Home>Finance>Pension Funds Are Prohibited From Using Which Investment Strategy?

Finance

Pension Funds Are Prohibited From Using Which Investment Strategy?

Published: January 23, 2024

Pension funds are restricted from employing which finance investment strategy? Discover the limitations and alternatives in this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Pension Funds: Balancing Security and Growth

Introduction

Pension funds play a pivotal role in securing the financial future of millions of individuals around the world. These funds are designed to provide a steady income during retirement, offering a sense of security and stability as individuals transition into their golden years. To achieve this noble objective, pension funds employ various investment strategies aimed at generating returns while managing risks.

The investment landscape for pension funds is multifaceted, encompassing a diverse array of asset classes such as stocks, bonds, real estate, and alternative investments. Each asset class presents unique opportunities and challenges, requiring prudent decision-making to strike a balance between growth and stability. However, amidst the myriad of investment options available, there exists a specific strategy that pension funds are prohibited from utilizing due to its inherent risks and potential adverse impact on fund beneficiaries.

In the following sections, we will delve into the investment strategies commonly employed by pension funds, explore the prohibited investment strategy, analyze its impact, and ultimately gain a comprehensive understanding of the intricate dynamics at play in the realm of pension fund management. Let's embark on this insightful journey to unravel the complexities and nuances of pension fund investment strategies, shedding light on the crucial regulations that safeguard the financial well-being of retirees.

Pension Fund Investment Strategies

Pension funds are entrusted with the task of prudently managing the contributions made by employers and employees to ensure that sufficient funds are available to meet future pension obligations. To achieve this objective, pension funds employ a range of investment strategies tailored to their specific objectives, risk tolerance, and time horizon.

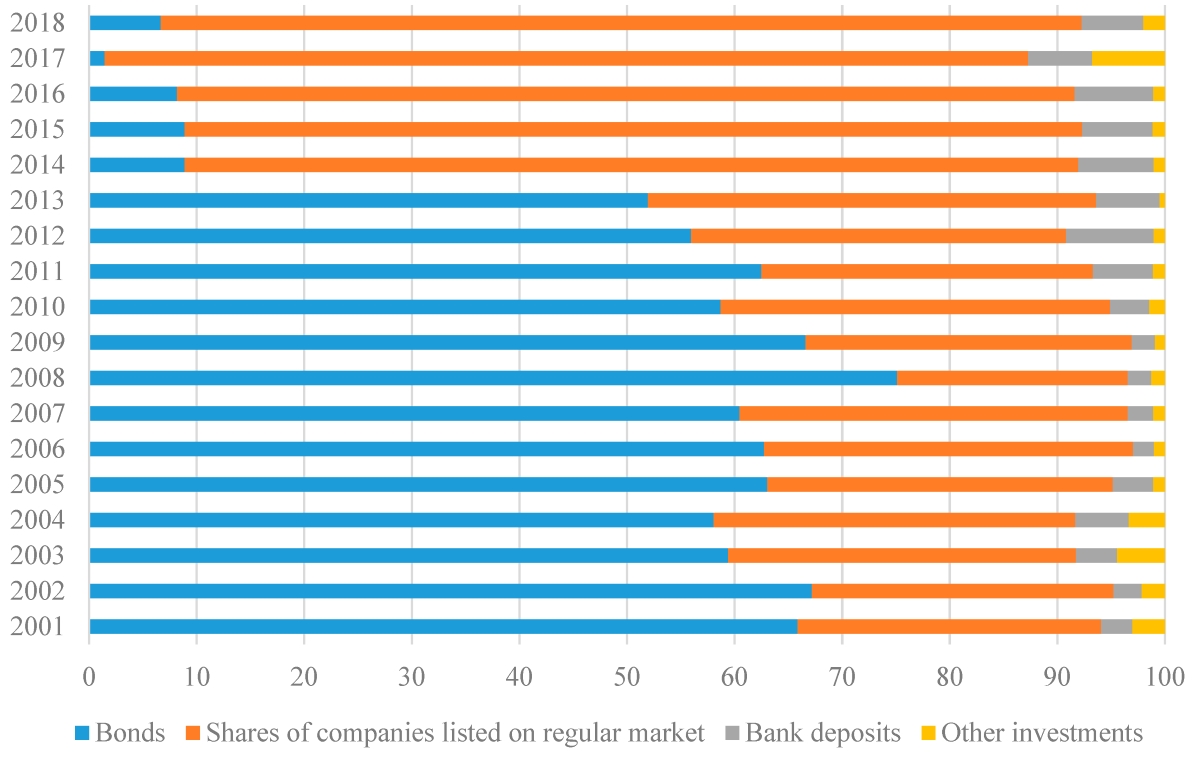

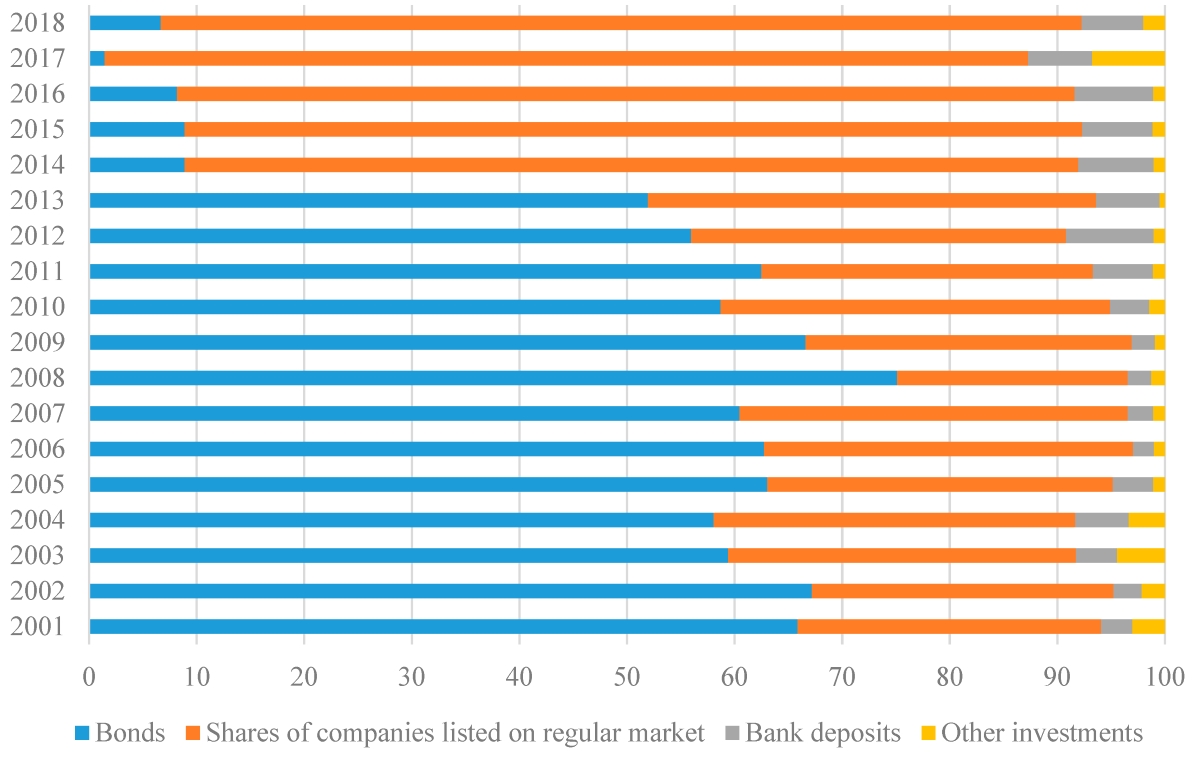

1. Equities: Many pension funds allocate a portion of their portfolio to equities, seeking long-term capital appreciation and dividend income. Equities offer the potential for high returns, albeit with higher volatility compared to other asset classes.

2. Bonds: Fixed-income securities, such as government bonds and corporate bonds, are favored by pension funds for their income-generating potential and relatively lower risk compared to equities. Bonds provide a steady stream of interest income and serve as a diversification tool within the portfolio.

3. Real Estate: Investment in real estate assets, including commercial properties and real estate investment trusts (REITs), offers pension funds an avenue for generating rental income and capital appreciation. Real estate investments can provide inflation protection and diversification benefits.

4. Alternative Investments: Pension funds often allocate a portion of their assets to alternative investments, such as private equity, hedge funds, and infrastructure projects. These investments aim to enhance portfolio diversification and capture returns not readily available through traditional asset classes.

5. Asset Allocation: A critical aspect of pension fund management involves strategic asset allocation, where funds distribute investments across various asset classes based on their risk-return profiles and correlation with market conditions. This approach aims to optimize returns while mitigating risk through diversification.

By diligently employing these investment strategies, pension funds strive to achieve their dual mandate of preserving capital to meet future pension obligations and generating returns to ensure the long-term sustainability of the fund. However, amidst these prudent investment approaches, there exists a specific investment strategy that pension funds are prohibited from leveraging due to its inherent risks and potential impact on fund stability and beneficiaries.

Prohibited Investment Strategy

Amidst the array of investment strategies available to pension funds, there exists a notable strategy that is strictly prohibited due to its high-risk nature and potential to compromise the financial security of the fund and its beneficiaries. This prohibited strategy is known as speculative trading on margin.

Speculative Trading on Margin:

Speculative trading on margin involves using borrowed funds from a brokerage or other financial institution to purchase securities. While margin trading is a common practice in the financial markets, allowing investors to amplify their buying power, it poses significant risks, especially when employed by institutional investors such as pension funds.

When pension funds engage in speculative trading on margin, they expose the fund to heightened levels of leverage, amplifying both potential gains and losses. This heightened risk is exacerbated by the fact that pension funds operate as stewards of retirement savings, necessitating a prudent and conservative approach to investment management.

Furthermore, margin trading introduces the potential for margin calls, wherein the brokerage demands additional funds or securities to cover potential losses if the value of the purchased securities declines. Failure to meet margin calls can lead to forced liquidation of assets, crystallizing losses and jeopardizing the long-term financial stability of the pension fund.

Regulatory authorities and industry watchdogs impose strict prohibitions on speculative trading on margin by pension funds to safeguard the interests of retirees and ensure the prudent management of pension assets. By enforcing these prohibitions, regulators aim to mitigate the risk of excessive leverage and speculative activities that could undermine the solvency of pension funds and erode the retirement savings of beneficiaries.

It is imperative for pension fund managers and fiduciaries to adhere to these prohibitions and uphold their fiduciary duty to act in the best interests of plan participants. By steering clear of speculative trading on margin and embracing sound investment practices, pension funds can uphold their commitment to long-term financial security and the fulfillment of pension obligations.

Impact on Pension Funds

The prohibition of speculative trading on margin carries significant implications for pension funds, influencing their risk management practices, financial stability, and ability to fulfill pension obligations. Understanding the impact of this prohibition is essential in comprehending its role in safeguarding the long-term interests of pension fund beneficiaries.

Risk Mitigation:

By prohibiting speculative trading on margin, regulatory authorities and governing bodies mitigate the risk of excessive leverage and speculative activities within pension fund portfolios. This restriction aligns with the overarching goal of preserving capital and managing risk prudently, ensuring that pension funds uphold their fiduciary duty to act in the best interests of plan participants.

Financial Stability:

The prohibition serves as a safeguard against excessive exposure to market volatility and potential margin calls, thereby contributing to the overall financial stability of pension funds. By avoiding the inherent risks associated with speculative trading on margin, pension funds can maintain a more resilient financial position, reducing the likelihood of abrupt asset liquidation and the erosion of fund value.

Long-Term Sustainability:

Adhering to the prohibition of speculative trading on margin reinforces the long-term sustainability of pension funds, bolstering their ability to meet future pension obligations and provide a secure retirement income for beneficiaries. This commitment to prudent investment practices aligns with the fundamental objective of pension funds to safeguard and grow the assets entrusted to them, ensuring the enduring financial well-being of retirees.

Regulatory Compliance and Fiduciary Responsibility:

Compliance with the prohibition underscores the adherence of pension fund managers and fiduciaries to regulatory guidelines and their commitment to fulfilling their fiduciary responsibility. By prioritizing the prudent management of pension assets and steering clear of high-risk speculative activities, pension funds demonstrate their dedication to the welfare and financial security of plan participants.

Enhanced Investor Confidence:

The prohibition of speculative trading on margin contributes to bolstering investor confidence in pension funds, underscoring their commitment to sound investment practices and risk management. This enhanced confidence is instrumental in maintaining the credibility and reputation of pension funds, fostering trust among stakeholders and beneficiaries.

Overall, the prohibition of speculative trading on margin plays a pivotal role in shaping the risk profile, financial resilience, and long-term outlook of pension funds, reinforcing their commitment to prudent stewardship and the fulfillment of pension obligations.

Conclusion

The intricate world of pension fund management is characterized by a diverse array of investment strategies aimed at achieving the dual mandate of preserving capital and generating returns to fulfill future pension obligations. Amidst these strategies, the prohibition of speculative trading on margin stands as a critical safeguard, protecting the financial well-being of pension funds and their beneficiaries.

By delving into the realm of pension fund investment strategies, we have gained valuable insights into the prudent approaches employed to navigate the complexities of the financial markets. Equities, bonds, real estate, alternative investments, and strategic asset allocation all play integral roles in shaping the investment landscape of pension funds, offering avenues for growth and risk management.

However, the prohibition of speculative trading on margin serves as a crucial regulatory measure, mitigating the risks associated with excessive leverage and speculative activities within pension fund portfolios. This prohibition underscores the commitment of pension funds to prudent stewardship, financial stability, and the long-term sustainability of retirement savings.

As we reflect on the impact of this prohibition, it becomes evident that its influence extends beyond risk mitigation. It encompasses the fundamental principles of regulatory compliance, fiduciary responsibility, and the preservation of investor confidence, all of which are essential in upholding the integrity and credibility of pension funds.

In conclusion, the prohibition of speculative trading on margin stands as a testament to the unwavering commitment of pension funds to act in the best interests of plan participants, safeguarding their retirement savings and ensuring a secure financial future. By embracing sound investment practices and adhering to regulatory guidelines, pension funds continue to uphold their pivotal role in providing financial security and peace of mind to retirees, embodying the essence of responsible and prudent fund management.