Finance

What Is A Cash Flow Model

Published: December 21, 2023

Discover how a cash flow model can help you analyze your finances. Understand the importance of cash flow in finance and make informed decisions for your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Model

- Importance of Cash Flow Models

- Components of a Cash Flow Model

- Benefits of Using a Cash Flow Model

- Limitations of Cash Flow Models

- Steps to Build a Cash Flow Model

- Factors to Consider in a Cash Flow Model

- Common Mistakes to Avoid in Cash Flow Modeling

- Applications of Cash Flow Models

- Conclusion

Introduction

When it comes to managing finances, organizations and individuals alike rely on various tools and techniques to make informed decisions. One such tool that plays a crucial role in financial planning is the cash flow model. A cash flow model provides a detailed analysis of the inflows and outflows of cash over a specific period of time. It allows businesses to project their future financial position, making it an essential tool for budgeting, forecasting, and strategic planning.

In simple terms, a cash flow model is a financial tool that tracks the movement of cash within an organization. It takes into account all cash receipts from sales, investments, and loans, as well as cash payments for expenses, purchases, and other financial obligations.

By analyzing the cash flow model, businesses can gain valuable insights into their financial health and make well-informed decisions. They can identify potential cash shortages, plan for future investments, and assess their ability to meet financial obligations.

Whether you are a small business owner, a finance professional, or an individual looking to manage your personal finances, understanding the concept of cash flow modeling is essential. In this article, we will explore the definition, importance, components, benefits, limitations, and applications of cash flow models. We will also discuss the steps to build a cash flow model, as well as common mistakes to avoid in the process.

By the end of this article, you will have a comprehensive understanding of cash flow models and be equipped with the knowledge to leverage them effectively in your financial planning strategies.

Definition of Cash Flow Model

A cash flow model is a financial tool used to track and analyze the movement of cash into and out of an organization or individual’s finances. It provides a comprehensive and detailed view of the cash inflows and outflows over a specified period, typically monthly, quarterly, or annually.

In essence, a cash flow model serves as a roadmap for understanding how cash is generated and spent within a given timeframe. It takes into account various sources of cash inflow, including revenue from sales, investments, or borrowing, as well as cash outflows such as expenses, loan repayments, and investments.

The purpose of a cash flow model is to provide an accurate and realistic depiction of the financial health of an entity. It enables businesses to assess their liquidity and financial stability by determining if they have sufficient cash on hand to meet their obligations. It also helps individuals and organizations identify potential cash shortages or excesses and make informed decisions based on their financial situation.

Moreover, a cash flow model allows for financial forecasting and budgeting. By analyzing historical cash flows and making projections for future periods, businesses can anticipate cash needs and plan accordingly. This helps in optimizing cash management, ensuring that funds are allocated efficiently and strategically.

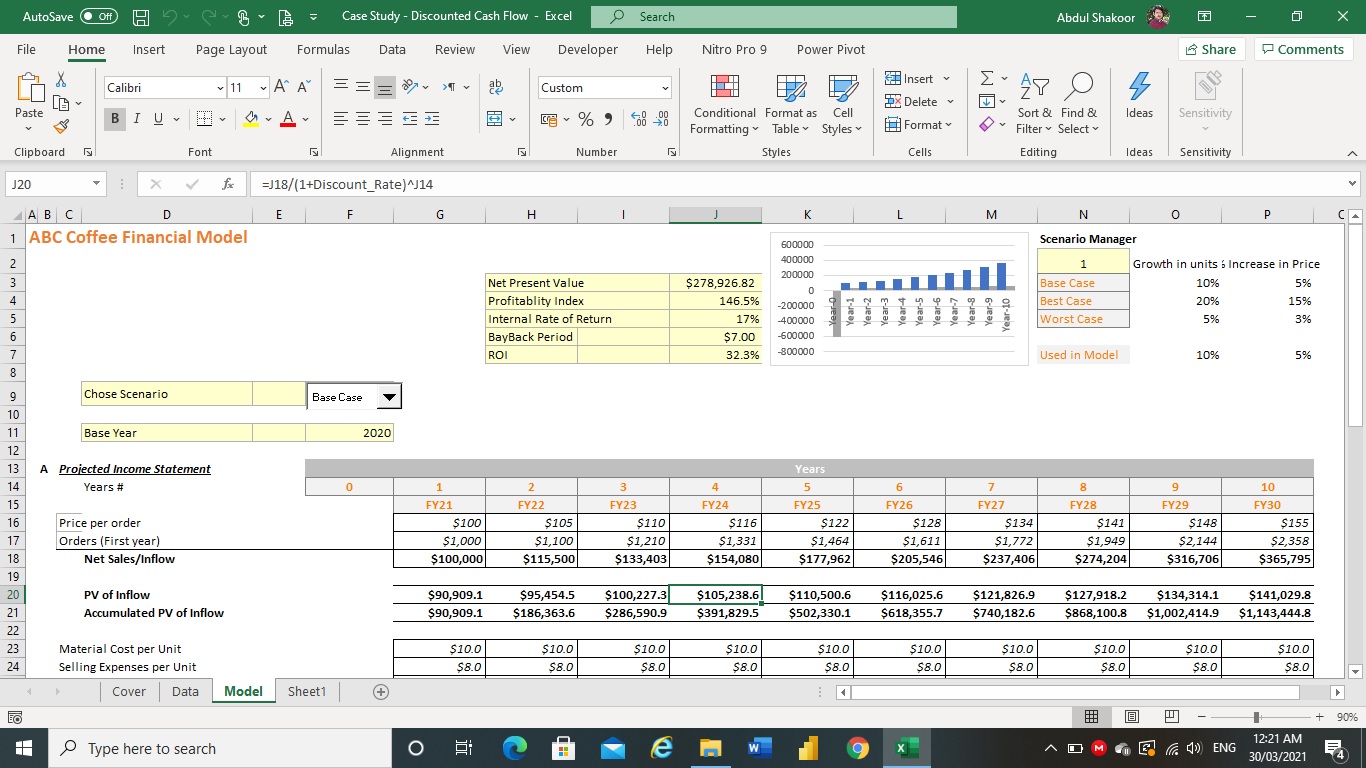

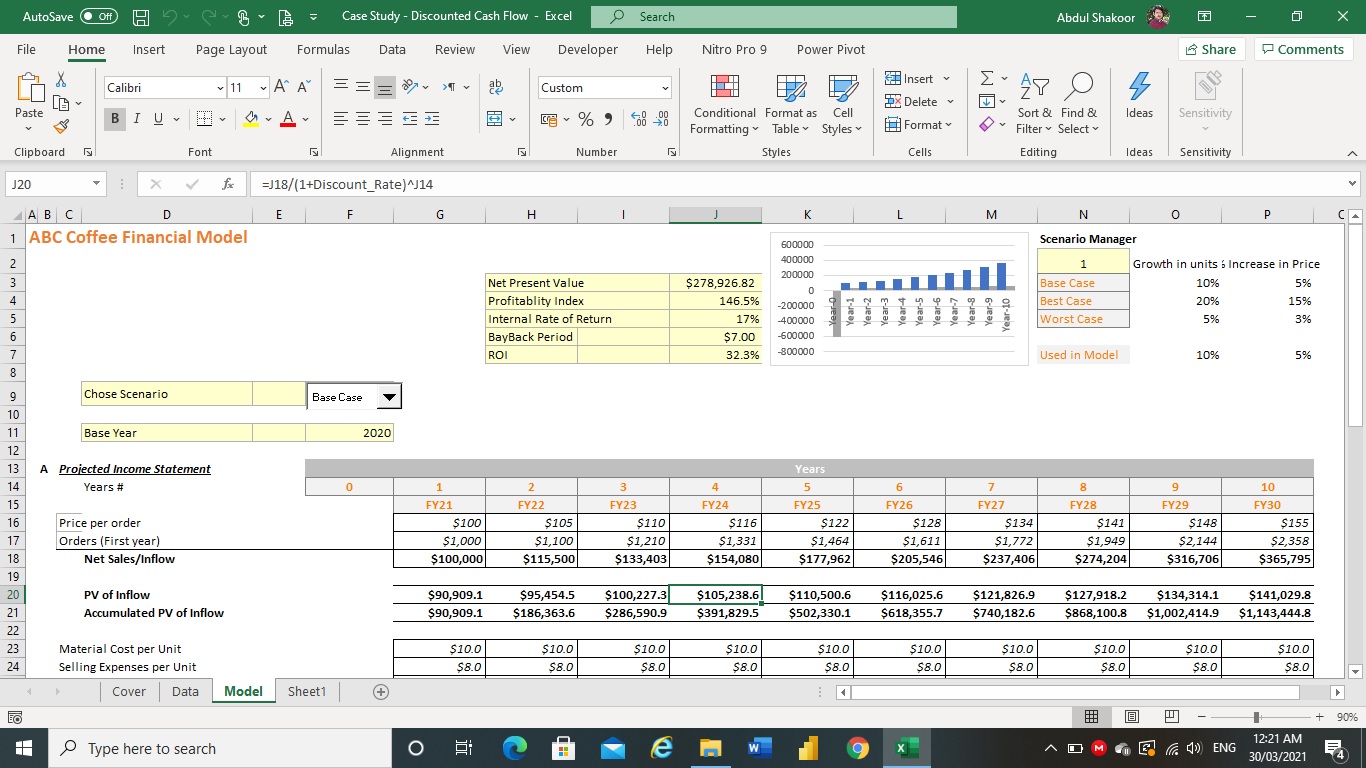

A cash flow model can be presented in various formats, including spreadsheets, graphs, or financial software tools. It typically includes several categories, such as operating cash flows, investing cash flows, and financing cash flows, which provide a comprehensive overview of the financial activities of an entity.

Overall, the purpose of a cash flow model is to provide a clear and structured representation of an organization’s or an individual’s cash flows, enabling them to make informed decisions, mitigate financial risks, and achieve financial stability.

Importance of Cash Flow Models

Cash flow models play a crucial role in financial management for both businesses and individuals. They provide valuable insights into the movement of cash and help in making informed decisions. Here are some key reasons why cash flow models are important:

- Financial Planning: Cash flow models are essential for effective financial planning. By analyzing past and projected cash flows, businesses can identify patterns, trends, and potential cash shortfalls. This allows them to make informed decisions about budgeting, investment, and resource allocation.

- Budgeting and Forecasting: Cash flow models provide a framework for creating budgets and making financial projections. By tracking the inflow and outflow of cash, businesses can accurately estimate future cash needs and plan accordingly. This helps in avoiding cash shortages and ensures that resources are allocated optimally.

- Liquidity Management: Understanding the cash position of a business is crucial for managing liquidity. Cash flow models provide insights into the timing and amount of cash inflows and outflows, helping businesses maintain adequate working capital and meet financial obligations on time.

- Financial Health Analysis: Cash flow models enable businesses to assess their overall financial health. By analyzing cash flows, businesses can determine their ability to cover expenses, pay off debts, and invest in growth opportunities. This information is vital for shareholders, lenders, and investors to evaluate the financial stability and performance of an organization.

- Investment Decision Making: Cash flow models assist in evaluating the financial viability of investment opportunities. By considering the cash inflows and outflows associated with potential investments, businesses can assess their profitability and determine the best course of action. This helps in making informed decisions about resource allocation and expanding the business.

- Risk Management: Cash flow models help in identifying and managing financial risks. By monitoring cash flows, businesses can identify potential cash flow gaps, excessive spending, or delayed payments. This allows them to take necessary actions to mitigate risks and ensure the stability of their cash position.

In summary, cash flow models are essential for effective financial management. They provide valuable insights into cash inflows and outflows, assist in financial planning and budgeting, enable liquidity management, and help in making informed investment decisions. By utilizing cash flow models, businesses and individuals can achieve financial stability, optimize their resource allocation, and make sound financial decisions.

Components of a Cash Flow Model

A cash flow model is composed of several key components that contribute to its effectiveness in analyzing and managing cash flow. Understanding these components is essential for building a comprehensive and accurate cash flow model. Here are the key components of a cash flow model:

- Operating Cash Flows: This component represents the cash flow generated from the core business operations of an organization. It includes cash inflows from sales revenue, accounts receivable, and other operational sources. Operating cash flows also encompass cash outflows such as expenses, inventory purchases, and supplier payments.

- Investing Cash Flows: This component reflects the cash flows associated with investment activities, such as the purchase or sale of long-term assets, investments in other businesses, or the receipt of dividends from investments. It includes cash inflows from asset sales and investments, as well as cash outflows from asset purchases and investments made by the business.

- Financing Cash Flows: This component represents the cash flows related to financing activities. It includes cash inflows from borrowing, obtaining loans, or issuing equity, as well as cash outflows from loan repayments, dividend payments, and stock buybacks.

- Net Cash Flow: This component calculates the overall cash flow of the business by subtracting cash outflows from cash inflows. Net cash flow is a key metric that indicates the overall cash position of the organization, whether positive or negative, for a given period.

- Opening and Closing Cash Balances: These components represent the opening and closing cash balances for each period. The opening cash balance represents the cash on hand at the beginning of the period, while the closing cash balance represents the cash on hand at the end of the period.

- Cash Flow Forecasts: Cash flow models often include cash flow forecasts, which estimate future cash inflows and outflows based on historical data and projected business activities. These forecasts provide valuable insights for planning and decision-making.

- Periodicity: The cash flow model is typically divided into periods, such as monthly, quarterly, or annually. This allows for better tracking and analysis of cash flow patterns over time.

- Anomalies and Variances: Cash flow models may include the identification and analysis of any anomalies or variances in cash flow. These abnormalities can help in identifying areas of improvement or potential risks.

By incorporating these components into a cash flow model, businesses and individuals can acquire a comprehensive understanding of their cash inflows and outflows, making it easier to assess their financial position, plan for the future, and optimize cash management strategies.

Benefits of Using a Cash Flow Model

Utilizing a cash flow model provides numerous benefits for businesses and individuals alike. It serves as a valuable tool for financial analysis, planning, and decision-making. Here are some key benefits of using a cash flow model:

- Improved Financial Decision-making: A cash flow model enables businesses and individuals to make informed financial decisions. By tracking cash inflows and outflows, they can assess the impact of various scenarios on their cash position and evaluate the feasibility of different options. This helps in optimizing resource allocation and minimizing financial risks.

- Enhanced Budgeting and Forecasting: Cash flow models provide a solid foundation for effective budgeting and forecasting. By analyzing historical cash flows and making projections, businesses can accurately estimate their future financial needs, plan for contingencies, and set realistic goals. This helps in aligning financial strategies with business objectives.

- Identifying Cash Shortfalls and Surpluses: Cash flow models highlight potential cash shortages or excesses within a given period. This allows businesses to take proactive measures to address cash shortfalls by exploring financing options or adjusting spending. Conversely, it helps in identifying opportunities to invest or repay debt during periods of cash surplus.

- Better Cash Management: A cash flow model facilitates effective cash management by providing insights into the timing and magnitude of cash inflows and outflows. This helps in optimizing working capital, ensuring that there is sufficient liquidity to meet financial obligations, and avoiding unnecessary borrowing or idle cash balances.

- Improved Financial Health Analysis: Cash flow models allow businesses and individuals to assess their financial health accurately. By analyzing cash flows, they can evaluate liquidity, solvency, profitability, and overall financial stability. This information is essential for lenders, investors, and shareholders to make informed decisions and assess the financial viability of an entity.

- Evaluation of Investment Opportunities: Cash flow models assist in evaluating the financial viability of potential investments. By considering the cash inflows and outflows associated with an investment, businesses can assess its profitability, payback period, and return on investment. This helps in making sound investment decisions and allocating resources effectively.

- Stakeholder Communication: Cash flow models provide a clear and concise representation of an organization’s financial position. This helps in communicating financial information to stakeholders, such as lenders, investors, and shareholders, facilitating transparency, trust, and credibility.

By leveraging the benefits of a cash flow model, businesses and individuals can gain a deeper understanding of their financial situation, improve decision-making, optimize cash management, and achieve long-term financial stability.

Limitations of Cash Flow Models

While cash flow models are valuable tools for financial analysis and planning, it is important to be aware of their limitations. Understanding these limitations can help users make more informed decisions and avoid potential pitfalls. Here are some key limitations of cash flow models:

- Subject to Uncertainty: Cash flow models are based on assumptions and projections, making them susceptible to uncertainty. The accuracy of the model depends on the correctness of these assumptions, which may not always align with the actual outcomes. External factors such as market conditions, economic trends, or unforeseen events can significantly impact cash flows and deviate from the projected figures.

- Focus on Cash Only: Cash flow models primarily focus on cash inflows and outflows, neglecting other valuable financial metrics such as accruals or non-cash transactions. This means that the models may not provide a complete picture of the overall financial health of a business or individual.

- Short-Term Bias: Cash flow models typically emphasize short-term cash movements, often projecting cash flows for only a specific time period. This may overlook the long-term financial sustainability and growth potential of a business. It is important to supplement cash flow models with other financial analysis techniques to gain a comprehensive view.

- Dependent on Historical Data: Cash flow models heavily rely on historical data to project future cash flows. However, the future may not perfectly mirror the past, especially in dynamic and evolving business environments. Changes in market conditions, customer behavior, or competitive landscape can invalidate historical patterns and impact cash flow projections.

- Non-Financial Factors: Cash flow models tend to focus solely on the financial aspects, neglecting important non-financial factors that can influence cash flows. Factors such as changes in regulations, technological advancements, or shifts in consumer preferences can have substantial impacts on cash flows but may not be adequately captured in the model.

- Limited Scope: Cash flow models primarily analyze cash inflows and outflows, but they may not capture other critical aspects of financial planning, such as asset valuation, capital structure, or risk management. Integrating other financial models and tools can provide a more comprehensive understanding of the overall financial picture.

Despite these limitations, cash flow models remain vital tools for understanding and managing cash flows. By acknowledging these limitations and utilizing cash flow models in conjunction with other financial analysis techniques, businesses and individuals can make more informed decisions and mitigate potential risks.

Steps to Build a Cash Flow Model

Building a cash flow model requires careful planning and attention to detail. While the specific steps may vary depending on the complexity of the financial situation, here are some general steps to follow when building a cash flow model:

- Gather Relevant Data: Start by collecting all relevant financial information, including historical cash flow statements, income statements, balance sheets, and any other financial documents. Ensure that the data is accurate, organized, and up-to-date.

- Define the Time Period: Determine the time period for which you want to build the cash flow model. This could be monthly, quarterly, or annually, depending on your needs and the level of detail you require.

- Identify Cash Flow Categories: Categorize cash flows into different groups based on their nature, such as operating cash flows, investing cash flows, and financing cash flows. This will help provide a comprehensive view of the cash inflows and outflows.

- Estimate Cash Inflows: Estimate the cash inflows by analyzing historical data and projecting future revenue streams. Consider factors such as sales, accounts receivable collections, rental income, and any other sources of cash inflow specific to your situation.

- Estimate Cash Outflows: Estimate the cash outflows by analyzing historical expenses and projecting future expenses. Include categories like operating expenses, loan payments, inventory purchases, taxes, and any other cash outflows relevant to your circumstances.

- Consider Timing: Take into account the timing of cash inflows and outflows. Some cash flows may occur at the beginning or end of a period, while others may be spread evenly throughout the period. Adjust the timing accordingly to reflect the actual cash flow patterns.

- Account for Non-Cash Items: Incorporate any non-cash items, such as depreciation or other non-cash expenses, into the cash flow model. While they do not directly impact cash flows, they are important for assessing overall financial health.

- Calculate Net Cash Flow: Subtract the total cash outflows from the total cash inflows to calculate the net cash flow for each period. This represents the overall cash position at the end of each period.

- Include Opening and Closing Cash Balances: Include the opening cash balance (the cash on hand at the beginning of the period) and the closing cash balance (the cash on hand at the end of the period) to provide a complete view of the cash flow cycle.

- Review and Analyze: Validate the results of the cash flow model by reviewing and analyzing the data. Look for any discrepancies, outliers, or trends that may require further investigation. This will help ensure the accuracy and usefulness of the cash flow model.

Remember, building a cash flow model is an iterative process. It may require adjustments, refinements, and ongoing monitoring to maintain its relevancy and accuracy. Regularly updating the model and comparing the projected cash flows with the actual results will enable you to make informed decisions and navigate your financial activities effectively.

Factors to Consider in a Cash Flow Model

Building an accurate and effective cash flow model requires careful consideration of various factors. These factors influence the cash inflows and outflows of an organization or individual and play a crucial role in the model’s validity and reliability. Here are some key factors to consider when building a cash flow model:

- Sales and Revenue Trends: Analyze historical sales and revenue data to identify trends and patterns. Consider external market factors, customer behavior, and industry-specific dynamics that could impact future sales and revenue. This will help in making realistic projections and estimating cash inflows.

- Expenses and Cost Structure: Understand the cost structure of the business or individual. Identify and categorize different expense items such as rent, utilities, payroll, raw materials, and marketing expenses. Consider any planned cost reduction initiatives or potential cost increases in the future.

- Working Capital Management: Assess the efficiency of working capital management. Consider factors such as inventory turnover, accounts receivable collection period, and accounts payable payment terms. These factors can impact the timing of cash inflows and outflows and should be reflected in the cash flow model.

- Capital Expenditures: Project and include anticipated capital expenditures, such as investments in new equipment, facilities, or technology. These expenses can have a significant impact on cash outflows and should be considered in the cash flow model.

- Debt Servicing: Consider any existing debt obligations, such as loan repayments or interest payments. Assess the terms and conditions of the debt and incorporate these cash outflows into the model. This will help in accurately estimating the impact of debt servicing on cash flow.

- Tax Liabilities: Take into account tax liabilities and obligations. Consider the applicable tax rates, tax filing periods, and any changes in tax regulations or legislation. Accurately estimating tax payments will ensure that cash outflows related to taxes are adequately captured in the cash flow model.

- Economic and Market Conditions: Evaluate the prevailing economic and market conditions that may impact cash flows. This includes factors such as inflation rates, interest rates, exchange rates, and regulatory changes. Understanding and accounting for these conditions will help in creating more realistic cash flow projections.

- Seasonality and Cyclical Patterns: Consider any seasonal or cyclical patterns that may affect revenue and expenses. Adjust the cash flow model accordingly to reflect the anticipated variations in cash flow during different periods.

- Risk and Contingencies: Identify potential risks and contingencies that could impact cash flow. This includes factors such as changes in customer demand, supplier disruptions, natural disasters, or regulatory compliance issues. Incorporating these risks and contingencies in the cash flow model will help in assessing their potential financial impact.

It is important to thoroughly analyze and consider these factors when building a cash flow model. By doing so, organizations and individuals can ensure that their cash flow projections are as accurate and realistic as possible, enabling them to make better-informed decisions and plans for the future.

Common Mistakes to Avoid in Cash Flow Modeling

Building an accurate and reliable cash flow model is crucial for effective financial planning and decision-making. However, there are several common mistakes that people often make when creating cash flow models. Being aware of these mistakes can help you avoid them and ensure the accuracy and usefulness of your cash flow model. Here are some common mistakes to avoid in cash flow modeling:

- Underestimating or Overestimating Cash Inflows: Failing to accurately predict or project cash inflows can lead to significant discrepancies in the cash flow model. Carefully analyze historical data, market trends, and customer behavior to ensure realistic and accurate estimations of cash inflows.

- Neglecting Non-Cash Transactions: Cash flow models sometimes focus solely on cash transactions and overlook non-cash items. Remember to account for non-cash expenses, such as depreciation or changes in inventory value, to ensure a comprehensive representation of the financial situation.

- Ignoring the Timing of Cash Flows: The timing of cash inflows and outflows is critical for accurate cash flow modeling. Be mindful of the time lags between the occurrence of a transaction and its impact on cash flow. Overlooking or misrepresenting the timing of cash flows can lead to inaccurate projections.

- Forgetting to Include All Relevant Cash Outflows: Ensure that you include all relevant cash outflows in the cash flow model. It is common to overlook certain expenses, such as one-time costs, loan repayments, or taxes, which can significantly impact the overall cash flow picture.

- Not Incorporating Contingencies or Unforeseen Events: Cash flow models should account for unpredictable events or contingencies that may impact cash flows. Failing to consider these factors can lead to unrealistic projections and inadequate preparation for potential risks.

- Overcomplicating the Model: Keep the cash flow model simple and easy to understand. Overcomplicating the model can introduce unnecessary complexity and increase the likelihood of errors or confusion. Strive for a clear and user-friendly format that facilitates better decision-making.

- Ignoring Updates and Revisions: Cash flow models should be periodically reviewed, updated, and revised to reflect changing circumstances and evolving business conditions. Ignoring updates and revisions can lead to outdated and inaccurate cash flow projections.

- Not Comparing Projected Cash Flows to Actuals: Regularly compare the projected cash flows in the model to the actual cash flows experienced. This helps identify any discrepancies or inaccuracies in the model and allows for adjustments to improve accuracy in future projections.

- Overlooking External Factors: Cash flow models should consider external factors that can impact cash flows, such as changes in the economic environment, industry trends, or regulatory updates. Failing to account for these external factors can result in unreliable cash flow projections.

By avoiding these common mistakes and taking a thoughtful and meticulous approach to cash flow modeling, you can build a robust and accurate model that provides valuable insights for financial planning and decision-making.

Applications of Cash Flow Models

Cash flow models have a wide range of applications in both business and personal finance. They are versatile tools that provide valuable insights and aid in making informed decisions. Here are some key applications of cash flow models:

- Financial Planning and Budgeting: Cash flow models are fundamental for effective financial planning and budgeting. They help businesses and individuals estimate future cash inflows and outflows, allowing for better resource allocation and setting realistic financial goals.

- Investment Analysis: Cash flow models assist in evaluating investment opportunities. By forecasting the expected cash inflows and outflows associated with an investment, individuals and businesses can assess its financial feasibility and make informed investment decisions.

- Loan and Financing Assessment: Cash flow models are essential tools for assessing loan eligibility and determining loan repayment capabilities. Lenders use cash flow models to evaluate the ability of borrowers to generate sufficient cash flow to meet repayment obligations.

- Working Capital Management: Cash flow models aid in optimizing working capital management. By accurately projecting cash flows, businesses can ensure an adequate cash reserve for day-to-day operations, manage inventory levels efficiently, and maintain healthy supplier and customer relationships.

- Financial Risk Analysis: Cash flow models enable businesses and individuals to assess their financial risks. By analyzing projected cash flows, they can identify potential cash shortages, anticipate periods of financial stress, and take necessary measures to mitigate risks.

- Business Valuation: Cash flow models play a significant role in determining the value of a business. In business valuation, cash flow projections are used to estimate the future cash flows that an investor can expect to receive from the business.

- Capital Expenditure Planning: Cash flow models help businesses plan and manage capital expenditures. By analyzing cash inflows and outflows, businesses can make informed decisions about investing in new assets, equipment, or technology while considering the impact on cash flow.

- Performance Monitoring and Evaluation: Cash flow models are valuable tools for monitoring and evaluating financial performance. By comparing actual cash flows with projected cash flows, businesses can assess their performance, identify areas for improvement, and make necessary adjustments to their financial strategies.

- Strategic Decision-Making: Cash flow models provide valuable insights for strategic decision-making. They assist businesses in evaluating different scenarios, assessing the financial implications of various options, and selecting the best course of action based on their cash flow projections.

These applications highlight the versatility and importance of cash flow models in managing finances effectively. Businesses and individuals can leverage cash flow models to make informed decisions, mitigate financial risks, and achieve long-term financial stability and success.

Conclusion

Cash flow models are invaluable tools that facilitate financial planning, analysis, and decision-making for businesses and individuals. By tracking the movement of cash inflows and outflows, cash flow models provide a comprehensive view of financial health, allowing for more informed and strategic actions.

In this article, we explored the definition and components of cash flow models, emphasizing their importance in financial management. We also discussed the benefits of using cash flow models, including improved financial decision-making, enhanced budgeting and forecasting, better cash management, and improved financial health analysis.

Additionally, we examined the limitations of cash flow models, such as uncertainty, short-term bias, and the potential oversight of non-cash transactions. Recognizing these limitations ensures a more accurate interpretation of the results and better decision-making based on the model’s outcomes.

We also delved into the step-by-step process of building a cash flow model, highlighting the significance of gathering relevant data, estimating cash inflows and outflows, and considering factors such as sales trends, expenses, and working capital management. Additionally, we outlined common mistakes to avoid in cash flow modeling, emphasizing the importance of accurate projections and thorough analysis.

Furthermore, we discussed the applications of cash flow models, ranging from financial planning and budgeting to investment analysis, loan assessment, and strategic decision-making. Understanding these applications enables businesses and individuals to effectively leverage cash flow models in various financial contexts.

In conclusion, cash flow models serve as indispensable tools for businesses and individuals to analyze, plan, and manage their finances. By harnessing the power of cash flow models, organizations and individuals can make informed decisions, optimize resource allocation, mitigate financial risks, and achieve long-term financial stability and success.