Home>Finance>Open Banking: Definition, How It Works, And Risks

Finance

Open Banking: Definition, How It Works, And Risks

Published: January 3, 2024

Discover the concept of Open Banking in the finance industry. Learn how it works, its definition, and associated risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Open Banking: Definition, How It Works, and Risks

Welcome to our Finance blog post series, where we dive into various financial topics to help you make informed decisions. In today’s edition, we will explore the concept of Open Banking. What is Open Banking, how does it work, and what are the risks involved? These are some of the questions we aim to answer as we unravel the world of Open Banking.

Key Takeaways:

- Open Banking is a system that allows banks to share customer financial data securely and with consent.

- It offers numerous benefits, including increased competition, enhanced personal financial management, and access to innovative financial services.

Now, let’s dive into the details.

What is Open Banking?

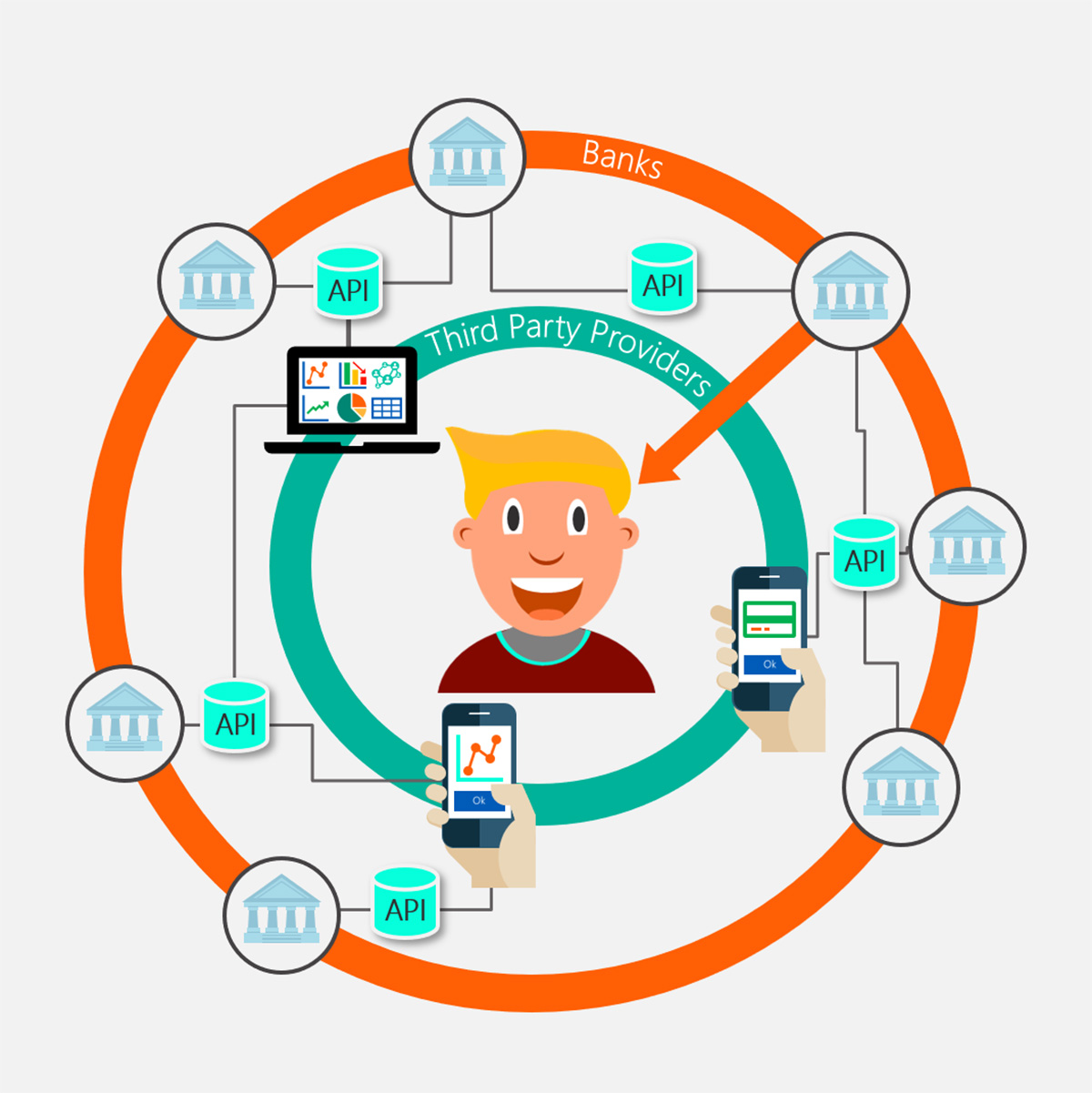

Open Banking is a revolutionary concept that aims to transform the way we interact with our financial data. Essentially, it is a system that enables banks and other financial institutions to share customer data securely, with the customer’s consent, through application programming interfaces (APIs).

But why is this important? Open Banking opens up a world of possibilities for customers and businesses alike. It promotes competition, fosters innovation, and empowers individuals to take control of their finances.

How Does Open Banking Work?

Open Banking relies on the secure sharing of financial data between different institutions. Here’s a simplified breakdown of how it works:

- Consent: The customer gives explicit consent to share their financial data with other institutions.

- API Integration: Banks and financial institutions develop APIs to securely share this data.

- Data Transfer: The customer’s financial data, such as transaction history and account balances, is transferred securely to the requested institution.

- Enhanced Services: Institutions can use this data to provide personalized services, such as offering tailored financial advice or recommending suitable financial products.

By allowing different institutions access to customer data, Open Banking encourages competition, leading to better services, improved affordability, and increased transparency in the financial sector.

The Risks of Open Banking

Like any technological advancement, Open Banking introduces potential risks that both consumers and financial institutions must be aware of. While the industry has implemented strict security measures to safeguard customer data, it’s important to understand and mitigate these risks. Some of the risks include:

- Data Breaches: The risk of unauthorized access to customer financial data.

- Identity Theft: The possibility of fraudsters using stolen data for malicious purposes.

- Consent Misuse: The potential for institutions to misuse customer consent, leading to unauthorized access or misuse of data.

It’s crucial for customers to ensure they understand the risks associated with Open Banking and take steps to protect their data. Choosing reputable institutions, monitoring accounts regularly, and being cautious with sharing sensitive information are some ways to mitigate these risks.

Conclusion

Open Banking is transforming the financial services industry, bringing with it countless potential benefits and risks. By allowing secure sharing of customer data, it empowers individuals to access better services, take control of their finances, and encourages innovation and competition among financial institutions.

However, it’s vital for both consumers and institutions to remain vigilant and actively manage the risks associated with Open Banking. With proper awareness and responsible data sharing practices, Open Banking can revolutionize the way we manage our finances and make financial decisions.