Finance

Property Derivative Definition

Published: January 12, 2024

Looking to understand property derivatives? Learn the definition and significance of this financial instrument in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Property Derivative? A Comprehensive Definition

Welcome to the Finance section of our blog, where we delve into various aspects of the financial world. In this post, we are focusing on an intriguing topic called property derivatives. Property derivatives are financial instruments that enable investors to gain exposure to the real estate market, without having to physically own or manage properties themselves. But what exactly are property derivatives? Let’s dive in and explore this fascinating concept.

Key Takeaways:

- Property derivatives are financial instruments that allow investors to gain exposure to the real estate market without owning physical properties.

- These derivatives can be used for speculation, hedging, or diversification purposes, offering investors flexibility in managing their portfolios.

Understanding Property Derivatives

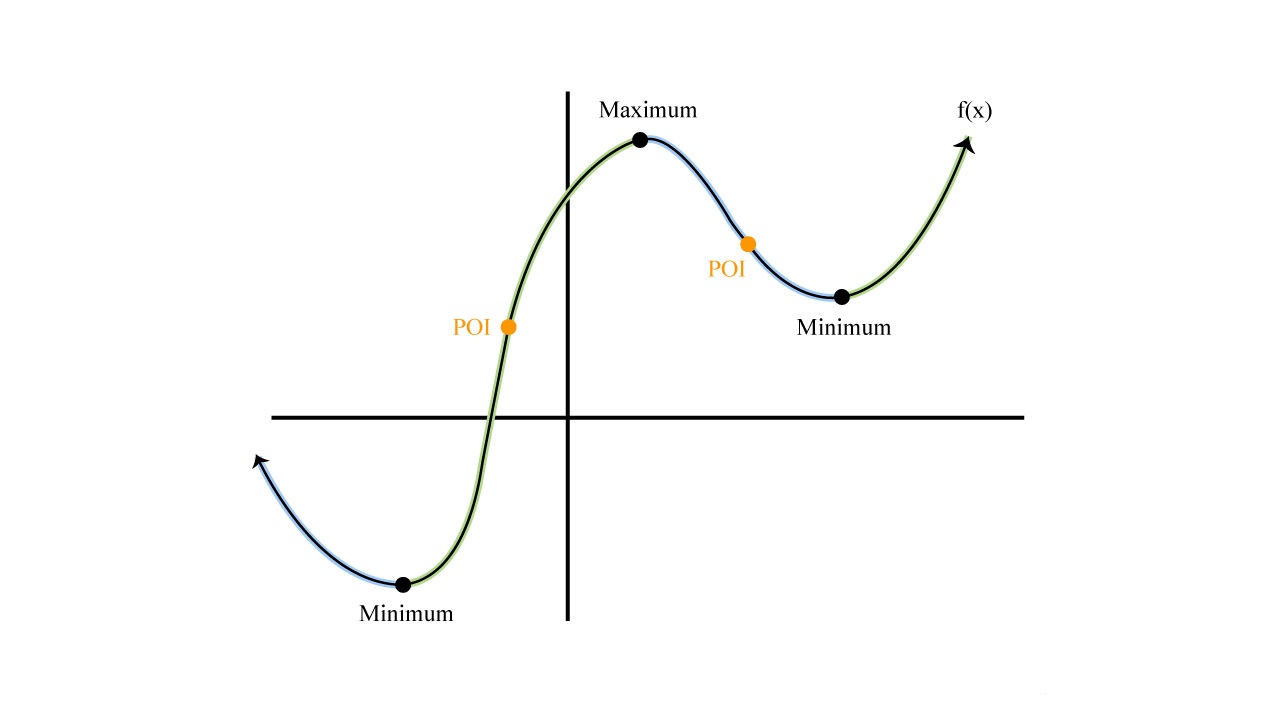

In simple terms, a property derivative is a financial contract whose value is based on the underlying performance of a property or a basket of properties. These derivatives can take various forms, including futures, options, swaps, or structured products. The prices of property derivatives are typically influenced by factors such as property values, rental income, occupancy rates, and market sentiment.

Here are some important points to understand about property derivatives:

- Speculation: Property derivatives provide opportunities for investors to speculate on the future direction of property prices. By taking long or short positions on these derivatives, investors can potentially profit from price movements without actually buying or selling physical properties.

- Hedging: Property derivatives offer a useful tool for hedging risks associated with real estate investments. For example, a property developer can use these derivatives to hedge against potential declines in property prices while waiting for a project to be completed.

- Diversification: Property derivatives allow investors to diversify their portfolios beyond traditional asset classes like stocks and bonds. By including property derivatives in their investment strategy, investors can gain exposure to the real estate market and potentially benefit from its long-term growth prospects.

- Liquidity: Property derivatives provide a liquid market for investors to buy or sell their positions. This liquidity enables investors to easily enter or exit their positions, making property derivatives a convenient tool for managing their investment portfolios.

The Benefits of Property Derivatives

Now that we have a better understanding of what property derivatives are, let’s explore some of the benefits they offer:

- Risk Management: Property derivatives provide investors with a means to manage risks associated with the real estate market. By using these derivatives, investors can hedge against potential price fluctuations or diversify their portfolio to reduce risk.

- Portfolio Diversification: Including property derivatives in an investment portfolio can help diversify overall risk exposure. The real estate market often behaves differently from other asset classes, which can provide valuable diversification benefits.

- Accessibility: Property derivatives offer investors an accessible way to gain exposure to the real estate market, even for those who may not have the means to physically own properties themselves. This accessibility makes property derivatives a viable option for a wider range of investors.

In conclusion, property derivatives are financial instruments that enable investors to gain exposure to the real estate market without owning physical properties. These derivatives can be used for speculation, hedging, or diversification purposes. With their potential benefits and the accessibility they offer, property derivatives can be a valuable addition to an investor’s toolkit.

Stay tuned to our finance section for more insights on various financial concepts and strategies.