Finance

PRAM Model Definition

Published: January 9, 2024

Looking for a clear definition of PRAM model in finance? Learn everything you need to know about the PRAM model and its significance in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Demystifying the PRAM Model: A Powerful Tool for Financial Planning

If you’re interested in diving deep into the world of finance, you may have come across the term PRAM model. But what exactly is the PRAM model, and what role does it play in financial planning? In this blog post, we will help demystify the PRAM model and give you a clear understanding of how it can empower your financial decisions.

Key Takeaways:

- The PRAM model is a popular framework used in financial planning.

- This model helps individuals make informed decisions about their investments and financial goals.

Understanding the PRAM Model

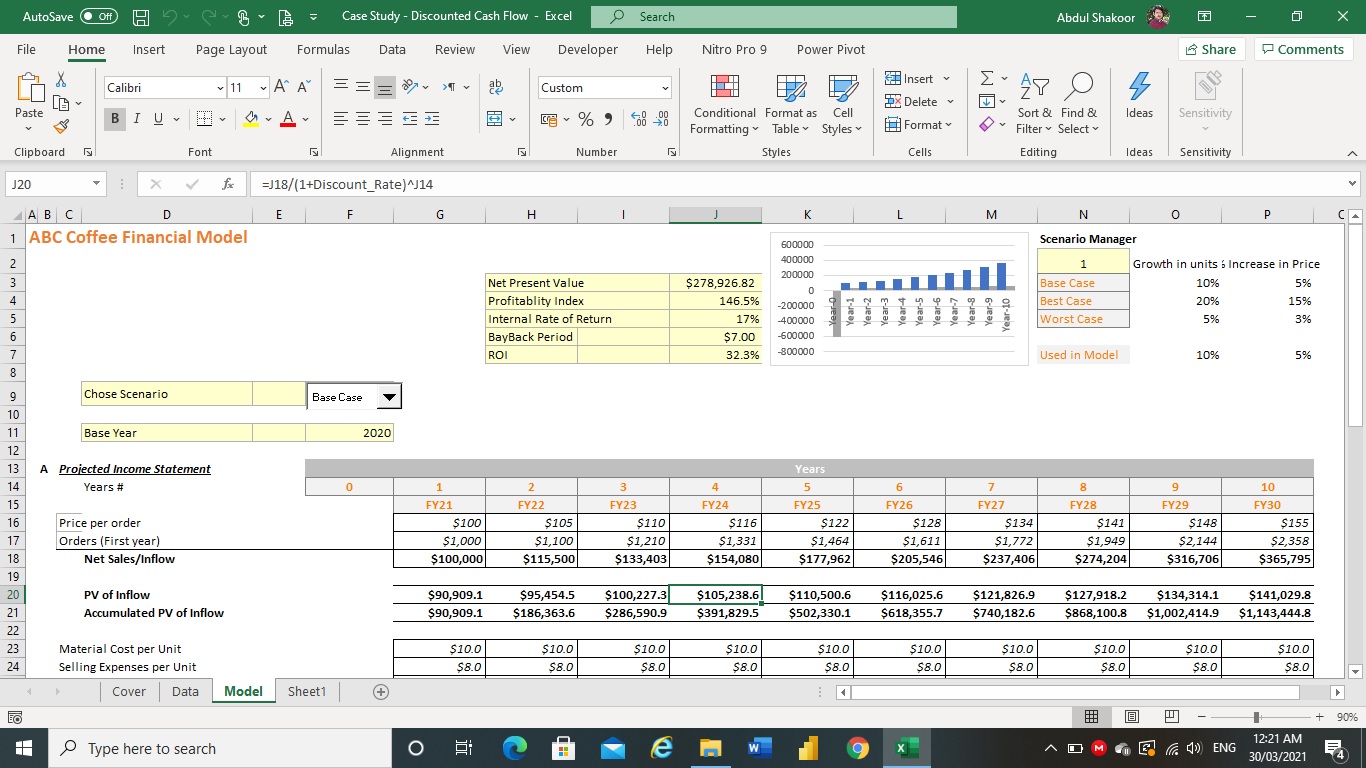

The PRAM model, also known as the Price, Returns, Attitude, and Market model, is a comprehensive framework that assists individuals in making better financial decisions. It takes into account various key factors that influence investment outcomes and provides a structured approach to financial planning.

So, what does each component of the PRAM model represent?

- Price: Price refers to the cost of acquiring an investment asset. It includes considerations like the purchase price, transaction costs, and fees associated with the investment.

- Returns: Returns represent the potential profits or losses an investment can generate over a specified period. It involves analyzing historical performance, expected future returns, and evaluating risk factors.

- Attitude: Attitude refers to the investor’s risk tolerance, investment objectives, and personal financial goals. Understanding one’s attitude is crucial as it helps align investment decisions with individual preferences and circumstances.

- Market: Market conditions play a significant role in investment outcomes. The market component of the PRAM model takes into account factors like economic trends, industry analysis, and market volatility to determine potential risks and rewards.

By considering each component of the PRAM model, individuals gain a holistic view of their financial situation and can make well-informed investment decisions. This model enables investors to align their investment choices with their specific goals, risk tolerance, and market conditions.

The Benefits of Using the PRAM Model in Financial Planning

Now that we understand the components of the PRAM model let’s explore the benefits it offers in financial planning:

- Structured Approach: The PRAM model provides a systematic approach to financial planning, ensuring that all crucial factors are considered before making investment decisions. It helps individuals avoid impulsive or emotion-driven choices and instead encourages a more strategic and disciplined approach.

- Informed Decision-Making: By incorporating the Price, Returns, Attitude, and Market components, the PRAM model equips individuals with the necessary information to make informed investment decisions. It helps investors evaluate the potential risks, rewards, and align their investments with their financial goals.

- Increased Confidence: Using the PRAM model can instill confidence in individuals as they gain a thorough understanding of their investments. This increased confidence allows investors to navigate the complexities of financial markets and make decisions that align with their long-term goals.

- Risk Mitigation: The PRAM model aids in the identification and assessment of potential investment risks. By considering various market factors and individual risk tolerance, investors can build a diversified portfolio that reduces vulnerability to market volatility.

In conclusion, the PRAM model is an invaluable tool in financial planning. By incorporating the Price, Returns, Attitude, and Market components, individuals can make more informed investment decisions, align their investments with their specific goals, and mitigate risk. So, the next time you embark on your financial planning journey, remember to leverage the power of the PRAM model to maximize your financial success.