Finance

Money Market Account Xtra (MMAX) Definition

Published: December 26, 2023

Learn about the definition of Money Market Account Xtra (MMAX) in finance. Enhance your financial knowledge and secure your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Money Market Account Xtra (MMAX)?

When it comes to managing your finances, having the right tools and knowledge is crucial. One financial instrument that you may come across is a Money Market Account Xtra (MMAX). But what exactly is MMAX, and how does it differ from other types of accounts? In this blog post, we’ll explore the definition of MMAX, its benefits, and why it might be a good option for your financial goals.

Key Takeaways:

- Money Market Account Xtra (MMAX) is a type of financial instrument that offers a high-yield savings option.

- MMAX typically offers a higher interest rate than traditional savings accounts, helping your money grow faster.

The Definition of MMAX

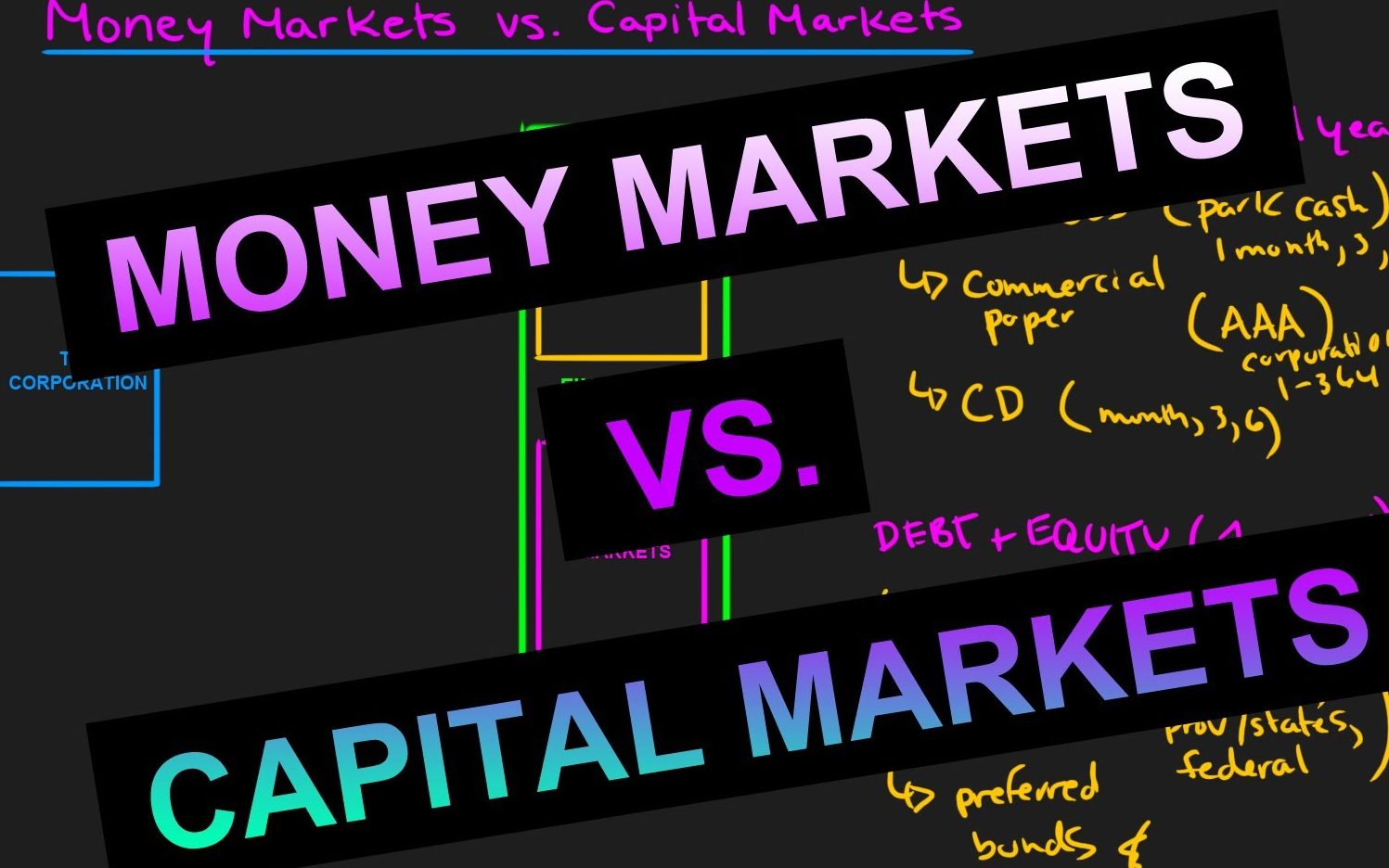

A Money Market Account Xtra (MMAX) is a hybrid account that combines the features of a traditional savings account and a money market account. It is typically offered by banks and credit unions and provides customers with a high-yield savings option. MMAX accounts are designed to offer a higher interest rate than regular savings accounts, allowing your money to grow at a faster pace.

As with a regular saving account, your MMAX funds are FDIC-insured, providing peace of mind and protection for your hard-earned savings. This means that even if the bank fails, you will be reimbursed up to the maximum insured amount.

The Benefits of MMAX

Now that we’ve defined MMAX, let’s explore some of the benefits this type of account offers:

- Higher Interest Rates: One of the primary advantages of choosing a Money Market Account Xtra (MMAX) is the potential for higher interest rates compared to traditional savings accounts. This means that your money has the potential to grow at a faster rate, helping you reach your financial goals sooner.

- Liquidity and Flexibility: MMAX accounts offer a higher degree of liquidity compared to other investment options, such as CDs or long-term investments. With an MMAX account, you can typically make withdrawals without penalty, giving you easy access to your funds when you need them.

- Federal Deposit Insurance Corporation (FDIC) Protection: Like regular savings accounts, MMAX funds are FDIC-insured up to the maximum insured amount. This provides an added layer of security for your savings, giving you peace of mind that your money is protected even in the event of a bank failure.

- Easy Account Access: MMAX accounts are designed to provide ease of use and convenient access to your funds. Many banks offer online and mobile banking platforms, allowing you to manage your money on the go and make transactions with just a few clicks or taps.

Overall, a Money Market Account Xtra (MMAX) can be a great option for those looking to grow their savings while maintaining a level of liquidity and easy access to their funds. Whether you’re saving for a short-term goal or building an emergency fund, MMAX accounts offer attractive interest rates and the security of FDIC insurance. Consider speaking with a financial advisor or your bank’s representative to learn more about MMAX and how it can fit into your overall financial strategy.