Finance

Withdrawal Benefits Definition

Published: February 18, 2024

Learn the definition of withdrawal benefits in finance and how they can help you in managing your finances. Discover the advantages of withdrawal benefits today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Withdrawal Benefits: Definition and How It Affects Your Finances

When it comes to managing your finances, understanding key terms and concepts is crucial. One such concept is withdrawal benefits, which can have a significant impact on your financial planning and decision-making. In this blog post, we will dive deep into the definition of withdrawal benefits and explore how it affects your overall financial well-being.

Key Takeaways:

- Withdrawal benefits refer to the ability to access funds from an investment or retirement account.

- Understanding withdrawal benefits is essential for financial planning and making informed decisions about your investments.

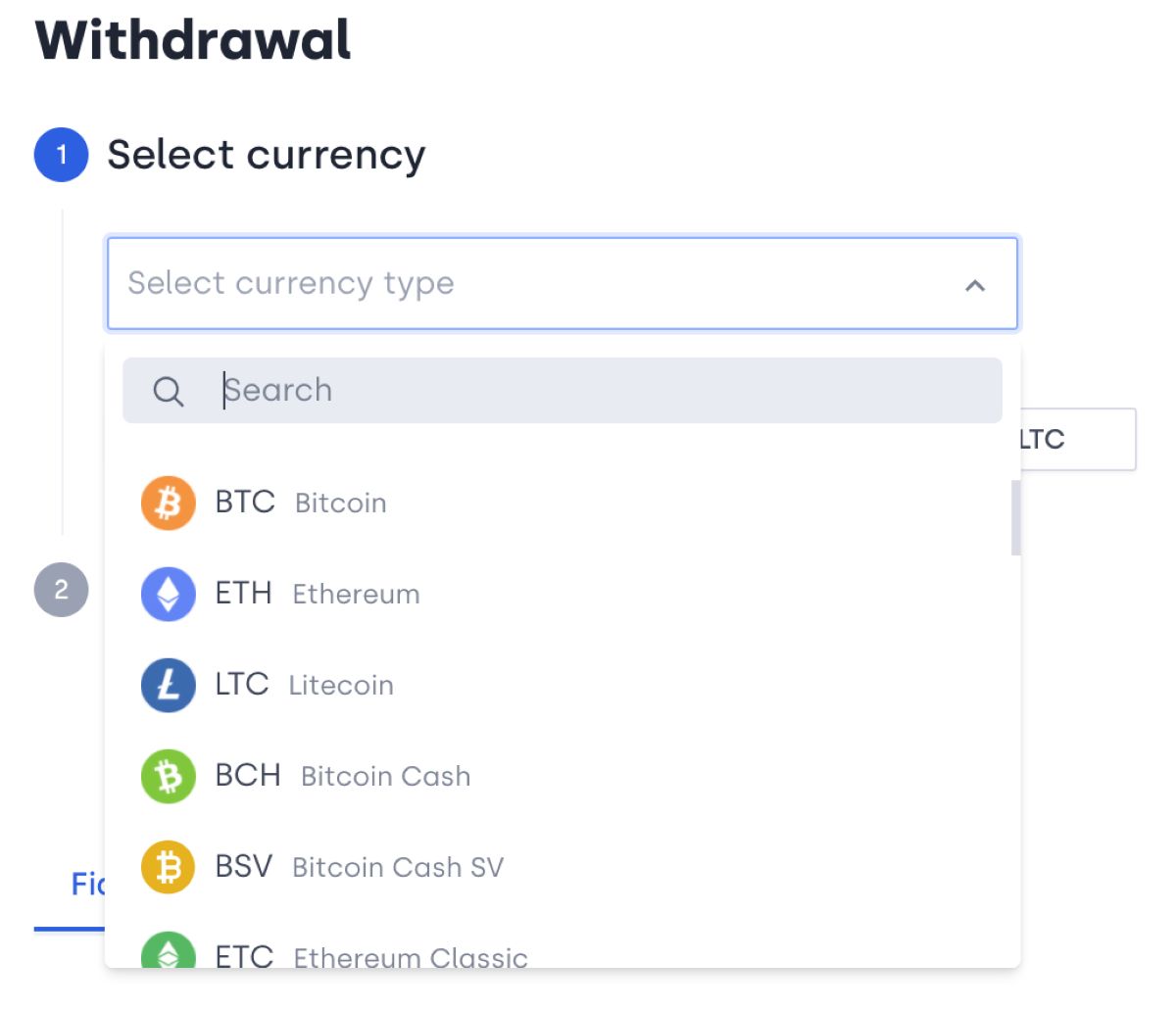

So, what exactly are withdrawal benefits? In simple terms, withdrawal benefits are the financial advantages you receive by being able to withdraw funds from an investment or retirement account. These benefits can come in various forms, such as cash payments, annuities, or access to certain types of accounts. It is important to note that withdrawal benefits are typically realized after a specific age or under specific circumstances, as determined by the rules and regulations of the investment or retirement plan.

Withdrawal benefits play a crucial role in your overall financial planning journey. Here’s a closer look at how it affects your finances:

1. Retirement Planning:

Withdrawal benefits are particularly relevant when it comes to planning for your retirement. If you have a retirement account or pension plan, understanding the withdrawal benefits associated with it is vital for setting realistic financial goals and making informed decisions. Knowing how and when you can access your funds can help you plan for a comfortable and financially secure retirement.

2. Tax Implications:

Withdrawal benefits can have tax implications, and understanding these implications is crucial for effective tax planning. Depending on the type of account and the amount of the withdrawal, you may be subject to taxes or penalties. By understanding the withdrawal benefits and the related tax consequences, you can make smart decisions to minimize your tax liabilities.

In conclusion, withdrawal benefits refer to the ability to access funds from an investment or retirement account. By understanding and closely managing these benefits, you can optimize your financial planning, secure a comfortable retirement, and minimize tax liabilities. Remember, always consult with a financial advisor or tax professional to ensure you make the best decisions based on your individual circumstances.