Home>Finance>What Is A Good Credit Score In Canada For A Mortgage

Finance

What Is A Good Credit Score In Canada For A Mortgage

Modified: February 21, 2024

Find out what is considered a good credit score in Canada for a mortgage. Discover how your finance plays a crucial role in securing the best mortgage rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- Importance of Credit Scores for a Mortgage

- Factors Affecting Credit Scores

- Minimum Credit Score Requirements for a Mortgage

- What Is Considered a Good Credit Score in Canada?

- How to Improve Your Credit Score for a Mortgage

- Benefits of Having a Good Credit Score for a Mortgage

- Conclusion

Introduction

When it comes to purchasing a home in Canada, one of the most important factors to consider is your credit score. Your credit score is a three-digit number that represents your creditworthiness and plays a crucial role in determining whether you qualify for a mortgage, the interest rate you’ll receive, and the terms of your loan.

Understanding what constitutes a good credit score in Canada for a mortgage is essential for anyone looking to embark on the homeownership journey. This article will delve into the significance of credit scores in the mortgage process, the factors that influence credit scores, the minimum credit score requirements for a mortgage, and strategies to improve your credit score.

Having a good credit score not only increases your chances of getting approved for a mortgage but also puts you in a favorable position to negotiate better loan terms and interest rates. So, let’s explore the world of credit scores and discover how you can achieve the credit score necessary to secure your dream home.

Understanding Credit Scores

Before diving into the specifics of what constitutes a good credit score for a mortgage in Canada, it’s important to understand how credit scores are calculated. Credit scores are generated by credit bureaus, such as Equifax and TransUnion, using a mathematical algorithm that takes into account various factors related to your credit history.

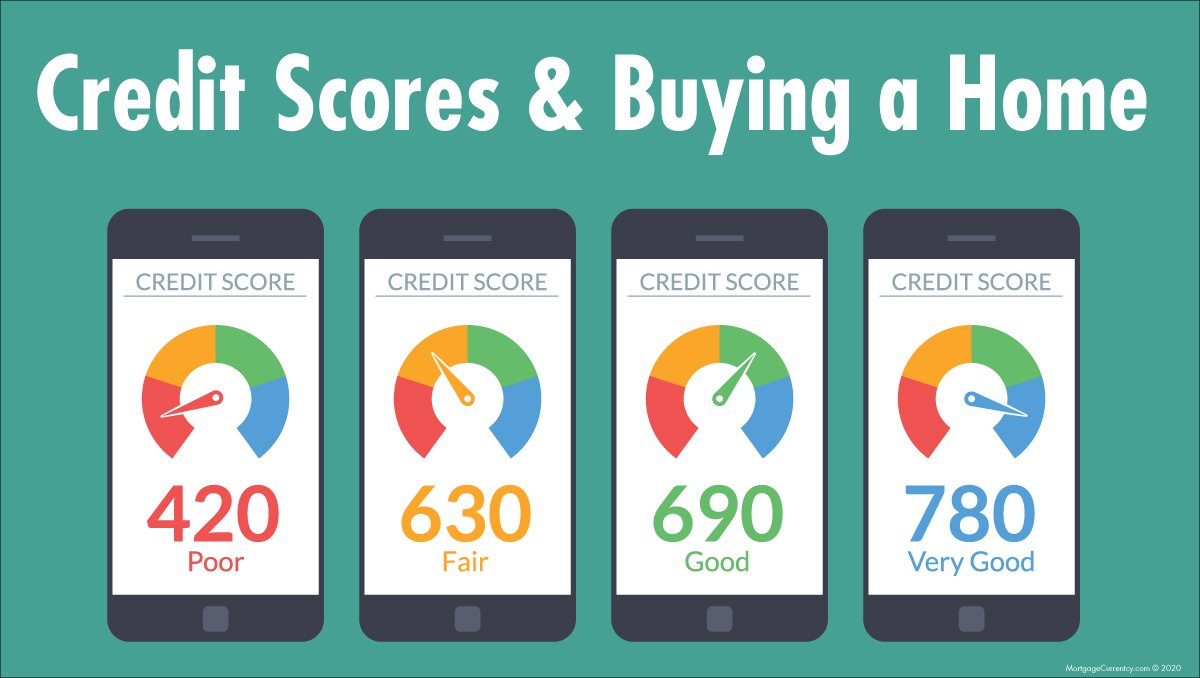

The most commonly used credit scoring model in Canada is the FICO Score, which ranges from 300 to 900. The higher your credit score, the better your creditworthiness is considered to be. Lenders use credit scores as a measure of risk – a higher credit score indicates a lower risk borrower, while a lower credit score suggests a higher risk borrower.

There are five main components that make up a credit score:

- Payment History: This factor holds the most significant weight in determining your credit score. It reflects your track record of making payments on time, including any late payments, collection accounts, or bankruptcies.

- Credit Utilization: This factor measures the amount of credit you are currently using compared to your total credit limit. Keeping your credit utilization below 30% shows responsible utilization of credit.

- Length of Credit History: The length of time you’ve had credit accounts impacts your credit score. A longer credit history demonstrates stability and responsible credit management.

- New Credit Inquiries: Applying for new credit can temporarily lower your credit score, especially if multiple inquiries are made within a short period. It’s important to be mindful of unnecessary credit inquiries.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. It shows that you can handle different types of credit responsibly.

Understanding these key components can help you in making informed decisions to improve your credit score and maintain healthy credit habits. It’s important to note that while the above factors are general guidelines, each credit bureau may have its own proprietary methods of calculating credit scores.

Importance of Credit Scores for a Mortgage

Your credit score plays a critical role in the mortgage application process. Lenders use your credit score to assess your creditworthiness and determine the level of risk associated with lending you money for a mortgage. Here are some key reasons why credit scores are important for obtaining a mortgage:

- Loan Approval: Most lenders have specific credit score requirements that borrowers must meet to be eligible for a mortgage. A higher credit score increases your chances of getting approved for a loan.

- Interest Rates: Lenders use credit scores to determine the interest rate they will offer you. Generally, borrowers with higher credit scores are seen as less risky and can qualify for lower interest rates, leading to significant long-term savings on mortgage payments.

- Loan Terms: In addition to interest rates, your credit score can also influence the terms of your mortgage, such as the duration of the loan and whether you are required to pay mortgage insurance.

- Down Payment: Some lenders may require a larger down payment if your credit score falls below a certain threshold. Having a higher credit score can potentially reduce the amount of down payment required.

- Overall Costs: A lower credit score can result in higher borrowing costs, including higher interest rates and additional fees. This can significantly impact your ability to afford a mortgage and the overall cost of homeownership.

Given the importance of credit scores in the mortgage process, it’s crucial to maintain a healthy credit profile and strive for a good credit score before applying for a mortgage. By doing so, you can secure a loan with favorable terms and save money in the long run.

Factors Affecting Credit Scores

Several factors can influence your credit score, and understanding these factors is essential for maintaining a good credit score. Here are some key elements that can impact your credit score:

- Payment History: Your payment history has the most significant impact on your credit score. Making all your credit payments on time demonstrates responsible credit management, while late payments or delinquencies can have a negative effect on your score.

- Credit Utilization: The amount of credit you are currently using compared to your total credit limit, also known as credit utilization, plays a significant role in your credit score. Aim to keep your credit utilization below 30% to maintain a healthy score.

- Length of Credit History: The length of time you’ve had credit accounts can impact your credit score. A longer credit history shows lenders that you have a track record of responsible credit management.

- New Credit Inquiries: Each time you apply for new credit, it generates a hard inquiry on your credit report. Multiple inquiries within a short period can lower your credit score temporarily. Be mindful of unnecessary credit applications.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. It shows that you can handle different types of credit responsibly.

- Public Records: Negative public records, such as bankruptcies, liens, or judgments, can severely impact your credit score for an extended period. It’s important to address and resolve any public records issues promptly.

It’s worth noting that the weight of each factor may vary slightly depending on the credit scoring model being used. However, maintaining a positive payment history, keeping credit utilization in check, and managing credit responsibly are the cornerstones of a good credit score. By understanding and actively managing these factors, you can work towards improving and maintaining a healthy credit score.

Minimum Credit Score Requirements for a Mortgage

When it comes to obtaining a mortgage in Canada, lenders have specific requirements regarding the minimum credit score they will accept from applicants. While the exact credit score requirements may vary between lenders and mortgage products, having a good credit score is generally essential.

The minimum credit score required for a mortgage can vary depending on factors such as the size of the loan, the type of mortgage, and the lender’s risk tolerance. In Canada, a credit score of 600 or higher is often considered the minimum threshold for eligibility.

However, it’s important to note that meeting the minimum credit score requirement does not guarantee mortgage approval. Lenders also take into consideration other factors, such as your income, employment history, and debt-to-income ratio, when assessing your mortgage application.

It’s worth noting that some lenders may be willing to work with borrowers who have lower credit scores, especially if they have strong compensating factors or are willing to provide a higher down payment. However, lower credit scores may result in higher interest rates or additional requirements, such as mortgage insurance, to mitigate the lender’s risk.

As a responsible borrower, it’s advisable to aim for a credit score higher than the minimum requirement to enhance your chances of mortgage approval and secure better terms and rates. By maintaining a good credit score, you demonstrate your creditworthiness and financial responsibility to lenders, thus increasing your likelihood of being approved for the mortgage you desire.

What Is Considered a Good Credit Score in Canada?

In Canada, credit scores typically range from 300 to 900, with a higher score indicating better creditworthiness. While the definition of a “good” credit score may vary depending on the lender and the specific mortgage product, here is a general guideline:

A credit score of 660 or higher is generally considered good in Canada. This score demonstrates responsible credit behavior and makes you an attractive borrower in the eyes of lenders. With a good credit score, you are more likely to be approved for a mortgage and receive favorable terms and interest rates.

However, it’s important to note that the specific credit score requirements can vary among lenders and mortgage products. Some lenders have more stringent requirements and may prefer borrowers with higher credit scores, especially for certain loan programs or lower down payment options.

On the other hand, a credit score below 660 does not necessarily mean you won’t be able to secure a mortgage. There are lenders who specialize in working with borrowers with lower credit scores or unique financial situations. However, lower credit scores may result in higher interest rates and additional requirements to mitigate the lender’s risk.

It’s important to strive for a credit score above 660 to improve your chances of getting approved for a mortgage and obtaining the most favorable terms and rates. To achieve and maintain a good credit score, make consistent payments, keep credit utilization low, maintain a diverse credit mix, and avoid unnecessary credit applications.

Keep in mind that every lender has its own criteria and may consider other factors beyond credit scores when evaluating your mortgage application. It’s beneficial to consult with different lenders or a mortgage professional to understand their specific requirements and find the best mortgage options for your unique situation.

How to Improve Your Credit Score for a Mortgage

If you’re looking to improve your credit score to increase your chances of getting approved for a mortgage or to obtain better terms and rates, here are some strategies to consider:

- Check Your Credit Report: Start by obtaining a copy of your credit report from both Equifax and TransUnion, the two main credit bureaus in Canada. Review the report carefully to identify any errors or discrepancies that could be negatively impacting your credit score.

- Make Payments on Time: Your payment history has a significant impact on your credit score. Ensure that you make all your credit payments on time, including credit cards, loans, and other obligations. Set up automatic payments or reminders to avoid missing any due dates.

- Reduce Credit Utilization: Aim to keep your credit utilization below 30% of your available credit limit. Paying down existing balances and avoiding maxing out your credit cards can help improve your credit score.

- Minimize Credit Applications: Each time you apply for new credit, it generates a hard inquiry on your credit report, which can temporarily lower your credit score. Avoid unnecessary credit applications, especially in the months leading up to your mortgage application.

- Build a Positive Credit History: If you have limited credit history, consider obtaining a secured credit card or becoming an authorized user on someone else’s credit card to start building a positive credit history. Make small purchases and pay them off in full each month.

- Address Delinquent Accounts: If you have any delinquent accounts or collections, work on resolving them as soon as possible. Contact the creditors or collection agencies to negotiate payment plans or settlements to improve your credit standing.

- Monitor Your Credit: Regularly monitor your credit reports and scores to stay informed about any changes or potential issues. There are numerous free or paid services that allow you to keep track of your credit profile.

- Seek Professional Advice: If you’re struggling with your credit or need personalized guidance, consider working with a credit counselor or financial advisor who can provide expert advice and help you develop a plan to improve your credit score.

Improving your credit score takes time and commitment. It’s important to be patient and consistent with your efforts. By implementing these strategies and practicing responsible credit management, you can enhance your creditworthiness and put yourself in a better position to achieve your homeownership goals.

Benefits of Having a Good Credit Score for a Mortgage

Holding a good credit score can provide significant advantages when it comes to obtaining a mortgage. Here are some key benefits of having a good credit score:

- Higher Chance of Approval: A good credit score increases your chances of being approved for a mortgage. Lenders view borrowers with higher credit scores as less risky, making them more inclined to extend a loan.

- Better Interest Rates: Lenders use credit scores to determine the interest rates offered to borrowers. With a good credit score, you are more likely to qualify for lower interest rates, saving you a considerable amount of money over the life of your mortgage.

- Favorable Loan Terms: A good credit score can also influence the terms of your mortgage. Lenders may offer more flexible terms, such as longer repayment periods or lower down payment requirements, to borrowers with a solid credit history.

- Access to More Mortgage Options: Having a good credit score opens up a wider range of mortgage options. Lenders may be more willing to offer you different types of loans, including conventional mortgages, adjustable-rate mortgages, or government-backed loan programs.

- Lower Mortgage Insurance Premiums: If you’re unable to make a down payment of 20% or more, you may be required to pay for mortgage insurance. With a good credit score, you may qualify for lower mortgage insurance premiums, reducing your overall borrowing costs.

- Easier Negotiation: A solid credit score gives you negotiating power when it comes to securing a mortgage. You can leverage your good credit to negotiate better terms, such as lower fees or a reduced interest rate, saving you money in the long run.

- Increased Borrowing Capacity: A good credit score can also increase your borrowing capacity. Lenders are more likely to approve larger loan amounts for borrowers with good credit, allowing you to afford a greater selection of properties.

- Improved Financial Confidence: Having a good credit score not only benefits your mortgage application but also reflects overall financial responsibility. It can boost your confidence by showcasing your ability to manage credit and debt responsibly.

Overall, a good credit score provides numerous advantages when it comes to obtaining a mortgage. It can save you money, improve your borrowing options, and enhance your overall financial well-being. By maintaining a good credit score, you can position yourself for a successful homeownership journey.

Conclusion

Understanding what constitutes a good credit score in Canada for a mortgage is crucial for anyone considering homeownership. Your credit score plays a significant role in determining your eligibility for a mortgage, the interest rates you’ll receive, and the terms of your loan. By knowing how to improve and maintain a good credit score, you can increase your chances of securing the mortgage you desire and save money in the long run.

Factors such as payment history, credit utilization, length of credit history, new credit inquiries, and credit mix all influence your credit score. It’s important to actively manage these factors, making timely payments and keeping credit utilization low to maintain a healthy credit profile.

Having a good credit score brings substantial benefits when it comes to a mortgage. It improves your chances of approval, allows you to access better interest rates and loan terms, and provides a wider selection of mortgage options. Additionally, a good credit score demonstrates financial responsibility and can boost your confidence throughout the homebuying process.

Remember, every lender has specific credit score requirements, and it’s advisable to aim for a credit score higher than the minimum threshold to increase your chances of mortgage approval with favorable terms and rates. If you have a lower credit score, there are strategies available to improve it, such as making timely payments, reducing credit utilization, and addressing any delinquent accounts.

Ultimately, maintaining a good credit score requires discipline, diligence, and responsible credit management. By prioritizing your creditworthiness, you can pave the way to homeownership and enjoy the benefits of having a solid credit foundation for all your future financial endeavors.