Finance

Micro Accounting Definition

Published: December 25, 2023

Discover the meaning of micro accounting and its role in finance. Gain insights into the importance of micro accounting for accurate financial analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of Micro Accounting: A Comprehensive Guide

Are you looking to take control of your finances and make smarter decisions? Then micro accounting might be the solution for you. In this blog post, we will delve into the world of micro accounting and provide you with a clear definition, along with valuable insights on how it can transform your financial management. So, let’s get started!

Key Takeaways:

- Micro accounting is a detailed and granular approach to managing finances, focusing on tracking and analyzing every small transaction.

- It allows individuals and businesses to gain a deeper understanding of their financial health and make data-driven decisions.

At its core, micro accounting is all about breaking down your financial records into smaller, more manageable components. Rather than viewing your finances as a whole, micro accounting enables you to analyze the individual transactions that make up your financial picture. By doing so, you gain a deeper understanding of where your money is coming from, how it is being spent, and where you can make improvements.

Here are a few key reasons why micro accounting is gaining popularity:

1. Enhanced Financial Awareness

With micro accounting, you gain a heightened level of financial awareness. By tracking each transaction, you can easily identify unnecessary expenses, detect patterns, and pinpoint areas where you can save money. This detailed approach helps to promote more intentional spending habits and helps you align your financial goals with your day-to-day activities.

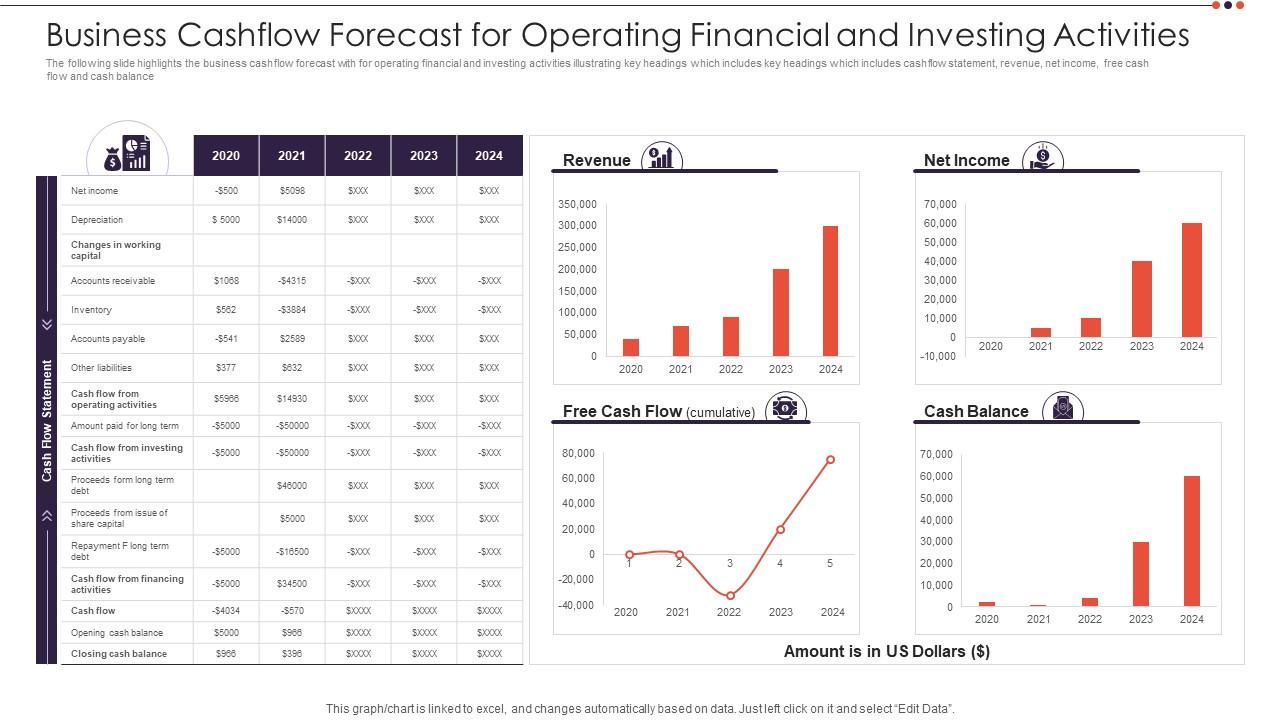

2. Data-Driven Decision Making

Micro accounting provides you with accurate and up-to-date data that can be used to drive financial decisions. Whether you are a business owner or an individual, this level of detail allows you to analyze the financial impact of different scenarios, plan for the future, and identify areas for growth or improvement. By leveraging data-driven insights, you can make more informed decisions that lead to long-term financial success.

If you’re ready to embrace the power of micro accounting, here are a few steps you can take to get started:

- Set up a dedicated system: Choose an accounting software or platform that allows you to track and categorize your transactions at a granular level. There are many options available, so choose the one that best suits your needs.

- Create detailed categories: Customize your accounts and categories to capture the specific details of each transaction. This will allow for accurate reporting and analysis.

- Regularly review and reconcile: Make it a habit to review and reconcile your transactions on a regular basis to ensure accuracy and maintain a clear financial picture.

- Utilize reporting features: Take full advantage of the reporting capabilities of your chosen accounting system. Generate custom reports to gain insights into your financial trends and patterns.

- Seek professional guidance: If you find the world of micro accounting overwhelming, consider seeking assistance from a financial professional who can guide you through the process and provide valuable advice.

Micro accounting is a powerful tool that can revolutionize the way you manage your finances. By diving deep into the details, you can gain a comprehensive understanding of your financial health and make informed decisions that will positively impact your personal or business financial goals. So, why not give micro accounting a try and unlock a new level of financial control and success?