Finance

What Is Real Estate In Accounting

Published: October 8, 2023

Learn about the role of finance in real estate accounting and its impact on financial management. Explore key concepts and strategies to maximize profitability and mitigate risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- What Is Real Estate in Accounting

- Definition of Real Estate in Accounting

- Classification of Real Estate in Accounting

- Different Types of Real Estate Assets

- Accounting for Real Estate Investments

- Measurement and Reporting of Real Estate Assets

- Key Financial Metrics for Real Estate Accounting

- Challenges in Real Estate Accounting

- Importance of Real Estate Accounting

- Conclusion

What Is Real Estate in Accounting

Real estate, in the context of accounting, refers to land, buildings, and other property holdings that are owned by individuals, businesses, or investment entities. It is an asset class that is significant in terms of its value, liquidity, and impact on financial statements. Real estate can encompass various types of properties, such as residential homes, commercial buildings, industrial facilities, and vacant land.

From an accounting perspective, real estate is treated as a tangible asset, which means it has a physical existence and can be measured and valued. It is essential to account for real estate accurately to reflect its value and the financial impact it has on an entity’s financial statements.

Real estate holdings are typically recorded on the balance sheet of an entity, indicating the value of the property as an asset. The value of real estate can appreciate or depreciate over time, depending on market conditions, location, and other factors.

In addition to owning real estate for operational purposes, many individuals and entities invest in real estate as a means of generating income and building wealth. Real estate investments can take various forms, such as rental properties, real estate investment trusts (REITs), or participation in real estate funds.

In accounting, real estate investments are classified as either held for use or held for investment. Real estate held for use refers to properties owned and used directly by an entity for its own operations. On the other hand, real estate held for investment refers to properties owned with the primary purpose of generating a return on investment through rental income or capital appreciation. The classification of real estate investments affects how they are accounted for and presented in financial statements.

Overall, real estate holds significant importance in accounting as it represents valuable assets for individuals, businesses, and investors. Proper accounting for real estate is essential to provide accurate financial reporting, assess the financial health of an entity, and make informed investment decisions.

Definition of Real Estate in Accounting

In accounting, real estate is a term used to describe land, buildings, and other property holdings that are owned by individuals, businesses, or investment entities. It is considered a significant asset class due to its tangible nature, value, and impact on financial statements.

Real estate assets are typically recorded on an entity’s balance sheet to reflect their value. These assets include both the land and any structures or improvements on the land, such as residential homes, commercial buildings, warehouses, or vacant plots.

Real estate can be further categorized into different types based on its use and purpose. Residential real estate refers to properties primarily used for living purposes, such as single-family homes, apartments, or condominiums. Commercial real estate includes properties used for business activities, such as office buildings, retail spaces, or hotels. Industrial real estate pertains to properties used for manufacturing, warehousing, or distribution. Finally, there is agricultural or rural real estate that encompasses farmland, ranches, or vineyards.

It is important to note that real estate assets are subject to valuation and can appreciate or depreciate over time. Changes in the real estate market, economic conditions, and other factors can influence the value of these assets. Therefore, regular assessments and valuations are necessary to ensure accurate financial reporting.

Real estate assets can be acquired for various purposes. Some entities purchase real estate for their operational needs, such as acquiring office space or manufacturing facilities. Others invest in real estate properties to generate rental income or capitalize on potential capital appreciation. These investments can take the form of direct ownership, real estate investment trusts (REITs), or participation in real estate funds.

In summary, real estate in accounting refers to land, buildings, and property holdings that hold significant value and impact an entity’s financial statements. It includes various types of properties and can be owned for operational purposes or investment purposes, depending on the entity’s objectives.

Classification of Real Estate in Accounting

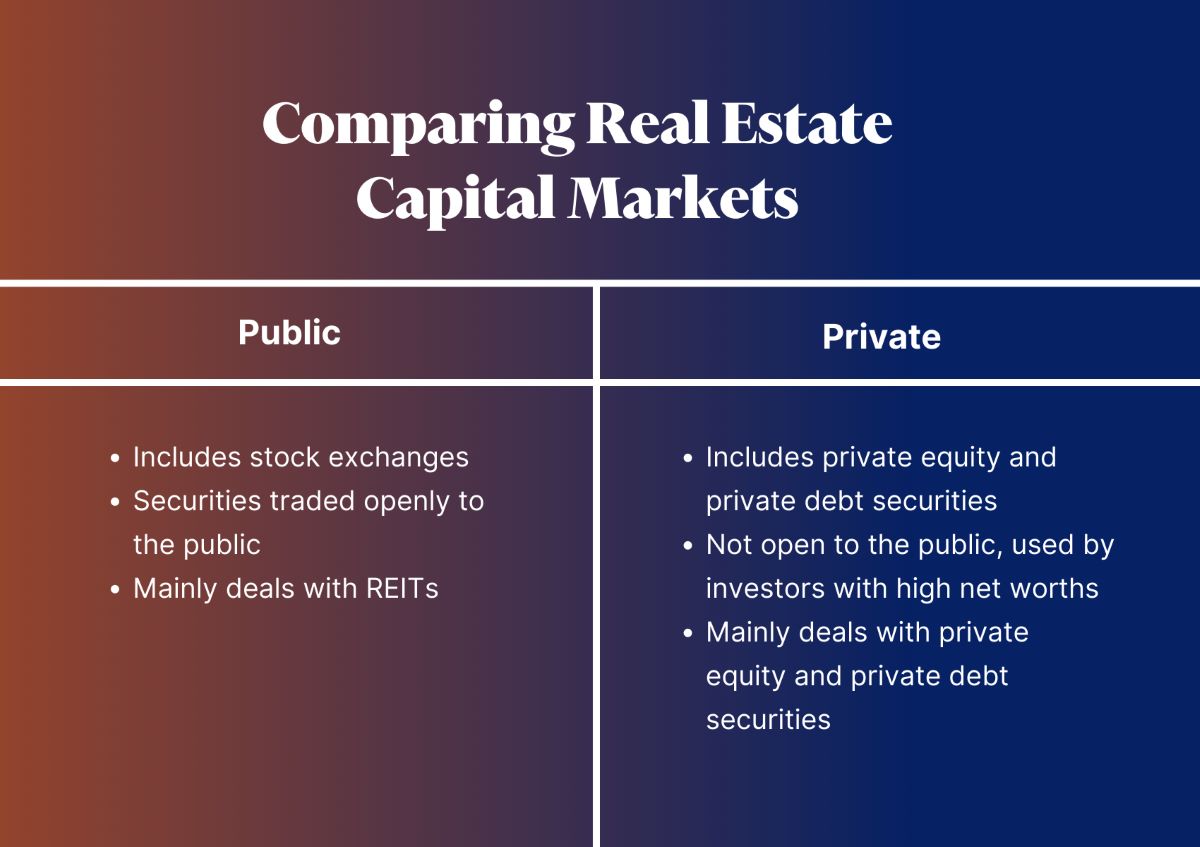

In accounting, real estate assets are classified based on their purpose and usage. The classification of real estate assets affects how they are accounted for and presented in financial statements. There are typically two main classifications of real estate in accounting: “held for use” and “held for investment.”

Held for Use: Real estate assets classified as “held for use” are properties that are owned and used directly by an entity for its own operations. These properties are essential for conducting business activities. For example, a manufacturing company may own a building and land for its production facilities, or a retail business may own a storefront for its operations. Held for use properties are recorded on the balance sheet as tangible assets and are subject to periodic depreciation expenses to reflect the wear and tear over time. The depreciation expenses reduce the value of the asset on the balance sheet and are recorded as expenses on the income statement.

Held for Investment: Real estate assets classified as “held for investment” are properties that are owned with the primary purpose of generating income or capital appreciation. These properties are not used directly for the entity’s operations but are held as investment assets. Examples of held for investment properties include rental properties, undeveloped land held for future development or sale, and real estate investments held through ownership in real estate investment trusts (REITs) or participation in real estate funds. Held for investment properties are also recorded on the balance sheet as tangible assets, but they are not subject to depreciation. Instead, they are periodically evaluated for impairment and their value may be adjusted based on changes in fair market value.

It’s important to note that the classification of real estate assets can have significant implications for how they are reported in financial statements. Assets held for use are typically presented under property, plant, and equipment (PP&E) on the balance sheet, while assets held for investment are presented as investments on the balance sheet. Each classification has different accounting treatment and disclosure requirements.

The classification of real estate assets in accounting is essential for providing transparency and clarity in financial reporting. It allows stakeholders to understand the purpose of real estate assets and their impact on an entity’s financial position and performance. Additionally, it helps investors and analysts assess the nature and risk associated with an entity’s real estate holdings and make informed investment decisions.

Different Types of Real Estate Assets

Real estate assets encompass a wide range of properties with diverse purposes and characteristics. Understanding the different types of real estate assets is crucial for investors, businesses, and individuals involved in the real estate industry. Here are some of the main types of real estate assets:

- Residential Real Estate: This category includes properties primarily intended for residential purposes, such as single-family homes, townhouses, condominiums, and apartments. Residential real estate assets can be owned by individuals, investors, or companies and are often used for rental or personal use.

- Commercial Real Estate: Commercial real estate refers to properties that are used for commercial or business activities. It includes office buildings, retail spaces, shopping centers, hotels, and warehouses. Commercial real estate assets generate income through leasing or renting space to businesses.

- Industrial Real Estate: Industrial real estate comprises properties used for industrial purposes, including manufacturing, distribution, and warehousing. Examples include factories, industrial parks, logistics centers, and storage facilities. Industrial real estate assets are typically designed to accommodate specialized equipment and machinery.

- Mixed-Use Real Estate: Mixed-use properties combine multiple types of real estate within a single development. These properties integrate residential, commercial, and sometimes even recreational spaces. Mixed-use real estate often aims to create a sense of community and convenience by providing a variety of amenities and services in one location.

- Vacant Land: Vacant land refers to undeveloped or unoccupied land without any structures. It can be used for future development, agricultural purposes, or held for investment. Vacant land is valued based on its location, potential for development, or any natural resources it may possess.

- Special Purpose Real Estate: Special purpose real estate refers to properties designed and built for specific purposes. Examples include healthcare facilities like hospitals and clinics, educational institutions, religious buildings, and recreational properties such as stadiums, arenas, and theme parks. These properties are typically tailored to meet specific operational requirements.

- Real Estate Investment Trusts (REITs): REITs are investment vehicles that pool funds from multiple investors to invest in a diversified portfolio of income-generating real estate properties. REITs offer investors the opportunity to participate in real estate ownership without directly owning and managing properties.

- Real Estate Development Projects: Real estate development includes the process of acquiring land, obtaining permits, and constructing buildings or infrastructure. These development projects can range from residential housing developments to large-scale commercial or mixed-use projects.

These different types of real estate assets serve various purposes and have unique characteristics and investment potential. Understanding the distinctions between each type is crucial for making informed decisions, assessing risk, and determining the appropriate investment strategy in the real estate market.

Accounting for Real Estate Investments

Accounting for real estate investments involves the proper recognition, measurement, and reporting of the financial activities related to the acquisition, use, and disposal of real estate assets. Accurate and transparent accounting practices are essential for real estate investors, developers, and businesses to effectively manage and report their real estate holdings. Here are some key considerations in accounting for real estate investments:

Initial Recognition: When a real estate investment is acquired, it should be initially recognized on the balance sheet at its cost, which includes the purchase price and any related costs, such as legal fees, commissions, or refurbishment expenses. This cost becomes the basis for subsequent measurement and valuation.

Subsequent Measurement: After initial recognition, real estate investments are typically measured at cost less accumulated depreciation, amortization, or impairment. Depreciation is the systematic allocation of the cost of the investment over its estimated useful life, reflecting the wear and tear or obsolescence of the asset. Amortization may be applicable to certain leasehold improvements or intangible assets associated with the investment. Impairment occurs when the carrying value of the investment exceeds its recoverable amount, requiring a downward adjustment in value.

Income Recognition: Real estate investments that generate rental income are typically accounted for on an accrual basis. Rental income is recognized as revenue in the period it is earned, regardless of when the cash is received. Expenses related to the real estate investment, such as property maintenance, insurance, and property management fees, are recognized in the period incurred. The net rental income is reported on the income statement.

Fair Value Measurement: Real estate investments held for investment purposes may be subject to fair value measurement. Fair value is the estimated price that would be received if the asset were to be sold in an orderly transaction between market participants at the measurement date. Fair value measurement involves the use of valuation techniques, such as appraisal reports, market comparisons, or discounted cash flow analysis. Changes in fair value are recognized in the income statement or other comprehensive income, depending on the specific accounting standards.

Disclosure Requirements: Real estate investments are subject to various disclosure requirements to provide transparency and allow users of financial statements to understand the nature and risks associated with these investments. These disclosures may include information about significant lease agreements, fair value measurements, commitments, contingencies, and related party transactions.

Proper accounting for real estate investments is crucial for accurate financial reporting, compliance with accounting standards, and effective decision-making. Compliance with applicable accounting standards, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP), is essential to ensure consistency and comparability of financial information related to real estate investments.

Real estate accounting may involve complexities due to the unique characteristics of real estate assets, such as their physical nature, market valuation uncertainties, and long-term investment horizons. As such, it’s crucial for real estate investors and businesses to work with qualified accountants or financial professionals with expertise in real estate accounting to ensure proper recording, reporting, and analysis of their real estate investments.

Measurement and Reporting of Real Estate Assets

The measurement and reporting of real estate assets play a crucial role in providing accurate and transparent financial information. Real estate assets can have significant value and impact an entity’s financial statements. Therefore, proper measurement and reporting practices are essential for investors, businesses, and other stakeholders. Here are some key aspects of measuring and reporting real estate assets:

Valuation Methods: Real estate assets are typically measured at their fair value. Fair value is the estimated amount that would be received from selling the asset in an orderly transaction between market participants at the measurement date. Various valuation methods are used to determine the fair value of real estate assets. These methods include the market approach, which compares the property to similar properties in the market, the cost approach, which estimates the cost of replacing the asset, and the income approach, which estimates the present value of future cash flows generated by the property.

Depreciation and Amortization: Real estate assets, particularly buildings and improvements, are subject to depreciation. Depreciation is the systematic allocation of the asset’s cost over its estimated useful life. The depreciation expense is recorded on the income statement and reduces the carrying value of the asset on the balance sheet. Additionally, certain real estate assets may also involve amortization, which applies to intangible assets or leasehold improvements associated with the property.

Revaluation: Real estate assets may be subject to revaluation in certain circumstances. Revaluation is the process of adjusting the carrying value of an asset to reflect its fair value at a specific point in time. Revaluation is typically conducted when there is a significant change in market conditions or when the asset’s carrying value deviates significantly from its fair value. Revaluation can result in a gain or loss, which is recognized in the income statement.

Disclosure Requirements: Real estate assets have specific disclosure requirements that provide relevant information to users of financial statements. These disclosures typically include details about significant real estate transactions, property holdings, rental income, leasing arrangements, vacancies, commitments, and contingent liabilities related to real estate assets. The disclosures aim to provide transparency and enable stakeholders to assess the nature and risks associated with the real estate assets.

Segment Reporting: Real estate assets may be segregated into specific segments based on their characteristics or usage. Segment reporting allows entities to provide detailed information on the performance and financial position of different segments of their real estate portfolio. This information enables stakeholders to analyze the profitability, risks, and growth prospects of each segment individually.

Accurate measurement and reporting of real estate assets are crucial for various reasons. It allows investors to make informed decisions based on reliable financial information, helps entities assess the financial impact of their real estate holdings, and provides regulators with information to ensure compliance with accounting standards. Adequate measurement and reporting practices also facilitate comparison between different entities and contribute to transparency and trust in the real estate industry.

Key Financial Metrics for Real Estate Accounting

In real estate accounting, several key financial metrics are used to assess the performance and financial health of real estate assets and investments. These metrics provide valuable insights into the profitability, efficiency, and sustainability of the real estate portfolio. Here are some key financial metrics commonly used in real estate accounting:

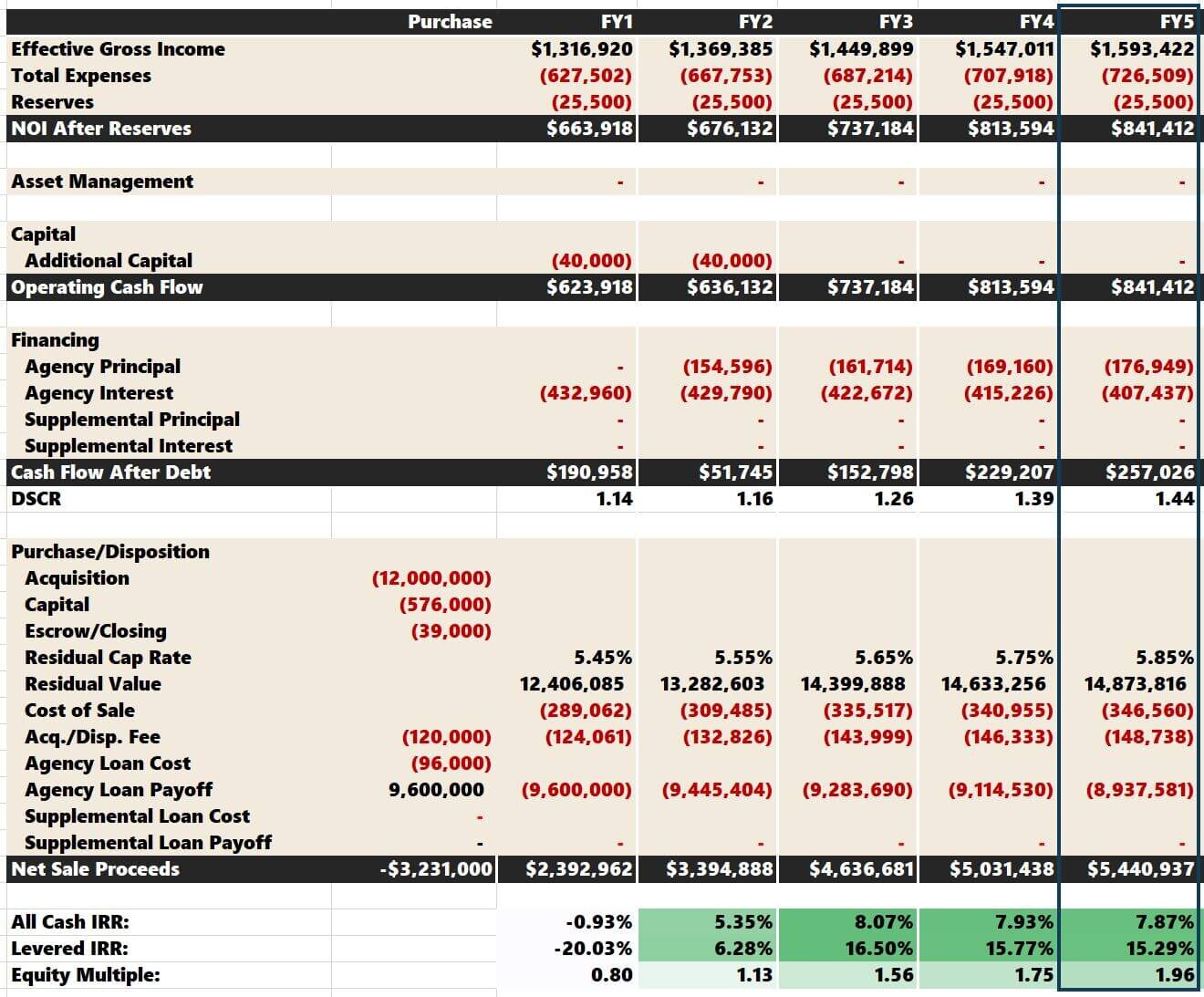

Net Operating Income (NOI): Net Operating Income is a fundamental metric in real estate accounting that provides a snapshot of the property’s profitability. It is calculated by subtracting operating expenses from the property’s gross rental income. NOI helps assess the property’s ability to generate income as it excludes factors such as debt and tax considerations.

Cash Flow: Cash Flow is another important metric that indicates the actual amount of cash generated or consumed by the real estate investment. It considers the inflow of rental income and other revenue sources, minus operating expenses, debt service, and capital expenditures. Positive cash flow is essential for maintaining the property’s viability and meeting financial obligations.

Capitalization Rate (Cap Rate): The Cap Rate is a widely used metric to determine the rate of return on a real estate investment. It is calculated by dividing the property’s net operating income by its market value or purchase price. Cap Rate helps investors compare different real estate opportunities and assess the potential profitability and risk associated with a property.

Return on Investment (ROI): ROI measures the return earned on an investment relative to its cost. In real estate, ROI is calculated by dividing the property’s net profit or cash flow by the total amount invested. ROI helps assess the profitability and efficiency of the investment and serves as a benchmark for comparing different investment opportunities.

Vacancy Rate: The Vacancy Rate represents the percentage of unoccupied or vacant rental units or space within a property. It is calculated by dividing the number of vacant units by the total number of units or the total available rental space. The Vacancy Rate provides insights into the property’s ability to attract and retain tenants, and it helps assess the potential rental income and the overall market demand for the property.

Debt Service Coverage Ratio (DSCR): DSCR measures the property’s ability to cover its debt obligations using its net operating income. It is calculated by dividing the property’s NOI by its annual debt payments. The DSCR helps assess the property’s financial stability and its capacity to generate sufficient income to service its debt.

Equity Ratio: The Equity Ratio measures the proportion of the property’s value that is financed through equity rather than debt. It is calculated by dividing the property’s total equity by its total asset value. A higher equity ratio indicates a lower financial risk and greater ownership stake in the property.

Return on Equity (ROE): ROE is a measure of the return earned on the equity invested in a real estate property. It is calculated by dividing the property’s net income by its equity investment. ROE helps assess the profitability and efficiency of the equity investment and helps measure the return generated by the investor’s ownership stake.

These key financial metrics provide valuable insights into the performance and financial viability of real estate assets and investments. They help investors, developers, and entities in making informed decisions, assessing risk, and evaluating the success of their real estate strategies.

Challenges in Real Estate Accounting

Real estate accounting poses several challenges due to the unique characteristics of real estate assets and the complexities involved in their measurement and reporting. These challenges require careful consideration and expertise to ensure accurate and compliant accounting practices. Here are some common challenges in real estate accounting:

Valuation Uncertainty: Real estate assets are often subject to valuation uncertainties due to the lack of an active market or the unique nature of the properties. Determining the fair value of real estate assets can be challenging, as it requires taking into account various factors such as location, condition, market conditions, and comparable sales. Valuation specialists or independent appraisers may be necessary to ensure proper valuation practices.

Revenue Recognition: Revenue recognition in real estate accounting can be complex, especially for long-term lease agreements or real estate development projects. Determining when and how to recognize revenue from leases or development contracts can be challenging due to factors such as lease incentives, contingent rent, lease modifications, and contract complexities. Compliance with accounting standards, such as the International Financial Reporting Standards (IFRS 16) or the Generally Accepted Accounting Principles (GAAP), is crucial for proper revenue recognition.

Lease Accounting: Accounting for leases can be challenging, particularly with the implementation of new lease accounting standards, such as IFRS 16 and ASC 842. The accounting for operating leases has changed, requiring lessees to recognize lease assets and liabilities on the balance sheet. The identification, measurement, and disclosure of lease information can be complex, especially for entities with a large portfolio of leased properties.

Accounting for Real Estate Investment Trusts (REITs): Real Estate Investment Trusts (REITs) have specific accounting requirements. REITs must distribute a significant portion of their taxable income to shareholders, which affects the recognition and reporting of revenue and expenses. Additionally, the valuation and accounting treatment of investment properties held by REITs may differ from those of other real estate entities, requiring specialized knowledge in REIT accounting.

Complexity of Joint Ventures and Partnerships: Real estate investments often involve joint ventures or partnerships, where multiple entities pool resources and share ownership. Accounting for joint ventures and partnerships can be challenging, requiring careful consideration of the ownership structure, profit sharing, distributions, and the appropriate equity method of accounting.

Compliance with Regulatory Requirements: Real estate accounting is subject to various regulatory requirements, such as tax regulations, local laws, and accounting standards. Remaining compliant with these requirements can be challenging, as they may differ across jurisdictions and change over time. Staying updated on regulatory changes and working with qualified professionals is essential to ensure compliance.

Complex Financial Reporting: Real estate entities, particularly those with extensive property portfolios, may face difficulties in preparing comprehensive and accurate financial reports. Consolidation of financial statements, segment reporting, and the necessary disclosures for real estate assets can be complex and time-consuming.

Addressing these challenges requires a deep understanding of real estate accounting principles, knowledge of applicable accounting standards, and access to specialized resources. Engaging the expertise of skilled accountants and staying updated on industry developments can help overcome these challenges and ensure accurate and compliant real estate accounting practices.

Importance of Real Estate Accounting

Real estate accounting plays a crucial role in the financial management, decision-making, and transparency of the real estate industry. Accurate and transparent accounting practices are essential for various stakeholders, including investors, businesses, lenders, and regulators. Here are some key reasons highlighting the importance of real estate accounting:

Financial Transparency: Proper accounting practices in real estate provide transparency and accurate reporting of financial information related to real estate assets. This transparency enables stakeholders to evaluate the financial health and performance of entities involved in real estate activities. Investors can make informed decisions based on reliable financial information, lenders can assess the creditworthiness of borrowers, and regulators can ensure compliance with accounting standards.

Asset Valuation: Real estate accounting ensures proper valuation of real estate assets. Real estate assets often represent a significant portion of an entity’s total assets and value. Accurate valuation is necessary for financial reporting, determining capital gains or losses, assessing property tax obligations, and making informed investment decisions.

Investment Analysis: Real estate accounting provides critical information for investment analysis. Investors evaluate potential real estate investments based on financial metrics such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Return on Investment (ROI). Accurate accounting practices enable investors to assess the profitability, risks, and returns associated with different real estate investment opportunities.

Financial Decision-Making: Real estate accounting data is essential for making informed financial decisions. Entities involved in real estate activities rely on financial information to evaluate the viability of property acquisitions, determine appropriate rental rates, assess the need for property improvements, and make strategic decisions such as property sales or expansions.

Tax Compliance: Real estate accounting is crucial for meeting tax obligations. Property owners and real estate entities must accurately report income, expenses, and capital gains to comply with tax regulations. Proper accounting practices facilitate the preparation of financial statements and tax returns, enabling entities to accurately calculate taxes and meet reporting requirements.

Risk Management: Effective real estate accounting allows entities to identify and manage financial risks associated with real estate assets. By accurately assessing the financial implications of real estate holdings, entities can proactively address issues such as liquidity challenges, debt service obligations, and changes in market conditions. Furthermore, real estate accounting assists in identifying potential risks in lease agreements, property impairments, and potential legal and regulatory compliance issues.

Financial Reporting Standards: Compliance with accounting standards, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP), is crucial in real estate accounting. Adhering to these standards promotes consistency, comparability, and transparency in financial reporting, fostering trust among stakeholders and facilitating fair evaluation of real estate entities.

Overall, real estate accounting is of paramount importance in providing accurate financial information, facilitating investment decisions, managing risk, and ensuring compliance with regulatory requirements. By maintaining proper accounting practices, entities can enhance transparency, mitigate financial risks, and make sound financial decisions in the dynamic and complex real estate industry.

Conclusion

Real estate accounting is a vital component of the real estate industry, contributing to financial transparency, accurate valuation, and informed decision-making. The proper measurement and reporting of real estate assets, along with the analysis of key financial metrics, enable investors, businesses, and stakeholders to assess the performance and financial health of real estate investments.

Through accurate valuation methods, such as fair value measurement, depreciation, and amortization, real estate assets are properly reflected on the balance sheet, allowing for a true representation of the entity’s financial position. Key financial metrics, including net operating income (NOI), cash flow, capitalization rate (Cap Rate), and return on investment (ROI), provide insights into the profitability, efficiency, and sustainability of the real estate portfolio.

However, real estate accounting does come with challenges, such as the uncertainty in valuation, complex revenue recognition for long-term leases, compliance with lease accounting standards, and the complexity of joint ventures and partnerships. Overcoming these challenges requires expertise, staying up-to-date with accounting standards, and engaging qualified professionals.

The importance of real estate accounting cannot be overstated. It provides financial transparency, facilitates investment analysis and decision-making, ensures tax compliance, enables risk management, and promotes adherence to accounting standards. Accurate financial reporting fosters trust among stakeholders, supports fair evaluation of real estate entities, and contributes to the overall integrity of the real estate industry.

In conclusion, real estate accounting is a crucial discipline that plays a significant role in the management, evaluation, and transparency of real estate assets and investments. By employing proper accounting practices, entities involved in real estate activities can effectively navigate the ever-evolving real estate landscape, make informed decisions, and achieve their financial objectives.