Home>Finance>International Foreign Exchange Master Agreement (IFEMA) Definition

Finance

International Foreign Exchange Master Agreement (IFEMA) Definition

Published: December 11, 2023

Learn the definition and key features of the International Foreign Exchange Master Agreement (IFEMA) in the finance industry. Best practices and insights shared.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The International Foreign Exchange Master Agreement (IFEMA) Definition Explained

Welcome to our Finance blog! Today, we will be diving into the world of international finance and taking a closer look at the International Foreign Exchange Master Agreement, also known as IFEMA.

If you’re involved in financial markets, especially the foreign exchange market, then understanding the various legal agreements that govern these transactions is crucial. The IFEMA is one such agreement that provides a standardized framework for foreign exchange transactions between parties.

Key Takeaways:

- IFEMA is an integral part of the foreign exchange market, providing a standardized framework for transactions.

- It helps to mitigate counterparty risks and ensure transparency in foreign exchange transactions.

Now, let’s take a closer look at what exactly IFEMA entails and why it is important.

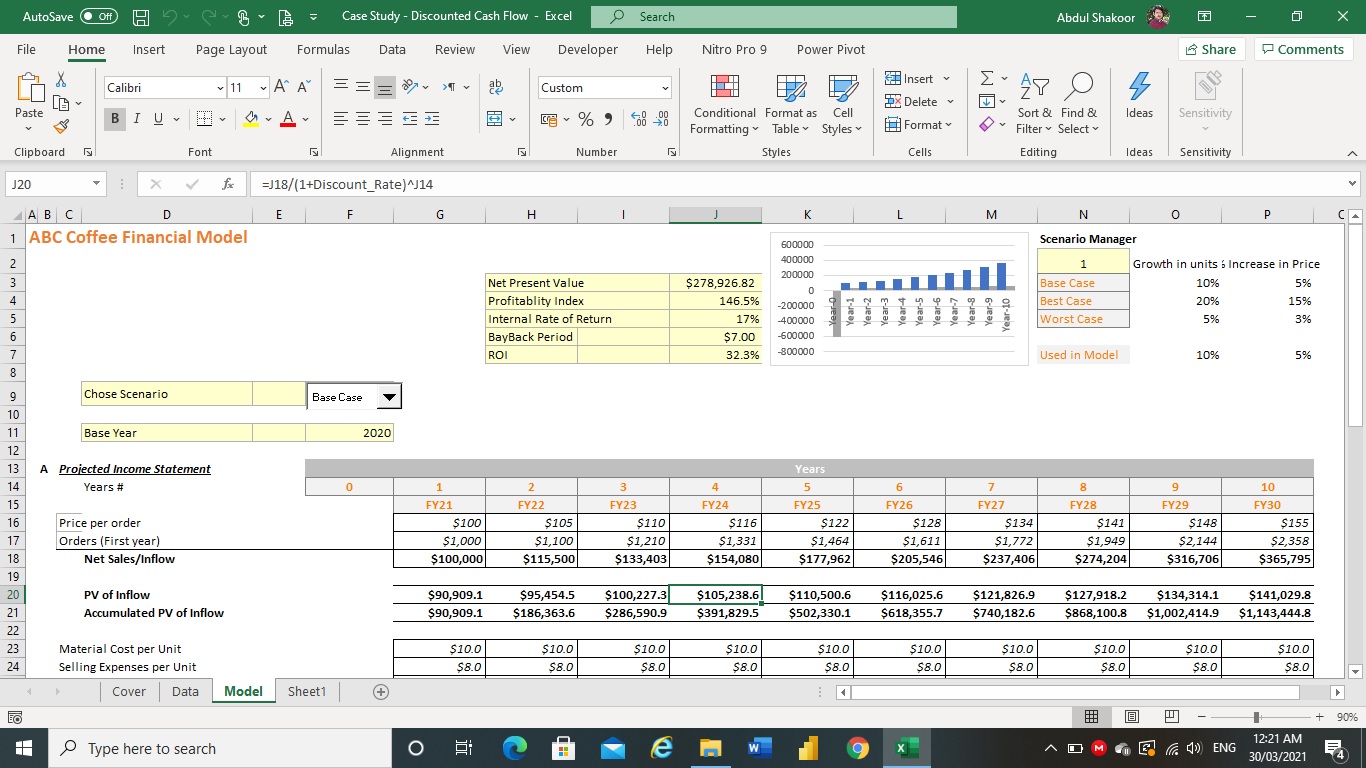

What is IFEMA?

IFEMA is a legal document that governs foreign exchange transactions between two parties. It establishes the rights, obligations, and responsibilities of both parties involved in the transaction. The agreement covers a wide range of provisions, including payment, delivery, netting, set-off, and more.

IFEMA provides a standardized framework for foreign exchange transactions, which helps to streamline the process and reduce the potential for conflicts and disputes. It is often used in over-the-counter (OTC) markets, where parties negotiate the terms of the agreement.

Why is IFEMA important?

IFEMA plays a crucial role in the foreign exchange market for several reasons:

- Standardization: IFEMA provides a standardized framework for foreign exchange transactions. This helps to ensure that all parties involved are working with the same terms and conditions, reducing the potential for misunderstandings or discrepancies.

- Counterparty Risk Mitigation: IFEMA includes provisions for netting and set-off, which helps to mitigate counterparty risks. By offsetting obligations and payments between parties, potential losses can be minimized.

- Transparency: With its standardized format, IFEMA promotes transparency in foreign exchange transactions. Parties can easily understand their rights and obligations, reducing the potential for conflicts and disputes.

- Efficiency: By using IFEMA, parties can benefit from a streamlined process for foreign exchange transactions. This helps to save time and resources, making it easier to conduct business in global financial markets.

As the global financial markets continue to evolve, having standardized legal agreements like IFEMA is essential. It provides a solid foundation for foreign exchange transactions, ensuring fairness, transparency, and efficiency.

Conclusion

The International Foreign Exchange Master Agreement (IFEMA) is an important legal document that governs foreign exchange transactions. With its standardized framework, IFEMA helps to mitigate counterparty risks, promote transparency, and streamline the process. By understanding the definition and significance of IFEMA, finance professionals can navigate the complex world of foreign exchange with greater confidence and clarity.