Home>Finance>Senior Bank Loan: Definition, How It Works, Rates & Risks

Finance

Senior Bank Loan: Definition, How It Works, Rates & Risks

Published: January 26, 2024

Discover the ins and outs of senior bank loans in the world of finance. Understand how they work, explore interest rates, and weigh the associated risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Senior Bank Loan: Definition, How It Works, Rates & Risks

When it comes to personal finance, it’s essential to have a thorough understanding of the different types of loans available. One such loan that you may come across is a senior bank loan. In this blog post, we’ll delve into what senior bank loans are, how they work, the rates involved, and the risks associated with them.

Key Takeaways:

- A senior bank loan is a type of loan that is given priority over other debt obligations in the event of a borrower defaulting.

- Senior bank loans typically have variable interest rates and are secured by collateral, such as assets or property.

What is a Senior Bank Loan?

A senior bank loan, also known as a senior secured loan or leveraged loan, is a loan provided by a bank or financial institution to a company or individual. What sets senior bank loans apart is their seniority – they are given priority over other debt obligations in the event of a borrower defaulting.

These loans are often used by businesses to fund their operations, acquisitions, or growth initiatives. Individuals may also opt for senior bank loans when they require substantial funds for personal purposes, such as debt consolidation or home renovations.

How Does a Senior Bank Loan Work?

When a borrower receives a senior bank loan, they agree to repay the loan amount along with interest over a specified period. Senior bank loans typically have variable interest rates, meaning the interest rate can fluctuate over time based on a benchmark rate, such as the London Interbank Offered Rate (LIBOR) or the Prime Rate.

These loans are secured by collateral, which can be in the form of assets, equipment, or property owned by the borrower. The collateral serves as a guarantee for the lender that they can recover their investment in case the borrower defaults. In other words, if the borrower fails to make payments, the lender has the right to seize and sell the collateral to recover the outstanding loan balance.

Rates and Risks of Senior Bank Loans

As mentioned earlier, senior bank loans typically have variable interest rates. This means that the interest rate charged on the loan can increase or decrease depending on market conditions. These rates are often calculated as a spread over a benchmark rate.

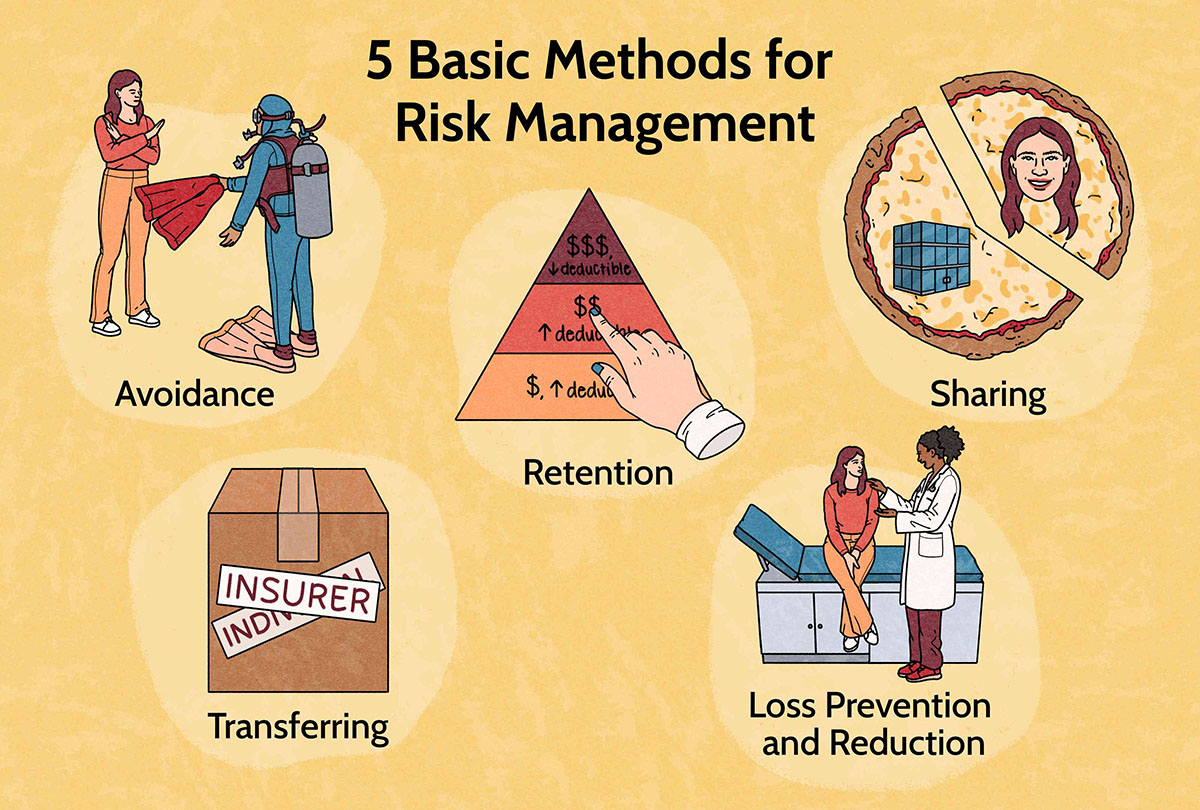

The risks associated with senior bank loans primarily depend on the borrower’s ability to repay the loan. If the borrower faces financial difficulties or experiences a decline in their creditworthiness, there is a higher risk of default. Additionally, if the value of the collateral declines significantly, it may not be sufficient to cover the outstanding loan balance.

Investors who purchase senior bank loans face risks as well. They are exposed to the potential credit risk of the borrower and may not be able to recover their investment in case of default. However, seniority in loan repayment priority provides some level of protection compared to other types of debt.

In Conclusion

A senior bank loan is a type of loan that holds a priority position in repayment compared to other debt obligations. These loans are commonly used by businesses and individuals for varying purposes. They come with variable interest rates and are secured by collateral, which reduces some of the risks associated with lending. However, it’s essential for both borrowers and investors to carefully consider the risks involved before opting for or investing in senior bank loans.

Key Takeaways:

- A senior bank loan is a type of loan that is given priority over other debt obligations in the event of a borrower defaulting.

- Senior bank loans typically have variable interest rates and are secured by collateral, such as assets or property.

Hopefully, this blog post has shed light on the concept of senior bank loans and provided valuable insights into how they work, the rates associated with them, and the risks involved. If you’re considering a senior bank loan, make sure to consult with a financial advisor or lender to ensure it aligns with your needs and risk tolerance.