Finance

Which Pension Funds Are At Risk In The UK?

Published: January 23, 2024

Discover which pension funds are at risk in the UK and learn how to protect your finances in an uncertain market. Stay informed with expert insights on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pension funds play a pivotal role in securing the financial future of individuals post-retirement. In the United Kingdom, these funds are instrumental in providing a source of income for retirees, ensuring financial stability during their golden years. However, the stability of pension funds can be susceptible to various risks, which can potentially jeopardize the financial security of retirees. This article delves into the intricacies of pension fund risks in the UK, shedding light on the factors that contribute to their vulnerability and the measures implemented to mitigate these risks.

The landscape of pension funds in the UK is multifaceted, encompassing diverse investment portfolios and regulatory frameworks. Understanding the dynamics of pension funds is crucial, as it enables individuals to make informed decisions regarding their retirement savings. Moreover, gaining insight into the potential risks that pension funds face is essential for both retirees and working individuals, as it empowers them to assess the robustness of their pension provisions and take proactive steps to safeguard their financial future.

Throughout this article, we will explore the underlying factors that influence the vulnerability of pension funds in the UK, providing an in-depth analysis of at-risk pension funds and the regulatory measures in place to mitigate these risks. By elucidating these critical aspects, readers will gain a comprehensive understanding of the complexities surrounding pension fund risks and the mechanisms employed to ensure the stability and security of retirement savings.

Overview of Pension Funds in the UK

Pension funds in the United Kingdom serve as essential financial vehicles that enable individuals to accumulate savings during their working years, ensuring a steady stream of income upon retirement. These funds are typically managed by pension providers, who invest contributions from employees and employers into a diversified portfolio of assets, such as stocks, bonds, and real estate, with the aim of generating returns that will fund retirees’ pensions.

Two primary types of pension schemes exist in the UK: defined benefit (DB) and defined contribution (DC) schemes. In a DB scheme, the retirement benefit is predetermined based on factors such as salary and years of service. Conversely, DC schemes entail contributions that are invested to build a pension pot, with the eventual income dependent on the performance of the investments.

The management of pension funds involves navigating a complex landscape of financial markets, economic trends, and regulatory requirements. Pension providers are tasked with making prudent investment decisions to safeguard and grow the funds, thereby ensuring that retirees receive the promised benefits. However, the inherent volatility and unpredictability of financial markets can pose significant challenges, potentially exposing pension funds to various risks.

Furthermore, the demographic dynamics in the UK, including an aging population and fluctuating birth rates, have implications for pension funds. As the number of retirees increases relative to the working-age population, the sustainability of pension schemes comes under scrutiny, necessitating strategic measures to address potential imbalances.

Understanding the structure and operation of pension funds in the UK is crucial for individuals planning for retirement, as it empowers them to make informed decisions regarding pension contributions and fund allocation. Moreover, gaining insight into the intricacies of pension schemes enables stakeholders to comprehend the factors that contribute to pension fund risks and the measures implemented to mitigate these risks, ensuring the long-term security of retirement savings.

Factors Affecting Pension Fund Risks

The vulnerability of pension funds in the UK is influenced by a myriad of factors, encompassing economic, demographic, and regulatory elements. Understanding these factors is essential for comprehending the complexities surrounding pension fund risks and formulating strategies to mitigate potential vulnerabilities.

- Market Volatility: Pension funds are inherently exposed to market fluctuations, with the performance of investment portfolios susceptible to economic uncertainties, geopolitical events, and industry-specific dynamics. Market volatility can impact the value of pension assets, potentially diminishing the funds available to fulfill retirees’ benefits.

- Longevity Risk: The increasing life expectancy of retirees poses a significant risk to pension funds, as providers must ensure that the accumulated savings are adequate to support individuals throughout their extended post-retirement years. Longevity risk necessitates meticulous financial planning and risk management to address the prolonged payout periods.

- Interest Rate Fluctuations: Pension funds are sensitive to interest rate movements, as they influence the present value of future pension liabilities. Fluctuations in interest rates can impact the funding position of pension schemes, potentially leading to deficits that require remedial measures to restore financial stability.

- Regulatory Changes: Evolving regulatory frameworks and compliance requirements can impact the operational landscape of pension funds, necessitating adjustments in investment strategies, governance practices, and reporting standards. Adapting to regulatory changes is crucial for mitigating risks and ensuring adherence to industry standards.

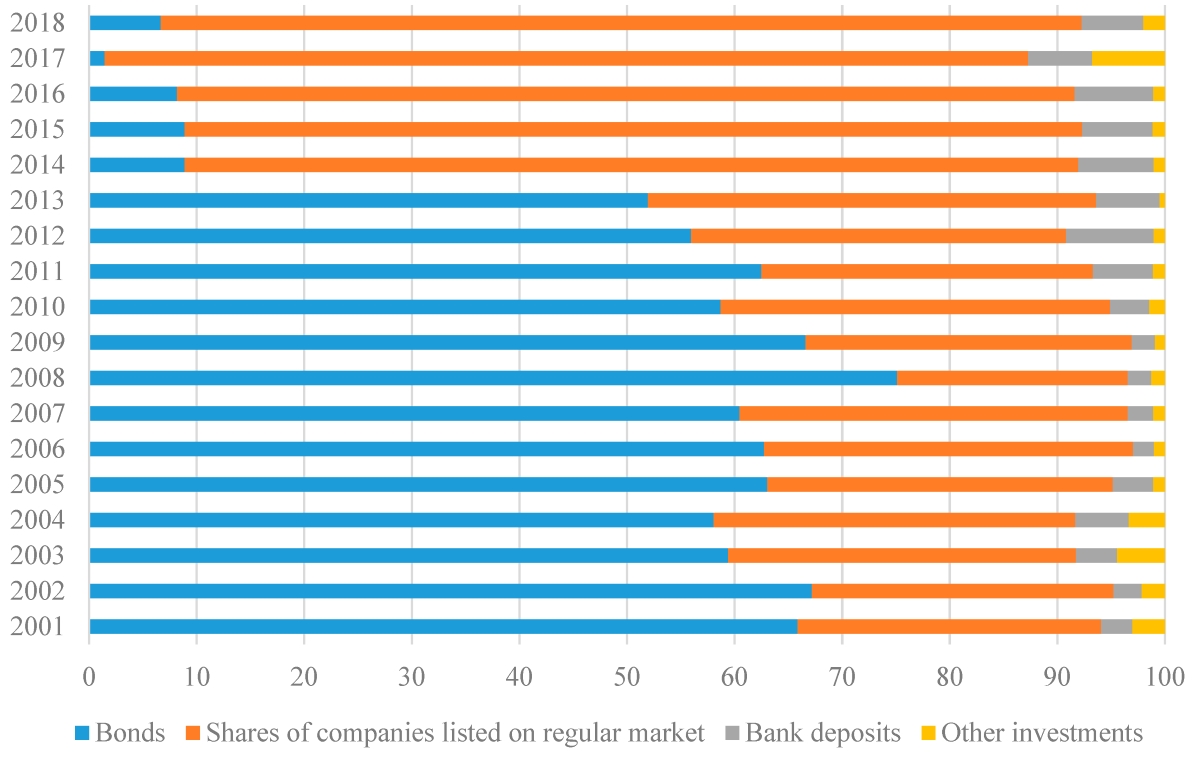

- Investment Diversification: The diversification of pension fund investments plays a pivotal role in mitigating risks associated with market volatility and asset performance. Prudent asset allocation and risk diversification strategies are essential for optimizing returns while minimizing the impact of adverse market conditions.

These factors collectively contribute to the vulnerability of pension funds in the UK, underscoring the need for proactive risk management and strategic planning to safeguard the long-term sustainability of retirement savings. By addressing these multifaceted influences, pension providers and stakeholders can fortify the resilience of pension schemes, ensuring the fulfillment of retirees’ financial entitlements and the preservation of their post-retirement security.

Analysis of At-Risk Pension Funds

Amidst the intricate landscape of pension funds in the UK, certain funds are particularly susceptible to inherent risks, necessitating a comprehensive analysis of their vulnerabilities and potential impact on retirees and stakeholders. Identifying and understanding at-risk pension funds is crucial for implementing targeted risk mitigation strategies and safeguarding the financial interests of pension scheme members.

Several indicators can signal the susceptibility of pension funds to heightened risks, including funding deficits, inadequate asset performance, and suboptimal risk management practices. Funds facing funding shortfalls, wherein the present value of pension liabilities exceeds the available assets, are at risk of being unable to meet their obligations to retirees, potentially leading to financial instability and reduced benefits payouts.

Furthermore, pension funds with limited diversification in their investment portfolios may be exposed to heightened market risks, as they lack the protective buffer of diversified assets to mitigate the impact of adverse market conditions. Inadequate risk management practices, such as insufficient hedging strategies or risk assessment protocols, can exacerbate the vulnerability of pension funds, amplifying the potential for financial shortfalls and compromised retirement benefits.

Demographic trends, including an aging membership base and shifting workforce dynamics, can also contribute to the susceptibility of pension funds to risks. Funds with a disproportionate ratio of retirees to active contributors may face challenges in maintaining sustainable funding levels, necessitating proactive measures to address demographic imbalances and ensure the long-term viability of pension schemes.

By conducting a comprehensive analysis of at-risk pension funds, stakeholders can proactively identify vulnerabilities and implement targeted interventions to mitigate risks and fortify the financial resilience of pension schemes. This proactive approach is essential for preserving the stability and security of retirement savings, ensuring that retirees receive the promised benefits and fostering confidence in the sustainability of pension provisions.

Regulatory Measures to Mitigate Pension Fund Risks

The regulatory landscape governing pension funds in the UK encompasses a robust framework aimed at mitigating risks, safeguarding the interests of pension scheme members, and ensuring the long-term sustainability of retirement provisions. Regulatory authorities and industry regulators play a pivotal role in establishing and enforcing measures designed to address the multifaceted risks associated with pension funds, fostering transparency, accountability, and prudent governance practices.

One of the key regulatory measures aimed at mitigating pension fund risks is the implementation of stringent funding and solvency requirements. Pension regulators impose funding standards that mandate pension schemes to maintain adequate reserves to cover their liabilities, thereby mitigating the risk of funding shortfalls and financial instability. These requirements serve to protect the financial security of retirees by ensuring that pension funds possess the necessary resources to fulfill their obligations.

Moreover, regulatory authorities prescribe investment guidelines and risk management standards to govern the allocation and management of pension assets. These guidelines aim to promote prudent investment practices, risk diversification, and adherence to fiduciary responsibilities, thereby mitigating the impact of market volatility and enhancing the resilience of pension funds against economic uncertainties.

Additionally, regulatory measures encompass stringent governance and reporting requirements, compelling pension providers to adhere to robust governance structures, transparent reporting practices, and effective oversight mechanisms. These measures are instrumental in promoting accountability, integrity, and ethical conduct within the management of pension funds, thereby mitigating the risks associated with inadequate governance and operational deficiencies.

Furthermore, regulatory authorities actively monitor and assess the financial health of pension funds through regular supervisory processes, stress testing, and risk assessments. By conducting comprehensive evaluations of pension schemes, regulators can proactively identify potential vulnerabilities, address emerging risks, and enforce remedial actions to mitigate the impact of adverse developments on retirees’ financial entitlements.

These regulatory measures collectively contribute to the resilience and stability of pension funds, mitigating risks and fostering confidence in the efficacy of pension provisions. By adhering to regulatory requirements and embracing a culture of compliance and prudence, pension providers can navigate the complexities of pension fund risks while upholding the financial security and well-being of retirees.

Conclusion

The landscape of pension funds in the United Kingdom is marked by a confluence of factors that influence their vulnerability to various risks. Market volatility, demographic dynamics, and regulatory intricacies collectively shape the complexities surrounding pension fund risks, underscoring the imperative of proactive risk management and strategic planning to safeguard the long-term security of retirement savings.

Understanding the multifaceted influences that impact pension fund risks is essential for retirees, working individuals, and pension providers, as it empowers stakeholders to navigate the intricacies of pension provisions and make informed decisions regarding retirement planning and financial security. By gaining insight into the factors affecting pension fund risks, individuals can assess the robustness of their pension provisions and take proactive measures to mitigate potential vulnerabilities, ensuring the fulfillment of their financial entitlements post-retirement.

Furthermore, the analysis of at-risk pension funds elucidates the importance of identifying vulnerabilities and implementing targeted interventions to fortify the financial resilience of pension schemes. Proactive risk mitigation strategies, coupled with prudent governance practices and investment diversification, are instrumental in mitigating the impact of market uncertainties and demographic shifts, preserving the stability and sustainability of retirement savings.

The regulatory measures governing pension funds play a pivotal role in mitigating risks, fostering transparency, and ensuring the accountability of pension providers. Stringent funding requirements, investment guidelines, and supervisory processes contribute to the resilience of pension funds, mitigating risks and safeguarding the financial interests of retirees.

In conclusion, the complexities surrounding pension fund risks underscore the significance of comprehensive risk management, proactive interventions, and regulatory compliance in preserving the stability and security of retirement savings. By addressing the multifaceted influences that impact pension fund risks, stakeholders can navigate the complexities of pension provisions with confidence, ensuring the fulfillment of retirees’ financial entitlements and fostering a resilient and sustainable pension landscape in the UK.