Home>Finance>How To Write A Complaint Letter About Credit Card Late Fee

Finance

How To Write A Complaint Letter About Credit Card Late Fee

Published: February 22, 2024

Learn how to effectively write a complaint letter about a credit card late fee. Get tips to resolve financial issues and improve your finances. Helpful advice for managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Dealing with a credit card late fee can be frustrating and stressful. Late fees can accumulate quickly, leading to financial strain and impacting your credit score. However, addressing this issue through a well-crafted complaint letter can potentially lead to a favorable resolution. In this comprehensive guide, we will explore the essential steps to writing an effective complaint letter about a credit card late fee. By understanding the intricacies of this process, you can assert your rights as a consumer and work towards a satisfactory outcome.

Late fees are a common source of frustration for credit card holders. Whether the late fee was the result of an oversight, a financial hardship, or a dispute with the credit card company, it's crucial to address the issue promptly and professionally. Writing a complaint letter allows you to articulate your concerns clearly and provides a formal record of your grievance.

Throughout this guide, we will delve into the key elements of crafting an impactful complaint letter, from understanding the issue at hand to the importance of gathering necessary information and structuring your letter effectively. Additionally, we will discuss the vital steps involved in sending the complaint letter and following up on your complaint. By following these steps, you can navigate the process with confidence and increase the likelihood of a successful resolution.

Understanding the nuances of writing a complaint letter about a credit card late fee is essential for effectively communicating your concerns to the credit card company. With this guide, you will gain valuable insights and practical tips to help you navigate this process with clarity and purpose. Let's embark on this journey to equip you with the knowledge and tools necessary to address credit card late fees through a well-crafted complaint letter.

**

Understanding the Issue

Before delving into the process of writing a complaint letter about a credit card late fee, it’s crucial to gain a comprehensive understanding of the issue at hand. Late fees can arise from various circumstances, including forgetfulness, financial hardship, or disputes with the credit card company. By identifying the specific cause of the late fee, you can tailor your complaint letter to address the root of the problem effectively.

It’s important to review your credit card statement and ascertain the exact details of the late fee, including the amount charged and the date it was incurred. Understanding the terms and conditions of your credit card agreement is also essential, as it provides insight into the policies regarding late payments and associated fees. By familiarizing yourself with these details, you can articulate your concerns with precision and clarity in your complaint letter.

Furthermore, consider the circumstances that led to the late payment. Whether it was an oversight due to a busy schedule or a genuine financial challenge, acknowledging the underlying reasons can add a human touch to your complaint letter. This can resonate with the recipient and potentially evoke empathy, increasing the likelihood of a positive response.

Additionally, if there were any extenuating circumstances, such as a billing error or a dispute with the credit card company, gather relevant documentation to support your claim. This may include correspondence with the credit card company, transaction records, or any other evidence that substantiates your position. Having this information at your disposal strengthens the validity of your complaint and reinforces your case.

By comprehensively understanding the issue surrounding the credit card late fee, you can approach the process of writing a complaint letter with clarity and purpose. This foundational knowledge will inform the content and tone of your letter, ultimately enhancing its effectiveness in conveying your concerns to the credit card company.

**

Gathering Necessary Information

Effective complaint letters are underpinned by thorough preparation and the gathering of essential information. As you embark on the process of addressing a credit card late fee, it’s vital to collect pertinent details that will bolster the validity of your complaint and strengthen your position.

Begin by reviewing your credit card statements to pinpoint the specific late fee in question. Note down the date of the late payment, the amount charged, and any accompanying details that will provide context for your complaint. This meticulous approach demonstrates your attention to detail and reinforces the legitimacy of your grievance.

Understanding the terms and conditions of your credit card agreement is paramount. Familiarize yourself with the policies concerning late payments, including any grace periods, penalty fees, and the escalation of charges for subsequent late payments. By equipping yourself with this knowledge, you can reference relevant clauses in your complaint letter, showcasing your understanding of the contractual agreement and underscoring the basis of your complaint.

If there were extenuating circumstances that contributed to the late payment, such as a billing error or a dispute with the credit card company, gather supporting documentation. This may encompass email correspondence, transaction records, or any written communication that substantiates your claim. Concrete evidence bolsters the credibility of your complaint and provides a compelling foundation for your case.

Moreover, it’s beneficial to review your payment history and credit standing with the credit card company. If you have a record of timely payments and a positive credit history, highlighting this information can reinforce your position and underscore the atypical nature of the late fee in question.

By methodically gathering necessary information, you lay the groundwork for a compelling and well-substantiated complaint letter. This preparatory phase is instrumental in fortifying your case and enhancing the efficacy of your communication with the credit card company.

Structuring Your Complaint Letter

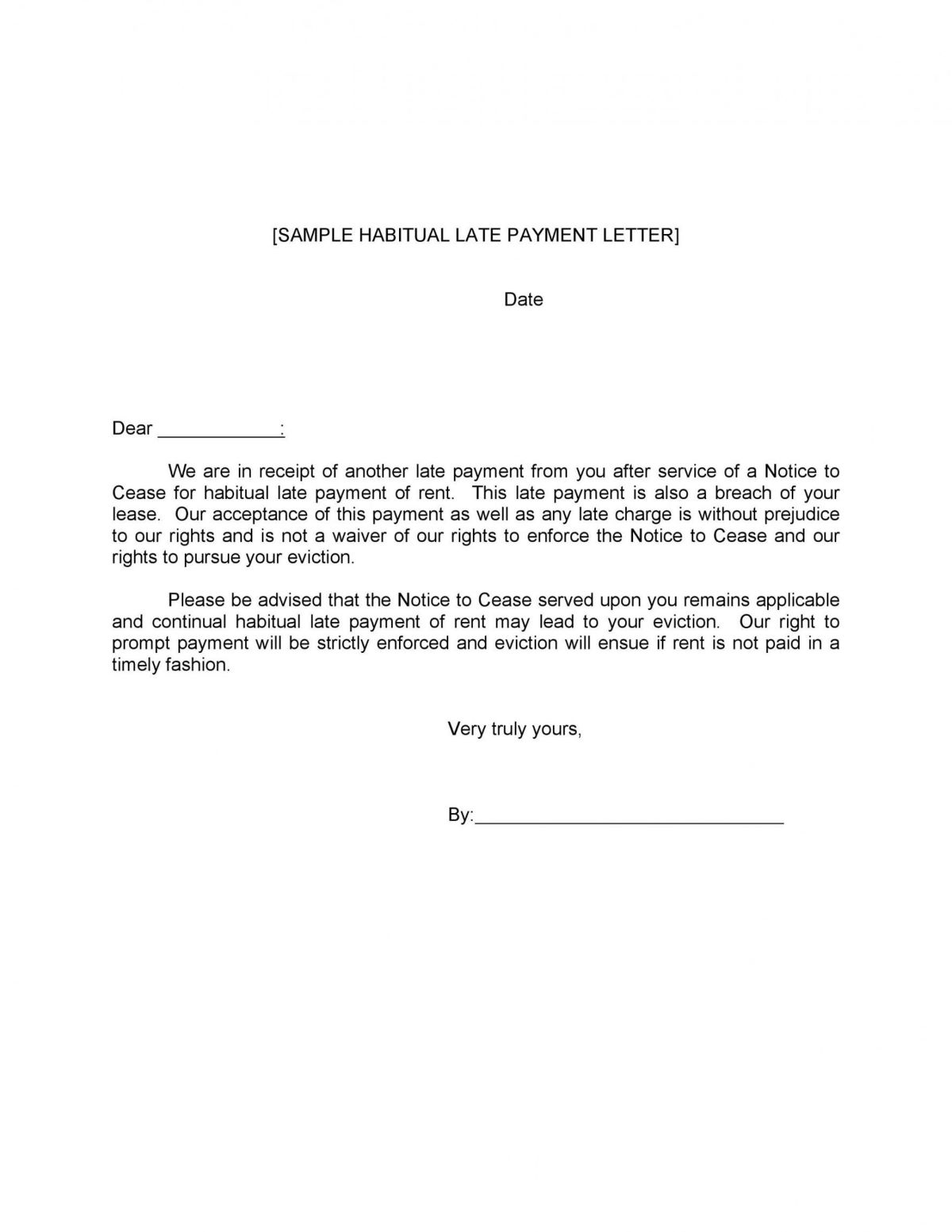

When composing a complaint letter about a credit card late fee, the structure and organization of your communication play a pivotal role in conveying your message effectively. A well-structured letter not only enhances readability but also ensures that your grievances are clearly articulated, increasing the likelihood of a favorable response from the credit card company.

Begin by formatting your letter with a professional and courteous tone. Address the recipient formally, using their appropriate title and full name. This sets a respectful and business-like tone for the correspondence, laying the groundwork for a constructive dialogue.

The opening paragraph should succinctly introduce the purpose of your letter. Clearly state that you are addressing a late fee charged to your credit card account and express your intention to contest the validity of the fee. This serves as a concise yet impactful way to set the stage for the ensuing details of your complaint.

Subsequently, provide a chronological account of the events leading to the late fee. Detail the circumstances that contributed to the late payment, emphasizing any extenuating factors or disputes that may have precipitated the situation. This narrative approach adds depth to your complaint, offering a comprehensive view of the circumstances surrounding the late fee.

Following the exposition of the events, articulate the specific grievances you have regarding the late fee. This may include concerns about the fairness of the fee, discrepancies in billing, or any challenges you faced in attempting to rectify the situation. Clearly delineate the reasons why you believe the late fee is unjust or unwarranted, substantiating your assertions with factual information and supporting documentation.

Conclude your letter with a call to action, expressing your expectation for a prompt and equitable resolution. Encourage the recipient to address your concerns and seek an amicable resolution to the matter. Conveying a sense of optimism and openness to resolution fosters a constructive dialogue and sets the stage for a favorable outcome.

By adhering to a well-structured format, you can effectively convey your grievances and position yourself for a meaningful response from the credit card company. The structural clarity of your complaint letter enhances its impact and underscores the validity of your concerns.

Writing the Complaint Letter

As you embark on the process of drafting your complaint letter about a credit card late fee, it’s essential to infuse your communication with clarity, precision, and a professional yet assertive tone. The content of your letter serves as a powerful tool to convey your grievances effectively and elicit a meaningful response from the credit card company.

Commence your letter with a formal salutation, addressing the recipient by their full name and title. This sets a respectful and professional tone for the correspondence, laying the foundation for a constructive exchange.

In the opening paragraph, concisely state the purpose of your letter. Clearly articulate that you are addressing a late fee charged to your credit card account and express your intent to contest the validity of the fee. This direct and succinct approach sets the stage for the detailed exposition of your grievances.

Subsequently, provide a chronological account of the events that led to the late fee. Articulate the circumstances surrounding the late payment, emphasizing any mitigating factors or disputes that may have contributed to the situation. By presenting a coherent narrative, you provide the recipient with a comprehensive understanding of the context in which the late fee arose.

Following the exposition of the events, articulate your specific grievances regarding the late fee. Clearly delineate the reasons why you believe the late fee is unjust or unwarranted, substantiating your assertions with factual information and supporting documentation. This evidence-based approach reinforces the validity of your complaint and bolsters the credibility of your position.

Conclude your letter by expressing your expectation for a prompt and equitable resolution. Encourage the recipient to address your concerns and seek an amicable resolution to the matter. Conveying a sense of optimism and openness to resolution fosters a constructive dialogue and positions your letter as a catalyst for a favorable outcome.

Throughout the letter, maintain a professional and courteous tone, avoiding confrontational language or emotional rhetoric. Clear, concise, and respectful communication enhances the impact of your letter and increases the likelihood of a constructive response from the credit card company.

Sending the Complaint Letter

Once you have meticulously crafted your complaint letter about the credit card late fee, the next crucial step is to ensure its timely and secure delivery to the appropriate recipient within the credit card company. The manner in which you send the letter can significantly impact its reception and the subsequent handling of your grievance.

First and foremost, ensure that the letter is addressed to the correct department or individual within the credit card company. This may involve referencing specific contact information provided on the company’s website or in previous correspondence. Accuracy in addressing the letter minimizes the risk of misdirection and ensures that it reaches the relevant decision-makers.

Consider sending the letter via certified mail with return receipt requested. This method provides tangible evidence of the letter’s delivery and receipt, offering a layer of security and accountability. The confirmation of receipt serves as a valuable record, verifying that the credit card company has officially received your complaint.

Alternatively, if the credit card company provides an online portal or designated email address for customer complaints, ensure that your letter is submitted through the prescribed channels. Adhering to the company’s preferred mode of communication streamlines the process and aligns with their established procedures for grievance resolution.

As you dispatch the complaint letter, retain a copy for your records. This ensures that you have a comprehensive record of the communication, including the content of the letter and the details of its delivery. Maintaining thorough documentation is essential for tracking the progress of your complaint and facilitating follow-up actions if necessary.

Upon sending the letter, exercise patience while awaiting a response from the credit card company. Allow a reasonable timeframe for the company to acknowledge receipt of your complaint and initiate the process of addressing your concerns. If a response is not received within the stipulated timeframe, consider following up with the company to ensure that your letter has been duly processed.

By conscientiously managing the process of sending your complaint letter, you demonstrate a proactive and diligent approach to addressing the credit card late fee. The methodical dispatch of your letter lays the groundwork for a constructive dialogue and sets the stage for a meaningful resolution to your grievance.

Following Up on Your Complaint

After sending your complaint letter about the credit card late fee, it’s essential to maintain proactive engagement and follow up on your grievance to ensure that it receives due consideration and prompt resolution. By strategically following up on your complaint, you demonstrate your commitment to seeking a satisfactory outcome and can navigate any potential challenges that may arise during the resolution process.

Allow a reasonable timeframe for the credit card company to acknowledge receipt of your complaint and initiate the process of addressing your concerns. This period may vary based on the company’s stated timelines for responding to customer grievances. Exercise patience while awaiting a response, but remain attentive to the passage of time to ensure that your concerns are being actively addressed.

If a response is not received within the stipulated timeframe, consider following up with the credit card company to inquire about the status of your complaint. This follow-up communication can be conducted via email, phone, or through the company’s designated customer service channels. Clearly reference the details of your initial complaint and express your desire for an update on the progress of your case.

When following up, maintain a courteous and professional demeanor, reiterating the specifics of your grievance and the steps you have taken thus far. Clearly articulate your expectation for a timely and equitable resolution, emphasizing your commitment to reaching a mutually satisfactory outcome. By demonstrating persistence and clarity in your follow-up communication, you convey the importance of your concerns and your proactive approach to seeking resolution.

If the credit card company provides a designated timeline within which they commit to addressing customer complaints, ensure that your follow-up aligns with this timeframe. This demonstrates your adherence to the company’s procedures and expectations, fostering a constructive and cooperative approach to grievance resolution.

Throughout the follow-up process, maintain comprehensive records of all communication, including the details of your initial complaint, the dispatch of your letter, and subsequent follow-up interactions. This documentation serves as a valuable resource for tracking the progress of your grievance and provides a clear record of your proactive engagement in seeking resolution.

By diligently following up on your complaint, you assertively advocate for the fair and timely resolution of the credit card late fee issue. Your proactive approach to engagement underscores the importance of your concerns and positions you as a committed and informed consumer seeking a meaningful resolution.

Conclusion

Addressing a credit card late fee through a well-crafted complaint letter is a proactive and effective means of asserting your rights as a consumer and seeking a favorable resolution to financial grievances. Throughout this comprehensive guide, we have explored the essential steps involved in navigating this process with clarity, precision, and professionalism. By understanding the nuances of writing a complaint letter and strategically following up on your grievance, you can position yourself for a meaningful dialogue with the credit card company and work towards a satisfactory outcome.

By comprehensively understanding the issue surrounding the credit card late fee and gathering necessary information, you lay a solid foundation for articulating your concerns in a compelling and well-substantiated manner. The meticulous structuring and writing of your complaint letter, infused with a professional yet assertive tone, enhances the impact of your communication and underscores the validity of your grievances.

As you dispatch the complaint letter and diligently follow up on its progress, you demonstrate a proactive and engaged approach to seeking resolution. Your commitment to maintaining thorough documentation and adhering to the company’s procedures underscores the importance of your concerns and positions you as a informed and persistent consumer advocating for a fair and equitable resolution.

Ultimately, the process of addressing a credit card late fee through a complaint letter empowers you to assert your rights and engage in a constructive dialogue with the credit card company. By navigating this process with clarity, professionalism, and persistence, you enhance the likelihood of a successful resolution and pave the way for a mutually satisfactory outcome. Armed with the insights and strategies outlined in this guide, you are well-equipped to address credit card late fees effectively and advocate for your financial well-being as a conscientious consumer.