Home>Finance>Irrevocable Letter Of Credit (ILOC): Definition, Uses, Types

Finance

Irrevocable Letter Of Credit (ILOC): Definition, Uses, Types

Modified: January 10, 2024

Looking for reliable financing options? Discover the definition, uses, and types of Irrevocable Letter of Credit (ILOC). Enhance your finance strategies today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Irrevocable Letter of Credit (ILOC): Definition, Uses, Types

When it comes to international trade or business transactions, financial instruments play a crucial role in ensuring smooth and secure transactions. One such instrument is an Irrevocable Letter of Credit (ILOC). But what exactly is an ILOC, and how does it work? In this blog post, we will dive deep into the definition, uses, and types of Irrevocable Letter of Credit, providing you with a clear understanding of this important financial tool.

Key Takeaways:

- An Irrevocable Letter of Credit (ILOC) is a financial instrument used in international trade to guarantee payment to the exporter.

- It provides a level of security and assurance to both the buyer and the seller in a cross-border transaction.

Definition of Irrevocable Letter of Credit

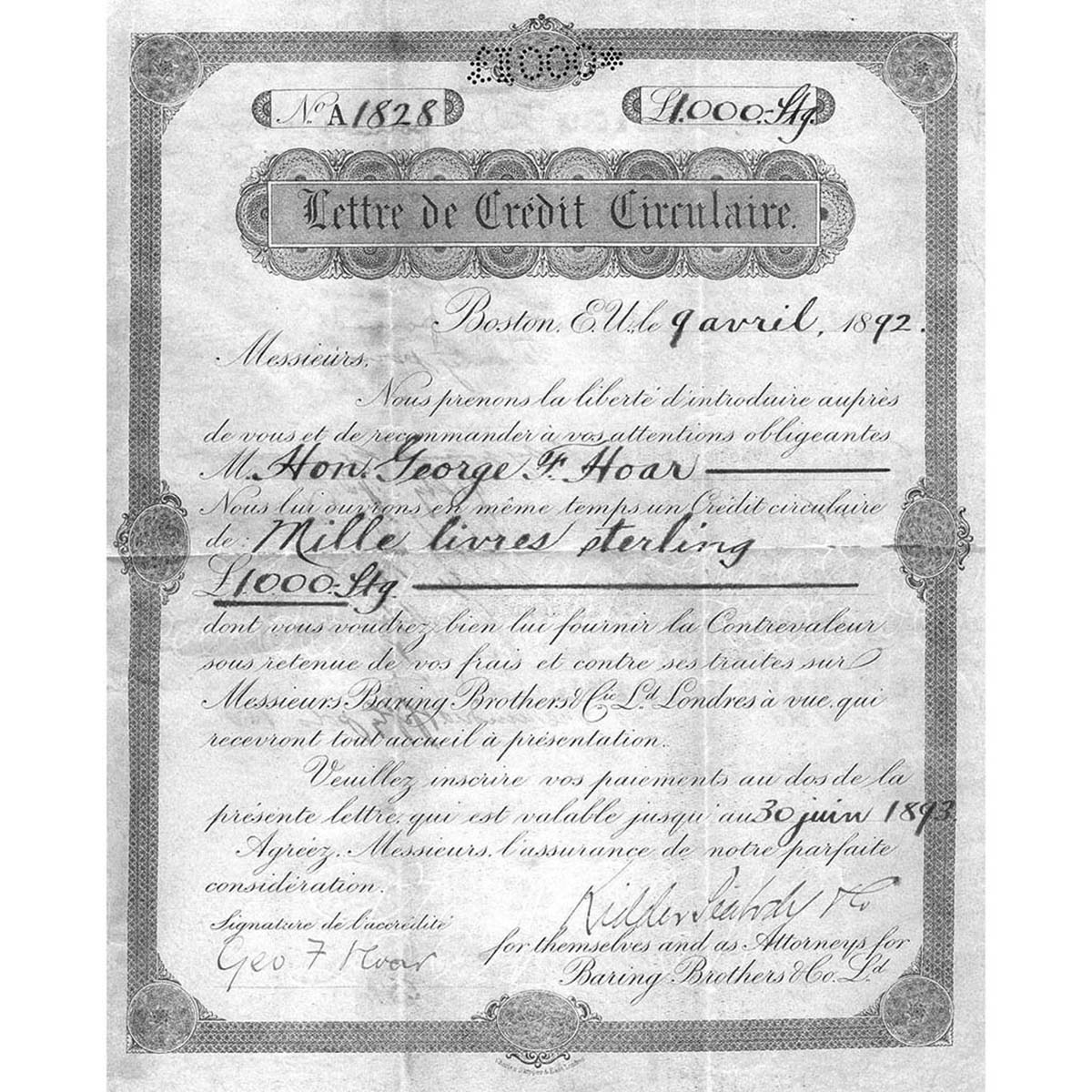

An Irrevocable Letter of Credit is a written commitment issued by a bank on behalf of the buyer (importer) to the seller (exporter) guaranteeing payment for the goods or services provided. As the name suggests, it is an irrevocable commitment, meaning it cannot be altered or canceled without the consent of all parties involved.

Typically, the buyer’s bank, referred to as the issuing bank, opens the ILOC in favor of the seller or the beneficiary. The ILOC specifies the agreed-upon payment terms, such as the amount, currency, and any conditions that must be met by the seller before payment is made.

Uses of Irrevocable Letter of Credit

ILOCs are widely used in international trade, offering benefits to both buyers and sellers. Here are some common uses of Irrevocable Letters of Credit:

- Payment Assurance: An ILOC provides assurance to the seller that they will receive payment once they fulfill the terms of the agreement. This eliminates the risk of non-payment and builds trust between the parties involved.

- Financial Security: For the buyer, an ILOC provides financial security by ensuring that payment will only be made upon satisfactory delivery of the goods or services. This helps mitigate the risk of receiving substandard or non-compliant products.

- International Trade: ILOCs facilitate international trade by providing a secure and efficient method of payment. They are particularly useful when dealing with unfamiliar suppliers or when operating in countries with unstable political or economic conditions.

- Working Capital: Depending on the terms agreed upon, an ILOC can be used as a form of working capital for the seller, allowing them to obtain financing based on the creditworthiness of the issuing bank.

Types of Irrevocable Letter of Credit

There are different types of ILOCs based on the specific requirements of the buyer and seller. Some common types include:

- Confirmed ILOC: In a confirmed ILOC, an additional bank, usually in the seller’s country, adds its confirmation to the ILOC, further guaranteeing payment. This type of ILOC offers an extra layer of security for the seller.

- Revocable ILOC: Unlike the standard irrevocable ILOC, a revocable ILOC can be altered or cancelled by the issuing bank without prior notice to the beneficiary. Due to its lack of reliability, revocable ILOCs are rarely used in international trade.

- Transferable ILOC: A transferable ILOC allows the beneficiary to transfer a portion or the entire ILOC amount to another party as a form of payment for goods or services. This is useful when intermediary agents or middlemen are involved in the transaction.

In conclusion, an Irrevocable Letter of Credit (ILOC) is a valuable financial instrument that provides security and trust in international trade transactions. By guaranteeing payment, it helps build strong business relationships and fosters smooth global commerce. Understanding the types and uses of ILOCs can benefit both buyers and sellers, ensuring successful cross-border transactions.