Finance

What Are Credit Derivatives

Modified: February 21, 2024

Learn more about credit derivatives and their role in finance. Understand how they work, their benefits, and potential risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit derivatives! In the complex and ever-evolving realm of finance, credit derivatives play a crucial role in managing and hedging credit risks. These financial instruments have gained significant popularity and have become essential tools for institutions and investors alike.

Credit derivatives are financial contracts that allow market participants to transfer credit risks from one party to another. They are based on the performance of underlying credit assets such as bonds, loans, or other debt instruments. The essence of credit derivatives lies in their ability to provide protection or speculate on credit events, such as defaults or downgrades, without having to own the actual underlying credit asset.

Since their introduction in the 1990s, credit derivatives have revolutionized the way financial institutions and investors manage and mitigate credit risks. These instruments offer a wide range of benefits and uses, but they’re not without their fair share of risks and limitations. Understanding the intricacies of credit derivatives is vital for anyone seeking to navigate the world of finance effectively.

In this article, we will delve into the definition, various types, benefits, risks, and the market outlook of credit derivatives. By the end, you will have a comprehensive understanding of what credit derivatives are and how they function in the financial landscape.

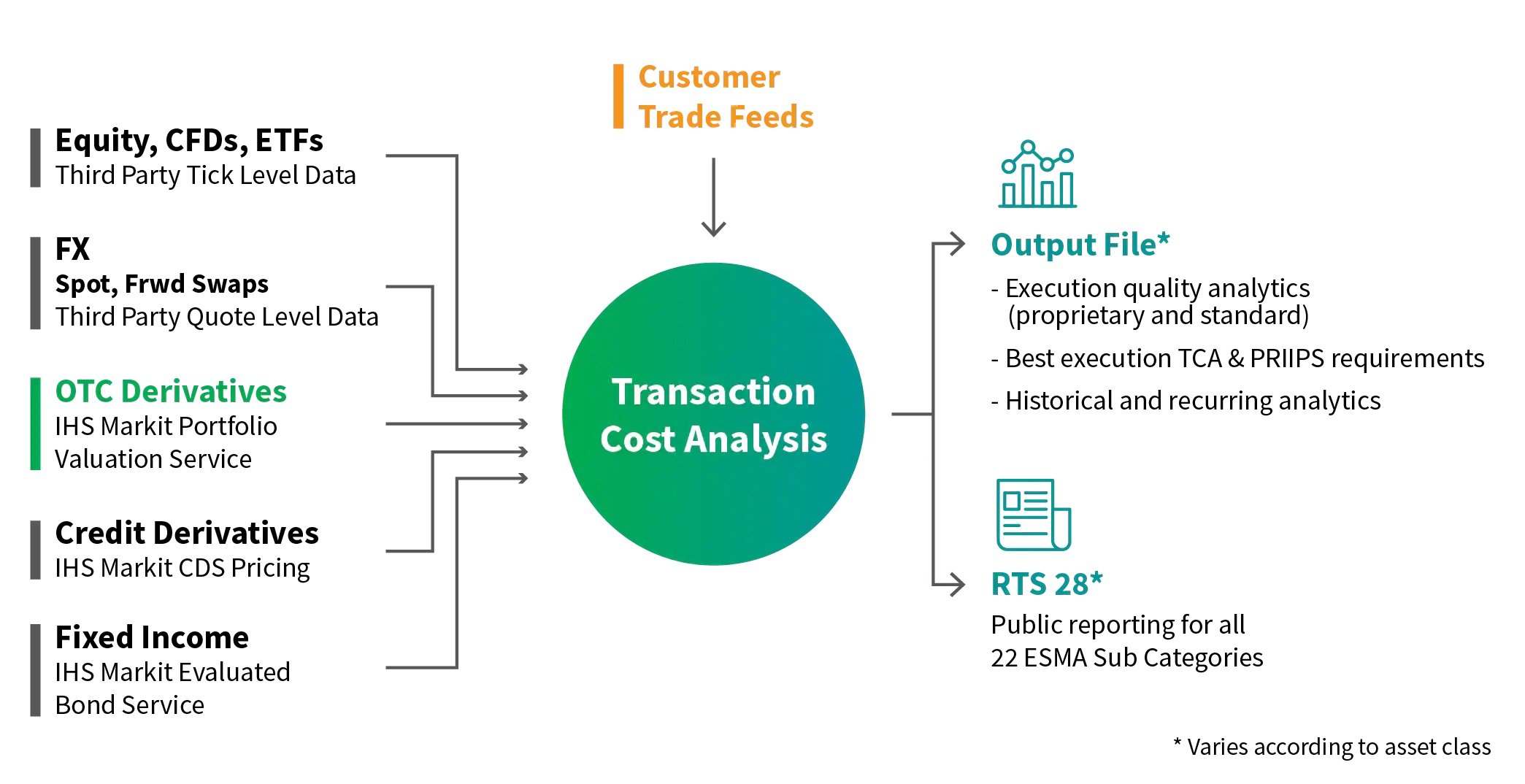

Definition of Credit Derivatives

Credit derivatives are a class of financial instruments that allow market participants to manage credit risks associated with debt securities or loans. They are agreements between two parties that derive their value from an underlying credit asset, typically referred to as the reference entity or reference obligation.

The primary purpose of credit derivatives is to transfer or mitigate credit risk. They enable parties to hedge against potential credit events, such as defaults, bankruptcies, or credit rating downgrades, without the need to actually own the underlying asset. In other words, credit derivatives allow investors and institutions to take a position on the creditworthiness of a borrower or issuer without having to hold the debt obligation.

One commonly used credit derivative is a credit default swap (CDS). A CDS is a contract in which one party, known as the protection buyer, makes periodic payments to another party, known as the protection seller, in exchange for protection against a credit event. If a credit event occurs, such as a default on the underlying debt, the protection seller compensates the protection buyer for the loss incurred.

Another type of credit derivative is a collateralized debt obligation (CDO). CDOs pool together various debt securities, such as bonds or loans, and create different tranches with varying levels of risk and return. Investors can then buy specific tranches based on their risk appetite. The cash flows generated from the underlying debt securities are distributed to the different tranches, providing varying degrees of risk protection and return potential.

Other credit derivatives include total return swaps, credit-linked notes, and credit spread options, each with their unique features and applications. These derivatives are traded over-the-counter (OTC) rather than on traditional exchanges, making them customizable to suit the specific needs and requirements of market participants.

Overall, credit derivatives provide a flexible and efficient means for investors and institutions to manage credit risks, enhance portfolio diversification, and access credit exposures that may otherwise be challenging to obtain directly in the market.

Types of Credit Derivatives

Credit derivatives come in various forms, each designed to address specific credit risk management needs. Here are some of the common types of credit derivatives:

- Credit Default Swaps (CDS): This is the most widely traded type of credit derivative. A CDS is a bilateral contract between the protection buyer and the protection seller. The buyer makes periodic payments to the seller in exchange for protection against a credit event, such as a default or credit rating downgrade. If a credit event occurs, the protection seller compensates the buyer for the loss incurred.

- Collateralized Debt Obligations (CDOs): CDOs are structured products that consolidate a pool of debt securities, such as bonds or loans, into different tranches. Each tranche has a unique level of risk and return. Investors can purchase specific tranches based on their risk appetite. The cash flows from the underlying debt securities are distributed to the tranches, offering varying degrees of risk protection and return potential.

- Total Return Swaps (TRS): TRS are financial contracts in which two parties exchange the total return of an underlying credit asset. One party pays the total return of the asset, which includes any coupon payments or price appreciation, while the other party pays a fixed or floating-rate. TRS can be used to transfer credit risk or speculate on the performance of the underlying asset.

- Credit-Linked Notes (CLNs): CLNs are debt instruments that offer investors exposure to the credit risk of certain reference entities. These notes can be structured to provide different levels of credit protection and returns. Holders of CLNs are entitled to repayments based on the credit events, such as defaults or downgrades, of the reference entities specified in the contract.

- Credit Spread Options: Credit spread options give the holder the right but not the obligation to buy or sell a credit default swap or another derivative instrument at a specified spread over a benchmark. These options are used to hedge or speculate on changes in the credit spread of the underlying instrument.

These are just a few examples of the many different types of credit derivatives available in the market. Each type of credit derivative serves a unique purpose and caters to the diverse risk management needs of investors and institutions. The flexibility and variety of credit derivatives enable market participants to tailor their credit risk exposures and optimize their risk-return profiles.

Benefits and Uses of Credit Derivatives

Credit derivatives offer a range of benefits and uses that make them valuable tools for managing credit risks and optimizing investment portfolios. Here are some key advantages of credit derivatives:

- Risk Management: Credit derivatives allow market participants to transfer credit risks to other parties, providing a means of hedging against potential credit events. Institutions can use credit derivatives to mitigate the impact of defaults or downgrades on their portfolios.

- Enhanced Portfolio Diversification: Credit derivatives provide the opportunity to obtain exposure to credit risks that may not be readily available through traditional bond or loan investments. This expands the range of assets investors can include in their portfolios and enhances diversification.

- Liquidity and Flexibility: The over-the-counter (OTC) nature of credit derivatives offers liquidity and flexibility, as they can be customized to suit specific risk management needs. Market participants can easily enter into contracts with counterparties and adjust their positions as market conditions change.

- Access to Credit Exposure: By using credit derivatives, investors and institutions can gain exposure to specific credit risks without physically owning the underlying debt securities. This access allows for efficient deployment of capital and targeting of specific credit opportunities.

- Price Discovery: The trading and pricing of credit derivatives provide valuable information about the creditworthiness of issuers and borrowers. Market participants can utilize this information to assess the prevailing credit market sentiment and make informed investment decisions.

- Speculation and Trading: Credit derivatives also offer opportunities for speculation and trading. Investors can take positions on the creditworthiness of reference entities and potentially profit from changes in credit spreads or other credit events.

These benefits and uses of credit derivatives make them invaluable in managing credit risks, enhancing portfolio performance, and accessing credit exposures. However, like any financial instrument, credit derivatives come with certain risks and limitations that should be carefully considered.

Risks and Limitations of Credit Derivatives

While credit derivatives offer numerous benefits, it is important to understand the risks and limitations associated with these financial instruments. Here are some key considerations:

- Counterparty Risk: Credit derivatives are typically traded in over-the-counter (OTC) markets, which means there is a risk of default by the counterparty. If a counterparty fails to fulfill its obligations, it can result in significant financial losses for the other party involved.

- Illiquidity: Although credit derivatives provide flexibility and customization, they can also be illiquid compared to more traditional securities. During periods of market stress or disruption, it may be challenging to find buyers or sellers for credit derivative contracts, potentially leading to increased costs or limited exit options.

- Complexity: Credit derivatives can be complex financial instruments, requiring a deep understanding of their structure, pricing, and associated risks. This complexity can make it difficult for investors and institutions to accurately assess the potential outcomes and evaluate the risks involved.

- Market Volatility: The value of credit derivatives is influenced by market conditions and credit events, making them susceptible to increased volatility. Rapid and unexpected changes in credit spreads, interest rates, or credit rating downgrades can have significant impacts on the value and performance of these derivatives.

- Basis Risk: Basis risk arises from the imperfect correlation between the credit derivative and the underlying credit asset. The derivative’s performance may not exactly mirror that of the reference entity, leading to potential discrepancies and mismatches in risk exposure.

- Regulatory and Legal Changes: Credit derivatives are subject to regulatory oversight, and changes in regulations can impact their trading, documentation, and pricing. Furthermore, legal disputes and uncertainties around the enforceability of derivative contracts can create additional risks and uncertainties.

It is essential for market participants to carefully evaluate and manage these risks when engaging in credit derivative transactions. Proper risk management practices, including diversification, thorough due diligence, and effective monitoring of counterparties, can help mitigate these risks and ensure the prudent use of credit derivatives.

Market Outlook for Credit Derivatives

The market for credit derivatives has experienced significant growth since their inception. As financial markets continue to evolve and institutions seek innovative ways to manage credit risks, the outlook for credit derivatives remains positive. Here are some key factors influencing the market:

- Increased Demand for Risk Management: Given the complexity and interconnectedness of global financial markets, the need for effective risk management tools is ever-present. Credit derivatives provide institutions with the means to transfer and manage credit risks, making them an attractive solution for risk mitigation.

- Expanding Use of Technology: Technological advancements have greatly influenced the credit derivatives market, enabling more efficient trading, pricing, and risk analytics. Automated trading platforms, machine learning algorithms, and improved data analytics have enhanced market liquidity and transparency while reducing transaction costs.

- Regulatory Changes and Standardization: Regulatory reforms following the 2008 financial crisis have aimed to increase transparency, reduce systemic risks, and enhance the stability of financial markets. These changes have led to greater standardization of credit derivative contracts, improved risk disclosures, and increased regulatory oversight, thereby instilling confidence and trust in the market.

- Integration of Environmental, Social, and Governance (ESG) Factors: The growing focus on sustainability and responsible investing has led to the integration of ESG factors in credit risk assessments. Market participants are increasingly considering a borrower’s ESG performance when evaluating creditworthiness, which may influence the development of ESG-focused credit derivatives in the future.

- Emerging Markets and New Participants: As emerging markets continue to develop and open up, the demand for credit risk management tools is expected to increase. Additionally, non-traditional participants, such as hedge funds and asset managers, are increasingly utilizing credit derivatives to enhance portfolio performance and manage credit exposures.

- Evolution of New Product Offerings: Market participants are constantly exploring and developing new types of credit derivatives to meet evolving market needs. These innovations, such as index-based credit derivatives and synthetic securitization products, provide investors with more options for credit risk exposure and customization.

Overall, the market outlook for credit derivatives is shaped by ongoing market dynamics, regulatory developments, technological advancements, and evolving investor preferences. As credit risks continue to play a significant role in financial markets, credit derivatives are expected to remain a vital tool for managing and hedging these risks.

Conclusion

Credit derivatives have revolutionized the way institutions and investors manage credit risks in the dynamic world of finance. These financial instruments provide a means to transfer credit risks, enhance portfolio diversification, and access specific credit exposures. From credit default swaps to collateralized debt obligations, credit derivatives offer a range of tools to address diverse risk management needs.

While credit derivatives come with several benefits, they are not without their risks and limitations. Counterparty risk, illiquidity, complexity, and market volatility are some of the factors that market participants must carefully consider. However, prudent risk management practices, proper due diligence, and keeping up with regulatory changes can help mitigate these risks effectively.

The market outlook for credit derivatives remains positive amid increasing demand for risk management tools, advancements in technology, and regulatory reforms. As institutions seek innovative ways to manage credit risks and navigate volatile markets, credit derivatives provide a flexible and efficient solution.

It is important for market participants to stay informed and adapt to changing market dynamics. The integration of environmental, social, and governance factors, the emergence of new participants, and the development of new product offerings will continue to shape the credit derivatives market in the future.

In conclusion, credit derivatives play a vital role in the financial landscape, offering opportunities for risk management, portfolio diversification, and access to credit exposures. With proper understanding, risk management, and regulatory compliance, credit derivatives can help institutions and investors navigate the complexities of credit risks and achieve their financial objectives.