Home>Finance>Real Estate Limited Partnership (RELP): Definition And Roles

Finance

Real Estate Limited Partnership (RELP): Definition And Roles

Published: January 16, 2024

Learn about the definition and roles of Real Estate Limited Partnership (RELP) in the field of finance. Explore the benefits and structure of RELPs for successful real estate investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Potential of Real Estate Limited Partnerships (RELPs)

When it comes to finance and investment strategies, one option that has gained popularity is the Real Estate Limited Partnership (RELP). With its potential for high returns and tax advantages, a RELP can be an attractive opportunity for investors looking to diversify their portfolios. In this article, we will delve into the definition and roles of a RELP, providing valuable insights to help you make informed investment decisions.

Key Takeaways:

- A Real Estate Limited Partnership (RELP) is a business structure that combines the benefits of a limited partnership with real estate investment.

- RELPs offer tax advantages, potential returns, and diversification opportunities to investors.

Now, let’s dig deeper into understanding the fundamentals of a RELP.

What is a Real Estate Limited Partnership (RELP)?

A Real Estate Limited Partnership (RELP) is a unique business structure that combines the benefits of a limited partnership with real estate investment. It involves two types of partners: general partners and limited partners.

The general partners in a RELP are the individuals or entities responsible for the day-to-day management and decision-making of the partnership. They have unlimited personal liability and are actively involved in the operations of the partnership, including acquiring, managing, and selling real estate assets.

On the other hand, limited partners are the investors who contribute capital to the partnership but have limited liability. They are passive investors and are not involved in the day-to-day management of the partnership. Limited partners have the potential to earn returns on their investments based on the success of the partnership’s real estate ventures.

The Roles and Responsibilities in a RELP

Each partner in a RELP plays a distinct role with specific responsibilities:

General Partners:

- Oversee the day-to-day operations and decision-making of the RELP.

- Identify real estate investment opportunities and conduct due diligence.

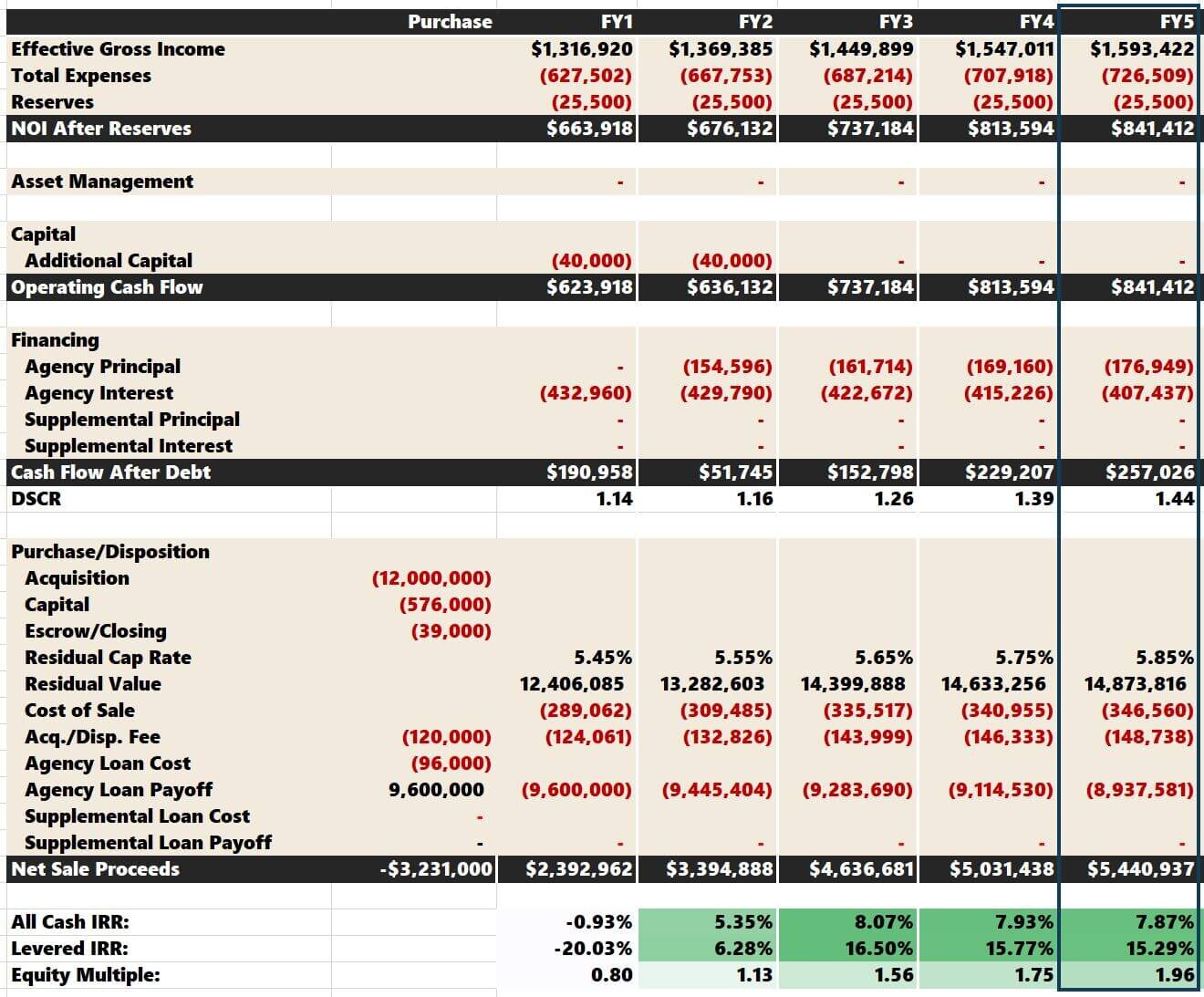

- Secure financing and negotiate deals with lenders.

- Manage the property, including maintenance, repairs, and tenant relations.

- Evaluate and mitigate potential risks and market fluctuations.

- Prepare financial reports and distribute profits to limited partners.

Limited Partners:

- Provide capital to the partnership for real estate investments.

- Have limited liability, meaning they are not personally responsible for partnership debts.

- Enjoy potential returns from the partnership’s real estate ventures.

- Participate in major partnership decisions, such as the sale of assets, as stipulated in the partnership agreement.

- Are not involved in the day-to-day management of the partnership.

Advantages of Investing in a RELP

There are several advantages to consider when investing in a Real Estate Limited Partnership:

Investing in a RELP can be a rewarding venture. However, it’s crucial to conduct thorough research, analyze the potential risks, and consult with financial advisors before making any investment decisions.

Now that you have a better understanding of what a Real Estate Limited Partnership (RELP) entails and the roles of different partners, you can confidently explore this investment option and make informed financial decisions.