Finance

Which Pension Funds Are At Risk?

Published: January 23, 2024

Discover the potential risks facing pension funds in the finance sector and learn how to safeguard your retirement savings. Explore expert insights and advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pension funds play a crucial role in securing the financial well-being of individuals during their retirement years. These funds are designed to provide a steady income stream to retirees, ensuring they can maintain a comfortable standard of living after exiting the workforce. However, the stability of pension funds is not guaranteed, and various factors can put them at risk. In this article, we will explore the potential risks that pension funds face, the contributing factors, and the impact of pension fund failures. Additionally, we will discuss strategies to mitigate these risks and safeguard the long-term security of pension funds.

As individuals contribute a portion of their earnings to pension funds throughout their working lives, they do so with the expectation that these funds will be prudently managed and will yield reliable returns upon retirement. However, the reality is that pension funds are susceptible to a range of risks, including market volatility, economic downturns, and inadequate fund management. Understanding these risks is essential for both pension fund beneficiaries and the broader financial community, as the consequences of pension fund failures can be far-reaching.

In the following sections, we will delve into the complexities of pension fund risks, examining the factors that contribute to their vulnerability and the potential repercussions of mismanagement. By shedding light on these critical issues, we aim to empower readers with the knowledge needed to make informed decisions regarding their retirement planning and to advocate for responsible governance and risk mitigation within the pension fund industry. Let's embark on this exploration of pension fund risks and discover the measures that can be taken to fortify these essential pillars of financial security.

Understanding Pension Fund Risks

Before delving into the specific risks that pension funds face, it is essential to grasp the fundamental nature of these risks. Pension funds are entrusted with the task of preserving and growing the capital contributed by employees and employers, with the ultimate goal of generating income for retirees. However, this responsibility exposes pension funds to a myriad of potential hazards that can jeopardize their ability to fulfill their obligations.

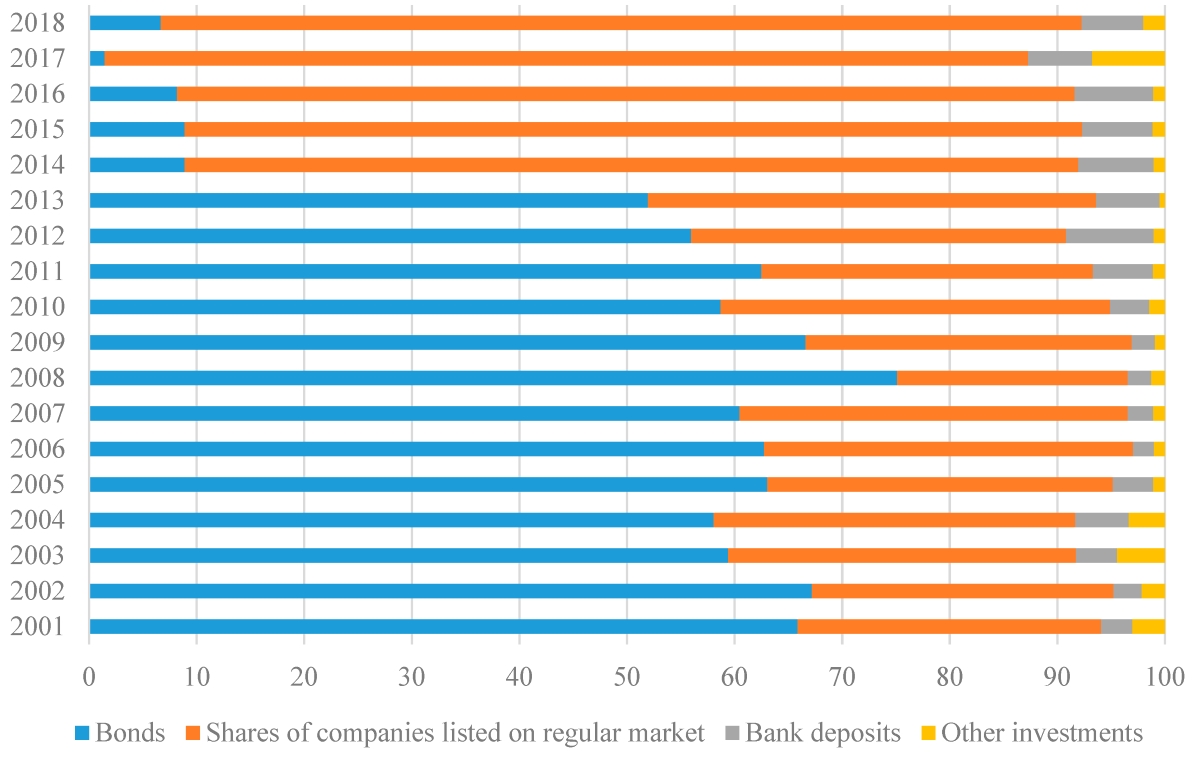

One of the primary risks faced by pension funds is investment risk. This encompasses the possibility of financial loss resulting from market volatility, economic instability, and poor investment decisions. Pension funds typically allocate a significant portion of their assets to equities, fixed-income securities, and alternative investments to generate returns. However, fluctuations in the financial markets can erode the value of these assets, leading to diminished fund performance and potentially inadequate resources to meet future pension obligations.

Furthermore, longevity risk poses a significant challenge to pension funds. This risk arises from the uncertainty surrounding the lifespan of retirees. With advancements in healthcare and increased life expectancy, pension funds must anticipate the potential for prolonged periods of pension payouts, placing strain on fund resources and sustainability.

Regulatory and compliance risks also feature prominently in the landscape of pension fund vulnerabilities. Changes in legislation, regulatory requirements, and governance standards can impact the operational framework of pension funds, necessitating adaptability and adherence to evolving compliance mandates. Failure to navigate these regulatory challenges effectively can expose pension funds to legal and reputational repercussions.

Another critical risk factor is interest rate risk, which pertains to the impact of fluctuating interest rates on the value of fixed-income investments held by pension funds. In a low-interest-rate environment, pension funds may struggle to generate sufficient returns to meet their long-term obligations, potentially leading to funding shortfalls and heightened financial pressure.

By comprehending the multifaceted nature of these risks, stakeholders can appreciate the intricate landscape within which pension funds operate. This understanding forms the basis for implementing proactive risk management strategies and fortifying the resilience of pension funds against potential threats, ensuring the sustainable delivery of retirement benefits to workers.

Factors That Put Pension Funds at Risk

Several factors contribute to the vulnerability of pension funds, exposing them to a range of risks that can undermine their stability and jeopardize the future financial security of retirees. Understanding these factors is crucial for identifying potential threats and implementing effective risk mitigation measures within the pension fund industry.

- Market Volatility: Fluctuations in the financial markets, driven by factors such as economic conditions, geopolitical events, and investor sentiment, can significantly impact the performance of pension fund investments. Sudden market downturns can lead to substantial portfolio losses, impairing the ability of pension funds to meet their long-term obligations.

- Demographic Shifts: Changing demographics, including aging populations and shifting workforce dynamics, pose challenges to pension funds. An aging population results in a higher proportion of retirees relative to active contributors, placing strain on fund resources and necessitating careful management of payout structures.

- Longevity Trends: Increasing life expectancy and the prospect of longer retirement periods amplify longevity risk for pension funds. The potential for extended pension payouts requires prudent planning to ensure the sustainability of fund assets over an extended time horizon.

- Regulatory Changes: Evolving regulatory frameworks and compliance requirements introduce uncertainty and operational complexities for pension funds. Adapting to regulatory shifts and maintaining adherence to governance standards demand vigilance and proactive governance practices.

- Investment Management: Ineffective investment strategies, inadequate diversification, and suboptimal asset allocation can heighten investment risk for pension funds. Sound investment management practices are essential to mitigate the impact of market volatility and generate sustainable returns.

- Interest Rate Environment: Fluctuations in interest rates influence the performance of fixed-income investments within pension fund portfolios. Low interest rate environments can diminish investment returns, posing challenges to meeting long-term pension obligations.

These factors collectively contribute to the exposure of pension funds to various risks, necessitating a comprehensive approach to risk identification, assessment, and management. By addressing these underlying factors, pension funds can enhance their resilience and adaptability in the face of dynamic economic and demographic landscapes, safeguarding the financial futures of retirees and beneficiaries.

Examples of Pension Funds at Risk

Several high-profile examples illustrate the challenges and vulnerabilities faced by pension funds, shedding light on the potential ramifications of inadequate risk management and external pressures. These instances serve as poignant reminders of the complex dynamics that can place pension funds at risk, impacting the financial well-being of retirees and beneficiaries.

1. Public Pension Systems: In the United States, numerous state and municipal pension systems have grappled with funding shortfalls and mounting liabilities. Factors such as underfunding, investment losses during economic downturns, and demographic shifts have strained the financial sustainability of these pension systems, prompting concerns about their ability to meet future obligations.

2. Corporate Pension Plans: Several large corporations have faced challenges related to their pension plans, with funding gaps and volatile investment performance contributing to heightened risks. The restructuring of companies, mergers and acquisitions, and economic disruptions have impacted the stability of corporate pension funds, necessitating strategic interventions to mitigate potential risks.

3. Multi-Employer Pension Funds: Multi-employer pension funds, which cover workers from multiple employers within specific industries, have encountered vulnerabilities stemming from industry-wide challenges, economic downturns, and regulatory changes. The precarious financial positions of certain multi-employer pension funds have raised concerns about the security of pension benefits for participating workers.

4. International Pension Systems: Globally, various pension systems have faced pressures arising from demographic shifts, geopolitical uncertainties, and economic volatility. Countries grappling with aging populations and strained public finances have encountered difficulties in ensuring the long-term sustainability of their pension programs, highlighting the pervasive nature of pension fund risks on a global scale.

These examples underscore the diverse array of challenges faced by pension funds across different sectors and geographic regions. The complexities of managing pension fund risks are evident in these scenarios, emphasizing the imperative of proactive risk mitigation strategies and prudent governance practices to safeguard the interests of pension fund participants and mitigate potential adverse outcomes.

Impact of Pension Fund Failures

The repercussions of pension fund failures extend far beyond the confines of the financial industry, permeating the lives of retirees, workers, and the broader economy. When pension funds falter or face insolvency, the impact reverberates across multiple facets of society, engendering profound implications that warrant careful consideration and proactive intervention.

1. Retiree Financial Security: The primary consequence of pension fund failures is the jeopardy of retirees’ financial security. Retirees rely on pension benefits as a vital source of income during their post-employment years. When pension funds fail to meet their obligations, retirees face the prospect of diminished or interrupted income, disrupting their ability to cover essential living expenses and maintain their standard of living.

2. Economic Strain: Pension fund failures can exert strain on the broader economy, particularly in the case of large-scale public and corporate pension systems. Funding shortfalls and insolvency scenarios can necessitate government interventions, impacting public finances and potentially leading to increased fiscal burdens on taxpayers. Moreover, the redirection of resources to address pension fund crises can divert funds from other critical areas of public investment and social welfare.

3. Workforce Confidence: The stability and sustainability of pension funds influence workforce confidence and labor market dynamics. When pension funds face uncertainties or funding challenges, active workers may experience heightened concerns about the security of their future retirement benefits. This can impact labor mobility, career decisions, and overall job satisfaction, contributing to broader implications for workforce productivity and engagement.

4. Social Welfare Pressures: In instances where pension fund failures result in reduced or discontinued benefits for retirees, there may be increased reliance on social welfare programs and support mechanisms. This places additional strain on public welfare systems and safety nets, potentially necessitating expanded government assistance to mitigate the impact on affected retirees and their families.

By recognizing the multifaceted impact of pension fund failures, stakeholders can appreciate the urgency of implementing robust risk management practices and governance frameworks to avert potential crises. Proactive measures aimed at fortifying the resilience of pension funds are essential to uphold the long-term financial security of retirees, mitigate economic disruptions, and foster confidence in retirement planning and pension systems.

Mitigating Pension Fund Risks

Effectively mitigating pension fund risks requires a multifaceted approach that encompasses prudent governance, strategic investment management, and proactive risk mitigation strategies. By addressing the underlying vulnerabilities and challenges faced by pension funds, stakeholders can fortify the resilience of these essential financial vehicles and uphold their capacity to provide sustainable retirement benefits. Several key measures can be employed to mitigate pension fund risks:

- Robust Risk Assessment: Conduct comprehensive risk assessments to identify and evaluate potential threats to pension fund stability. This entails analyzing investment risks, longevity risk, regulatory compliance, and other pertinent factors to develop a nuanced understanding of the fund’s risk landscape.

- Strategic Asset Allocation: Implement sound asset allocation strategies that balance risk and return objectives while considering the fund’s long-term obligations. Diversification across asset classes, geographies, and investment styles can mitigate concentration risk and enhance portfolio resilience.

- Governance and Compliance: Foster a culture of effective governance and compliance within pension fund management. Adherence to regulatory requirements, transparent reporting, and robust internal controls are pivotal in mitigating legal and operational risks.

- Stress Testing and Scenario Analysis: Conduct stress testing and scenario analysis to assess the fund’s resilience under adverse market conditions, demographic shifts, and regulatory changes. This proactive approach enables the identification of potential vulnerabilities and the formulation of contingency plans.

- Risk Transfer Mechanisms: Explore risk transfer mechanisms, such as liability-driven investment strategies, hedging solutions, and insurance products, to mitigate specific pension fund risks. These mechanisms can enhance risk management capabilities and provide downside protection.

- Engagement with Stakeholders: Foster open communication and engagement with pension fund participants, beneficiaries, and regulatory authorities. Transparency and dialogue can engender trust, mitigate reputational risks, and align stakeholder interests with the long-term sustainability of the fund.

Furthermore, collaboration with experienced financial advisors, actuaries, and legal experts can provide valuable insights and guidance in navigating the complexities of pension fund risk management. By leveraging the expertise of industry professionals and staying attuned to evolving market dynamics and regulatory developments, pension funds can proactively adapt to emerging risks and opportunities.

Ultimately, the effective mitigation of pension fund risks demands a holistic and forward-looking approach that prioritizes the long-term security of retirees and the sustainable delivery of pension benefits. By embracing proactive risk management practices and governance standards, pension funds can navigate the complexities of the financial landscape with resilience and prudence, safeguarding the interests of current and future beneficiaries.

Conclusion

The landscape of pension fund risks is characterized by a complex interplay of economic, demographic, and regulatory factors that pose significant challenges to the stability and sustainability of retirement benefit programs. As highlighted throughout this exploration, the impact of pension fund failures extends beyond financial markets, permeating the lives of retirees, workers, and the broader economy. The imperative of mitigating these risks and fortifying the resilience of pension funds cannot be overstated, as the long-term financial security of retirees and the stability of social welfare systems hinge upon the effective management of pension fund vulnerabilities.

By comprehensively understanding the multifaceted nature of pension fund risks and the factors that contribute to their vulnerability, stakeholders are empowered to implement proactive risk mitigation strategies and governance frameworks. Robust risk assessment, strategic asset allocation, and engagement with stakeholders are pivotal components of a holistic risk management approach that aims to safeguard the long-term sustainability of pension funds.

Furthermore, the examples of pension funds at risk underscore the pervasive nature of these challenges, transcending geographic boundaries and industry sectors. The lessons gleaned from these examples serve as poignant reminders of the imperative to address pension fund risks with diligence, foresight, and a commitment to the long-term interests of retirees and beneficiaries.

As we navigate an evolving financial landscape marked by dynamic market conditions, demographic shifts, and regulatory changes, the imperative of proactive risk management practices within the pension fund industry cannot be overstated. By embracing a forward-looking approach and fostering a culture of transparency, compliance, and strategic risk mitigation, pension funds can navigate the complexities of the financial landscape with resilience and prudence, ensuring the sustainable delivery of retirement benefits to workers.

Ultimately, the mitigation of pension fund risks is an ongoing endeavor that demands collaboration, innovation, and a steadfast commitment to the fiduciary responsibilities inherent in managing retirement benefit programs. By addressing these risks proactively and fortifying the resilience of pension funds, stakeholders can uphold the fundamental promise of financial security in retirement, fostering confidence in pension systems and contributing to the well-being of individuals and society as a whole.