Home>Finance>OTCQB (The Venture Market): Definition In Stocks And Benefits

Finance

OTCQB (The Venture Market): Definition In Stocks And Benefits

Published: January 4, 2024

Learn about OTCQB, the venture market for finance stocks, and discover the benefits of trading in this alternative stock exchange.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding OTCQB: The Venture Market

When it comes to investing, there are various stock markets and exchanges to choose from. One such option is the OTCQB, also known as the Venture Market. But what exactly is it, and why should investors consider it? In this blog post, we will shed light on the definition of OTCQB and explore its benefits, helping you make informed decisions when it comes to your personal finance goals.

Key Takeaways:

- OTCQB is an alternative stock market that offers trading opportunities for emerging companies.

- Investing in OTCQB stocks provides access to potential high-growth opportunities.

The Definition of OTCQB

OTCQB stands for Over-The-Counter Quotation Bureau, and it is a market operated by the OTC Markets Group. It serves as a platform for trading stocks of emerging companies that do not meet the requirements of major exchanges like the NASDAQ or NYSE. While OTCQB is an alternative to these larger exchanges, it is an important stepping stone for many companies on their path to growth and recognition.

Companies listed on the OTCQB must meet certain eligibility criteria, including ongoing financial reporting and disclosure obligations. This requirement helps ensure transparency and provides investors with valuable information to make informed investment decisions. While OTCQB may cater to smaller companies, it is still subject to regulatory oversight.

The Benefits of OTCQB

Now that we understand what OTCQB is, let’s delve into its benefits for investors:

1. Access to Emerging Companies

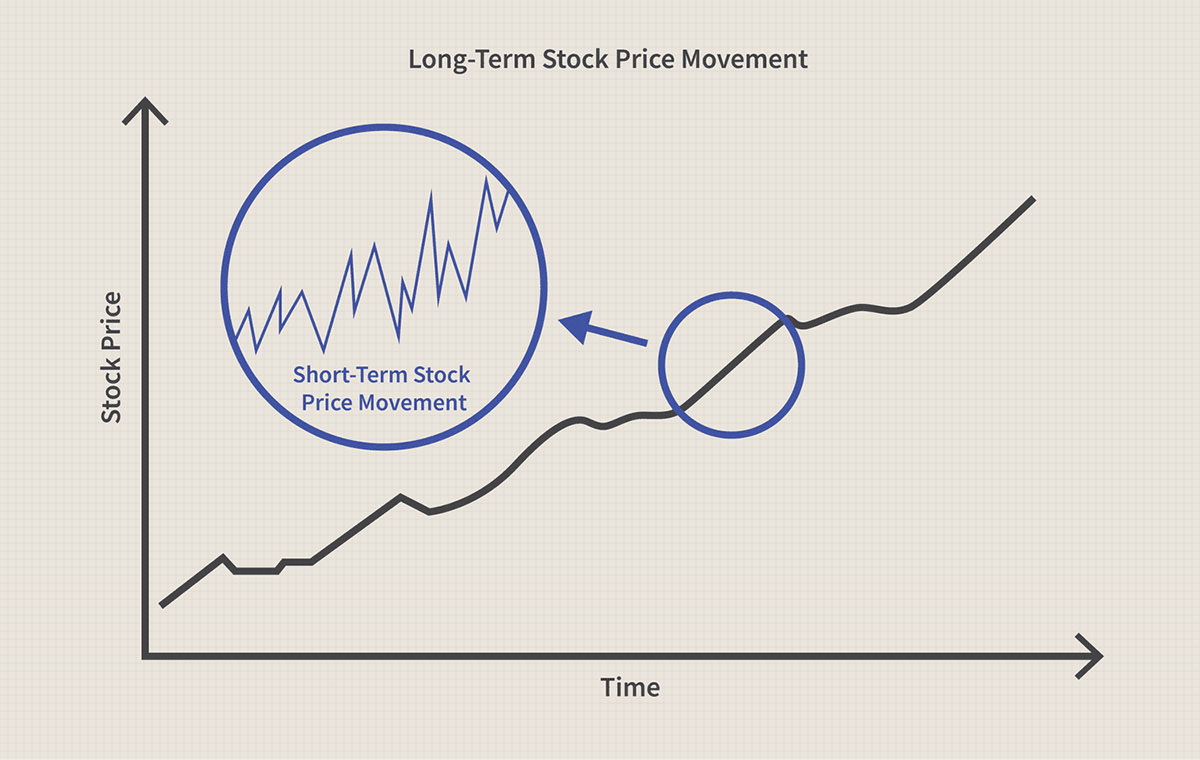

OTCQB is a platform that allows investors to access stocks of emerging companies with promising potential. These companies may be in the early stages of growth, offering investors the opportunity to get in on the ground floor. By investing in OTCQB stocks, you can potentially tap into high-growth opportunities before they become widely recognized, potentially earning substantial returns.

2. Diversification

Investing in OTCQB stocks adds an additional layer of diversification to your investment portfolio. By including emerging companies from this market, you can spread your risk across different sectors and company sizes. Diversification is a key strategy to mitigate risk and enhance the overall performance of your investment portfolio.

3. Increased Liquidity

While OTCQB stocks may not have the same liquidity as those listed on major exchanges, trading volumes and liquidity on this market have been increasing over time. This means that buying and selling OTCQB stocks has become easier, providing investors with more flexibility and potentially reducing transaction costs.

By considering the benefits of investing in OTCQB, you can make informed decisions about diversifying your portfolio and tapping into emerging companies’ potential. Remember to conduct thorough research and due diligence before investing, as the risks associated with these stocks may be higher compared to more established exchanges.

At the end of the day, OTCQB provides an avenue for investors to explore new opportunities in the financial market. By understanding its definition and benefits, you can navigate this alternative stock market with confidence and potentially reap the rewards of investing in emerging companies.