Finance

Which Firm Holds The Most Pension Funds?

Published: January 23, 2024

Discover which finance firm holds the most pension funds and learn how it impacts your retirement. Find out more about pension fund management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Pension funds play a pivotal role in securing the financial future of millions of individuals worldwide. These funds are managed by various firms, which handle the investments and administration of the pensions on behalf of the beneficiaries. Understanding which firms hold the most pension funds is crucial for gaining insights into the dynamics of the global financial landscape. This knowledge not only sheds light on the dominant players in the pension fund industry but also provides valuable information for investors, policymakers, and individuals planning for retirement.

In this article, we delve into the world of pension funds and explore the top firms that hold these substantial financial assets. By examining the methodology used to determine the leading firms, as well as the results of this analysis, we aim to provide a comprehensive overview of the current state of pension fund management. Furthermore, we will discuss the implications of these findings and their potential impact on the financial sector and retirement planning.

Pension funds are a cornerstone of retirement security, and the firms responsible for managing these funds wield significant influence in the global financial market. By uncovering which firms hold the most pension funds, we can gain valuable insights into the distribution of financial power and the strategies employed by these firms to safeguard and grow the retirement savings of millions of individuals. This exploration is essential for anyone interested in the intersection of finance, investment management, and retirement planning.

Join us as we embark on a journey to unravel the top firms holding pension funds, shedding light on the intricate web of financial stewardship and the far-reaching implications for retirees, investors, and the broader economy.

Overview of Pension Funds

Pension funds, also known as superannuation funds in some regions, are investment pools that provide income to individuals during retirement. These funds are typically sponsored by employers, governments, or labor unions, and they serve as a crucial component of retirement planning for workers across various industries. Pension funds are designed to ensure that individuals have a stable and reliable source of income after they exit the workforce, allowing them to maintain their standard of living and meet essential expenses during retirement.

There are two primary types of pension funds: defined benefit plans and defined contribution plans. Defined benefit plans guarantee a specific payout amount to retirees based on factors such as salary history and years of service. In contrast, defined contribution plans, such as 401(k) accounts, involve contributions from both employees and employers, with the eventual payout dependent on the performance of the investment portfolio.

Investment management is a critical aspect of pension funds, as the assets within these funds must be prudently managed to generate returns while mitigating risk. Pension fund managers allocate the assets across various investment vehicles, including stocks, bonds, real estate, and alternative investments, with the goal of achieving long-term growth and stability. Additionally, pension funds often maintain diversified portfolios to spread risk and capitalize on different market opportunities.

Regulatory oversight and compliance are fundamental to the operation of pension funds, as governments impose strict guidelines to safeguard the interests of pension beneficiaries. Transparency, accountability, and fiduciary responsibility are paramount in the management of pension funds, ensuring that the funds are administered in the best interests of the retirees.

Given the significant financial resources involved, pension funds have a substantial impact on the broader economy and financial markets. The decisions made by pension fund managers can influence investment trends, corporate governance practices, and capital allocation strategies, making these funds influential players in the global financial landscape.

Understanding the structure, management, and impact of pension funds provides valuable insights into the mechanisms that underpin retirement security and long-term financial planning. As we explore the top firms holding pension funds, it is essential to grasp the foundational principles and functions of these critical investment vehicles.

Top Firms Holding Pension Funds

As the custodians of vast financial resources earmarked for retirement, numerous firms are entrusted with the management of pension funds across the globe. These firms vary in size, scope, and expertise, and they play a pivotal role in shaping the investment landscape and safeguarding the financial security of retirees. Identifying the top firms holding pension funds provides valuable insights into the concentration of pension assets and the strategies employed by these firms to generate returns and manage risk on behalf of pension beneficiaries.

Several prominent financial institutions and asset management firms consistently rank among the top holders of pension funds. These firms leverage their expertise in investment management, asset allocation, and risk mitigation to steward the retirement savings of millions of individuals. Their ability to navigate dynamic market conditions, capitalize on investment opportunities, and adhere to regulatory requirements positions them as influential players in the pension fund ecosystem.

Furthermore, the top firms holding pension funds often exhibit a global presence, managing assets across diverse geographic regions and asset classes. This international reach enables them to access a broad spectrum of investment opportunities, diversify risk, and optimize portfolio performance to meet the long-term obligations of pension funds.

It is important to note that the rankings of firms holding pension funds may fluctuate over time due to various factors, including changes in investment performance, shifts in asset allocation strategies, and industry consolidation. Monitoring these trends provides valuable insights into the evolving landscape of pension fund management and the competitive dynamics among the leading firms.

By examining the top firms holding pension funds, we gain a deeper understanding of the entities responsible for shaping the financial future of retirees and the broader implications for investment markets and regulatory frameworks. The strategies, performance, and stewardship practices of these firms have far-reaching effects on retirement security and the stability of the financial system, making them integral components of the global investment landscape.

As we delve into the methodology and results of identifying the top firms holding pension funds, we aim to shed light on the influential players driving the management and allocation of pension assets, offering valuable insights for investors, policymakers, and individuals planning for retirement.

Methodology

Identifying the top firms holding pension funds involves a comprehensive and data-driven approach to assess the scale and impact of pension fund management across the financial industry. The methodology employed in this analysis aims to provide a rigorous and objective evaluation of the firms responsible for overseeing substantial pension assets, offering valuable insights into their market influence and investment strategies.

The methodology begins with gathering data from reputable sources, including regulatory filings, industry reports, and financial publications. These sources provide detailed information on the assets under management by various firms, enabling a comprehensive assessment of their pension fund holdings. Additionally, insights from industry experts and market analysts contribute to the qualitative dimension of the analysis, offering perspectives on the performance, reputation, and market positioning of the firms in question.

Quantitative analysis forms a core component of the methodology, involving the examination of key financial metrics, such as total assets under management, pension fund allocations, and investment performance. By quantifying the scale of pension fund holdings and the relative significance of these assets within the overall investment portfolios of the firms, a clear picture emerges of the leading players in the pension fund management landscape.

Furthermore, the methodology incorporates a comparative analysis of the investment strategies and risk management practices employed by the top firms holding pension funds. This comparative assessment sheds light on the approaches taken to generate returns, mitigate risk, and align investment objectives with the long-term obligations of pension funds. Understanding the strategic differences and similarities among these firms provides valuable insights into the diversification, asset allocation, and performance drivers within the pension fund management space.

It is important to note that the methodology emphasizes objectivity, accuracy, and transparency in evaluating the top firms holding pension funds. By leveraging a combination of quantitative data and qualitative insights, this analysis seeks to offer a comprehensive and nuanced perspective on the dynamics of pension fund management, empowering stakeholders with actionable intelligence for investment decision-making and strategic planning.

As we delve into the results derived from this methodology, it is essential to recognize the robust framework underpinning the assessment of the top firms holding pension funds, ensuring a thorough and insightful examination of their roles in shaping the retirement security landscape.

Results

The analysis of the top firms holding pension funds has revealed compelling insights into the landscape of pension fund management and the influential players within this domain. Several prominent financial institutions and asset management firms have emerged as leading custodians of pension assets, wielding significant influence in shaping the investment strategies and risk management practices that underpin retirement security.

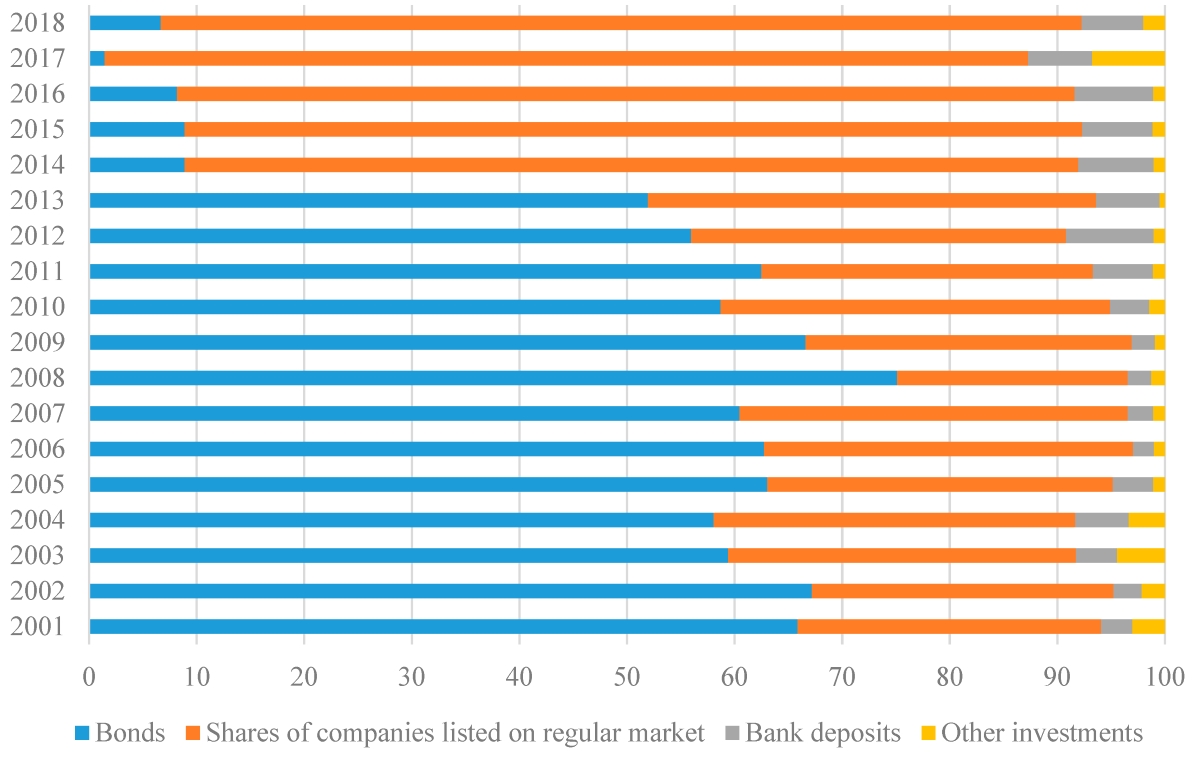

Among the top firms holding pension funds, a consistent theme is the global reach and diversified asset allocation strategies employed to optimize portfolio performance. These firms demonstrate a strong emphasis on geographic diversification and exposure to a wide array of asset classes, including equities, fixed income securities, real estate, and alternative investments. This approach reflects a commitment to managing risk and capturing investment opportunities across different markets and economic environments.

Furthermore, the results highlight the scale of pension fund holdings within the overall assets under management by these firms, underscoring the significance of pension assets in driving investment decisions and shaping long-term financial outcomes. The prudent management and strategic deployment of pension funds by these firms play a pivotal role in supporting the retirement aspirations of millions of individuals while contributing to the stability and growth of the broader financial markets.

Additionally, the results shed light on the performance metrics and risk-adjusted returns achieved by the top firms holding pension funds. By evaluating key financial indicators and investment outcomes, this analysis provides valuable benchmarks for assessing the effectiveness of pension fund management strategies and the ability of these firms to deliver sustainable long-term value for pension beneficiaries.

It is important to recognize that the results of this analysis offer actionable insights for investors, policymakers, and industry stakeholders, providing a deeper understanding of the dynamics and implications of pension fund management. The strategic positioning and market influence of the top firms holding pension funds have far-reaching effects on retirement security, investment trends, and the broader financial ecosystem, making these results essential for informed decision-making and strategic planning.

As we delve into the discussion of these results, it is imperative to consider the implications and potential ramifications of the influential role played by these firms in shaping the future of pension fund management and retirement planning.

Discussion

The findings regarding the top firms holding pension funds underscore the critical role played by these entities in shaping the landscape of retirement security and investment management. These firms, through their stewardship of substantial pension assets, exert significant influence on the financial markets, corporate governance practices, and the long-term well-being of retirees.

One key aspect of the discussion revolves around the responsibility and fiduciary duty of the top firms holding pension funds. As custodians of retirement savings, these firms are entrusted with the paramount task of prudently managing assets, generating sustainable returns, and safeguarding the financial futures of pension beneficiaries. The discussion delves into the strategies and practices employed by these firms to fulfill their fiduciary obligations, emphasizing the imperative of aligning investment decisions with the long-term interests of retirees.

Furthermore, the discussion explores the implications of the global reach and diversified asset allocation strategies adopted by these firms. By maintaining exposure to various geographic regions and asset classes, these firms seek to optimize risk-adjusted returns and capitalize on investment opportunities while mitigating potential downsides. This approach underscores the interconnectedness of pension fund management with global economic trends and market dynamics, highlighting the far-reaching impact of these firms on the broader financial ecosystem.

Moreover, the discussion addresses the performance metrics and risk-adjusted returns achieved by the top firms holding pension funds. By evaluating the efficacy of investment strategies and the ability to deliver consistent value for pension beneficiaries, this discussion provides a nuanced assessment of the impact of these firms on retirement security and long-term financial outcomes. Additionally, the discussion delves into the implications of these performance metrics for investors and policymakers, offering insights into the factors driving investment decisions and the potential implications for retirement planning and fund management.

It is crucial to consider the broader societal and economic implications of the influential role played by these firms in managing pension funds. The discussion encompasses the potential effects on retirement security, investment trends, and regulatory frameworks, emphasizing the need for transparency, accountability, and sustainable practices in pension fund management. By fostering a deeper understanding of the dynamics and implications of pension fund management, this discussion empowers stakeholders to make informed decisions and advocate for the long-term interests of retirees.

As we reflect on the discussion of the top firms holding pension funds, it is imperative to recognize the multifaceted impact of their actions on retirement security, investment markets, and the global financial landscape, underscoring the significance of prudent and ethical pension fund management in securing the financial well-being of future retirees.

Conclusion

The exploration of the top firms holding pension funds has provided valuable insights into the pivotal role played by these entities in shaping the landscape of retirement security and investment management. As custodians of substantial pension assets, these firms wield significant influence on the financial markets, corporate governance practices, and the long-term well-being of retirees, underscoring the critical importance of prudent and ethical pension fund management.

By identifying the leading players in pension fund management and assessing their global reach, diversified asset allocation strategies, and performance metrics, this analysis has shed light on the multifaceted impact of these firms on retirement security and the broader financial ecosystem. The results of this exploration offer actionable insights for investors, policymakers, and industry stakeholders, providing a deeper understanding of the dynamics and implications of pension fund management.

Furthermore, the discussion surrounding the responsibility and fiduciary duty of the top firms holding pension funds emphasizes the imperative of aligning investment decisions with the long-term interests of retirees. It underscores the need for transparency, accountability, and sustainable practices in pension fund management, advocating for the prudent stewardship of retirement savings to ensure the financial well-being of future retirees.

As we conclude this exploration, it is evident that the top firms holding pension funds occupy a central role in shaping the future of retirement security and investment management. Their strategic positioning, market influence, and ethical practices have far-reaching effects on retirement planning, investment trends, and the stability of the financial system, making them integral components of the global investment landscape.

Moving forward, continued vigilance, transparency, and adherence to fiduciary responsibilities are essential to uphold the integrity of pension fund management and safeguard the financial futures of retirees. By fostering a deeper understanding of the dynamics and implications of pension fund management, stakeholders can advocate for sustainable practices and ethical stewardship, ensuring that retirement security remains a cornerstone of financial well-being for generations to come.

In conclusion, the exploration of the top firms holding pension funds serves as a call to action for ethical and responsible pension fund management, emphasizing the imperative of prioritizing the long-term interests of retirees and fostering a financial landscape that upholds the principles of transparency, accountability, and sustainability.