Home>Finance>Letter Of Comfort: Definition, Uses, Vs. Guarantee

Finance

Letter Of Comfort: Definition, Uses, Vs. Guarantee

Published: December 17, 2023

Looking for a Letter of Comfort in finance? Discover the definition, uses, and the key differences between a Letter of Comfort and a Guarantee in the financial sector.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Letter of Comfort: Definition, Uses, Vs. Guarantee

When it comes to navigating the complex world of finance, understanding the various instruments and agreements that are commonly used can be critical. One such instrument is the letter of comfort. In this blog post, we will explore what a letter of comfort is, its uses, and how it differs from a guarantee. So, let’s dive in!

Key Takeaways:

- A letter of comfort is a non-binding document issued by a party to provide assurance of financial support or business solvency to another party.

- It is commonly used in situations where a formal guarantee is not desired or possible, providing a level of comfort to the receiving party.

What is a Letter of Comfort?

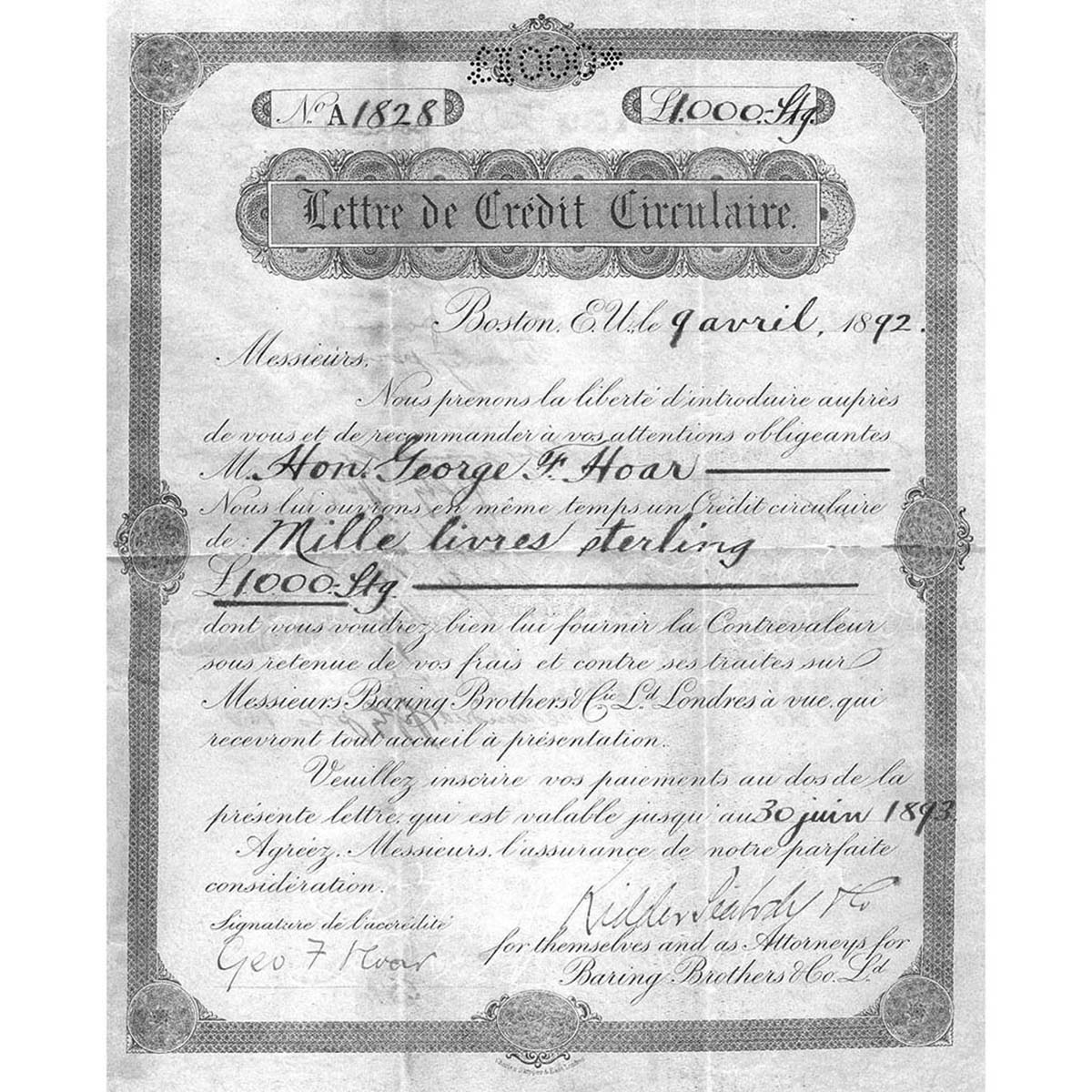

A letter of comfort, sometimes referred to as a letter of intent, is a legal document issued by one party to a recipient party. This document provides reassurance or comfort to the recipient that they will receive financial support or that the issuing party is financially stable and reliable. Unlike a formal guarantee, a letter of comfort is typically not legally binding, but it carries a certain level of moral obligation.

A letter of comfort is often used in a wide range of financial transactions, including loans, investments, joint ventures, and partnerships. It serves as a tool to inspire confidence and trust between the parties involved. The issuing party may choose to provide a letter of comfort when a formal guarantee is not practical or when they want to avoid potential legal liabilities.

How is a Letter of Comfort Different from a Guarantee?

While a letter of comfort may appear similar to a guarantee, there are key differences between the two:

Legal Binding:

- A guarantee is a legally binding contract that imposes a legal obligation on the guarantor to fulfill the financial obligations of the debtor in the event of default.

- A letter of comfort, on the other hand, is typically not legally binding and does not impose a strict legal obligation on the issuing party.

Enforceability:

- Guarantees can be enforced through court proceedings and the guarantor can be held legally liable for the debtor’s obligations.

- A letter of comfort, being non-binding, may not be enforceable in court. However, the moral obligation it carries can influence the behavior and actions of the issuing party.

Intention:

- A guarantee is intended to provide a stronger commitment and greater assurance to the recipient, as it includes legally enforceable obligations.

- A letter of comfort, although not legally binding, still demonstrates a certain level of commitment and willingness to support the recipient party if needed.

In summary, a letter of comfort provides a level of comfort and reassurance to the recipient, establishing trust and confidence in the issuing party’s financial stability. While not legally binding like a guarantee, it signifies a moral obligation that can provide a certain level of security in financial transactions.

So, the next time you come across a letter of comfort in your financial dealings, you’ll have a better understanding of its purpose and how it differs from a guarantee. Keep these points in mind to make well-informed decisions in your financial endeavors!