Home>Finance>How To Negotiate Credit Card Debt With Discover

Finance

How To Negotiate Credit Card Debt With Discover

Modified: December 29, 2023

Learn effective strategies to negotiate your credit card debt with Discover and regain control of your finances. Explore expert tips and advice in managing your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Your Credit Card Debt

- Exploring the Options for Negotiating with Discover

- Preparing for Negotiation

- Initiating Contact with Discover

- Negotiation Techniques and Strategies

- Presenting Your Offer to Discover

- Finalizing the Negotiation

- Considerations and Tips for Successful Negotiation

- Conclusion

Introduction

Dealing with credit card debt can be overwhelming, especially if you find yourself struggling to make the minimum monthly payments. If you have a Discover credit card and are facing financial difficulties, negotiating your credit card debt with Discover could be a viable solution. By understanding the negotiation process and employing effective strategies, you can potentially reduce your debt and find a more manageable repayment plan.

When it comes to negotiating credit card debt, it is important to approach the situation with a clear understanding of your financial situation. This will help you determine what you can realistically afford to pay and the terms you would like to negotiate. Additionally, having a solid grasp of the options available to you will allow you to make informed decisions during the negotiation process.

In this article, we will explore the options for negotiating credit card debt with Discover and provide strategies to help you navigate the process successfully. We will discuss how to prepare for negotiation, initiate contact with Discover, employ effective negotiation techniques, and finalize the negotiation. By following these steps and keeping a few key considerations in mind, you can increase your chances of reaching a favorable debt settlement with Discover.

Understanding Your Credit Card Debt

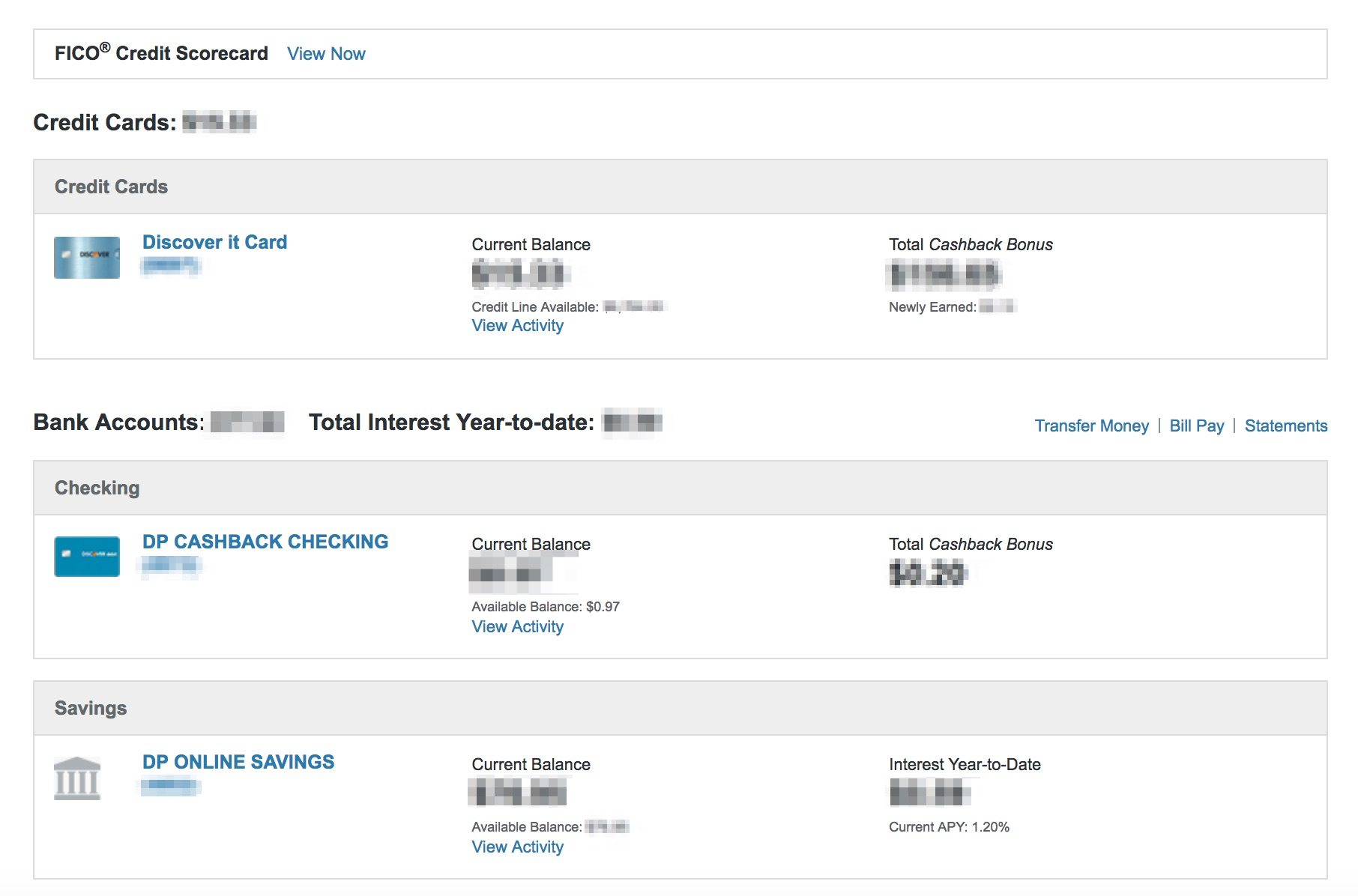

Before you can effectively negotiate your credit card debt with Discover, it is crucial to have a comprehensive understanding of your debt situation. This includes knowing the amount owed, the interest rates applied, and any additional fees or charges. By having this information at hand, you will be able to develop a realistic repayment plan and negotiate from a position of knowledge.

Start by gathering all of your credit card statements from Discover and any other relevant documents. Take note of the outstanding balance on each card, the minimum monthly payment, and the interest rate being charged. It’s also important to identify any additional fees, such as late payment penalties or annual fees, that may be affecting your overall debt.

Next, evaluate your current financial situation. Take a close look at your income, expenses, and any other outstanding debts you may have. This will help you determine how much you can afford to pay towards your credit card debt and what kind of negotiation strategy would be most beneficial for your circumstances.

Additionally, it is important to understand the potential consequences of not addressing your credit card debt. Late or missed payments can result in a lower credit score, making it more difficult to obtain future credit or loans. By taking proactive steps to negotiate your debt, you can potentially avoid these negative consequences and regain control of your financial well-being.

By truly understanding the ins and outs of your credit card debt, you will be better equipped to communicate with Discover and negotiate a resolution that works for both parties. With this knowledge, you can confidently move forward in the negotiation process and work towards financial freedom.

Exploring the Options for Negotiating with Discover

When it comes to negotiating credit card debt with Discover, there are several options available to borrowers. It is important to understand these options and choose the one that best aligns with your financial goals and capabilities.

1. Request a lower interest rate: One possible negotiation tactic is to contact Discover and request a lower interest rate on your credit card. This can help reduce the total amount of interest you will have to pay over time, making it easier to manage your debt. Be prepared to provide a valid reason for your request, such as financial hardship, and highlight your reliable payment history to strengthen your case.

2. Set up a repayment plan: Discover may be willing to work with you to establish a repayment plan that fits your budget. This could involve reducing or freezing the interest charges for a period of time or extending the repayment period. Discussing your financial situation openly and demonstrating your commitment to paying off the debt can increase your chances of securing a favorable repayment plan.

3. Seek a hardship program: Discover offers hardship programs for customers facing significant financial difficulties. These programs may allow you to temporarily reduce or suspend your monthly payments, providing you with some relief while you work on improving your financial situation. Contact Discover’s customer service to inquire about their hardship programs and the eligibility criteria.

4. Explore debt settlement: If you are unable to repay your debt in full, you can negotiate a debt settlement with Discover. This involves reaching an agreement to pay a lump sum that is less than the total outstanding balance. Keep in mind that debt settlement can have a negative impact on your credit score, so carefully consider its implications before pursuing this option.

It is worth noting that these options may not be available or suitable for every borrower. The outcome of the negotiation will depend on your individual circumstances, financial standing, and the policies of Discover. Take the time to assess each option carefully and consider seeking professional advice if needed.

By exploring these negotiation options, you can proactively address your credit card debt with Discover and work towards finding a solution that can alleviate your financial burden.

Preparing for Negotiation

Preparing for the negotiation process is crucial to increasing your chances of success when negotiating credit card debt with Discover. Taking the time to gather the necessary information and plan your approach can help you navigate the negotiation with confidence.

1. Review your financial situation: Before entering into negotiation, carefully assess your current financial standing. Calculate your total income, monthly expenses, and other outstanding debts. This will help you determine how much you can realistically afford to pay towards your credit card debt and what kind of negotiation strategy would be most suitable for your situation.

2. Understand Discover’s policies: Familiarize yourself with Discover’s policies regarding credit card debt negotiation. Take note of any specific guidelines or requirements they have in place. This understanding will enable you to tailor your negotiation approach accordingly and increase your chances of a favorable outcome.

3. Prioritize your debts: If you have multiple debts, it’s important to prioritize them according to their interest rates, outstanding balances, and penalties. By doing so, you can allocate your financial resources efficiently and determine which debts to tackle first. Keep in mind that while negotiating with Discover, prioritizing your credit card debt should be a top consideration.

4. Gather necessary documentation: Before initiating contact with Discover, gather all the relevant documentation related to your credit card debt. This may include your credit card statements, proof of income, and any correspondence you have had with Discover regarding your debt. Having this information readily available will facilitate the negotiation process and provide evidence and support for your requests.

5. Develop a negotiation strategy: Plan your negotiation strategy based on your financial situation and goals. Consider factors such as whether you want to reduce the interest rate, establish a repayment plan, or explore debt settlement options. Having a clear strategy will help you articulate your requests and negotiate effectively during your discussions with Discover.

6. Practice for the negotiation: It can be helpful to practice and role-play before engaging in the actual negotiation. Anticipate potential objections or counteroffers from Discover and prepare responses that address these concerns. Practicing will help you feel more confident and comfortable during the negotiation process.

By adequately preparing for the negotiation, you can approach Discover with confidence and clarity. Being well-prepared will allow you to advocate for your needs effectively and increase the likelihood of a successful negotiation outcome.

Initiating Contact with Discover

When you are ready to negotiate your credit card debt with Discover, the first step is to initiate contact with the company. By reaching out, you can begin the conversation and express your willingness to work towards a resolution. Here are some steps to help you effectively initiate contact:

1. Confirm the contact information: Double-check the contact information for Discover’s customer service. This may include their phone number, email address, or online messaging portal. Ensure that you have the correct and up-to-date information before reaching out.

2. Prepare a script: In order to stay focused and convey your message clearly, it can be helpful to prepare a script or outline of what you want to say during the conversation. This will help you articulate your intentions and requests effectively.

3. Be polite and professional: When contacting Discover, it’s crucial to maintain a polite and professional demeanor. Remember that the representative you speak with is there to help you find a resolution. Remain calm, courteous, and focused on reaching a mutually beneficial agreement.

4. Clearly explain your situation: Briefly explain your financial situation and the reasons why you are seeking assistance with your credit card debt. This could include a loss of income, unexpected expenses, or other financial hardships. Provide relevant details that will help Discover understand your circumstances.

5. Articulate your goals: Clearly communicate your desired outcome for the negotiation. Whether it’s a lower interest rate, a repayment plan, or a debt settlement, expressing your goals will help guide the conversation and ensure that both parties are on the same page.

6. Take thorough notes: During your conversation with Discover, take detailed notes of the discussion. This includes the name of the representative you spoke with, the date and time of the call or interaction, and any important details or agreements that were made. These notes will be helpful for reference during future communications.

7. Follow up in writing: After initiating contact, it can be beneficial to follow up with Discover in writing. This can be in the form of a letter or email reiterating the main points discussed during the initial contact. This serves as a written record and can help ensure that both parties are aware of the agreed-upon action steps.

Remember, the key to initiating contact with Discover is to be clear, polite, and professional throughout the interaction. By following these steps, you can establish open lines of communication and set the stage for productive negotiations to resolve your credit card debt.

Negotiation Techniques and Strategies

When negotiating your credit card debt with Discover, employing effective techniques and strategies can significantly impact the outcome of your negotiation. Here are some techniques to consider:

1. Remain calm and composed: Keep your emotions in check during the negotiation process. Stay calm, composed, and focused on the objective at hand. Avoid becoming defensive or confrontational, as this can hinder productive discussions.

2. Active listening: Actively listen to the representative from Discover, as this will help you understand their perspective and concerns. By demonstrating that you are attentive and receptive, you can establish rapport and potentially find common ground for a resolution.

3. Be prepared to compromise: Negotiation requires a willingness to compromise. Understand that you may need to make concessions in order to reach a mutually agreeable outcome. Be open to alternative solutions and think creatively to find common ground.

4. Emphasize your payment history: Highlight your positive payment history with Discover, especially if you have consistently made on-time payments in the past. This can strengthen your position and illustrate your commitment to fulfilling your financial obligations.

5. Present a detailed financial plan: Prepare a detailed financial plan that clearly outlines your income, expenses, and proposed repayment strategy. By presenting a well-thought-out plan, you demonstrate your commitment and ability to manage your debt responsibly.

6. Leverage competition: If you have received offers or promotions from other credit card companies that offer more favorable terms, mention this during the negotiation. This can create a sense of competition and potentially incentivize Discover to provide better terms.

7. Stay informed about your rights: Familiarize yourself with your rights as a borrower, including consumer protection laws and regulations. Knowing your rights can empower you during negotiations and help you advocate for fair treatment.

8. Remain patient and persistent: Negotiating credit card debt can be a time-consuming process. It requires patience and persistence to navigate through multiple conversations and potential setbacks. Stay committed to your goal and continue advocating for a resolution.

Remember, negotiation is a skill that improves with practice. By employing these techniques and strategies, you can navigate the negotiation process with confidence and increase your chances of reaching a favorable outcome with Discover.

Presenting Your Offer to Discover

When it comes to negotiating credit card debt with Discover, presenting your offer effectively is key to maximizing the chances of reaching a favorable agreement. Here are some steps to help you present your offer in a clear and compelling manner:

1. Organize your offer: Before presenting your offer to Discover, organize your proposal in a clear and structured manner. This includes summarizing the key points, such as the amount you are willing to pay, the repayment terms, and any other concessions you are seeking.

2. Highlight your financial capabilities: Clearly demonstrate to Discover that you have the means to fulfill your proposed offer. Provide evidence of your income, savings, or any other financial resources that support your ability to make the agreed-upon payments. This can help instill confidence in Discover that you are a reliable borrower.

3. Emphasize the benefits to Discover: Frame your offer in a way that highlights the benefits to Discover. For example, stress that your proposal will ensure a consistent stream of payments, reduce their risk of non-payment, and potentially save them from having to engage in costly debt collection efforts. Show them that accepting your offer is a win-win situation.

4. Negotiate additional terms if necessary: If Discover expresses reservations or counteroffers your initial proposal, be open to negotiation. Remain flexible and willing to consider alternative terms that may still address your financial constraints while meeting Discover’s requirements.

5. Use persuasive language and evidence: Make use of persuasive language and provide supporting evidence during the presentation of your offer. Utilize specific examples and data to illustrate your financial situation and the feasibility of your proposed terms. This can lend credibility to your offer and increase its chances of acceptance.

6. Maintain professionalism and respect: Throughout the presentation and negotiation process, maintain a professional and respectful tone. Avoid becoming confrontational or making demands. Instead, focus on constructive dialogue and finding common ground that benefits both parties.

7. Follow up in writing: After presenting your offer verbally, follow up in writing to solidify the terms discussed. This can be done through a formal letter or email, summarizing the key points of your agreement. Request written confirmation from Discover to ensure that both parties are on the same page.

By presenting your offer in a clear, logical, and persuasive manner, you can increase the likelihood of reaching a favorable agreement with Discover. Remember to approach the negotiation process with professionalism, flexibility, and a focus on mutual benefit.

Finalizing the Negotiation

Finalizing the negotiation of your credit card debt with Discover is an important step towards resolving your financial obligations. It involves reaching a mutually agreed-upon settlement that satisfies both parties. Here are some key steps to consider when finalizing the negotiation:

1. Confirm the terms: Ensure that both you and Discover are in agreement regarding the final terms of the negotiation. Review the proposed payment amounts, interest rates, repayment schedules, and any other agreed-upon concessions. Clarify any points of confusion or uncertainty before proceeding.

2. Get written confirmation: Request written confirmation from Discover that outlines the finalized terms of the negotiation. This written agreement serves as proof of the agreement reached and can protect you from any future disputes or misunderstandings.

3. Verify the final settlement amount: Double-check the final settlement amount that you will be paying to Discover. Ensure that it aligns with the negotiated terms and reflects any discounts, forgiven fees, or reductions in the total outstanding balance that were agreed upon during the negotiation process.

4. Make the payment as agreed: Fulfill your side of the negotiated settlement by making the agreed-upon payment to Discover. Ensure that you adhere to the repayment schedule and pay the agreed amounts on time to honor the agreement. Consider setting up automatic payments if it is an option to avoid missing any payments.

5. Retain documentation: Keep copies of all documentation related to the negotiation and settlement. This includes the written confirmation, payment receipts, and any correspondence with Discover. These records can be essential for reference purposes and can protect you in case of any future disputes or inquiries.

6. Monitor your account: After finalizing the negotiation, closely monitor your credit card account with Discover to ensure that the negotiated terms are being implemented correctly. Check your statements regularly and verify that the agreed-upon payment amounts and interest rates are being applied accurately. If you notice any discrepancies, contact Discover promptly to address the issue.

7. Maintain communication: Even after the negotiation is finalized, it is beneficial to maintain open lines of communication with Discover. Keep them informed of any changes to your financial situation that may impact your ability to meet the agreed-upon payments. By establishing a good relationship and demonstrating your commitment, you may be able to negotiate further if needed in the future.

Finalizing the negotiation with Discover requires attention to detail and follow-through. By confirming the terms, obtaining written confirmation, making payments on time, and maintaining open communication, you can successfully navigate this final stage and effectively resolve your credit card debt with Discover.

Considerations and Tips for Successful Negotiation

When negotiating your credit card debt with Discover, there are several considerations and tips that can help you increase your chances of a successful outcome. Keep the following points in mind as you navigate the negotiation process:

1. Understand your priorities: Clearly define your priorities and objectives before entering into negotiations. Knowing what is most important to you, whether it’s reducing the outstanding balance, lowering the interest rate, or establishing a manageable repayment plan, will help guide your negotiation strategy.

2. Do your research: Familiarize yourself with standard negotiation practices and techniques. Understand the options available to you and the range of outcomes that are feasible. Being well-informed will allow you to confidently advocate for your needs and explore potential solutions.

3. Document everything: Keep detailed records of all communications and agreements during the negotiation process. This includes emails, letters, notes from phone conversations, and any written confirmation. These records will serve as evidence of the agreed-upon terms and protect you in case of any disputes.

4. Be aware of your rights: Understand your rights and protections as a borrower. Review regulations related to credit card debt, consumer protection laws, and any relevant policies specific to Discover. Knowing your rights will give you confidence and enable you to assert them during the negotiation process if necessary.

5. Be patient and persistent: Negotiating credit card debt can be a lengthy process. It requires patience and persistence. Be prepared for multiple rounds of discussions and potential setbacks. Stay committed to your goal and continue to engage in constructive dialogue to find a resolution.

6. Seek professional advice if needed: If you feel overwhelmed or lack experience in negotiation, consider seeking professional advice. Consult with a credit counseling agency, a financial adviser, or an attorney who specializes in debt negotiation. Their expertise can provide valuable guidance and increase your chances of success.

7. Be honest and transparent: Maintain honesty and transparency throughout the negotiation process. Disclose relevant financial information and clearly communicate your limitations and constraints. Trust is essential in negotiations, and being forthright will help build a foundation for productive discussions.

8. Consider the long-term impact: Evaluate the long-term impact of the negotiated settlement on your financial situation. Assess how the terms will affect your ability to manage your debt and future financial goals. Strive for a resolution that not only provides immediate relief but also sets you up for long-term financial stability.

9. Stay focused on a win-win outcome: Remember that negotiation is about finding a mutually beneficial solution. Strive for a win-win outcome where both you and Discover feel satisfied with the agreement. By maintaining this mindset, you can foster a cooperative atmosphere that increases the chances of reaching a resolution.

10. Keep emotions in check: Emotions can run high during negotiations, but it’s important to remain calm and composed. Avoid becoming defensive or confrontational. Instead, focus on clear communication and addressing the issues at hand objectively. A calm and rational approach will yield better results.

By considering these tips and keeping these factors in mind, you can navigate the negotiation process with Discover more effectively. Remember that successful negotiation requires preparation, patience, and a willingness to find common ground for a mutually beneficial resolution.

Conclusion

Negotiating credit card debt with Discover can be a challenging process, but with careful preparation and effective strategies, it is possible to find a favorable resolution. By understanding your credit card debt, exploring negotiation options, and preparing for the negotiation process, you lay the foundation for success.

Initiating contact with Discover and presenting your offer in a clear and persuasive manner are essential steps in the negotiation process. Remaining calm, professional, and persistent throughout the negotiation can pave the way for a mutually beneficial agreement.

Finalizing the negotiation requires attention to detail, thorough documentation, and adherence to the agreed-upon terms. Carefully monitor your account and maintain open lines of communication with Discover to ensure a smooth process and successful outcome.

Keep in mind the considerations and tips provided, such as understanding your priorities, conducting research, and seeking professional advice if needed. By being patient, staying focused on win-win outcomes, and keeping emotions in check, you can navigate the negotiation process with confidence.

Remember, negotiating credit card debt with Discover is an opportunity to regain control of your finances and find a solution that works for you. With determination and a proactive approach, you can reduce your debt burden and embark on a path towards financial freedom.

Always prioritize your financial well-being, learn from the negotiation experience, and apply the knowledge gained to improve your financial habits moving forward. By taking control of your credit card debt, you are taking a significant step towards a more secure and stable financial future.