to external investors, along with the overall impact on the parent company’s financial position.

In this guide, we will explore how minority interest is calculated, how it is reported on the balance sheet, and the disclosure requirements surrounding it. We will also delve into the importance of minority interest in analyzing a company’s financial performance and its implications for investors and stakeholders.

By the end of this guide, you will have a solid understanding of minority interest on the balance sheet and its significance in evaluating a company’s financial health. So, let’s dive in and explore this concept further.

Definition of Minority Interest

Minority interest, also known as non-controlling interest (NCI), refers to the portion of equity or ownership interest in a subsidiary company that is held by external investors or non-controlling shareholders. It represents the share of profits or losses attributed to these investors and reflects their ownership rights in the subsidiary.

When a company owns less than 100% of another company, it consolidates the financial statements of the subsidiary and includes the minority interest as a separate line item on its own balance sheet. The minority interest represents the portion of the subsidiary’s equity that the parent company doesn’t own.

The presence of minority interest implies that the subsidiary has some level of autonomy and may have its shareholders and decision-making processes. These external investors have a say in the affairs of the subsidiary but might not have control over its operations or strategic decisions.

It’s important to note that minority interest can also arise in the case of joint ventures, where two or more entities collaborate to undertake a specific business endeavor. In such cases, the minority interest represents the share of ownership and profits attributable to the non-controlling partner(s) in the joint venture.

The calculation of minority interest involves determining the proportionate share of the subsidiary’s equity that is owned by external investors. This is usually expressed as a percentage and is based on the ownership interest held by the non-controlling shareholders.

While minority interest represents a lesser ownership stake, it still holds importance. It reflects the value of the subsidiary and the rights of the external investors, providing a clear picture of the subsidiary’s financial performance and its impact on the parent company’s overall financial position.

Now that we have a solid understanding of the definition of minority interest, let’s explore how it is calculated in the next section.

Calculation of Minority Interest

The calculation of minority interest involves determining the proportionate share of a subsidiary’s equity that is owned by external investors or non-controlling shareholders. This calculation is based on the ownership interest held by these investors and is usually expressed as a percentage.

To calculate minority interest, you need to know two key pieces of information:

- The total equity of the subsidiary

- The ownership interest held by the parent company

Once you have this information, you can use the following formula to calculate minority interest:

Minority Interest = Total Equity of Subsidiary x (1 – Ownership Interest of Parent Company)

Let’s take an example to illustrate this calculation:

Company X owns 80% of the equity of Subsidiary Y. The total equity of Subsidiary Y is $1,000,000. To calculate the minority interest, we can use the formula as follows:

Minority Interest = $1,000,000 x (1 – 0.80)

Minority Interest = $1,000,000 x 0.20

Minority Interest = $200,000

In this example, the minority interest in Subsidiary Y would be $200,000.

It’s important to note that the ownership interest of the parent company should be expressed as a decimal or a percentage. For example, if the parent company owns 60% of the subsidiary’s equity, the ownership interest would be represented as 0.60 or 60% in the formula.

Furthermore, if the subsidiary has multiple non-controlling shareholders, the ownership interests of each shareholder should be taken into account when calculating the minority interest. This may require further adjustments to the formula based on the specific ownership percentages held by these external investors.

By calculating the minority interest accurately, a company can provide a clear reflection of the non-controlling shareholders’ equity in the subsidiary and present a complete financial picture on the balance sheet.

Now that we understand how to calculate minority interest, let’s move on to the next section where we will discuss the reporting of minority interest on the balance sheet.

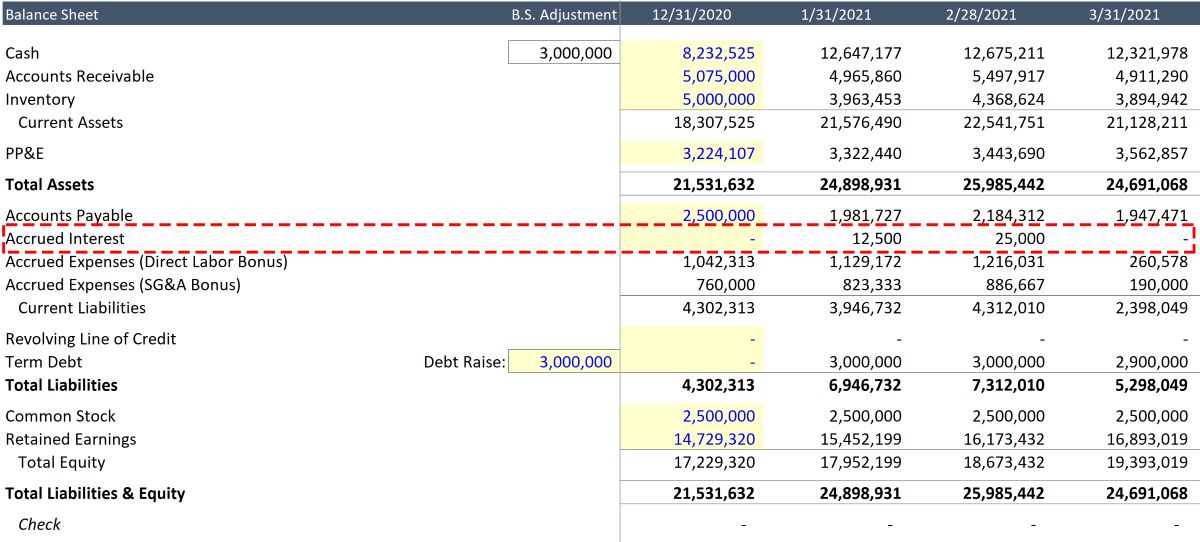

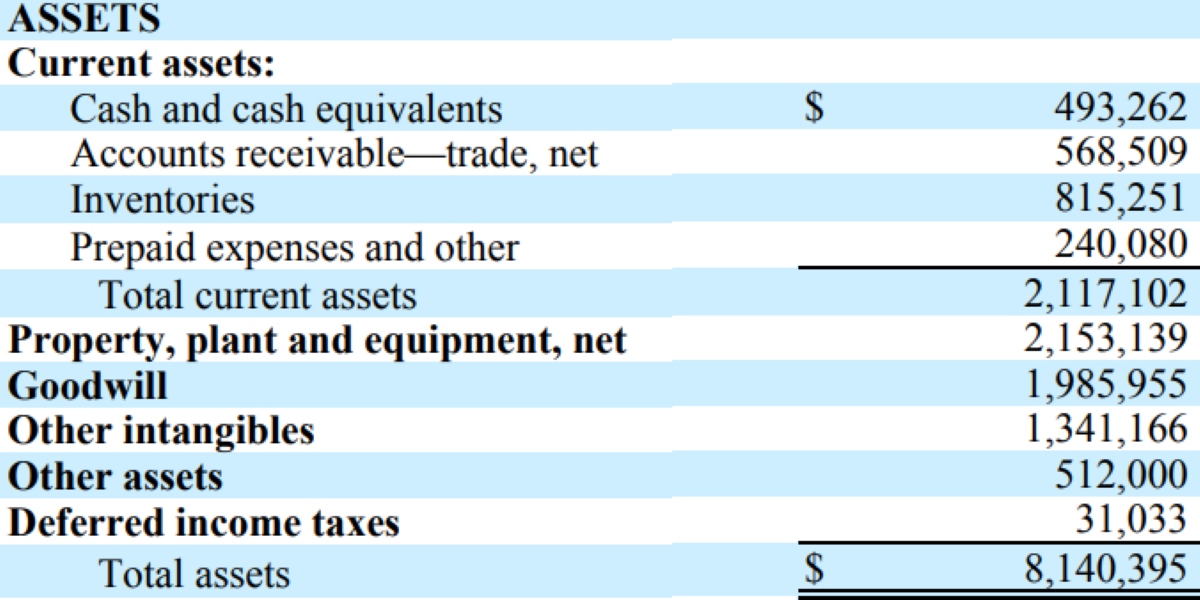

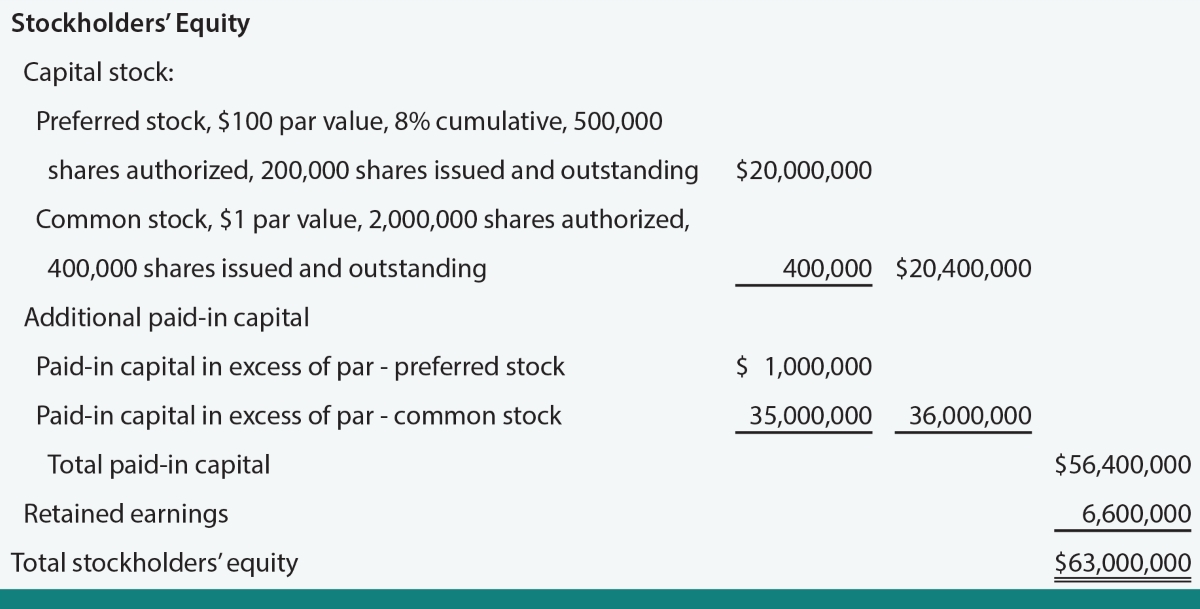

Reporting Minority Interest on the Balance Sheet

When it comes to reporting minority interest on the balance sheet, the key principle is to present it as a separate line item to clearly distinguish it from the parent company’s equity. This allows stakeholders to easily identify and assess the impact of the minority interest on the overall financial position of the reporting entity.

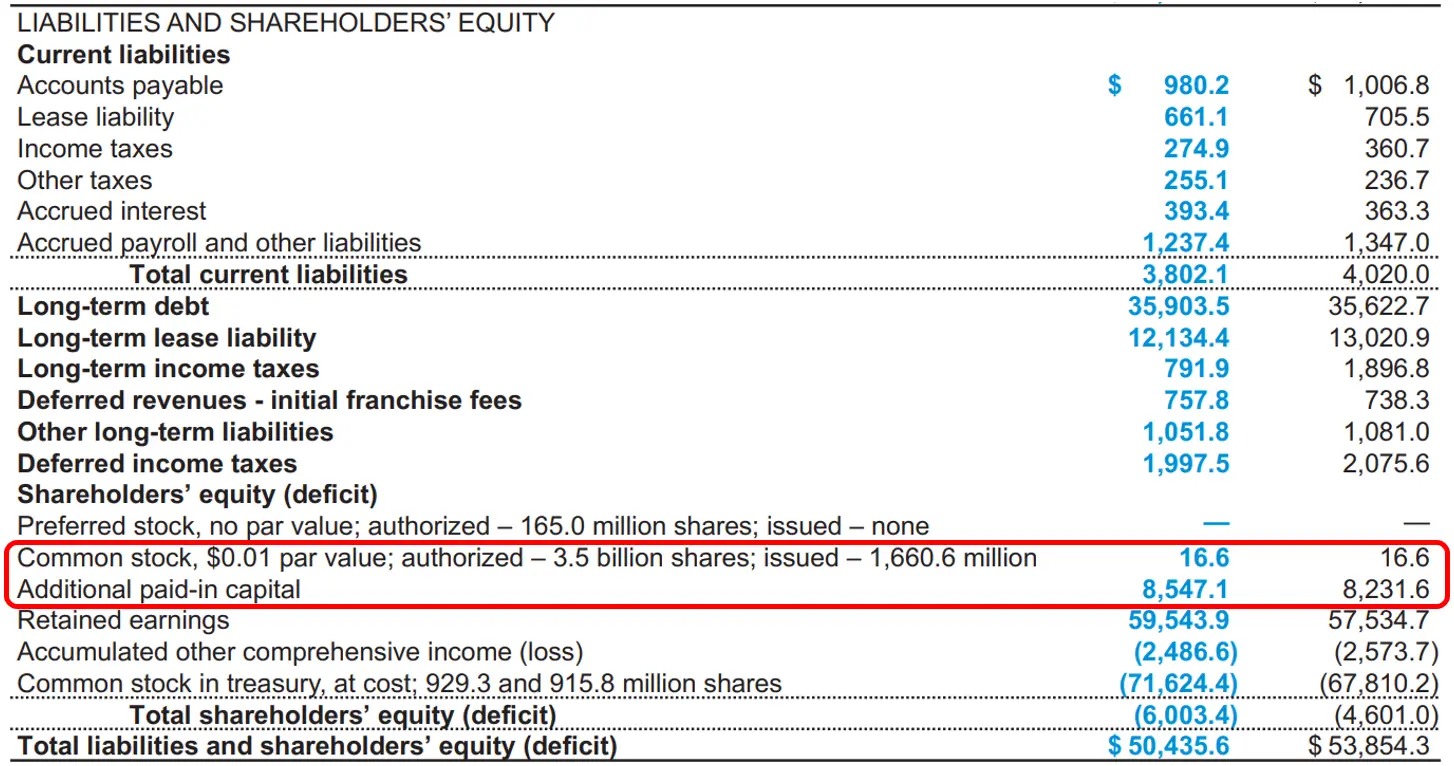

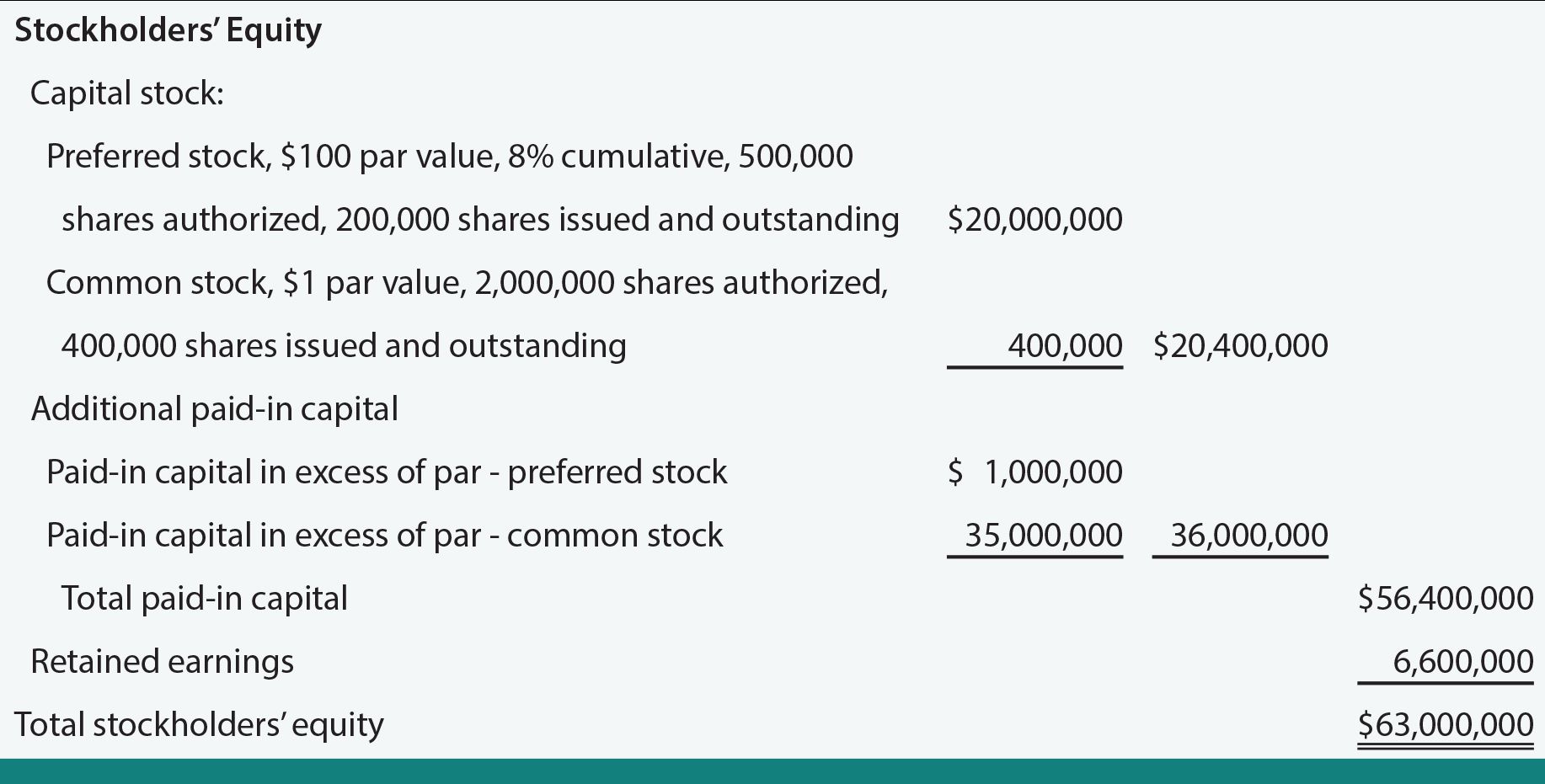

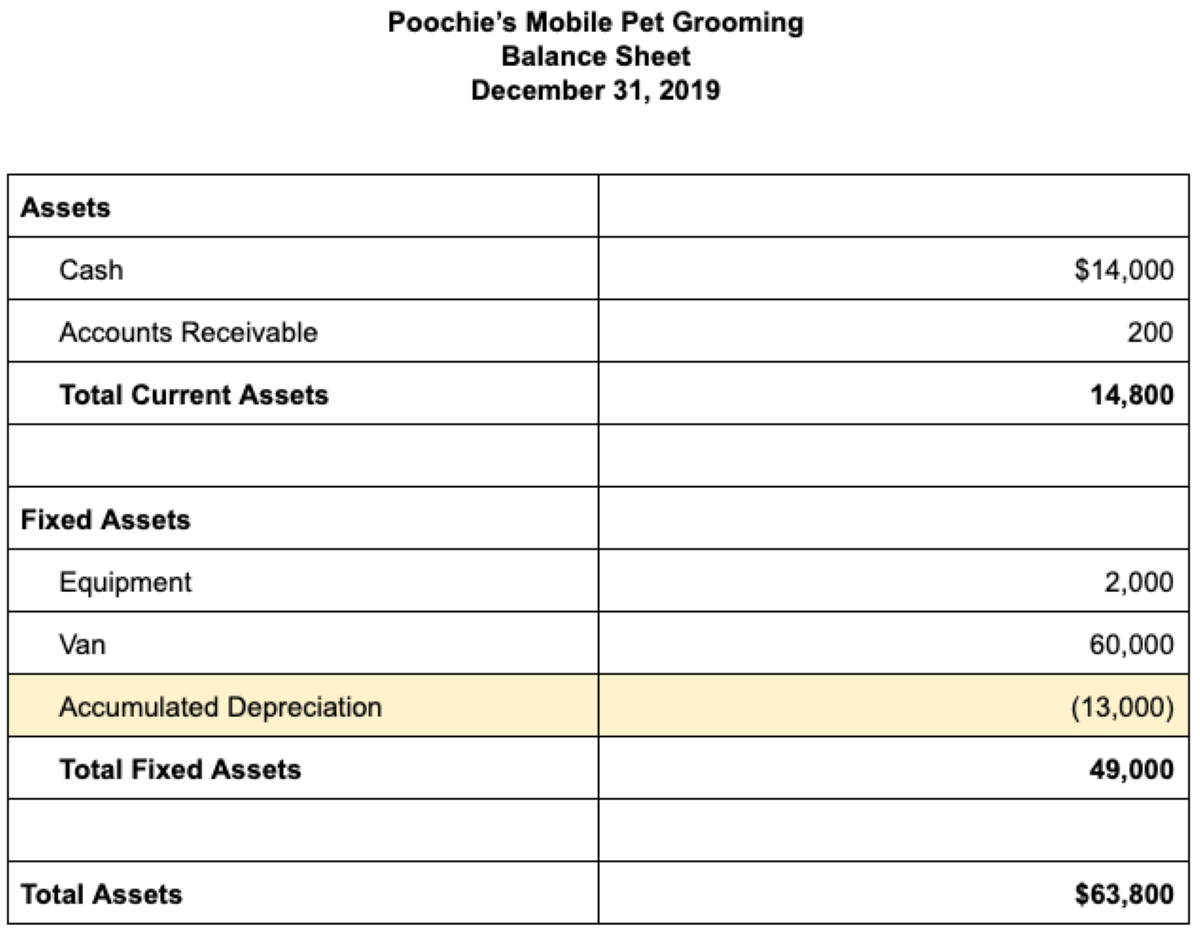

Minority interest is typically reported within the equity section of the balance sheet, often under the heading “Minority Interest” or “Non-controlling Interest”. It represents the non-controlling shareholders’ proportionate share of the subsidiary’s equity.

In the balance sheet presentation, minority interest is listed below the parent company’s equity and any retained earnings or accumulated profits of the subsidiary. It is essential to display minority interest as a distinct component, highlighting the separate ownership rights and obligations of the non-controlling shareholders.

The reporting of minority interest on the balance sheet is usually accompanied by other related financial information, such as the subsidiary’s name, its fiscal year-end, and the ownership percentage held by the parent company.

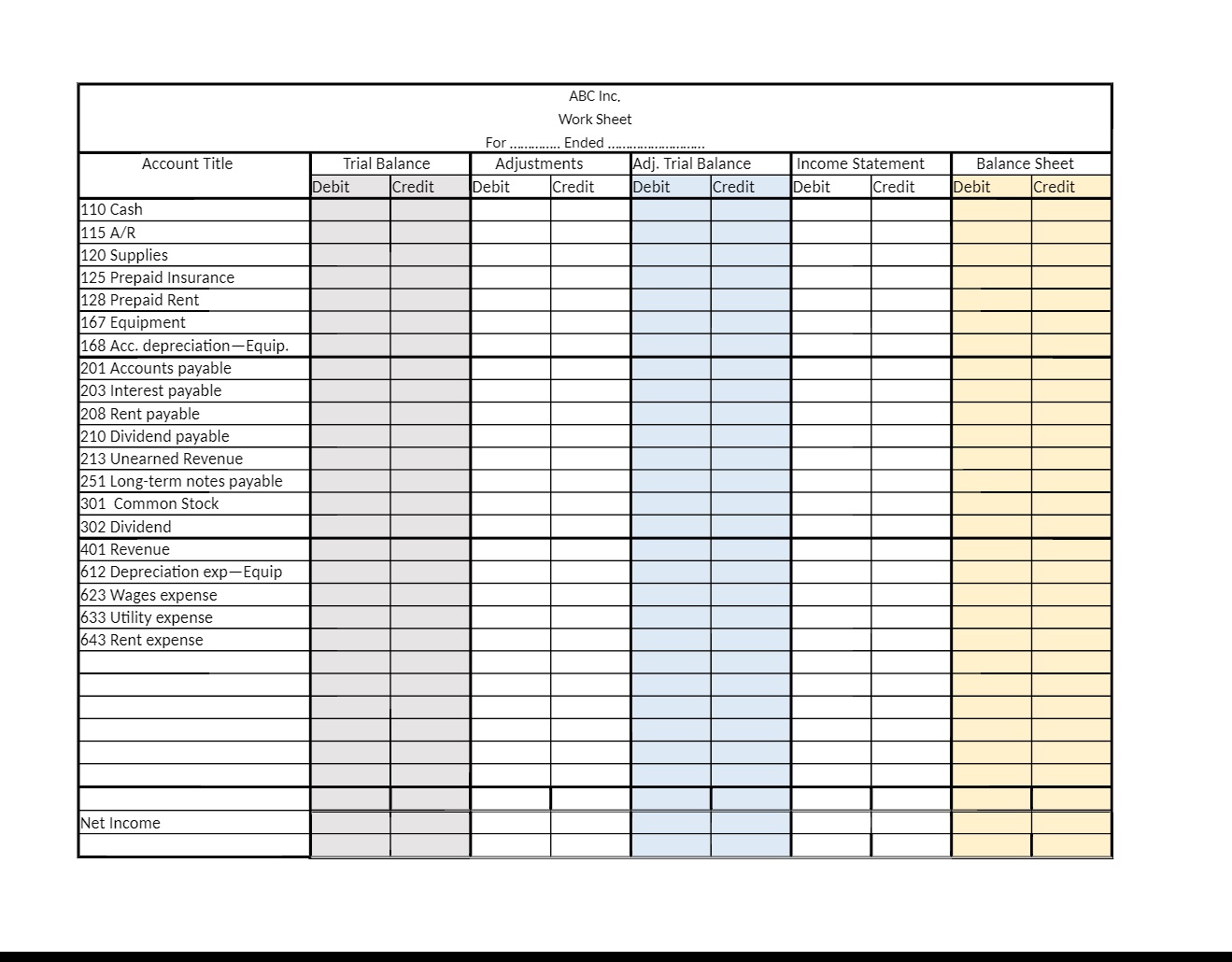

For example, the balance sheet may appear as follows:

Assets Liabilities and Equity

Current Assets Current Liabilities

...

Non-current ...

Assets Total Liabilities

...

Equity

...

Minority Interest

...

Total Equity

This clear segregation of minority interest enables stakeholders to understand how much of the subsidiary’s equity belongs to external investors and assess the financial impact of the non-controlling shareholders’ participation in the subsidiary’s profitability.

Proper disclosure and transparency in reporting minority interest on the balance sheet are crucial for complying with accounting standards and providing accurate financial information to users of the financial statements.

Now that we understand how minority interest is reported on the balance sheet, let’s move on to the next section, where we will discuss the disclosure requirements for minority interest.

Disclosure Requirements for Minority Interest

Disclosure requirements for minority interest are essential for providing transparency and ensuring that users of financial statements have access to all relevant information to make informed decisions. These requirements are determined by accounting standards and regulatory bodies, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP).

The following are some common disclosure requirements for minority interest:

- Percentage of ownership: The balance sheet should disclose the percentage of ownership held by the parent company in the subsidiary, as well as the percentage of minority interest.

- Nature of ownership: The nature of the relationship between the parent company and the subsidiary should be disclosed, including details regarding the level of control exerted by the parent company and any significant terms of the non-controlling shareholders’ agreement.

- Composition of minority interest: If there are multiple non-controlling shareholders, the balance sheet should disclose the ownership percentage held by each shareholder and any relevant terms regarding their rights and obligations.

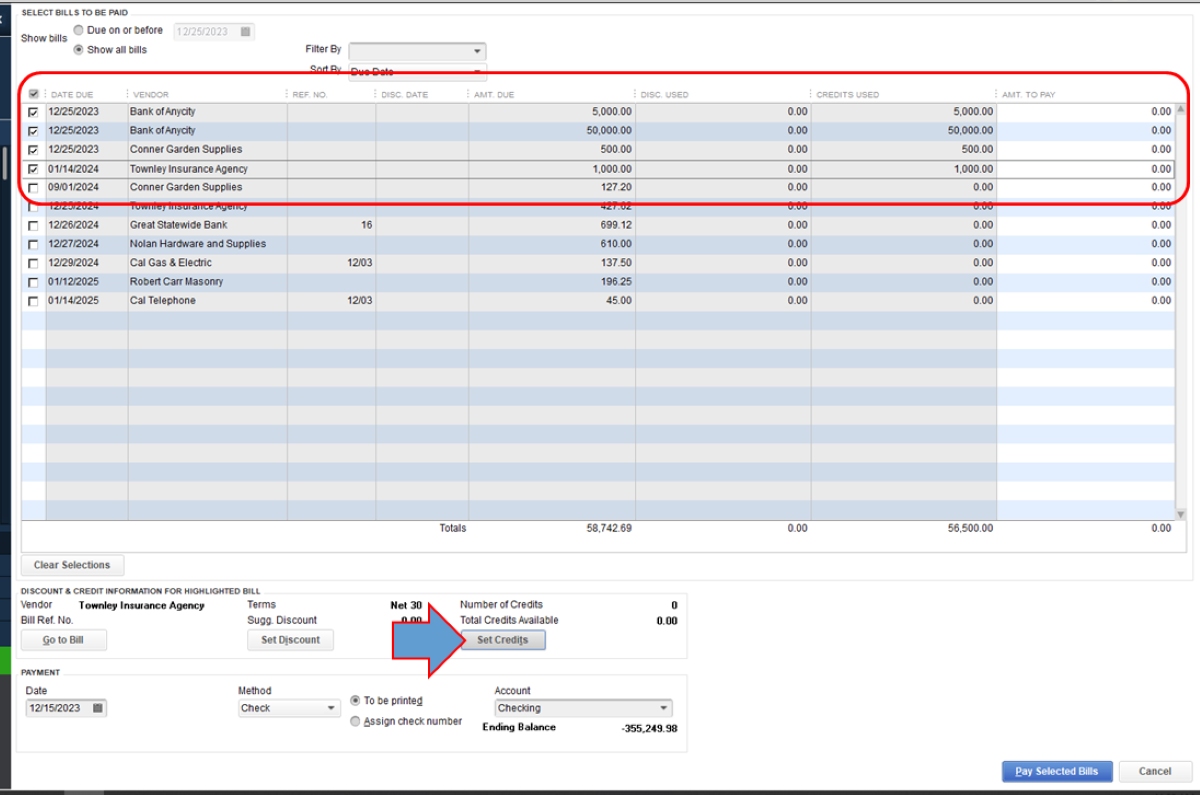

- Treatment of dividends: If the subsidiary pays dividends, the balance sheet should disclose the amounts attributable to the parent company and the amounts attributable to the minority interest.

- Treatment of losses: The balance sheet should disclose how losses of the subsidiary are shared between the parent company and the minority interest. This includes the extent to which the non-controlling shareholders are responsible for absorbing losses.

- Changes in minority interest: Any significant changes in the ownership percentage of the non-controlling shareholders should be disclosed, including details of any transactions or events that led to such changes.

These disclosure requirements aim to provide transparency and ensure that stakeholders have a clear understanding of the minority interest’s impact on the financial statements of the reporting entity. They also serve to protect the rights of the non-controlling shareholders and provide an accurate representation of their equity in the subsidiary.

It is important for companies to comply with these disclosure requirements in their financial reporting to maintain transparency and accountability. By providing relevant information about minority interest, companies can enhance the trust of investors, analysts, and other stakeholders.

Now that we have explored the disclosure requirements for minority interest, let’s proceed to the next section where we will discuss the importance of minority interest on the balance sheet.

Importance of Minority Interest on the Balance Sheet

Minority interest on the balance sheet holds significant importance in evaluating a company’s financial health and decision-making processes. It provides valuable insights into the impact of subsidiary companies and external investors on the overall financial position of the reporting entity. Here are some key reasons why minority interest is important:

- Financial Performance: Minority interest helps in assessing the financial performance of a subsidiary that is partially owned by external investors. By segregating the equity component related to non-controlling shareholders, it allows stakeholders to understand the subsidiary’s profitability and its contribution to the parent company’s financial results.

- Responsibility for Liabilities: Minority interest also sheds light on the allocation of liabilities between the parent company and the non-controlling shareholders. It reveals the extent to which the external investors are responsible for the subsidiary’s debts and obligations.

- Independent Valuation: Minority interest can provide an opportunity for an independent valuation of the subsidiary. This valuation can be useful in assessing the fairness of the subsidiary’s value and determining the accuracy of the parent company’s financial statements.

- Investor Confidence: Minority interest information contributes to investor confidence by providing a comprehensive view of a company’s overall financial position. Investors can assess the risks associated with the non-controlling shareholders’ participation in the subsidiary and evaluate the potential impact on future earnings and cash flows.

- Strategic Decision-Making: Understanding the minority interest on the balance sheet allows for more informed strategic decision-making. It helps the parent company consider the input and interests of external investors when making decisions regarding the subsidiary, such as expansion plans, acquisitions, or divestitures.

- Compliance and Transparency: Disclosure of minority interest on the balance sheet ensures compliance with accounting standards and regulatory requirements. It promotes transparency and accountability by providing stakeholders with accurate financial information, which enhances trust and credibility.

In summary, minority interest on the balance sheet plays a vital role in understanding the financial performance, ownership structure, and decision-making dynamics within a company. It allows stakeholders to evaluate the subsidiary’s contributions, its impact on the parent company’s financial position, and the level of influence external investors hold. By considering minority interest, investors and analysts can make well-informed decisions and gain a comprehensive understanding of a company’s overall financial health.

Now, let’s move on to the next section where we will explore the implications and analysis of minority interest.

Implications and Analysis of Minority Interest

The presence of minority interest on the balance sheet has various implications and can provide valuable insights into a company’s financial position and performance. Analyzing minority interest can offer a deeper understanding of the relationships between the parent company, subsidiaries, and external investors. Here are some key implications and analysis considerations:

- Earnings Attribution: Minority interest allows for the assessment of earnings attribution between the parent company and non-controlling shareholders. By analyzing the proportionate share of profits or losses attributable to the minority interest, analysts can evaluate the impact of the subsidiary’s financial performance on the overall financial results of the reporting entity.

- Risk Assessment: Examining minority interest can help in assessing the risk associated with external investors’ participation in the subsidiary. It enables stakeholders to evaluate the potential exposure to financial obligations, liabilities, and potential conflicts of interest between the parent company and non-controlling shareholders.

- Momentum and Growth: Minority interest analysis can provide insights into the growth prospects of the subsidiary. If the minority interest’s share of profits is consistently increasing over time, it can indicate positive momentum and a strong performance of the subsidiary. This may signal potential opportunities for future growth.

- Valuation: Evaluating minority interest can contribute to the overall valuation of the reporting entity. Assessing the fair value of the subsidiary and the impact of minority interest on the parent company’s equity can assist in determining the intrinsic value of the business.

- Investor Perception: Minority interest information can influence the perception of investors and analysts. A significant minority interest may be seen as a positive indication of diversified ownership and potential for increased shareholder value. On the other hand, if the minority interest is low or declining, it may raise concerns about potential conflicts of interest or limited representation for non-controlling shareholders.

- Legal and Regulatory Considerations: Analyzing minority interest can also help in understanding the legal and regulatory implications surrounding the subsidiary and its operations. This can assist in complying with accounting standards, taxation requirements, and other regulations specific to the subsidiary and external investors.

Incorporating these implications and analysis considerations allows investors, analysts, and stakeholders to gain a more comprehensive understanding of the financial dynamics and risks associated with minority interest. It provides insights into the relationship between the parent company, subsidiaries, and external investors, helping facilitate informed decision-making and strategic planning.

Now let’s conclude our discussion on minority interest on the balance sheet in the next section.

Conclusion

Understanding minority interest on the balance sheet is crucial for investors, analysts, and stakeholders seeking a complete picture of a company’s financial position and performance. This term refers to the ownership interest held by external investors or non-controlling shareholders in a subsidiary that is partially owned by a parent company.

In this comprehensive guide, we have explored the definition of minority interest, the calculation of minority interest, and how it is reported on the balance sheet. We have also discussed the disclosure requirements and the significance of minority interest in analyzing a company’s financial health.

By accurately calculating and reporting minority interest, companies provide transparency and enable stakeholders to evaluate the financial impact of non-controlling shareholders on the subsidiary and the parent company. It helps in assessing the profitability, liability obligations, and risks associated with the subsidiary’s operations.

Analyzing minority interest provides insights into earnings attribution, risk assessment, growth prospects, and valuation of the reporting entity. It also influences investor perception and contributes to sound decision-making regarding strategic initiatives and compliance with legal and regulatory requirements.

By incorporating these considerations, stakeholders can make well-informed decisions and have a more comprehensive understanding of a company’s financial performance, ownership structure, and relationship with external investors.

In conclusion, understanding minority interest on the balance sheet is essential for evaluating a company’s financial health and making informed investment decisions. It provides deeper insights into the financial dynamics between the parent company, subsidiaries, and external investors. By paying attention to minority interest, stakeholders can gain a holistic view of a company’s financial position and navigate the complex landscape of subsidiary ownership.