Home>Finance>In What Ways Do Efficient Capital Markets Help Both Issuers And Investors

Finance

In What Ways Do Efficient Capital Markets Help Both Issuers And Investors

Modified: December 30, 2023

Efficient capital markets play a vital role in the finance industry, benefiting both issuers and investors by facilitating fair pricing, improved liquidity, and informed decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

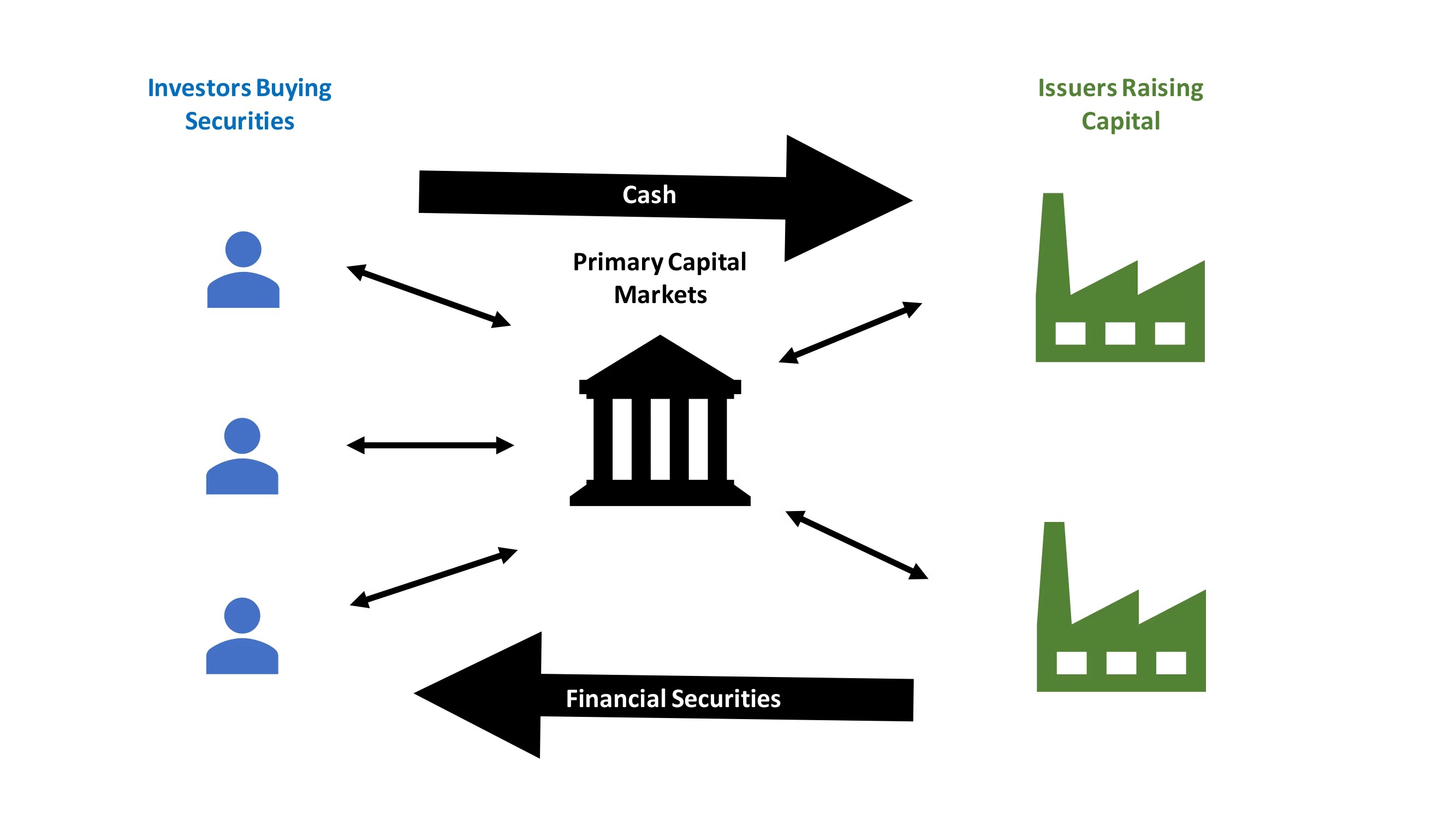

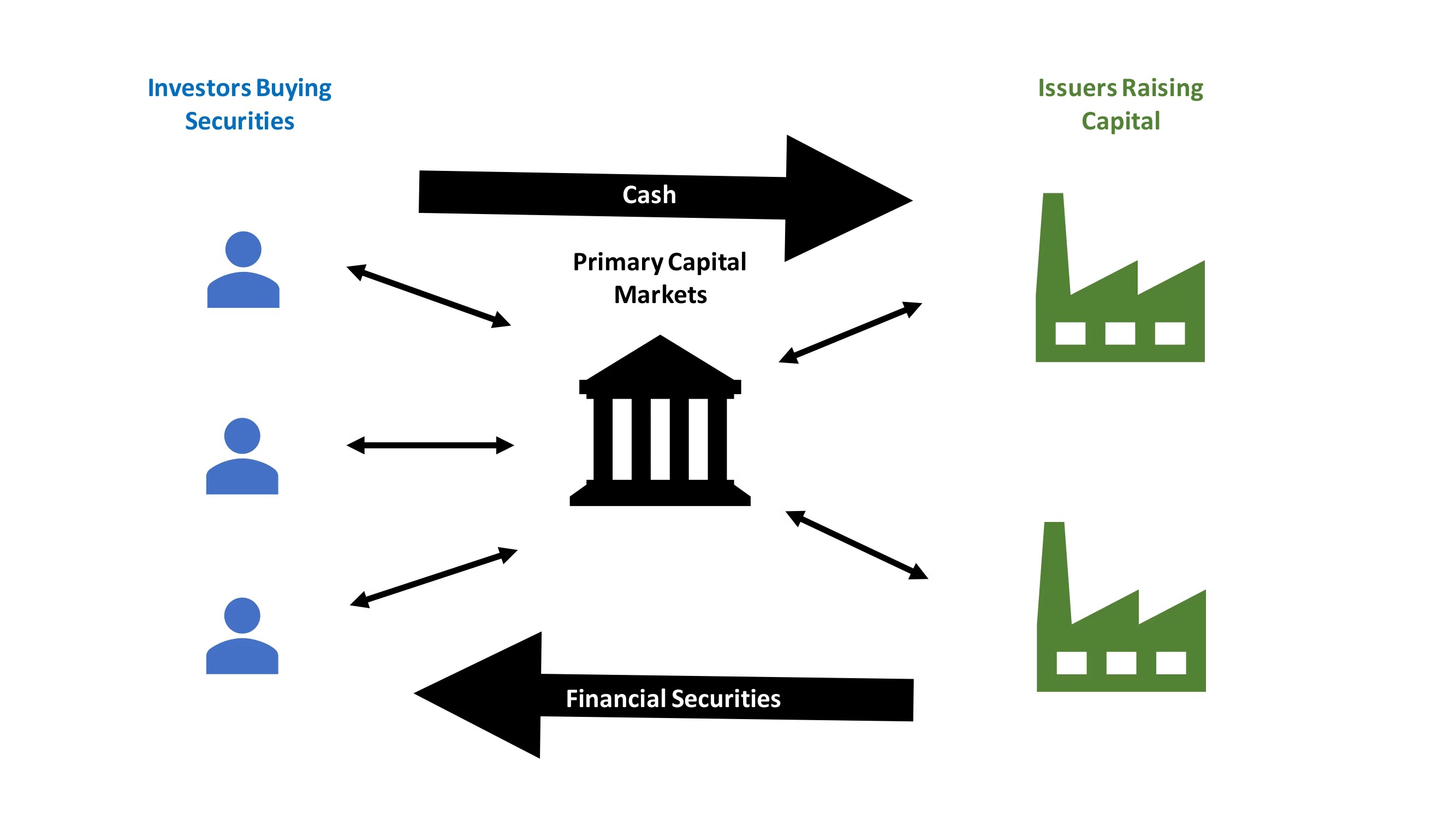

A capital market is a vital component of any economy, serving as a platform for companies to raise funds and for investors to allocate their capital effectively. One measure of a successful capital market is its efficiency. Efficient capital markets are characterized by the quick, accurate, and fair pricing of securities, low transaction costs, and the free flow of information.

In this article, we will delve into the ways in which efficient capital markets benefit both issuers (companies raising capital) and investors. Understanding the advantages of efficient capital markets is crucial for individuals and entities involved in the financial industry as it can impact their decision-making and ultimately drive economic growth.

Before we explore the benefits, let’s briefly define what we mean by efficient capital markets. In an efficient capital market, prices of securities reflect all available information, making it difficult for investors to consistently achieve above-average returns by trading on that information. This concept is based on the efficient market hypothesis, which suggests that all relevant information is incorporated into stock prices, making it virtually impossible to consistently outperform the market.

Definition of Efficient Capital Markets

An efficient capital market is a financial market where security prices accurately reflect all available information. In other words, it is a market where investors cannot consistently generate abnormal profits by exploiting price discrepancies based on publicly available information. The concept of efficient capital markets is rooted in the efficient market hypothesis (EMH), which asserts that financial markets are efficient in processing and incorporating all relevant information.

Efficient capital markets can be classified into three different forms:

- Weak Form Efficiency: In weak-form efficient markets, security prices reflect all historical data, such as past trading prices and trading volumes. In this form, technical analysis techniques, such as analyzing price patterns or trends, are deemed ineffective in generating consistent above-average returns.

- Semi-Strong Form Efficiency: In semi-strong form efficient markets, security prices reflect all publicly available information, including financial statements, news releases, and economic indicators. In this form, not only is technical analysis ineffective, but fundamental analysis, which is the analysis of a company’s financial health and future prospects, is also unable to consistently outperform the market.

- Strong Form Efficiency: In strong form efficient markets, security prices reflect all information, including both public and private information. This means that even insider trading, which involves trading based on privileged information not available to the public, would not provide an advantage in consistently outperforming the market.

Efficient capital markets play a crucial role in ensuring fair and transparent trading, attracting investors, and facilitating capital allocation. When prices accurately reflect all available information, investors can make informed decisions about buying, selling, or holding securities. Issuers can raise capital at fair prices, encouraging investment in new projects and fostering economic growth.

In the next sections, we will explore the benefits of efficient capital markets for both issuers and investors, highlighting how these markets contribute to overall financial stability and efficiency.

Benefits to Issuers

Efficient capital markets offer a range of benefits to issuers, which are the companies or entities raising capital through the issuance of securities. These advantages can have a significant impact on their ability to access funds, grow their businesses, and make strategic decisions. Here are some key benefits that issuers derive from efficient capital markets:

- Access to Capital: Efficient capital markets provide issuers with access to a larger pool of potential investors. This increases the likelihood of successfully raising capital and allows issuers to fund their operations, expand their businesses, and undertake new projects. The ability to access capital efficiently is particularly essential for startups and smaller companies with limited resources.

- Lower Cost of Capital: In efficient capital markets, the pricing of securities reflects all available information and investor expectations. As a result, issuers can raise capital at fair market prices, reducing the cost of capital. Efficient markets enable issuers to avoid overpaying for funds and attract investors who are willing to invest capital at competitive rates.

- Enhanced Liquidity: An efficient capital market provides a platform for issuers to trade their securities easily. This increased liquidity enables issuers to buy back their own shares, issue new securities, or sell existing ones more swiftly. The ability to access liquidity helps issuers manage their capital structure, respond to changing market conditions, and optimize their financial strategies.

- Improved Market Image: Operating in an efficient capital market enhances the reputation and image of an issuer. It signals to investors and stakeholders that the company is committed to transparency, fairness, and good governance practices. Investors are more likely to trust an issuer operating in an efficient market, which can positively impact the company’s valuation and access to future capital.

- Market Visibility and Information Dissemination: Efficient capital markets facilitate the dissemination of information about issuers. This allows companies to reach a broader audience of investors and stakeholders, raising awareness about their businesses, financial performance, and growth prospects. Increased market visibility improves the chances of attracting new investors and enhances the efficiency of capital allocation.

Overall, efficient capital markets provide issuers with a platform to access funding, manage their capital structure, and enhance their reputation. These benefits contribute to the growth and development of issuers, ensuring a robust and dynamic economy.

Benefits to Investors

Efficient capital markets not only benefit issuers but also provide numerous advantages to investors, who allocate their capital to different investment opportunities. These benefits contribute to investor confidence, fair trading, and the overall efficiency of the financial system. Here are some key benefits that investors derive from efficient capital markets:

- Fair Pricing: In efficient capital markets, securities are priced based on all available information and investor expectations. This ensures that the prices of securities accurately reflect their underlying value, reducing the likelihood of overvalued or undervalued assets. Investors can make informed investment decisions and avoid situations where they overpay or underpay for securities.

- Equal Access to Information: Efficient capital markets promote the equal access to information for all investors. Publicly available information is widely disseminated, ensuring that all market participants have access to the same data. This reduces information asymmetry and levels the playing field, allowing investors to make decisions based on a fair and transparent market.

- Liquidity: Efficient capital markets provide liquidity, allowing investors to buy and sell securities quickly and easily. Investors can enter or exit positions without significant disruption to market prices, enabling them to manage their portfolios efficiently. Liquidity increases flexibility and reduces the risk of holding illiquid assets that are difficult to sell when needed.

- Diversification Opportunities: Efficient capital markets offer a wide array of investment options across different asset classes, sectors, and geographies. This allows investors to diversify their portfolios and spread their risk. Diversification helps mitigate the impact of individual investment losses and can enhance overall portfolio performance.

- Price Discovery: Efficient capital markets facilitate price discovery, as prices continuously adjust based on available information and investor sentiment. Investors can rely on market prices to determine the fair value of securities and make informed investment decisions. Price discovery ensures that securities are traded at their true worth, promoting market efficiency.

- Increased Market Efficiency and Stability: By reflecting all available information, efficient capital markets contribute to overall market efficiency and stability. Efficient markets absorb new information quickly, reducing the likelihood of price manipulation or excessive volatility. This fosters trust and confidence in the financial system, attracting more investors and supporting long-term economic growth.

Investors engaging in efficient capital markets benefit from fair pricing, equal access to information, liquidity, diversification opportunities, price discovery, and increased market efficiency. These advantages enhance the investor experience, encourage participation in the market, and facilitate the optimal allocation of capital.

Conclusion

Efficient capital markets play a crucial role in the functioning of the financial system, benefiting both issuers and investors. These markets ensure fair pricing, equal access to information, liquidity, and diversification opportunities, promoting transparency, trust, and overall market efficiency.

For issuers, efficient capital markets provide access to capital, lower the cost of capital, enhance liquidity, improve market image, and facilitate information dissemination. These benefits enable issuers to fund their operations, grow their businesses, and make strategic decisions with the confidence that they are operating in a fair and transparent environment.

Similarly, investors reap various advantages from participating in efficient capital markets. They benefit from fair pricing, equal access to information, liquidity, diversification opportunities, price discovery, and increased market efficiency and stability. These benefits empower investors to make informed decisions, manage their portfolios effectively, and contribute to the proper functioning of the financial system.

Efficient capital markets are the backbone of a healthy and thriving economy. By facilitating the efficient allocation of capital, these markets support economic growth, innovation, and job creation. They attract investors, promote confidence, and enable companies to access the funds they need to expand and succeed.

However, it is important to recognize that achieving and maintaining efficient capital markets requires ongoing efforts. Regulators, market participants, and policymakers must continually work towards enhancing transparency, promoting fair trading practices, and ensuring equal access to information. By doing so, we can continue to reap the benefits of efficient capital markets, fostering sustainable economic development and prosperity.