Home>Finance>Life Income Fund (LIF): Definition And How Withdrawals Work

Finance

Life Income Fund (LIF): Definition And How Withdrawals Work

Published: December 18, 2023

Learn about Life Income Funds (LIF) - a key financial product in the world of finance. Discover the definition and how withdrawals work.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Life Income Fund (LIF): Definition and How Withdrawals Work

Are you nearing retirement and wondering about your options for managing your pension funds? Look no further! In this blog post, we will dive into the world of Life Income Funds (LIFs) and demystify the concept for you. Whether you are a novice or have some basic understanding, this article aims to provide an expert overview of LIFs, their definition, and how withdrawals work.

Key Takeaways:

- A Life Income Fund (LIF) is a registered retirement income fund that allows you to access your pension funds while providing a steady stream of income during your retirement years.

- Withdrawals from a LIF are subject to minimum and maximum annual limits outlined by government regulations, providing you with a structured approach to managing your retirement income.

So, what exactly is a Life Income Fund (LIF)? In simple terms, a LIF is a type of registered retirement income fund that allows you to transfer your pension funds into a tax-deferred account. The purpose of this fund is to provide you with a regular and steady stream of income during your retirement years.

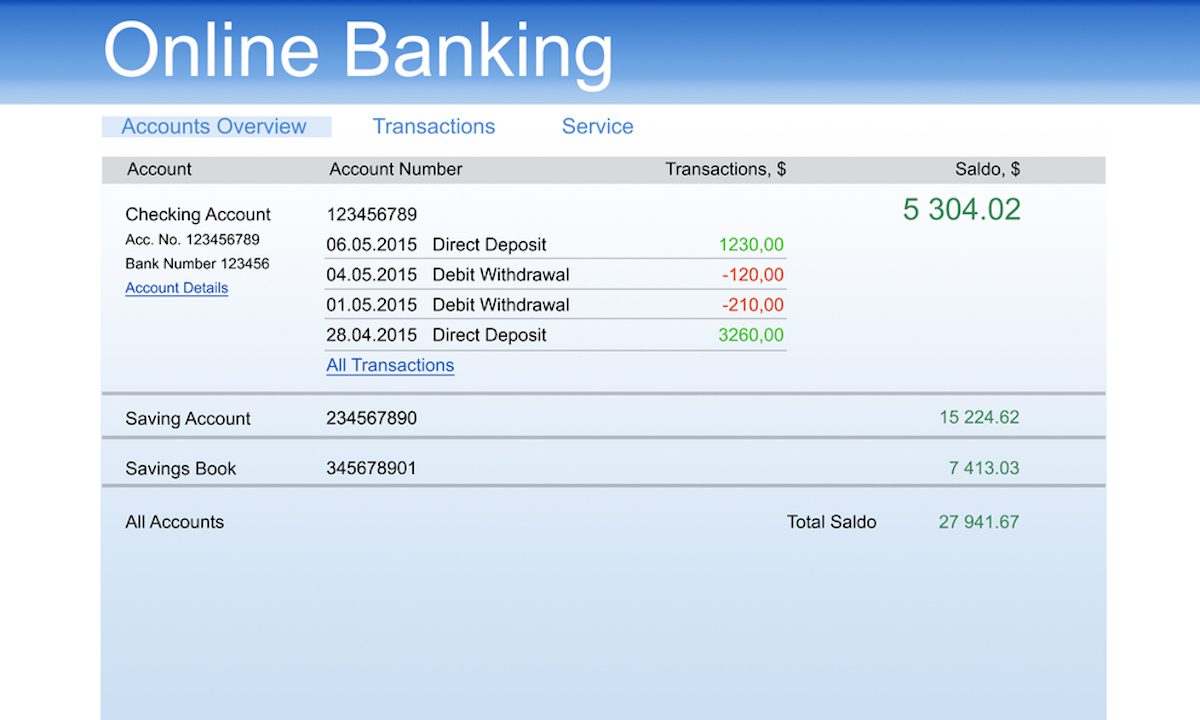

Now, let’s explore how withdrawals work with a LIF. It is important to note that LIFs have both minimum and maximum annual withdrawal limits, which are determined by government regulations. These limits ensure that you have a structured approach to managing your retirement income while also preserving your savings for the long term.

When it comes to withdrawals, you must withdraw at least the minimum annual amount specified by the government. The minimum withdrawal amount is calculated based on factors such as your age and the market value of your LIF. This ensures that you are receiving a fair and sustainable income throughout your retirement.

On the other hand, there is also a maximum annual limit on how much you can withdraw from your LIF. This limit is designed to prevent retirees from depleting their retirement savings too quickly. The maximum withdrawal amount is also influenced by your age and the market value of your LIF.

It’s important to remember that while these limits provide structure and guidance for managing your retirement income, you have the flexibility to adjust your withdrawals within these limits. This means you can scale your income according to your specific needs and financial circumstances.

In summary, a Life Income Fund (LIF) is a valuable tool for managing your retirement income. It allows you to access your pension funds while providing a steady stream of income throughout your retirement. With minimum and maximum annual withdrawal limits, a LIF ensures that you have a structured approach to managing your retirement finances, balancing regular income with long-term savings preservation.

To learn more about Life Income Funds and how they can benefit you, consult with a financial advisor or pension specialist who can guide you through the process and help you make informed decisions based on your unique circumstances.