Home>Finance>Merger Arbitrage: Definition And How It Works To Manage Risk

Finance

Merger Arbitrage: Definition And How It Works To Manage Risk

Published: December 24, 2023

Learn about merger arbitrage in finance and how it's utilized to control risk. Explore the definition and workings of this strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Merger Arbitrage: Definition and How It Works to Manage Risk

Welcome to another blog post in our Finance category! Today, we are going to delve into the fascinating world of merger arbitrage. Have you ever wondered how investors manage risk in the financial market amidst corporate mergers and acquisitions? Well, wonder no more! In this article, we will explore what merger arbitrage is, how it works, and its role in managing risk for investors.

Key Takeaways:

- Merger arbitrage is an investment strategy that involves exploiting pricing discrepancies between a target company’s stock price and the price offered in a merger or acquisition deal.

- By engaging in merger arbitrage, investors aim to profit from the successful completion of the merger or acquisition while minimizing their exposure to market fluctuations.

What is Merger Arbitrage?

At its core, merger arbitrage is an investment strategy that seeks to take advantage of the price discrepancy between a target company’s stock price and the price offered in a merger or acquisition deal. When a merger is announced, the stock price of the target company often doesn’t immediately reach the full acquisition price. This discrepancy arises due to uncertainties surrounding the completion of the deal, regulatory approval, and market sentiment.

The goal of merger arbitrage is to profit from this price discrepancy by buying the stock of the target company at a lower price and simultaneously shorting the acquiring company’s stock or selling the target company’s stock at the acquisition price. If the merger is successfully completed, the investor earns the difference between the acquisition price and the lower purchase price. This strategy allows investors to potentially generate returns irrespective of the overall market direction.

How Does Merger Arbitrage Manage Risk?

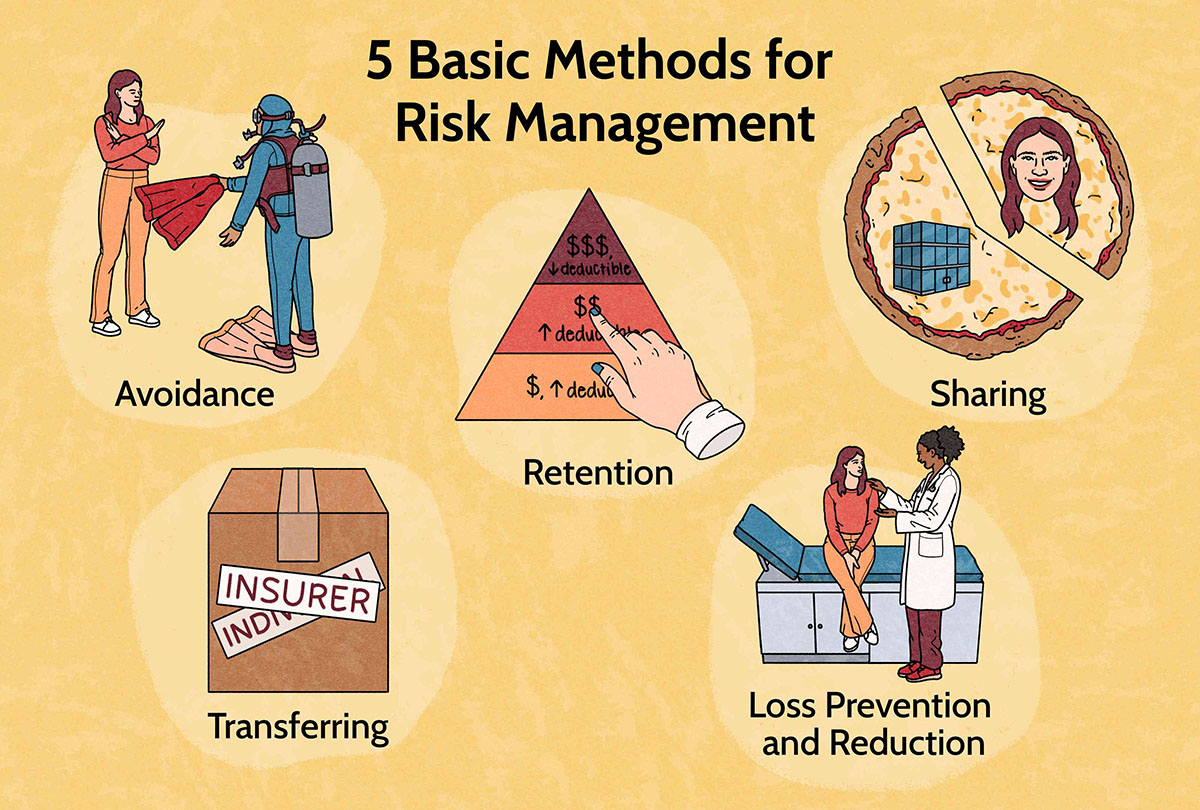

Merger arbitrage plays a crucial role in managing risk for investors. Here’s how:

- Hedging Market Risk: By simultaneously buying the stock of the target company and shorting the stock of the acquiring company, merger arbitrage creates a market-neutral position. This means that the strategy is less susceptible to broad market movements, reducing the investor’s exposure to market risk.

- Risk Assessment: Merger arbitrage involves detailed analysis of the potential risks associated with a transaction, including regulatory hurdles, financing risks, and shareholder approval. Through thorough due diligence, investors can assess the likelihood of a deal closing and adjust their positions accordingly, mitigating risk.

By combining these risk management techniques, merger arbitrage allows investors to participate in the potential upside of a merger or acquisition while minimizing their exposure to market volatility and other uncertainties.

Conclusion

Merger arbitrage is a strategy that provides investors with the opportunity to profit from pricing discrepancies during corporate mergers and acquisitions. By employing market-neutral positions and thorough risk analysis, it enables investors to manage risk and potentially generate returns regardless of the overall market direction.

So, the next time you come across news about a major merger or acquisition, take a moment to appreciate the intricacies of merger arbitrage and how it helps investors navigate the complex world of finance.