Home>Finance>How Can Interest Be Found In A Delta Hedging Simulation

Finance

How Can Interest Be Found In A Delta Hedging Simulation

Published: January 15, 2024

Discover the importance of interest in a delta hedging simulation and how it impacts finance. Explore methods to find interest and optimize your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of delta hedging simulations! In finance, delta hedging is a commonly used strategy to manage and reduce risk in various financial instruments, such as options and derivatives. It involves adjusting the holdings of an underlying asset to offset changes in the value of the options or derivatives that are derived from it. Delta, a measure of the sensitivity of the option price to changes in the underlying asset price, plays a crucial role in this hedging strategy.

While delta is a fundamental concept in delta hedging simulations, there is another important factor that often gets overlooked: interest. Interest, in the context of delta hedging, refers to the cost or benefit of financing the required position in the underlying asset or options. In other words, it represents the opportunity cost of tying up capital in the hedging strategy.

In this article, we will explore the significance of interest in delta hedging simulations and discuss methods for finding interest in these simulations. We will also delve into the implementation of interest in a delta hedging simulation and analyze the results obtained.

Delta hedging simulations are widely used in the financial industry to manage risk and optimize trading strategies. By understanding and incorporating interest in these simulations, traders and investors can make more informed decisions and potentially improve their overall profitability.

So, let’s dive into the world of delta hedging simulations and discover how interest can be found and utilized in this fascinating area of finance.

Understanding Delta Hedging

Before we delve into the importance of interest in delta hedging simulations, let’s first establish a clear understanding of what delta hedging entails. Delta hedging is a risk management technique used by traders to minimize their exposure to changes in the price of an underlying asset.

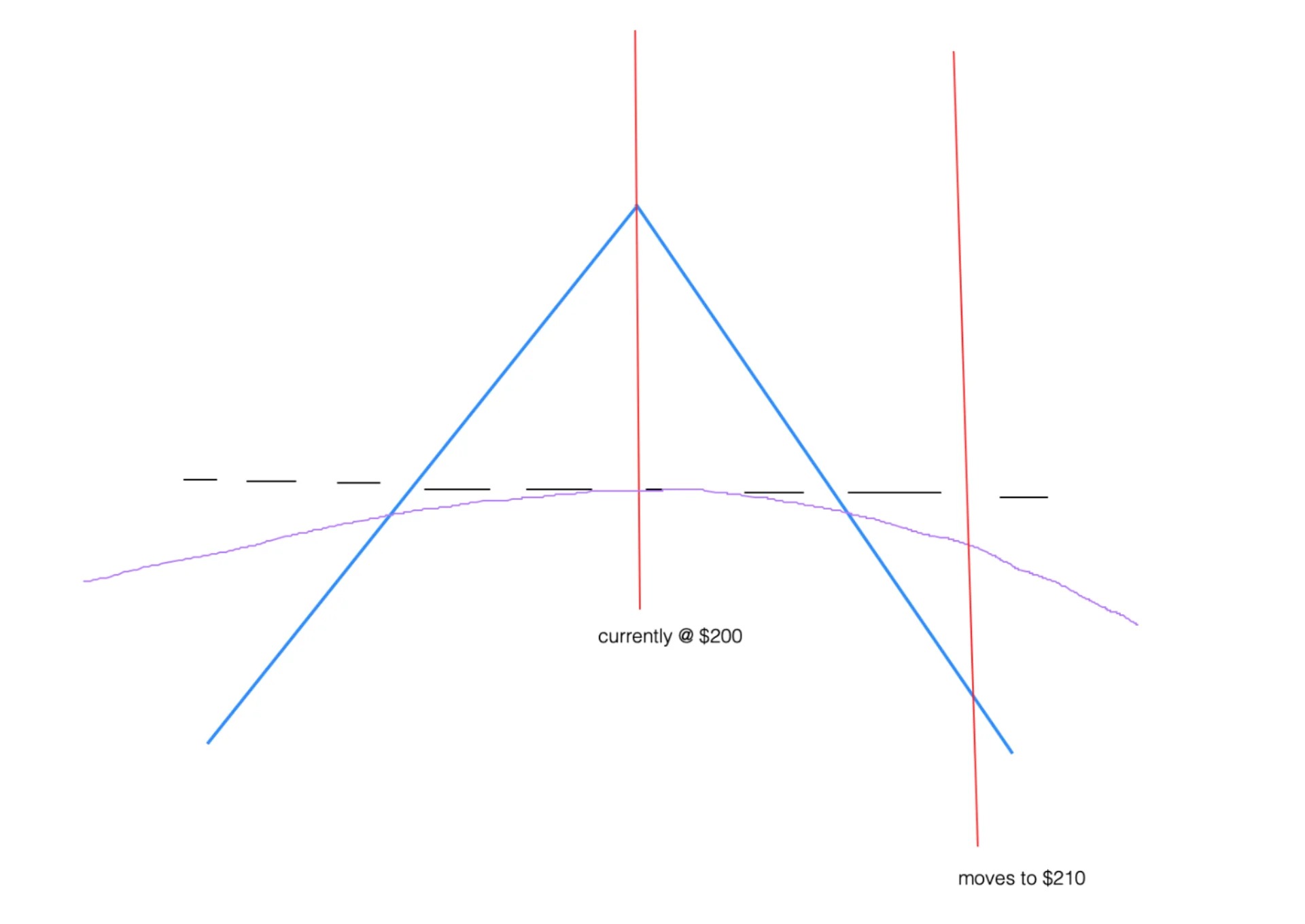

In simple terms, the delta of an option represents the rate of change in the option price for a given change in the price of the underlying asset. Delta values range from 0 to 1 for call options and from -1 to 0 for put options. A delta value of 0.5 indicates that the option price will increase or decrease by 0.5 times the change in the underlying asset price.

The objective of delta hedging is to neutralize the delta of the options position by establishing a position in the underlying asset. This is done by continuously adjusting the holdings of the underlying asset to offset any changes in the value of the options position. By doing so, traders can effectively reduce their exposure to fluctuations in the underlying asset price and protect themselves from potential losses.

Delta hedging is particularly useful for traders and investors who want to minimize the impact of directional moves in the market. It allows them to focus on capturing other sources of alpha, such as volatility or time decay, while reducing the risk associated with changes in the underlying asset price.

However, delta hedging simulations are not complete without considering the impact of interest. Interest plays a crucial role in these simulations as it represents the cost or benefit of financing the required position in the underlying asset or options.

When implementing a delta hedging strategy, traders need to consider the opportunity cost of tying up capital in the hedging position. If the interest rate is high, the cost of financing the position may be significant and can erode potential profits. On the other hand, if the interest rate is low or even negative, traders may benefit from the financing aspect of the strategy.

Now that we have a solid understanding of delta hedging, let’s explore why interest is an essential factor to consider in delta hedging simulations.

Importance of Interest in Delta Hedging Simulation

Interest plays a critical role in delta hedging simulations as it directly affects the profitability and risk management aspect of the strategy. It is important to consider interest in delta hedging simulations for several reasons:

- Cost of Financing: When establishing a delta hedging position, traders often need to borrow capital or invest their own funds to finance the required holdings of the underlying asset or options. The cost of this financing, typically represented by the interest rate, can significantly impact the overall profitability of the hedging strategy. Higher interest rates lead to increased financing costs, potentially reducing the profits generated from delta hedging. On the other hand, lower interest rates may offer a favorable financing environment, allowing traders to optimize their hedging positions and potentially increase profitability.

- Opportunity Cost: Tying up capital in a hedging position has an opportunity cost, as those funds could have been utilized elsewhere to generate returns. By incorporating interest into delta hedging simulations, traders can assess the opportunity cost of the strategy. This allows them to evaluate whether the potential benefits of delta hedging outweigh the potential returns that could have been achieved by investing the funds in alternative opportunities.

- Risk Management: Interest also plays a crucial role in risk management within delta hedging simulations. By considering the financing costs or benefits, traders can evaluate the risk-reward trade-off of the hedging strategy. A higher interest rate increases the cost of maintaining the hedging position, which may necessitate more frequent adjustments to the position to manage risk effectively. Conversely, a lower interest rate may allow for a more relaxed risk management approach, as the financing costs are minimized. Incorporating interest into the simulation enables traders to find the optimal balance between risk and cost.

- Market Conditions: Interest rates are influenced by various market conditions, such as central bank policies, economic indicators, and global financial trends. These factors can impact the profitability and risk management of delta hedging strategies. By considering interest rates and their potential changes, traders can adapt their hedging positions accordingly and make more informed decisions based on prevailing market conditions.

- Regulatory Compliance: In some cases, regulatory frameworks and trading agreements require traders to account for interest or financing costs in their delta hedging simulations. Compliance with these regulations is crucial to ensure the transparency and integrity of financial operations. By including interest in delta hedging simulations, traders can meet regulatory requirements and maintain compliance with the necessary standards.

In summary, interest is a key factor to consider in delta hedging simulations. It impacts the cost of financing, opportunity cost, risk management, market conditions, and regulatory compliance aspects of the hedging strategy. By incorporating interest into the simulation, traders can optimize their hedging positions, make informed decisions, and potentially enhance their profitability while managing risk effectively.

Methodology for Finding Interest in Delta Hedging Simulation

When it comes to finding interest in delta hedging simulations, several methods can be employed. The choice of methodology depends on various factors, including the specific financial instruments involved, market conditions, and the objectives of the simulation. Here are some common approaches:

- Market Interest Rates: One of the simplest and most commonly used methods is to utilize market interest rates. Traders can obtain the current interest rates from reliable financial sources or by accessing interest rate data provided by financial institutions or central banks. These rates are typically representative of the cost of financing and can be applied directly to the delta hedging simulation.

- Cost of Borrowing: In some cases, traders may need to borrow capital to finance the delta hedging position. If this is the case, the interest rate associated with borrowing funds should be incorporated into the simulation. The cost of borrowing can be obtained from lenders, financial institutions, or through negotiation with counterparties.

- Funding Costs: When traders use their own funds to finance the delta hedging position, they should consider the opportunity cost of tying up capital. This can be achieved by calculating the funding costs, which represent the potential returns that could have been achieved by investing the funds in alternative opportunities. The funding costs can be estimated based on market returns or specific investment options available.

- Volatility Risk Premium: Another approach is to consider the volatility risk premium when determining the cost of financing. The volatility risk premium refers to the additional compensation investors demand for bearing the risk of potential price fluctuations. By incorporating the volatility risk premium into the simulation, traders can account for the cost associated with holding a position that is exposed to market volatility.

- Option Pricing Models: Advanced option pricing models, such as the Black-Scholes model, can provide insights into the implied interest rates within the options market. These models use inputs such as option prices, time to expiration, strike prices, and the underlying asset’s price to calculate implied interest rates. By utilizing these models, traders can estimate the interest rate within the delta hedging simulation.

It is important to note that the methodology for finding interest in delta hedging simulations may involve a combination of these approaches. Additionally, traders should consider the specific requirements and regulations of their trading environment to ensure compliance.

By utilizing an appropriate methodology for finding interest, traders can accurately reflect the financing costs and opportunity costs of delta hedging in their simulations. This enables them to make informed decisions, optimize their hedging positions, and effectively manage their risk exposure.

Implementing Interest in Delta Hedging Simulation

Implementing interest in a delta hedging simulation involves incorporating the calculated or estimated interest rates into the simulation framework. This allows traders to capture the impact of financing costs or benefits on the profitability and risk management aspects of their hedging strategy. Here are some key steps to consider when implementing interest in a delta hedging simulation:

- Data Collection: The first step is to gather the necessary data, including the interest rates, borrowing costs, funding costs, or any other inputs required to calculate the interest component. Traders can obtain this information from reliable financial sources, financial institutions, or through negotiations with counterparties.

- Choose a Simulation Framework: Select or develop a suitable simulation framework that can accommodate the inclusion of interest rates. This can be a spreadsheet-based model, a proprietary trading platform, or specialized software designed for delta hedging simulations. The framework should allow for flexible adjustments to interest rates and provide accurate calculations and results.

- Incorporate Interest in Position Adjustments: When implementing interest in a delta hedging simulation, it is crucial to consider the timing and frequency of position adjustments. The simulation should account for the impact of financing costs or benefits on decisions related to position adjustments. This means adjusting the holdings of the underlying asset or options based on the calculated or estimated interest rates, along with other factors such as delta changes and market conditions.

- Monitor and Update Interest Rates: Interest rates can change over time due to market dynamics and economic factors. It is essential to monitor and update the interest rates used in the simulation periodically to ensure accuracy. Traders should stay informed about market developments, central bank policies, and economic indicators that can influence interest rates.

- Analyze Results: After implementing interest in the delta hedging simulation, it is essential to analyze the results and assess the impact of financing costs or benefits on the overall performance of the strategy. Traders should evaluate the profitability, risk exposure, and efficiency of the hedging positions, taking into account the interest component. This analysis can help identify areas for improvement and refine the delta hedging strategy.

By effectively implementing interest in the delta hedging simulation, traders can gain a comprehensive understanding of the true costs and benefits associated with their hedging positions. This allows for more accurate risk management, better decision-making, and enhanced profitability in dynamic market conditions.

Results and Analysis

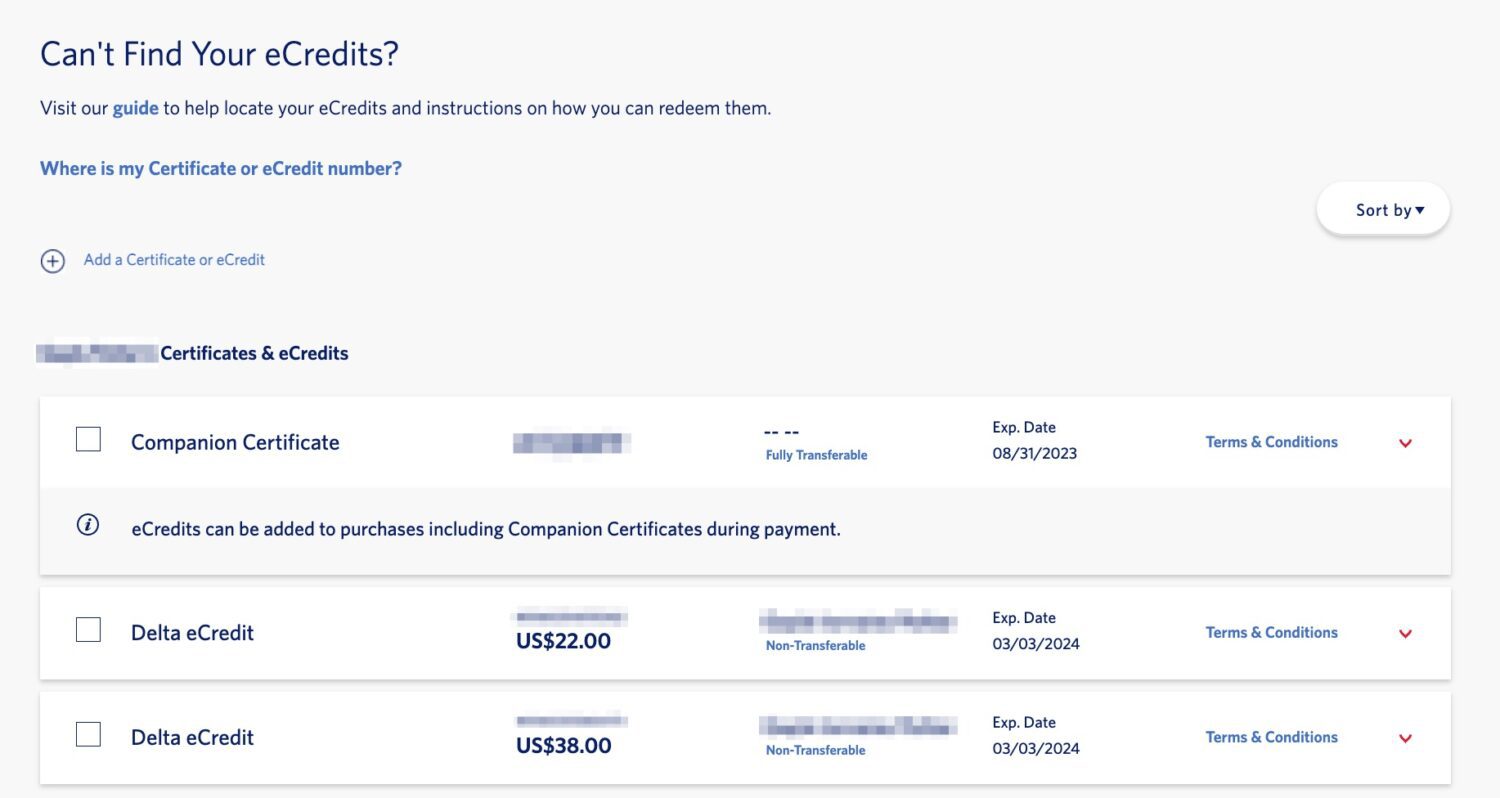

Once interest has been incorporated into a delta hedging simulation, it is essential to analyze the results to gain insights into the performance and effectiveness of the strategy. Here are some key aspects to consider when conducting the results and analysis:

- Profitability: Assess the impact of interest on the profitability of the delta hedging strategy. Compare the simulation results with and without the inclusion of interest to understand how financing costs or benefits affect the overall returns. This analysis can help traders determine the optimal level of interest rates that maximizes profits.

- Risk Management: Evaluate the risk exposure of the delta hedging positions when interest is considered. Analyze how the inclusion of financing costs or benefits influences the risk-reward trade-off. Risk measures such as volatility, value-at-risk, and Greek sensitivities (such as delta and gamma) can be used to assess the impact of interest on the risk management aspect of the strategy.

- Comparison to Market Conditions: Compare the simulation results with prevailing market conditions. If the interest rates used in the simulation align with market rates, it provides additional validation and confidence in the simulation outcomes. Deviations from market rates may indicate potential refinements in the interest rate estimation process.

- Optimization Opportunities: Identify potential optimization opportunities based on the analysis of the results. Evaluate whether adjustments can be made to the financing aspect of the delta hedging strategy to enhance profitability or mitigate risk. This may involve exploring alternative borrowing or funding sources, considering different interest rate scenarios, or adjusting the timing and frequency of position adjustments.

- Documentation and Reporting: Document the results and analysis for future reference and reporting purposes. Maintain clear records of the simulation outcomes, including the interest rates used, methodologies employed, and any assumptions made. This documentation ensures transparency and facilitates discussions with stakeholders, regulators, or compliance departments.

By conducting a comprehensive analysis of the results, traders can gain valuable insights into the impact of interest on the profitability and risk management of their delta hedging strategy. This analysis informs decision-making, helps optimize the strategy, and provides a basis for ongoing refinements and improvements in delta hedging simulations.

Conclusion

Incorporating interest into delta hedging simulations is essential for a comprehensive understanding of the profitability and risk management of the strategy. By considering the cost or benefit of financing, traders can make more informed decisions, optimize their hedging positions, and potentially enhance their overall returns.

The importance of interest in delta hedging simulations lies in its impact on the cost of financing, opportunity cost, risk management, market conditions, and regulatory compliance. Traders need to evaluate the financing costs associated with maintaining the delta hedging positions and assess the opportunity cost of tying up capital. Additionally, consideration of interest rates allows traders to adapt to prevailing market conditions and meet regulatory requirements.

When finding interest in a delta hedging simulation, multiple methodologies can be utilized, such as market interest rates, borrowing costs, funding costs, volatility risk premium, and option pricing models. The chosen methodology should align with the specific financial instruments involved, market conditions, and simulation objectives.

Implementing interest in the simulation involves incorporating the calculated or estimated interest rates into the simulation framework. This enables traders to accurately reflect the financing costs or benefits in their position adjustments and risk management strategies. Ongoing monitoring and updates of interest rates are crucial to ensure the accuracy of the simulation results.

The analysis of the results allows traders to evaluate the impact of interest on profitability, risk exposure, and optimize the delta hedging strategy. By comparing the simulation outcomes with prevailing market conditions, identifying potential optimization opportunities, and documenting the results, traders can refine their approach and make informed decisions regarding their delta hedging positions.

In conclusion, the incorporation of interest in delta hedging simulations provides a more comprehensive and accurate understanding of the impact of financing costs or benefits on the performance of the strategy. It allows traders to mitigate risk, enhance profitability, and adapt to changing market dynamics. By taking into account interest rates, traders can optimize their hedging positions and make well-informed decisions in pursuit of their financial goals.