Finance

Marketable Securities Definition

Published: December 23, 2023

Understand the meaning of marketable securities in finance. Learn how these assets are traded and their importance in investment portfolios.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Marketable Securities Definition and How They Impact Your Finances

When it comes to managing your finances, knowledge is power. One area that is important to understand is marketable securities. These financial instruments are a category of investments that can have a significant impact on your portfolio and overall financial well-being. In this blog post, we will delve into the definition of marketable securities and explore how they can affect your financial standing.

Key Takeaways:

- Marketable securities are financial instruments that can be easily bought, sold, and traded in the open market.

- They are typically classified as short-term or long-term investments and can include stocks, bonds, and money market instruments.

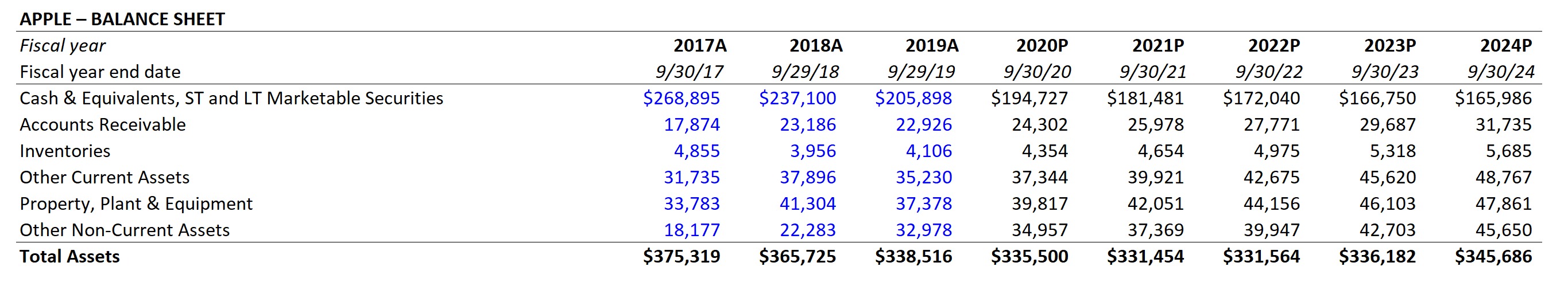

So, what exactly is the definition of marketable securities? In essence, they are financial instruments that are highly liquid and can be easily bought, sold, or traded in the open market. These securities are considered to be liquid assets because they can be converted into cash relatively quickly without a significant loss in value.

There are two main categories of marketable securities: short-term and long-term. Short-term marketable securities typically have a maturity period of less than one year, while long-term securities have a maturity period of over one year. Examples of short-term marketable securities include Treasury bills and commercial paper, while long-term marketable securities can include stocks and bonds.

Now, let’s explore how marketable securities can impact your finances:

1. Diversification

Investing in marketable securities allows you to diversify your portfolio. By spreading your investments across different asset classes, you can reduce the risk associated with any individual investment. This can help protect your finances from potential losses and provide a more stable return on investment.

2. Potential for Growth

Marketable securities, particularly stocks, offer the potential for capital appreciation and long-term growth. By carefully selecting securities based on thorough research and analysis, you can potentially earn significant returns on your investments. However, it’s important to note that investing in the stock market comes with inherent risks, and it’s crucial to strike a balance between risk and reward.

As with any investment, it’s important to understand the risks and potential rewards before venturing into the world of marketable securities. Seeking professional financial advice is recommended to ensure you make informed decisions and align your investments with your financial goals and risk tolerance.

In conclusion, understanding the definition of marketable securities is crucial for managing your finances effectively. By diversifying your portfolio and taking advantage of the potential growth opportunities they offer, these financial instruments can play a significant role in achieving your financial goals. Remember to conduct thorough research, seek professional advice, and stay informed about market trends to make informed investment decisions that align with your financial objectives.