Finance

How To Find AGI On Tax Return Transcript

Modified: February 21, 2024

Learn how to find your AGI on your tax return transcript and gain valuable finance insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is AGI?

- Why is AGI important?

- Overview of Tax Return Transcript

- Step 1: Accessing the IRS Website

- Step 2: Creating an Account

- Step 3: Requesting a Tax Return Transcript

- Step 4: Receiving the Tax Return Transcript

- Step 5: Locating the AGI on the Tax Return Transcript

- How to Use AGI in Various Situations

- Common Issues and Troubleshooting

- Conclusion

Introduction

Understanding your tax return and the information it contains is crucial for managing your finances effectively. One key component of your tax return is the Adjusted Gross Income, commonly abbreviated as AGI. AGI is an important figure that reflects your total income after deducting certain adjustments.

Knowing your AGI is essential for various reasons. It serves as the foundation for calculating your taxable income, determining eligibility for certain tax credits, and even applying for financial aid. However, locating your AGI on your tax return can sometimes be challenging, especially if you don’t have access to the original document.

In such instances, a Tax Return Transcript can come to your rescue. A Tax Return Transcript is an official document issued by the Internal Revenue Service (IRS) that provides a summary of your tax return information. It includes your AGI and other key financial details from your return.

In this article, we will guide you through the process of finding your AGI on a Tax Return Transcript. Whether you need it for filing an amended return, reviewing past filing information, or applying for financial aid, this step-by-step guide will help you easily locate your AGI.

Before we dive into the details, it’s important to note that the AGI can be found on different lines depending on the tax year and the type of tax return form used. However, the general process of accessing and locating the AGI on a Tax Return Transcript remains relatively consistent. So, let’s get started!

What is AGI?

In the context of income tax, AGI stands for Adjusted Gross Income. It is a crucial figure that reflects your total income after certain adjustments have been made. AGI serves as the starting point for calculating your taxable income, which is then used to determine how much tax you owe.

So, what exactly does “adjusted” mean in Adjusted Gross Income? It refers to the deductions that are subtracted from your total income, resulting in a lower taxable income. These deductions include allowable expenses such as student loan interest, educator expenses, moving expenses, and contributions to certain retirement accounts.

Calculating your AGI involves subtracting specific adjustments, also known as “above-the-line” deductions, from your total income. These deductions are taken into account before applying the standard or itemized deductions. By deducting these adjustments, you arrive at your AGI, which is a more accurate representation of your overall financial situation.

AGI is important because it affects various aspects of your financial life. For example, your AGI determines your eligibility for certain tax credits, deductions, and exemptions. It is also used to determine your eligibility for certain healthcare subsidies, financial aid for education, and other government assistance programs.

Furthermore, your AGI can impact your ability to qualify for loans or credit cards, as lenders often consider AGI when assessing your financial stability. Additionally, AGI is used to determine your participation in certain tax-advantaged retirement accounts and to calculate the phase-out limits for specific tax benefits.

Understanding your AGI and how it is calculated is crucial for effective tax planning and financial management. By knowing your AGI, you can make informed decisions about how to optimize your deductions, plan for future tax liabilities, and maximize your eligibility for various tax benefits and financial assistance programs.

Why is AGI important?

Adjusted Gross Income (AGI) is a crucial component of your tax return that has significant implications for your overall financial situation. Here are several reasons why AGI is important:

1. Tax Calculation:

Your AGI serves as the starting point for determining your taxable income. By subtracting certain adjustments from your total income, you arrive at your AGI, which forms the basis for calculating your tax liability. A lower AGI can result in a reduced tax burden.

2. Tax Credits and Deductions:

Many tax credits and deductions have AGI limitations. Your AGI determines if you qualify for various tax benefits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. Additionally, some deductions, like medical expenses or miscellaneous itemized deductions, require that they exceed a certain percentage of your AGI before you can claim them.

3. Financial Aid:

When applying for financial aid for education, your AGI is used to assess your eligibility. Institutions use AGI to determine the Expected Family Contribution (EFC), which determines how much financial assistance you may receive. A lower AGI can increase your eligibility for grants, scholarships, and need-based financial aid.

4. Health Insurance Subsidies:

Your AGI is also used to determine your eligibility for health insurance subsidies. If your AGI falls within a certain range, you may qualify for premium tax credits that reduce the cost of your health insurance, making it more affordable.

5. Loan Applications:

When applying for loans or credit cards, lenders often consider your AGI as part of their assessment of your financial stability and ability to repay. A higher AGI can positively impact your creditworthiness, potentially leading to more favorable loan terms and interest rates.

6. Retirement Planning:

AGI plays a role in determining your eligibility to contribute to certain tax-advantaged retirement accounts, such as Traditional IRAs and Roth IRAs. Additionally, your AGI affects the phase-out limits for deductions, credits, and contributions to retirement accounts, which may impact your retirement savings strategy.

In summary, AGI is a crucial figure that affects various aspects of your financial life. Understanding and managing your AGI can help you optimize your tax situation, qualify for tax benefits and financial aid, and make informed decisions regarding loans and retirement planning.

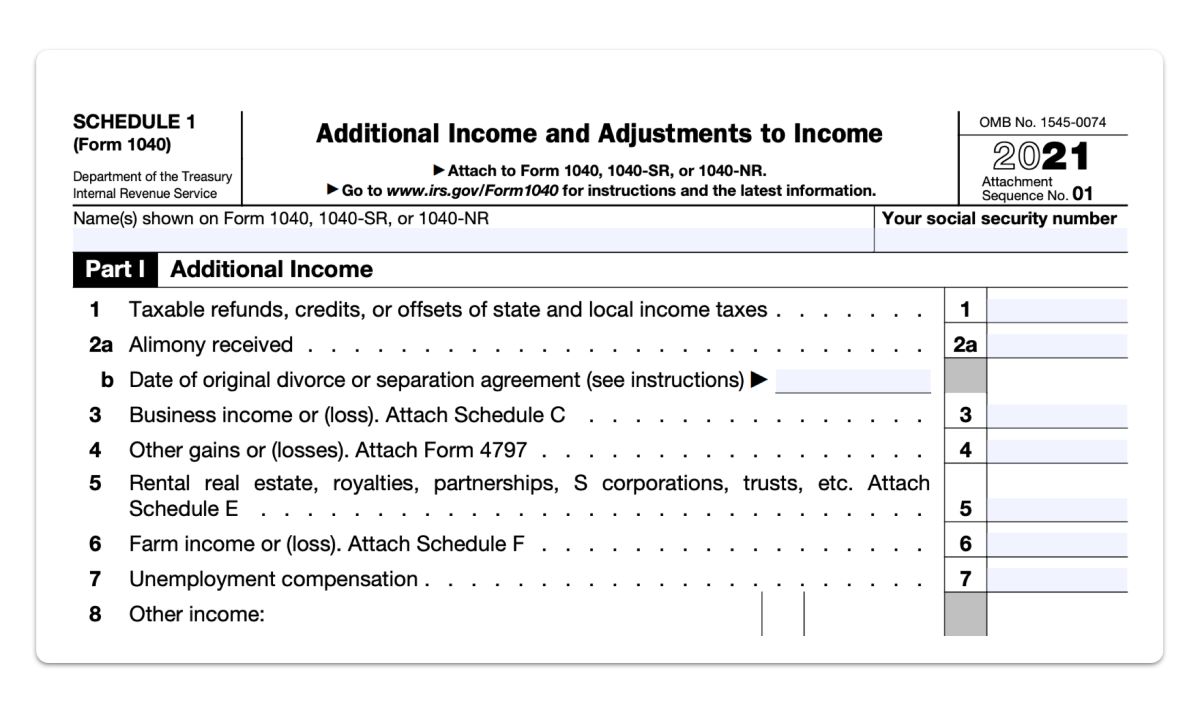

Overview of Tax Return Transcript

A Tax Return Transcript is an official document provided by the Internal Revenue Service (IRS) that summarizes the information from your tax return. It includes key details such as your Adjusted Gross Income (AGI), filing status, and any changes made to your tax return after it was initially filed.

The purpose of a Tax Return Transcript is to provide a record of your tax return information for a specific tax year. It can be useful for a variety of purposes, including filing an amended return, verifying past filing information, applying for financial aid, or resolving tax-related issues.

When you request a Tax Return Transcript, you have the option to choose between different types, including:

1. Tax Return Transcript:

This type of Transcript provides a summary of your original tax return as filed, including your AGI and other financial information. It is typically available for the current tax year and the previous three tax years.

2. Tax Account Transcript:

The Tax Account Transcript provides a summary of any changes made to your tax return after it was initially filed. It includes details of any payments or credits applied, as well as any penalties or interest assessed. This transcript can be useful for understanding any adjustments made to your tax liability.

Obtaining a Tax Return Transcript can be done online through the IRS website or by mail. The online option is typically faster and more convenient, allowing you to access and download the transcript immediately. The mailed option may take longer to receive.

It’s important to note that a Tax Return Transcript is not a copy of your actual tax return. It provides a summary of the key information from your return but does not include the complete set of forms and schedules submitted. If you need a copy of your actual tax return, you can request a Tax Return Copy from the IRS, which may incur a fee.

Having a Tax Return Transcript can be invaluable for various financial and tax-related purposes. It allows you to review and verify your AGI, confirm filing details, and resolve any discrepancies or issues. It is also a useful resource for financial planning, tax preparation, and maintaining accurate records.

Now that you have an overview of what a Tax Return Transcript is and how it can be beneficial, let’s proceed to the next section to learn how to access and obtain your Tax Return Transcript.

Step 1: Accessing the IRS Website

To obtain your Tax Return Transcript, the first step is to access the official website of the Internal Revenue Service (IRS). The IRS website provides a secure platform for accessing your tax information and obtaining your transcript online.

Here’s how to access the IRS website:

- Open your preferred web browser and go to the IRS website by typing in the URL: www.irs.gov.

- Once on the IRS homepage, navigate to the “Filing” section or use the search function to find the appropriate page for requesting a Tax Return Transcript. This section may vary slightly depending on the time of year, so make sure to select the correct option for the current tax year.

- Click on the link or button that says something like “Get Transcript” or “Get Your Tax Record.” This will take you to the page where you can request your transcript.

It’s important to note that the IRS website is the official and secure platform for accessing your tax information. Be cautious of any other websites that claim to provide tax transcripts or charge a fee for accessing your transcript. The IRS provides this service for free, so there is no need to use third-party websites.

When accessing the IRS website, make sure you are using a secure internet connection and a trusted device. It’s also advisable to keep your personal and financial information confidential by not sharing it with anyone or entering it on unsecured websites.

Once you have successfully accessed the IRS website, you are ready to proceed to the next step of creating an account. Creating an account is essential for requesting and accessing your Tax Return Transcript online.

In the next section, we will guide you through the process of creating an account on the IRS website to request your Tax Return Transcript.

Step 2: Creating an Account

In order to request and access your Tax Return Transcript on the IRS website, you will need to create an account. Creating an account will provide you with a secure and personalized platform to manage your tax information and access various IRS services. Here’s how you can create an account:

- On the IRS website, navigate to the login page for creating an account. Look for options like “Sign In” or “Create an Account.” Click on the appropriate link to begin the account creation process.

- Choose your account type. The IRS offers different account types, including “Individual” for personal use and “Business” for entities or organizations. Select the account type that best suits your needs.

- Provide your personal information. You will be required to enter your name, email address, and a unique username and password. Make sure to choose a strong password that includes a combination of letters, numbers, and special characters to enhance security.

- Verify your identity. As part of the account creation process, you will need to provide certain personal information to verify your identity. This may include your Social Security number, date of birth, and details from specific financial transactions or prior tax returns.

- Agree to the terms and conditions. Make sure to read and understand the terms and conditions of using the IRS online services. Once you agree to the terms, proceed to create your account.

- Verify your email address. After creating your account, you will receive an email from the IRS containing a verification link. Click on this link to verify your email address and activate your account.

Creating an account on the IRS website is an important step in gaining access to your Tax Return Transcript and other tax-related information. It provides a secure and convenient way to manage your tax affairs online.

Once your account is created and verified, you are ready to move on to the next step of requesting your Tax Return Transcript. In the following section, we will guide you through the process of requesting the transcript on the IRS website.

Step 3: Requesting a Tax Return Transcript

Now that your account is created and verified, you can proceed to request your Tax Return Transcript on the IRS website. The process of requesting a transcript is straightforward and can be done through your online account. Here’s how to request a Tax Return Transcript:

- Log in to your account on the IRS website using your registered username and password. Make sure you have your account credentials handy.

- Navigate to the appropriate section for requesting a Tax Return Transcript. This section may vary depending on the time of year and the specific tax year you need the transcript for. Look for options like “Transcript Delivery” or “Get Transcript” within your account dashboard.

- Choose the type of transcript you need. As mentioned earlier, the two common types are the Tax Return Transcript and the Tax Account Transcript. Select the appropriate option based on your requirements.

- Provide the necessary details. You will be prompted to enter the tax year for which you need the transcript. If you are unsure of the exact tax year, review your past records or consult a tax professional for assistance.

- Select the delivery method. The IRS provides two options for receiving the requested transcript: online viewing and mail delivery. Online viewing allows you to instantly access and download the transcript, while mail delivery can take several days to arrive.

- Confirm and submit your request. Review the information you have entered, ensuring its accuracy. Once you are satisfied, submit your request for the Tax Return Transcript.

Upon successful submission, you will either be redirected to the page where you can view and download the requested transcript or informed about the estimated delivery time for a mailed transcript.

It’s important to note that the availability of online viewing or mail delivery may vary depending on the specific tax year and individual circumstances. If online viewing is not available for a particular tax year, you will only have the option to request a mailed transcript.

Now that you have successfully requested your Tax Return Transcript, the next step is to wait for its arrival. In the following section, we will cover how to locate your AGI on the Tax Return Transcript once you have received it.

Step 4: Receiving the Tax Return Transcript

After requesting your Tax Return Transcript on the IRS website, you will need to wait for its delivery. Depending on the method you chose during the request process, the transcript will either be available for online viewing or sent to you by mail. Here’s what you can expect when receiving the Tax Return Transcript:

Online Viewing:

If you selected online viewing as the delivery method, you will receive instant access to the requested Tax Return Transcript. After submitting your request, you will be redirected to a page where you can view and download the transcript. The online transcript will be in a PDF format that you can save or print for your records.

It’s important to note that the online access to the transcript may have a time limit. Make sure to save a copy of the transcript for future reference before the access expires.

Mail Delivery:

If you chose mail delivery, the Tax Return Transcript will be sent to the address associated with your IRS account. The delivery time for the transcript can vary, typically taking several days or even weeks to arrive. The transcript will be mailed in a secure envelope from the IRS.

When receiving the transcript by mail, it is essential to keep it in a safe and secure place. This document contains sensitive information such as your AGI and should be treated with the same level of confidentiality as your tax return.

Once you have received your Tax Return Transcript, you are ready to proceed to the next step of locating your AGI on the transcript. In the following section, we will guide you through this process to help you easily locate your AGI.

Step 5: Locating the AGI on the Tax Return Transcript

Now that you have received your Tax Return Transcript, you can locate your Adjusted Gross Income (AGI) on the document. The precise location of the AGI on the transcript may vary depending on the tax year and the specific format of the transcript. However, the AGI is typically found in a section labeled “Income and Deductions” or “Adjusted Gross Income.”

Here’s how to locate your AGI on the Tax Return Transcript:

- Open the Tax Return Transcript document that you received, whether it’s in electronic format (PDF) or paper format.

- Look for a section labeled “Income and Deductions” or “Adjusted Gross Income.” This section may be located towards the top or bottom of the first page of the transcript.

- Within the “Income and Deductions” section, locate the line item or amount that corresponds to your AGI. It is often labeled as “Adjusted Gross Income” or “AGI.”

- Note down the AGI amount listed on the transcript. This is the figure that represents your total income after applying certain adjustments.

It’s important to ensure that you are looking at the correct tax year on the transcript, as your AGI can vary from year to year.

Once you have located your AGI on the Tax Return Transcript, you can use it for various purposes, such as filing an amended return, applying for financial aid, or verifying your income. Keep in mind that the IRS requires accurate and consistent reporting of your AGI, so it’s important to refer to the official Tax Return Transcript rather than relying on other sources of information.

Congratulations! You have successfully located your AGI on the Tax Return Transcript. In the next section, we will discuss how you can utilize your AGI in various situations.

How to Use AGI in Various Situations

Your Adjusted Gross Income (AGI) is a key figure when it comes to various financial and tax-related situations. Here are some common scenarios in which you may need to utilize your AGI:

Filing Taxes:

AGI is crucial for filing your tax return. It serves as the starting point for determining your taxable income and calculating your tax liability. When filing your tax return, you will be asked to input your AGI from the previous tax year to authenticate your identity.

Amending your Tax Return:

If you need to make changes to a previously filed tax return, you will need to provide your AGI for the tax year in question. This helps the IRS verify your identity and ensures that the amended return is associated with your correct tax records.

Applying for Financial Aid:

When applying for financial aid for education, such as federal student loans or grants, your AGI is used to determine your eligibility. The Free Application for Federal Student Aid (FAFSA) requires you to input your AGI to assess your financial need and determine your eligibility for need-based aid.

Claiming Tax Credits and Deductions:

Many tax credits and deductions have AGI limitations. To claim certain tax benefits, such as the Child Tax Credit, the Lifetime Learning Credit, or the Student Loan Interest Deduction, your AGI must fall within specific income thresholds. You will need to refer to your AGI to determine if you meet the eligibility criteria.

Verifying Income:

AGI can be used to verify your income in various situations. It may be required by lenders when applying for a mortgage or personal loan, by landlords when renting a property, or by government agencies when applying for certain assistance programs. Your AGI provides a comprehensive snapshot of your income for the tax year.

Tax Planning and Financial Management:

AGI plays a vital role in tax planning and financial management. By knowing your AGI, you can better project your tax liability, evaluate the impact of certain deductions or credits, and make informed decisions about retirement contributions, investment strategies, and other financial choices.

Regardless of the situation, it’s important to keep accurate records of your AGI. The IRS verifies AGI information and may request supporting documentation to substantiate the figures you provide. Always consult your Tax Return Transcript or other official IRS documents to ensure accuracy and compliance with tax regulations.

By understanding how to utilize your AGI in various situations, you can effectively navigate the tax landscape and make informed financial decisions tailored to your unique circumstances.

Common Issues and Troubleshooting

While accessing and utilizing your Adjusted Gross Income (AGI) can be a straightforward process, there are some common issues that individuals may encounter. Here are a few common issues and troubleshooting tips to help you navigate through them:

1. Unable to Access IRS Website:

If you are having trouble accessing the IRS website, ensure that you have a stable internet connection and are using a compatible web browser. Clear your browser cache and cookies or try accessing the site from a different device. If the issue persists, you can contact the IRS helpline or seek assistance from a tax professional.

2. Forgot Username or Password:

If you forget your IRS account username or password, utilize the “Forgot username” or “Forgot password” feature on the login page. Follow the prompts to reset your credentials. You may need to provide certain personal information for verification purposes.

3. Incorrect AGI on the Transcript:

If you believe the AGI listed on your Tax Return Transcript is incorrect, carefully review your original tax return and compare it with the data on the transcript. Look for errors or discrepancies in income, deductions, or adjustments. If there is a significant discrepancy, consider consulting a tax professional for guidance on how to rectify the issue with the IRS.

4. Transcript Not Available:

In some cases, the IRS may not have a Tax Return Transcript available for the requested tax year. This can occur if it is too soon after filing your return or if there were processing delays. In such instances, you may need to check back at a later date or contact the IRS for more information.

5. Verification Issues for Financial Aid:

If you are experiencing challenges with verification of your AGI for financial aid purposes, ensure that you are using the correct tax year’s transcript. Double-check the accuracy of the information entered on your financial aid application, as even small errors can lead to verification issues. Communicate with the financial aid office at your educational institution for further guidance and assistance.

6. Missing Transcripts by Mail:

If you have requested a Tax Return Transcript by mail and it has not arrived within the expected timeframe, it may be lost or delayed in transit. Consider contacting the IRS to inquire about the status of the transcript and explore alternative options, such as requesting the transcript online or visiting a local IRS office if available.

If you encounter any issues or have specific questions regarding your AGI or the Tax Return Transcript, it is recommended to reach out to the IRS directly for assistance. The IRS provides various channels for support, including helplines and online resources.

Remember, every individual’s tax and financial situation is unique. If you need personalized advice or encounter complex issues, it is advisable to consult with a qualified tax professional or financial advisor who can provide guidance based on your specific circumstances.

Conclusion

Understanding and utilizing your Adjusted Gross Income (AGI) is essential for effective tax planning and financial management. The AGI serves as a fundamental component in calculating your taxable income, determining eligibility for tax credits and deductions, and applying for financial aid.

In this article, we have guided you through the process of finding your AGI on a Tax Return Transcript. We discussed the importance of AGI and its role in various financial and tax-related situations. We also provided step-by-step instructions on accessing the IRS website, creating an account, requesting a Tax Return Transcript, and locating your AGI on the transcript.

Remember to keep your Tax Return Transcript in a safe and secure place, as it contains sensitive financial information. Ensure its accuracy and use it as a reliable source for reporting your AGI when required.

If you encounter any issues or have specific questions regarding your AGI or the Tax Return Transcript, don’t hesitate to reach out to the IRS directly for assistance. They can provide relevant guidance and support to help you navigate through any challenges you may face.

By understanding your AGI and utilizing it effectively, you can make informed decisions about your taxes, financial planning, and eligibility for various benefits and assistance programs.

We hope that this article has provided you with the necessary information and guidance to access your AGI on a Tax Return Transcript. Remember to consult with tax professionals or financial advisors for personalized advice tailored to your unique circumstances.