Home>Finance>Is Collecting Copayments Part Of A Specific Medical Billing Cycle Step?

Finance

Is Collecting Copayments Part Of A Specific Medical Billing Cycle Step?

Published: March 7, 2024

Learn the role of collecting copayments in the medical billing cycle and its impact on the financial aspect of healthcare practices. Understand the significance of copayments in managing the financial health of medical facilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Medical billing is a critical aspect of the healthcare industry, ensuring that healthcare providers receive proper compensation for the services they deliver. It involves a complex cycle of tasks and processes aimed at billing and collecting payments from patients and insurance companies. One essential component of this process is the collection of copayments from patients.

The medical billing cycle is a multifaceted procedure that encompasses various stages, from the initial patient encounter to the resolution of any outstanding balances. Understanding the intricacies of this cycle is crucial for healthcare providers, as it directly impacts their financial stability and the overall efficiency of their practice.

In this article, we will delve into the fundamental aspects of the medical billing cycle, emphasizing the significance of collecting copayments in this context. By exploring the relationship between copayments and the billing cycle, we aim to provide a comprehensive understanding of how these elements intersect within the broader framework of medical billing.

Throughout this discussion, we will underscore the importance of efficient billing practices and the role of copayments in sustaining the financial health of healthcare providers. Moreover, we will address the question of whether collecting copayments constitutes a specific step in the medical billing cycle, shedding light on the interconnected nature of these processes.

As we navigate through the intricacies of medical billing and copayment collection, it is essential to recognize the impact of these practices on both healthcare providers and patients. By illuminating the nuances of this domain, we can empower stakeholders within the healthcare ecosystem to navigate the complexities of medical billing with clarity and confidence.

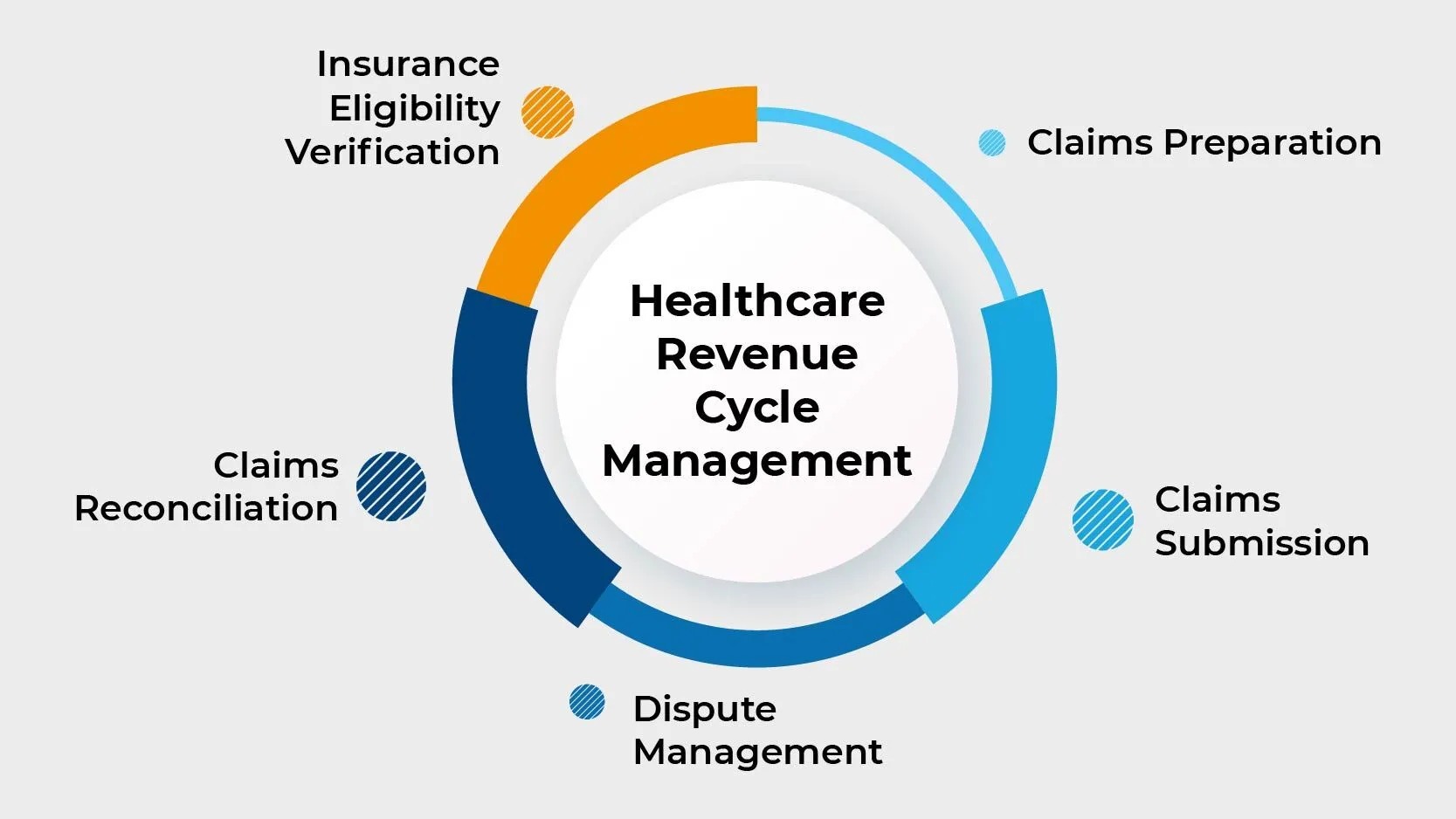

Understanding the Medical Billing Cycle

The medical billing cycle encompasses a series of interconnected steps that facilitate the reimbursement process for healthcare services. It commences when a patient schedules an appointment with a healthcare provider and culminates with the resolution of all outstanding balances. Understanding the various stages of the medical billing cycle is pivotal for healthcare professionals, as it enables them to streamline their revenue cycle management and optimize financial outcomes.

1. Patient Registration: The cycle initiates with patient registration, where demographic and insurance information is collected. This step lays the groundwork for accurate billing and ensures that the necessary details are on record for subsequent billing procedures.

2. Insurance Verification: Verifying the patient’s insurance coverage is essential to determine the extent of their benefits and any associated copayments or deductibles. This step is crucial for estimating the patient’s financial responsibility and preventing billing discrepancies.

3. Coding and Documentation: Healthcare services provided to the patient are translated into universal medical codes, which are then documented for billing purposes. Accurate coding is imperative for proper claim submission and reimbursement.

4. Claim Submission: Once the services are coded and documented, claims are submitted to the relevant insurance companies or payers. This step requires adherence to specific guidelines and timelines to expedite the reimbursement process.

5. Adjudication: After claim submission, the insurance company reviews the claims to determine the amount covered and any patient responsibility. This stage involves assessing the validity of the claims and processing them for payment.

6. Patient Billing and Payment Posting: Patients receive statements detailing their financial responsibility, including copayments, deductibles, and any outstanding balances. Upon receiving payments, the amounts are posted to the patient’s account, reflecting the resolution of their financial obligations.

7. Follow-Up and Collections: In instances where payments are delayed or denied, follow-up procedures are initiated to rectify discrepancies and resolve outstanding claims. This stage involves diligent efforts to collect payments from patients and address any billing concerns.

Understanding the intricacies of the medical billing cycle empowers healthcare providers to navigate the complexities of revenue cycle management effectively. By optimizing each stage of the cycle and prioritizing efficient billing practices, healthcare entities can mitigate financial challenges and foster sustainable operations within the dynamic healthcare landscape.

Importance of Collecting Copayments

Collecting copayments is a crucial aspect of the healthcare revenue cycle, playing a significant role in ensuring the financial viability of medical practices and healthcare facilities. Copayments, which are predetermined fixed amounts that patients are required to pay at the time of service, serve several essential functions within the healthcare ecosystem.

1. Revenue Generation: Copayments contribute to the overall revenue generated by healthcare providers, offsetting a portion of the costs associated with patient care. By collecting copayments upfront, providers can mitigate the financial impact of delivering services and maintain a steady stream of incoming revenue.

2. Patient Accountability: Requiring copayments fosters a sense of financial accountability among patients, encouraging them to actively engage in their healthcare and recognize the value of the services they receive. This financial participation also serves to deter unnecessary or frivolous healthcare utilization, promoting responsible patient behavior.

3. Cost Sharing: Copayments represent a form of cost-sharing between patients and their insurance providers, distributing the financial burden equitably. This shared responsibility helps contain healthcare costs and prevents overreliance on insurance coverage, fostering a balanced approach to healthcare utilization.

4. Revenue Cycle Efficiency: Integrating copayment collection into the billing process streamlines revenue cycle management, reducing the administrative burden associated with pursuing payments after the fact. By addressing patient financial obligations upfront, providers can enhance the efficiency of their billing operations and expedite the reimbursement process.

5. Compliance and Regulatory Adherence: Adhering to copayment collection guidelines is essential for healthcare providers to maintain compliance with regulatory standards and contractual obligations with insurance companies. Failure to collect copayments in accordance with established policies can result in financial penalties and regulatory scrutiny.

6. Patient Satisfaction and Trust: Transparent and consistent copayment policies contribute to positive patient experiences, fostering trust and satisfaction with the healthcare provider. By clearly communicating copayment requirements and demonstrating financial transparency, providers can enhance patient relationships and cultivate a patient-centric care environment.

Recognizing the pivotal role of copayments in the healthcare revenue cycle underscores the importance of implementing robust strategies for their collection. By integrating efficient copayment workflows and leveraging technology to facilitate seamless transactions, healthcare organizations can optimize their revenue cycle and fortify their financial sustainability.

Is Collecting Copayments Part of the Medical Billing Cycle?

Collecting copayments undeniably constitutes a vital component of the medical billing cycle, intertwining with various stages of the reimbursement process and exerting a tangible impact on the financial dynamics of healthcare operations. While not a standalone step in the traditional sense, copayment collection permeates multiple facets of the billing cycle, influencing revenue generation, patient engagement, and compliance considerations.

1. Patient Registration and Insurance Verification: The initial stages of the medical billing cycle involve patient registration and insurance verification, during which copayment details are ascertained. This early engagement with copayments sets the stage for subsequent billing procedures and lays the groundwork for accurate financial assessments.

2. Claim Submission and Adjudication: When claims are submitted to insurance companies, the inclusion of copayment information is essential for accurate reimbursement calculations. Insurance adjudication processes factor in copayments when determining the amount covered, underscoring the interconnected nature of copayments within the reimbursement framework.

3. Patient Billing and Payment Posting: Copayments feature prominently in patient billing statements, delineating the financial responsibilities owed by patients. The collection and posting of copayments represent pivotal steps in resolving patient balances and finalizing the financial transactions associated with healthcare services.

4. Follow-Up and Collections: In cases where copayments remain outstanding, follow-up procedures are initiated to rectify these financial discrepancies. This underscores the ongoing relevance of copayments throughout the billing cycle and the necessity of addressing any outstanding patient obligations.

While copayment collection may not be encapsulated as a discrete step within the medical billing cycle, its pervasive influence and integral role in revenue cycle management underscore its status as an inherent component of the broader billing process. By recognizing the pervasive influence of copayments and integrating strategies to optimize their collection, healthcare providers can fortify the financial robustness of their practices and uphold the integrity of the medical billing cycle.

Conclusion

The intricate interplay between copayments and the medical billing cycle underscores the profound impact of patient financial responsibilities on the financial health of healthcare providers. As we navigate the complexities of revenue cycle management, it becomes evident that collecting copayments is not merely a standalone task but an intrinsic element woven into the fabric of the billing process.

By comprehending the multifaceted nature of the medical billing cycle and recognizing the significance of copayments, healthcare entities can implement strategies to optimize revenue generation, enhance patient accountability, and fortify compliance with regulatory standards. Efficient copayment collection practices not only bolster the financial sustainability of providers but also foster a culture of transparency and trust within patient-provider relationships.

As the healthcare landscape continues to evolve, the seamless integration of copayment collection into the billing cycle emerges as a linchpin for operational efficiency and fiscal resilience. Embracing technological innovations and best practices in revenue cycle management empowers healthcare providers to navigate the complexities of copayment collection with precision and proficiency, ultimately fostering a robust and sustainable financial foundation.

In essence, the convergence of copayments and the medical billing cycle epitomizes the interconnectedness of financial dynamics within the healthcare ecosystem. By embracing this synergy and prioritizing the seamless integration of copayment collection into billing workflows, healthcare providers can cultivate a resilient financial infrastructure that aligns with the evolving demands of the industry.