Finance

How Is Income From Pension Funds Taxed?

Published: January 23, 2024

Learn about the taxation of income from pension funds and how it impacts your finances. Understand the tax implications and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pension funds are a crucial component of financial planning, providing individuals with a source of income during their retirement years. Understanding the taxation of income derived from pension funds is essential for effective retirement planning. In this comprehensive guide, we will delve into the intricate details of how income from pension funds is taxed, shedding light on the various aspects that impact the tax treatment of pension fund contributions, growth, withdrawals, lump sum payments, and annuity payments.

Navigating the tax implications of pension funds requires a nuanced understanding of the intricate tax regulations and guidelines that govern retirement income. By unraveling the complexities of pension fund taxation, individuals can make informed decisions to optimize their retirement income while minimizing tax liabilities.

Join us on this enlightening journey as we explore the taxation landscape of pension funds, unraveling the intricacies that shape the tax treatment of pension fund income. Whether you are a seasoned investor or a novice planner, this guide aims to equip you with the knowledge needed to navigate the tax implications of pension funds effectively. Let’s embark on this insightful exploration of how income from pension funds is taxed, empowering you to make informed decisions for a financially secure retirement.

Understanding Pension Funds

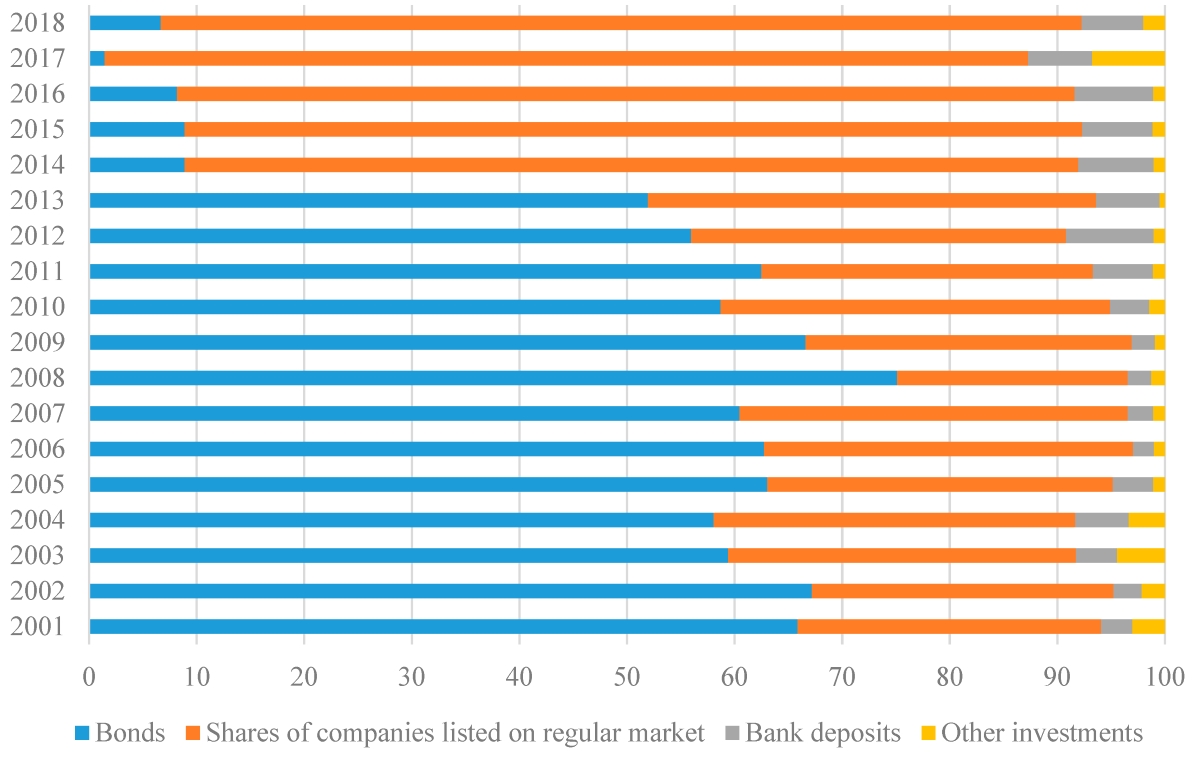

Pension funds, also known as retirement funds or superannuation funds, are investment vehicles designed to provide individuals with a source of income during their retirement years. These funds are typically funded through contributions made by individuals throughout their working years, often supplemented by contributions from employers. The accumulated funds are then invested in a diversified portfolio of assets, such as stocks, bonds, and other securities, with the aim of generating returns that will fund retirement income.

One of the key features of pension funds is their tax-advantaged status, which serves as an incentive for individuals to save for retirement. Contributions made to pension funds often qualify for tax deductions or credits, providing immediate tax benefits to contributors. Additionally, the investment growth within pension funds is usually tax-deferred, allowing the funds to grow unhindered by annual tax liabilities on investment returns.

Upon reaching retirement age, individuals can access the funds accumulated in their pension accounts to support their living expenses during retirement. This can be done through various methods, including lump sum withdrawals or the purchase of annuities that provide regular income streams. Understanding the tax implications of these withdrawal methods is crucial for effective retirement income planning.

Furthermore, pension funds are subject to regulatory oversight to ensure that they are managed prudently and in the best interests of the fund beneficiaries. Regulatory bodies and industry standards dictate the investment options, fee structures, and governance of pension funds to safeguard the retirement savings of individuals.

Overall, pension funds play a pivotal role in securing financial stability during retirement, and comprehending their structure, tax advantages, and withdrawal options is essential for making informed decisions regarding retirement planning and taxation.

Taxation of Pension Fund Contributions

Contributions made to pension funds often carry tax benefits, providing individuals with incentives to save for retirement. In many jurisdictions, contributions to pension funds are tax-deductible, meaning that the amount contributed is deducted from the individual’s taxable income, thereby reducing the overall tax liability. This tax deduction serves as a powerful incentive for individuals to allocate a portion of their earnings towards retirement savings, promoting long-term financial security.

The tax treatment of pension fund contributions varies across different jurisdictions, with specific limits and eligibility criteria governing the deductibility of contributions. In some cases, individuals may be eligible for tax credits or incentives for contributing to pension funds, further enhancing the tax advantages associated with retirement savings.

Employer contributions to pension funds may also carry tax implications. In many instances, employer contributions are not considered taxable income for the employee, providing a valuable benefit that augments the individual’s retirement savings without incurring immediate tax liabilities. This employer contribution often represents a significant component of an individual’s overall retirement savings strategy, bolstering the growth potential of the pension fund.

Understanding the tax treatment of pension fund contributions is pivotal for optimizing retirement savings and minimizing current tax liabilities. By leveraging the tax advantages associated with pension contributions, individuals can effectively allocate their resources towards building a robust retirement portfolio while harnessing the immediate tax benefits provided by pension fund contributions.

In essence, the tax treatment of pension fund contributions serves as a catalyst for long-term financial planning, incentivizing individuals to prioritize retirement savings and harness the tax advantages offered by pension funds to secure their financial well-being during retirement.

Taxation of Pension Fund Growth

One of the compelling features of pension funds is the tax-deferred growth of investments held within the fund. This tax advantage allows the funds to accumulate investment returns without incurring annual tax liabilities on the growth of the portfolio. The tax-deferred status of pension fund growth provides a powerful mechanism for maximizing the compounding effect of investment returns, enabling the funds to grow unhindered by immediate tax obligations.

As the investments within the pension fund generate returns through dividends, interest, and capital gains, the growth of the fund remains shielded from annual taxation. This tax-deferred status is instrumental in bolstering the long-term growth potential of the retirement savings, as the accumulated returns can be reinvested without being eroded by annual tax burdens.

Upon reaching retirement age and initiating withdrawals from the pension fund, the tax treatment of the accumulated growth comes into play. While the growth within the pension fund is tax-deferred during the accumulation phase, withdrawals from the fund are typically subject to taxation at the ordinary income tax rates applicable at the time of withdrawal. This tax treatment aligns with the principle of deferring taxation until retirement, when individuals may be in a lower tax bracket.

It’s important to note that the tax treatment of pension fund growth may vary based on the specific regulations and guidelines governing retirement accounts in different jurisdictions. Understanding the nuances of tax-deferred growth within pension funds is essential for individuals to effectively plan for retirement income and navigate the tax implications of fund withdrawals.

In summary, the tax-deferred growth of investments within pension funds represents a valuable advantage for retirement savings, allowing the funds to grow uninterrupted by annual tax obligations. This tax benefit underscores the significance of pension funds as a tax-efficient vehicle for long-term wealth accumulation, empowering individuals to harness the power of compounding returns in preparation for their retirement years.

Taxation of Pension Fund Withdrawals

As individuals reach retirement age and begin to access the funds accumulated in their pension accounts, the tax treatment of withdrawals becomes a pivotal consideration in retirement income planning. The taxation of pension fund withdrawals is contingent on the specific withdrawal method chosen, and the timing of withdrawals can significantly impact the tax implications.

When individuals initiate withdrawals from their pension funds, the withdrawn amount is typically treated as ordinary income and subject to income tax at the prevailing tax rates. The tax treatment of pension fund withdrawals aligns with the principle of deferring taxation until retirement, as individuals may be in a lower tax bracket during their retirement years.

Furthermore, the timing and frequency of withdrawals can influence the tax consequences. Individuals who opt for periodic withdrawals to supplement their retirement income may have the flexibility to manage their tax liabilities by controlling the annual income generated from the pension fund. This strategic approach allows retirees to optimize their tax position by spreading out the withdrawals over multiple years, potentially minimizing the impact of higher tax brackets on their retirement income.

It’s important to note that the tax treatment of pension fund withdrawals may vary based on the type of pension plan and the specific regulations governing retirement accounts in different jurisdictions. Additionally, the age at which withdrawals commence and the total amount withdrawn can impact the tax implications, underscoring the need for careful planning to mitigate tax liabilities.

Individuals may also have the option to allocate a portion of their pension fund to purchase annuities, which provide regular income streams during retirement. The tax treatment of annuity payments derived from pension funds is typically based on the portion of the payment representing investment growth, which is subject to income tax, and the portion considered a return of the original contributions, which may not be taxable.

In essence, understanding the tax implications of pension fund withdrawals is essential for retirees to make informed decisions regarding their retirement income strategy. By navigating the tax treatment of withdrawals with foresight and strategic planning, individuals can optimize their retirement income while managing their tax obligations effectively.

Taxation of Lump Sum Payments

When individuals approach retirement and consider accessing the funds accumulated in their pension accounts, the option of receiving a lump sum payment from the pension fund becomes a significant consideration. The tax treatment of lump sum payments derived from pension funds is a crucial aspect of retirement income planning, shaping the financial implications of this withdrawal method.

Upon receiving a lump sum payment from a pension fund, the withdrawn amount is typically subject to income tax at the prevailing tax rates. The tax treatment of lump sum payments aligns with the principle of treating the withdrawn amount as ordinary income, similar to the taxation of periodic withdrawals from pension funds. However, the tax implications of lump sum payments may differ based on the specific regulations governing retirement accounts in different jurisdictions.

It’s important to note that the tax treatment of lump sum payments may vary based on the composition of the withdrawn amount. In some cases, the lump sum payment may include both the individual’s original contributions and the investment growth generated within the pension fund. The portion representing the original contributions may not be subject to income tax, as it is considered a return of the individual’s after-tax contributions. Conversely, the portion representing investment growth is typically subject to income tax, as it reflects the accumulated returns on the tax-deferred investments within the pension fund.

Furthermore, the tax implications of receiving a lump sum payment can be influenced by the individual’s age at the time of withdrawal and the specific rules governing lump sum distributions from pension funds. Some jurisdictions may offer special tax treatments for lump sum payments, providing individuals with potential tax benefits or incentives based on their circumstances and the intended use of the funds.

Understanding the tax implications of lump sum payments from pension funds is essential for retirees to make informed decisions regarding their retirement income strategy. By carefully assessing the tax treatment of lump sum withdrawals and considering the potential impact on their overall tax position, individuals can navigate this withdrawal method with foresight and strategic planning, optimizing their retirement income while managing their tax obligations effectively.

In summary, the tax treatment of lump sum payments from pension funds plays a pivotal role in shaping the financial outcomes of retirees, underscoring the significance of comprehending the tax implications associated with this withdrawal method in the context of retirement income planning.

Taxation of Annuity Payments

As individuals transition into retirement, the option of using a portion of their pension funds to purchase annuities becomes a compelling consideration for securing a steady stream of income during their post-employment years. The tax treatment of annuity payments derived from pension funds is a critical aspect of retirement income planning, shaping the tax implications of this method of receiving retirement income.

When individuals receive annuity payments from pension funds, the tax treatment is typically based on the portion of the payment representing investment growth and the portion considered a return of the original contributions. The portion representing investment growth is subject to income tax at the prevailing tax rates, aligning with the taxation of investment returns derived from the pension fund. Conversely, the portion considered a return of the original contributions may not be subject to income tax, as it is viewed as a recovery of the individual’s after-tax contributions.

The tax treatment of annuity payments may vary based on the specific regulations governing retirement accounts in different jurisdictions. Some regions offer preferential tax treatments for annuity payments, providing retirees with potential tax benefits or incentives based on their circumstances and the structure of the annuity contract.

Furthermore, the timing and frequency of annuity payments can influence the tax consequences. Individuals receiving annuity payments may have the flexibility to manage their tax liabilities by spreading out the payments over multiple years, potentially mitigating the impact of higher tax brackets on their retirement income. This strategic approach allows retirees to optimize their tax position by controlling the annual income generated from the annuity payments.

Understanding the tax implications of annuity payments from pension funds is essential for retirees to make informed decisions regarding their retirement income strategy. By carefully assessing the tax treatment of annuity payments and considering the potential impact on their overall tax position, individuals can navigate this method of receiving retirement income with foresight and strategic planning, optimizing their financial well-being during retirement.

In summary, the tax treatment of annuity payments derived from pension funds plays a pivotal role in shaping the financial outcomes of retirees, underscoring the significance of comprehending the tax implications associated with this method of receiving retirement income in the context of retirement income planning.

Conclusion

Understanding the taxation of income from pension funds is integral to effective retirement planning, enabling individuals to navigate the complexities of retirement income with foresight and strategic insight. Throughout this comprehensive exploration, we have shed light on the intricate tax treatment of pension fund contributions, growth, withdrawals, lump sum payments, and annuity payments, providing valuable insights for individuals embarking on their retirement journey.

Pension funds serve as a cornerstone of financial security during retirement, offering individuals a tax-advantaged vehicle to accumulate and access funds to support their post-employment years. The tax benefits associated with pension fund contributions, including potential deductions and credits, incentivize individuals to prioritize retirement savings, fostering long-term financial stability.

Moreover, the tax-deferred growth of investments within pension funds represents a powerful mechanism for maximizing the compounding effect of returns, underscoring the tax efficiency of retirement savings. This tax advantage empowers individuals to harness the potential of their pension funds to grow unhindered by immediate tax obligations, bolstering their retirement income potential.

As individuals reach retirement age and contemplate accessing their pension funds, the tax treatment of withdrawals, lump sum payments, and annuity payments becomes a pivotal consideration. Navigating the tax implications of these withdrawal methods with informed decision-making is essential for optimizing retirement income while managing tax liabilities effectively.

In conclusion, the tax treatment of income from pension funds intertwines with the broader landscape of retirement planning, shaping the financial outcomes of individuals as they transition into their post-employment years. By comprehending the nuances of pension fund taxation and leveraging the tax advantages associated with retirement savings, individuals can embark on their retirement journey with confidence, equipped with the knowledge needed to make informed decisions for a financially secure future.

Ultimately, the taxation of income from pension funds underscores the intersection of financial prudence, tax efficiency, and retirement preparedness, highlighting the significance of proactive planning and informed decision-making in securing a fulfilling and financially stable retirement.