Finance

What Is Credit Derivatives

Published: January 4, 2024

Learn about credit derivatives in finance and how they impact the financial markets. Discover the benefits and risks of investing in these complex financial instruments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Credit Derivatives

- Types of Credit Derivatives

- Market Participants in Credit Derivatives

- Advantages and Disadvantages of Credit Derivatives

- Importance of Credit Derivatives in Financial Markets

- Criticisms and Controversies surrounding Credit Derivatives

- Regulation and Risk Management in Credit Derivatives

- Conclusion

Introduction

Credit derivatives are financial instruments that have become increasingly popular in financial markets. They play a pivotal role in managing credit risk, allowing investors to hedge against potential losses due to default or credit events. Understanding credit derivatives is crucial for anyone in the finance industry, as they impact various sectors and have the potential to affect the stability of the financial system.

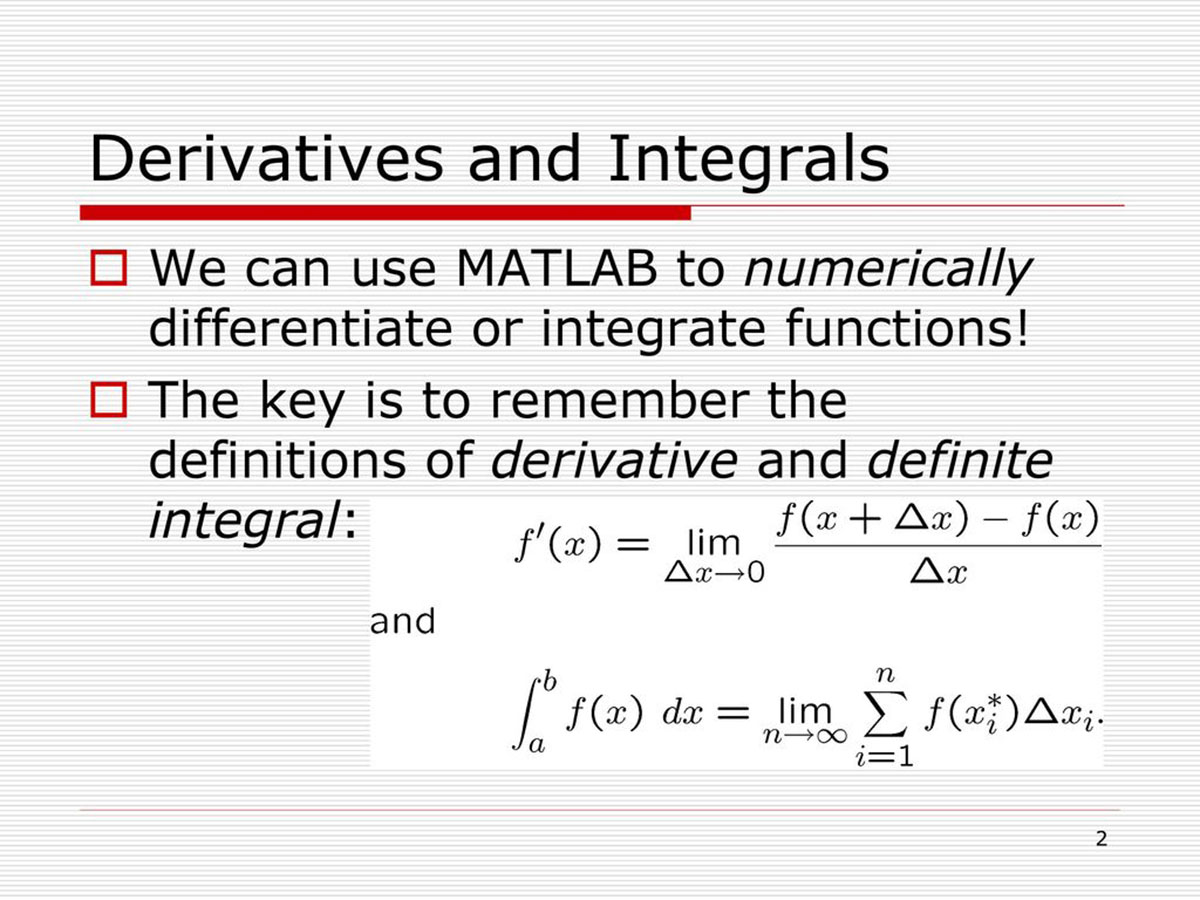

At its core, a credit derivative is a contract between two parties, where the value of the contract is linked to the performance of an underlying credit asset. This could be a loan, a bond, or even a portfolio of loans. The purpose of these derivatives is to transfer credit risk from one party to another, thereby providing an opportunity to manage and speculate on credit risk.

The development of credit derivatives can be traced back to the early 1990s, when financial institutions sought new ways to manage their credit exposure. Prior to the introduction of credit derivatives, banks and investors had limited options to protect themselves from default risk. The emergence of credit derivatives revolutionized the way credit risk is managed, enabling market participants to transfer, diversify, and redistribute risk.

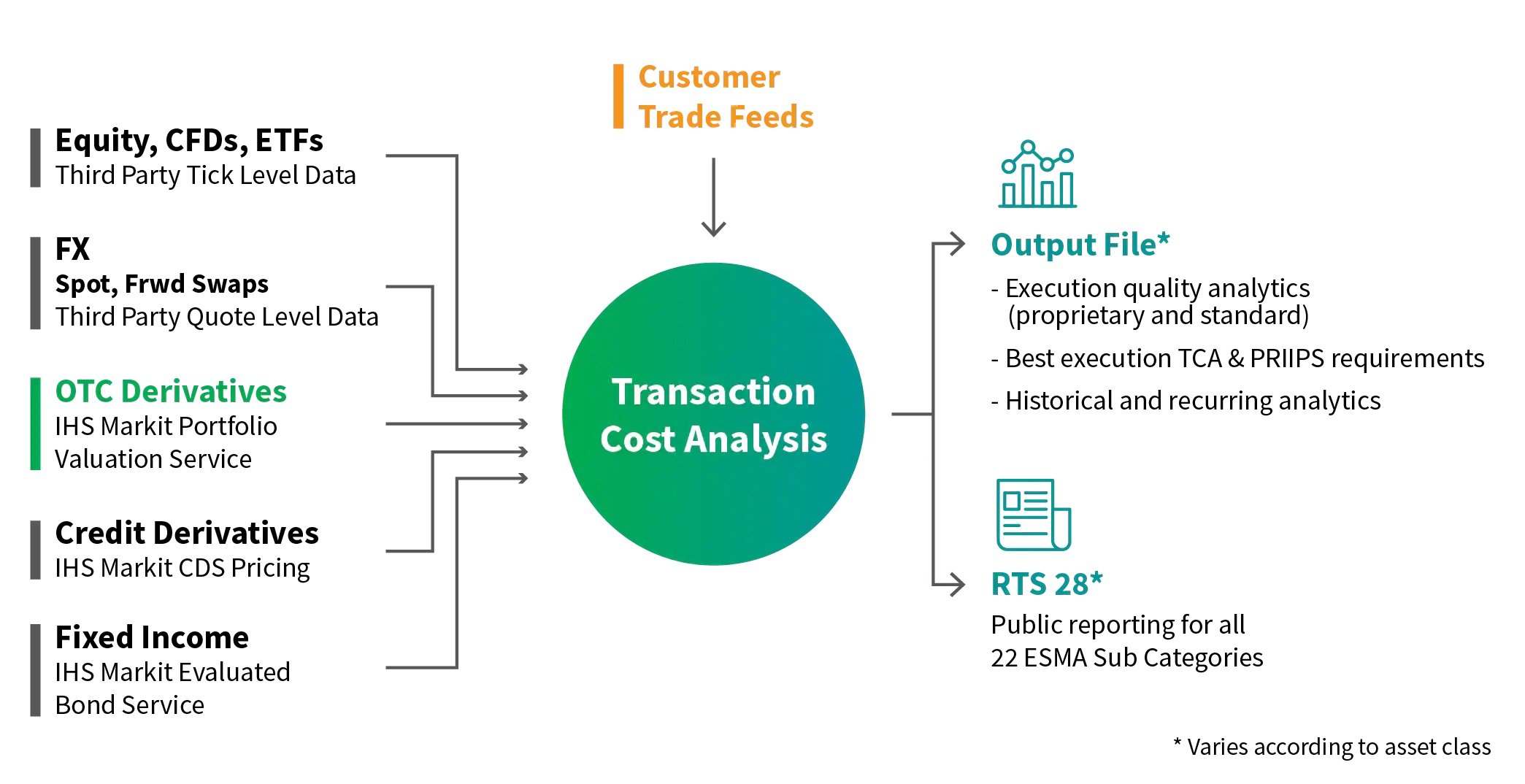

Credit derivatives come in various forms, including credit default swaps (CDS), collateralized debt obligations (CDOs), and credit spread options. Each type of credit derivative serves a unique purpose and offers different risk and return characteristics. These instruments have gained popularity due to their versatility and ability to tailor risk profiles to suit individual needs.

The market for credit derivatives has grown exponentially over the years, with financial institutions, corporations, and even retail investors participating in these markets. Credit derivatives have also attracted controversy and criticism due to their complexity and the role they played in the global financial crisis of 2008. Consequently, regulatory authorities have implemented measures to enhance transparency and oversight in credit derivatives markets.

This article aims to provide a comprehensive understanding of credit derivatives, exploring their definition, types, market participants, advantages and disadvantages, as well as their importance in financial markets. We will also discuss the criticisms and controversies surrounding credit derivatives, as well as the regulatory framework and risk management practices that govern these instruments.

Definition of Credit Derivatives

Credit derivatives are financial contracts whose value is derived from an underlying credit asset or reference entity. These derivatives allow market participants to transfer or manage credit risk associated with the underlying credit asset without owning the asset itself. In simpler terms, credit derivatives function as insurance against the risk of default or credit events.

The most common type of credit derivative is a credit default swap (CDS). A CDS is a contract between two parties, the protection buyer and the protection seller. The protection buyer makes periodic payments to the protection seller, known as the premium, in exchange for protection against the default of a specific reference entity, such as a company or a government. In the event of a credit event, such as a default or bankruptcy of the reference entity, the protection seller is obligated to pay the protection buyer the face value of the underlying credit asset or the remaining principal amount.

Another type of credit derivative is a collateralized debt obligation (CDO). It is a structured financial product that pools together various debt instruments, such as bonds and loans, and then tranche them into different levels of risk and return. Investors can purchase different tranches based on their risk appetite, with each tranche offering a different level of credit quality and yield. The performance of a CDO depends on the credit quality of the underlying debt instruments and the timing of credit events.

Credit spread options are also considered as credit derivatives. These options allow investors to speculate on the credit spread between two reference entities. The buyer of a credit spread option pays a premium to the seller and has the right, but not the obligation, to receive a payment if the credit spread widens beyond a predetermined level.

The key characteristic of credit derivatives is that they provide exposure to credit risk without requiring the ownership of the underlying credit asset. This allows investors to diversify their credit exposure, manage their portfolio risk, and create customized investment strategies. Credit derivatives also provide liquidity in the market by allowing investors to buy or sell protection or make bets on credit events, thereby facilitating price discovery and market efficiency.

It is important to note that credit derivatives carry inherent risks. The value of credit derivatives depends on the creditworthiness and performance of the underlying credit asset or reference entity. Therefore, fluctuations in credit quality, credit spreads, and market conditions can significantly impact the valuation and performance of credit derivatives.

In summary, credit derivatives are financial instruments that allow market participants to transfer or manage credit risk associated with an underlying credit asset. They provide opportunities for investors to hedge against credit events, speculate on credit spreads, and create custom investment strategies. Understanding credit derivatives is crucial for anyone involved in finance, as they play a significant role in risk management and financial markets.

Types of Credit Derivatives

Credit derivatives come in various forms, each serving a unique purpose and offering different risk and return characteristics. Below are three common types of credit derivatives:

- Credit Default Swaps (CDS): CDS is the most widely traded form of credit derivative. It is a contract between a protection buyer and a protection seller. The protection buyer pays a premium to the seller in exchange for protection against the default of a specific reference entity, such as a corporation or government. If a credit event, such as default or bankruptcy, occurs, the protection seller is obligated to pay the protection buyer the face value of the underlying credit asset or the remaining principal amount. CDS allows investors to hedge against credit risk or speculate on the creditworthiness of a particular entity.

- Collateralized Debt Obligations (CDOs): CDOs are structured financial products that pool together various debt instruments, such as bonds and loans. These instruments are then divided into different tranches with varying risk and return profiles. Investors can purchase tranches based on their risk appetite, with higher-risk tranches offering higher yields. The performance of CDOs depends on the credit quality of the underlying debt instruments and the occurrence of credit events. CDOs played a significant role in the 2008 financial crisis, as the value of many CDOs plummeted due to a wave of defaults in the underlying subprime mortgage loans.

- Credit Spread Options: Credit spread options allow investors to speculate on the credit spread between two reference entities. The buyer of a credit spread option pays a premium to the seller and has the right, but not the obligation, to receive a payment if the credit spread between the two entities widens beyond a predetermined level. These options provide flexibility for investors to take positions on credit spreads and profit from changes in the perceived creditworthiness of the reference entities.

Other types of credit derivatives include total return swaps, credit-linked notes, and credit options. Each type of credit derivative has its own unique characteristics and complexity, catering to different risk management strategies and investment objectives.

It is worth noting that credit derivatives can be used for both risk reduction and risk-taking purposes. Market participants employ credit derivatives to hedge against credit risk and protect their portfolios. On the other hand, speculators and traders use credit derivatives to take positions on credit events or profit from changes in credit spreads.

The use of credit derivatives has faced criticism for its role in the 2008 financial crisis and subsequent market turmoil. The complex nature of some credit derivatives, coupled with the lack of transparency and inadequate risk management practices, contributed to the systemic risk and contagion during the crisis. As a result, regulatory authorities have implemented measures to enhance transparency, reporting, and risk management practices in credit derivatives markets.

Overall, understanding the different types of credit derivatives is important for investors, financial institutions, and regulators to effectively manage credit risk and ensure the stability of the financial system.

Market Participants in Credit Derivatives

Credit derivatives markets attract a wide range of participants, including financial institutions, corporations, hedge funds, and retail investors. Each participant plays a unique role in the credit derivatives ecosystem, contributing to market liquidity and risk management. Below are some key participants in the credit derivatives market:

- Financial Institutions: Banks and other financial institutions are major participants in credit derivatives markets. They utilize credit derivatives to manage and hedge credit risk associated with their loan portfolios and other credit exposures. Financial institutions may act as both buyers and sellers of credit protection, depending on their risk appetite and hedging strategies. These participants play a critical role in providing liquidity to the market and facilitating transactions.

- Corporations: Corporations may engage in credit derivatives transactions for risk management purposes. For example, a corporation with exposure to a particular counterparty may use credit default swaps to protect against the default risk of that counterparty. Additionally, corporations may utilize credit derivatives to optimize their debt financing strategies, such as managing interest rate risk or enhancing the credit profile of their debt issuances.

- Hedge Funds and Asset Managers: Hedge funds and asset managers participate in credit derivatives markets to generate alpha and manage portfolio risk. They employ various investment strategies, including long/short positions, relative value trades, and event-driven strategies. Hedge funds and asset managers capitalize on price discrepancies in credit derivatives markets and actively trade these instruments to generate profits.

- Insurance Companies: Insurance companies are significant participants in credit derivatives markets due to their exposure to credit risk. They may utilize credit derivatives to hedge against the credit risk associated with their insurance policies or investment portfolios. Insurance companies may also trade credit derivatives to enhance their investment returns or take advantage of market opportunities.

- Retail Investors: With the proliferation of financial products and online trading platforms, retail investors have gained access to credit derivatives markets as well. While their participation is relatively small compared to institutional investors, retail investors may engage in credit derivatives trading for speculative purposes or to gain exposure to specific credit markets.

In addition to these primary participants, credit derivatives markets also involve interdealer brokers, clearinghouses, and regulatory authorities. Interdealer brokers act as intermediaries, facilitating trades between market participants and providing price transparency. Clearinghouses play a vital role in mitigating counterparty risk by acting as a central counterparty and ensuring the settlement of credit derivatives contracts. Regulatory authorities oversee credit derivatives markets to promote transparency, manage systemic risk, and protect investors.

Overall, the diversity of market participants in credit derivatives contributes to market liquidity, price discovery, and effective risk management. However, the involvement of various participants also highlights the importance of robust regulatory oversight to ensure market integrity and stability.

Advantages and Disadvantages of Credit Derivatives

Credit derivatives offer several advantages and disadvantages to market participants. Understanding these benefits and challenges is essential for investors, financial institutions, and regulators to effectively manage credit risk and navigate the complexities of these financial instruments.

Advantages:

- Risk Management: Credit derivatives provide a valuable tool for managing credit risk. Market participants can use credit derivatives to hedge against the risk of default or credit events, thereby reducing potential losses in their portfolios. These instruments allow investors to transfer credit risk to other participants who are willing to assume it, creating opportunities for risk diversification and more efficient risk allocation.

- Liquidity: Credit derivatives contribute to market liquidity by enabling investors to buy or sell protection or take positions on credit events. The ability to trade these instruments facilitates price discovery and efficient market functioning. Market liquidity benefits market participants by providing greater flexibility, better execution of trades, and improved access to credit markets.

- Customization: Credit derivatives offer flexibility and customization, allowing market participants to tailor risk profiles to suit their specific needs. Investors can choose from various credit derivatives with different credit quality, maturities, and risk-return characteristics. This customization enables market participants to align their investment strategies with their risk appetite and investment objectives.

- Enhanced Returns: Credit derivatives provide opportunities for investors to enhance their investment returns. By buying or selling protection, investors can capture the spread between the premium paid and the potential payout in the event of a credit event. This potential for higher returns attracts investors seeking to employ more sophisticated strategies and generate alpha.

Disadvantages:

- Complexity: Credit derivatives are complex financial instruments that require a deep understanding of credit risk and derivative markets. The complexity can make it challenging for market participants to accurately value these instruments and assess their associated risks. Lack of transparency and inadequate risk management practices can further amplify the complexity and create challenges in pricing and risk modeling.

- Systemic Risk: The interconnectedness of credit derivatives markets and the potential for contagion pose systemic risks. During periods of market stress, a significant number of credit derivatives can become illiquid and difficult to value, potentially amplifying the financial downturn. The 2008 financial crisis highlighted the systemic risks associated with credit derivatives, and regulatory authorities have since implemented measures to enhance transparency, reporting, and risk management practices.

- Counterparty Risk: Credit derivatives expose market participants to counterparty risk, which arises from the potential default or inability of the counterparty to fulfill its obligations. The failure of a counterparty to honor their contractual obligations can lead to substantial losses and exacerbate market turmoil. Counterparty risk management, including robust collateralization and credit assessment, is crucial in mitigating this risk.

- Limited Standardization: Credit derivatives lack standardization, which can complicate market operations and increase operational risk. Each transaction may have unique terms and conditions, making it challenging for market participants to compare pricing and assess the risks associated with different credit derivatives. Standardization efforts aim to address this issue but have been limited in their scope.

It is important to strike a balance between the advantages and disadvantages of credit derivatives. While these instruments provide risk management opportunities and enhance market liquidity, market participants and regulators must be mindful of the complexities and risks associated with credit derivatives and implement robust risk management practices to ensure the stability of financial markets.

Importance of Credit Derivatives in Financial Markets

Credit derivatives play a crucial role in financial markets, providing various benefits and functionalities that are important for market participants, investors, and the overall stability of the financial system. Here are some key reasons why credit derivatives are important:

Risk Management and Hedging:

Credit derivatives allow market participants to effectively manage and hedge credit risk. By transferring credit risk to other parties, investors can protect their portfolios from potential losses due to default or credit events. This risk management tool enables investors to diversify their exposure, reduce concentration risk, and enhance portfolio resilience. Additionally, credit derivatives offer the ability to customize risk profiles, providing tailored hedging strategies for specific credit exposures.

Price Discovery and Market Efficiency:

The trading of credit derivatives contributes to price discovery and enhances overall market efficiency. By actively buying and selling credit protection, investors provide liquidity and improve the transparency of credit markets. The availability of price information aids in determining fair values and valuations for the underlying credit assets. Moreover, credit derivatives enable market participants to express their views on credit risk, leading to more accurate pricing and improved market functioning.

Liquidity Enhancement:

Credit derivatives enhance market liquidity by allowing investors to buy or sell protection and take positions on credit events. This liquidity enables market participants to enter and exit positions more easily, facilitating efficient trading and reducing transaction costs. Improved liquidity also attracts a broader range of market participants, increasing the depth and breadth of credit markets.

Portfolio Diversification Opportunities:

Credit derivatives provide investors with opportunities to diversify their portfolios beyond traditional asset classes. By gaining exposure to credit risk without necessarily owning the underlying credit assets, investors can diversify their risk exposure and potentially enhance overall portfolio performance. This diversification helps in mitigating systematic risk and provides a broader range of investment options.

Optimized Debt Financing and Capital Management:

Credit derivatives enable corporations and financial institutions to optimize their debt financing and capital management strategies. By using credit derivatives, issuers can enhance their credit profiles, reduce funding costs, and access a broader investor base. This flexibility in debt financing helps to enhance capital efficiency, improve funding options, and support the growth of businesses.

Market Stability and Risk Transfer:

Credit derivatives facilitate risk transfer from entities with higher risk tolerance to those with a lower risk appetite. This transfer of credit risk helps to stabilize the financial system by redistributing risk across different market participants. It allows banks and financial institutions to reduce their credit exposures, improving their overall solvency and resilience.

In summary, credit derivatives are important in financial markets as they provide risk management tools, enhance market liquidity, support efficient price discovery, offer portfolio diversification, optimize debt financing, and contribute to overall market stability. However, it is essential to ensure that the use of credit derivatives is accompanied by proper risk management practices and regulatory oversight to maintain the integrity and stability of financial markets.

Criticisms and Controversies surrounding Credit Derivatives

Credit derivatives have been subject to criticism and controversies, particularly in light of their role in the 2008 financial crisis. The following are some key criticisms and controversies surrounding credit derivatives:

Opacity and Complexity:

One of the main criticisms of credit derivatives is their opacity and complexity. These derivatives can be highly intricate financial instruments, making it difficult for market participants, including investors, regulators, and even some financial professionals, to fully understand and evaluate their risks. The lack of transparency and complex structures have raised concerns about pricing accuracy, valuation models, and risk assessment. The complexity also adds to operational challenges in managing, trading, and reporting these instruments.

Systemic Risk and Contagion:

A major controversy involving credit derivatives is their potential to contribute to systemic risk and contagion. The interconnectedness of the credit derivatives market can amplify the impact of credit events, leading to widespread market disruptions. During times of financial distress, the rapid and widespread downgrading of creditworthiness, as seen in the 2008 financial crisis, put significant stress on the financial system. Critics argue that the interconnectedness and concentration of credit derivatives increase the risk of contagion and exacerbate financial instability.

Speculative and Excessive Risk-Taking:

Another criticism is that credit derivatives can facilitate speculative and excessive risk-taking behavior. Some market participants, including hedge funds and speculative traders, may use credit derivatives for speculative purposes, taking large positions that can exacerbate market volatility. Critics argue that this kind of behavior can contribute to asset bubbles, increase market fragility, and pose risks to the overall stability of financial markets.

Insufficient Risk Management and Supervision:

The 2008 financial crisis highlighted concerns around inadequate risk management and supervision of credit derivatives. Many financial institutions failed to accurately assess and manage the risks associated with their credit derivatives exposures, leading to substantial losses and, in some cases, even the collapse of institutions. This failure in risk management practices raised questions about the effectiveness of regulatory oversight and risk control measures in credit derivatives markets.

Pro-Cyclical Effects:

Credit derivatives have also been criticized for their pro-cyclical effects. During economic downturns and periods of market stress, the values of credit derivatives can decline sharply, exacerbating financial pressures on market participants and amplifying the downturn. The pro-cyclicality of credit derivatives adds to market volatility and can contribute to a downward spiral in credit markets.

Following the 2008 financial crisis, regulatory authorities have implemented reforms to address some of the criticisms and controversies surrounding credit derivatives. These reforms aim to enhance transparency, improve risk management practices, and strengthen regulatory oversight to mitigate potential risks associated with these instruments.

It is important to acknowledge both the benefits and challenges of credit derivatives, their role in risk management, and the need for tighter risk controls and regulatory supervision to ensure their safe and responsible usage in financial markets.

Regulation and Risk Management in Credit Derivatives

The regulation and risk management of credit derivatives have undergone significant changes since the global financial crisis in 2008. Regulators and market participants have recognized the need for increased transparency, enhanced risk controls, and improved oversight to mitigate potential risks associated with these complex financial instruments. Key measures have been implemented to address these concerns:

Regulatory Oversight:

Regulatory authorities, such as the Commodity Futures Trading Commission (CFTC) in the U.S. and the European Securities and Markets Authority (ESMA) in Europe, have implemented stringent regulations to improve transparency and oversight in credit derivatives markets. These regulations include mandatory reporting of trades, central clearing through clearinghouses, and trade execution on regulated platforms. Regulatory oversight aims to reduce counterparty risk, enhance market integrity, and improve price transparency.

Capital Adequacy Requirements:

Financial institutions and market participants are subject to regulatory capital adequacy requirements that aim to ensure they have sufficient capital buffers to absorb potential losses associated with credit derivatives. These requirements, such as the Basel III framework, impose stricter capital standards for credit risk exposures. The capital adequacy rules help protect financial institutions from excessive risk-taking and promote stability in the financial system.

Risk Management Practices:

Market participants have implemented more robust risk management practices to address the complexities of credit derivatives. This includes enhanced risk modeling, stress testing, and scenario analysis to accurately assess the potential risks and exposures associated with these instruments. Market participants are also adopting more sophisticated risk management tools and investing in technology infrastructure to improve risk management capabilities.

Valuation and Pricing Standards:

Efforts have been made to improve the valuation and pricing of credit derivatives. Guidelines and best practices have been established to ensure appropriate valuation methodologies and pricing models are used. Independent pricing services and methodologies are employed to enhance transparency, reduce conflicts of interest, and provide more accurate pricing indications for credit derivatives.

Market Conduct and Investor Protection:

Regulators have strengthened regulations to promote fair market conduct and protect investors in credit derivatives markets. Measures such as conflict of interest disclosures, suitability requirements, and investor education initiatives have been introduced to safeguard the interests of investors and prevent abusive practices.

Risk Disclosure and Reporting:

Market participants are required to provide comprehensive risk disclosures and regular reporting of credit derivatives transactions. This promotes transparency and enables regulators to monitor market activities more effectively. Increased disclosure requirements enhance market transparency and allow market participants and regulators to assess potential risks and exposures associated with credit derivatives.

These regulatory measures, coupled with proactive risk management practices from market participants, aim to address the criticisms and challenges surrounding credit derivatives. By promoting transparency, enhancing risk controls, and strengthening regulatory oversight, these measures strive to ensure the safe and responsible use of credit derivatives in financial markets.

Conclusion

Credit derivatives have emerged as essential financial instruments in modern financial markets, providing market participants with valuable risk management tools, liquidity enhancement, and portfolio diversification opportunities. These derivatives enable investors to hedge against credit risk, transfer risk, and optimize their debt financing strategies. However, credit derivatives have also faced criticisms and controversies, particularly in relation to their complexity, potential systemic risks, and the role they played in the 2008 financial crisis.

Regulatory authorities, recognizing the importance of addressing these concerns, have implemented reforms aimed at enhancing transparency, improving risk management practices, and strengthening regulatory oversight. Measures such as mandatory reporting, central clearing, and increased capital requirements have been put in place to mitigate counterparty risk, improve market integrity, and promote stability in credit derivatives markets.

As market participants navigate the complexities of credit derivatives, it is crucial for them to adopt robust risk management practices, including sophisticated modeling techniques and stress testing, to accurately assess and manage their exposure to credit risk. Valuation standards, pricing transparency, and comprehensive risk disclosures can further contribute to market efficiency and investor confidence.

While credit derivatives offer various advantages, including risk management, liquidity enhancement, and portfolio diversification, market participants and regulators must maintain a delicate balance between innovation and risk control. Ongoing monitoring and evaluation of credit derivatives markets are essential to identify potential risks and ensure the continued stability and integrity of the financial system.

In conclusion, credit derivatives play a vital role in financial markets, providing important risk management tools and liquidity enhancement. With the implementation of robust risk management practices and regulatory reforms, credit derivatives can be effectively utilized for the benefit of market participants while mitigating potential risks. As the financial landscape evolves, continued focus on transparency, risk control, and regulatory oversight will contribute to a more resilient and efficient credit derivatives market.