Home>Finance>Net Unrealized Appreciation (NUA): Definition And Tax Treatment

Finance

Net Unrealized Appreciation (NUA): Definition And Tax Treatment

Published: December 30, 2023

Learn about the definition and tax treatment of Net Unrealized Appreciation (NUA) in finance. Maximize your savings with smart financial strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Potential: Net Unrealized Appreciation (NUA) in Finance

Are you ready to explore an advanced strategy in finance that could potentially save you money on taxes? Look no further! In this article, we will delve into the world of Net Unrealized Appreciation (NUA) and reveal its definition and tax treatment. So, grab your curiosity and let’s get started on this exciting financial journey!

Key Takeaways:

- Net Unrealized Appreciation (NUA) is a strategy that allows you to take advantage of favorable tax treatment on the appreciated value of company stock held within a retirement plan.

- By utilizing NUA, you can potentially pay a lower tax rate on the appreciated portion of the stock if certain conditions are met.

Imagine this scenario: you have worked diligently for a company for many years, and during that time, you have acquired stock in your employer’s retirement plan. Now, as you approach retirement, you have the opportunity to tap into that investment. But what if there was a way to optimize the tax implications of that stock? That’s where Net Unrealized Appreciation (NUA) comes into play.

1. Understanding Net Unrealized Appreciation (NUA)

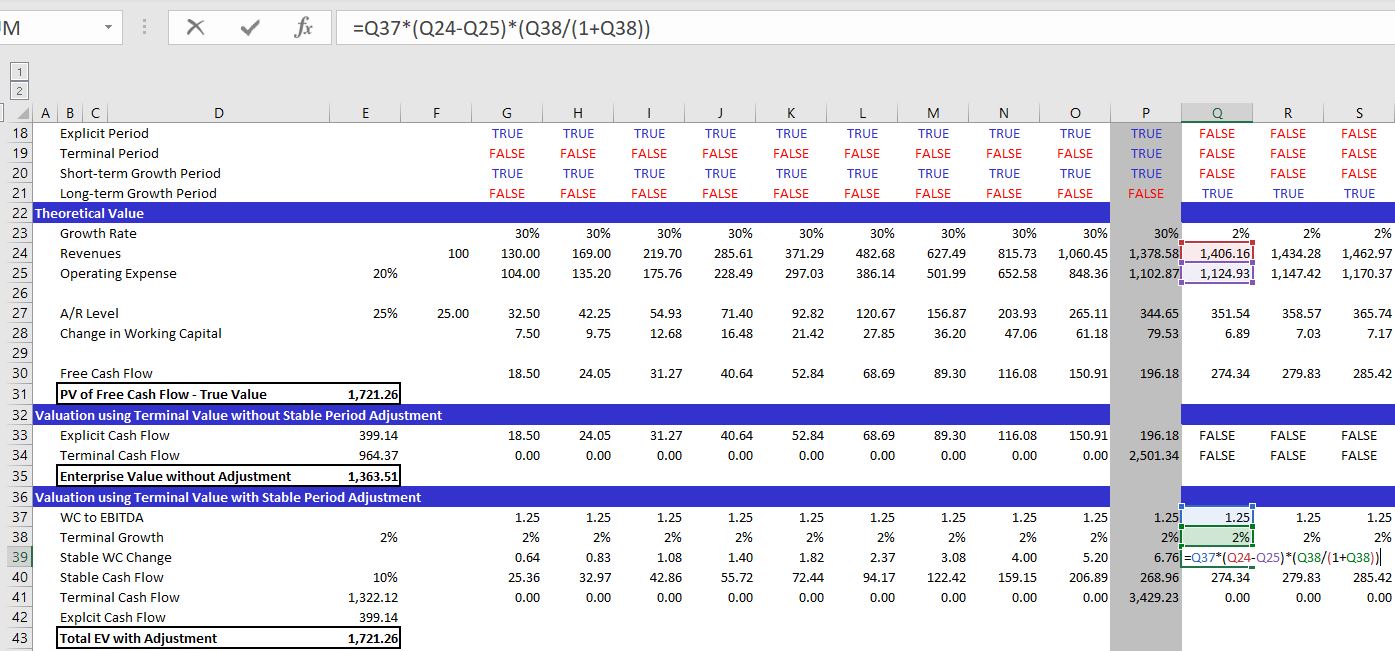

Net Unrealized Appreciation (NUA) refers to the difference between the cost basis of employer stock and its current market value. In simple terms, it is the amount by which the value of the stock has increased since the time it was acquired. This appreciation is realized when you sell the stock.

2. The Tax Treatment Advantage

What makes NUA a powerful strategy is its favorable tax treatment. Instead of treating the entire distribution from your retirement plan as taxable income, NUA allows you to separate the appreciated portion (the NUA) from the rest.

So, how does this benefit you? The appreciated value of the stock is generally subject to capital gains tax rates rather than ordinary income tax rates. Capital gains tax rates are often lower than income tax rates, providing you with potential tax savings. Keep in mind that to qualify for this treatment, the distribution must occur as part of a lump sum distribution.

3. Eligibility and Considerations

NUA is not applicable to all retirement plans. It specifically applies to employer-sponsored retirement plans, such as 401(k) plans, that hold company stock. It’s important to consult with a financial advisor or tax professional to determine if this strategy is suitable for your specific situation.

Additionally, NUA can have significant tax implications in the long term. It’s essential to consider factors such as the size of the NUA, your expected tax bracket, and your investment goals before deciding to utilize this strategy.

As with any financial strategy, Net Unrealized Appreciation (NUA) has its own set of complexities and considerations. While it has the potential to offer tax advantages, it may not be suitable for everyone. Therefore, it’s crucial to consult with professionals who can guide you through the process and help you make informed decisions.

When it comes to personal finance, exploring various strategies can be both exciting and rewarding. NUA offers a unique opportunity to optimize the tax implications of your retirement plan and potentially save money. By understanding the concept, benefits, and eligibility requirements, you can take control of your financial future and make informed decisions tailored to your specific circumstances.