Home>Finance>Which Most Effectively Describes What Weaken The Stock Market In The Late 1920s?

Finance

Which Most Effectively Describes What Weaken The Stock Market In The Late 1920s?

Published: November 24, 2023

Explore the impact of finance on the late 1920s stock market crash. Discover what factors contributed to weakening the stock market in this crucial period

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The stock market crash of 1929, also known as Black Tuesday, was a pivotal event in American history that marked the beginning of the Great Depression. It was a time of economic turmoil, with the stock market experiencing a rapid decline that sent shockwaves through the financial landscape. But what were the factors that led to the collapse of the stock market in the late 1920s?

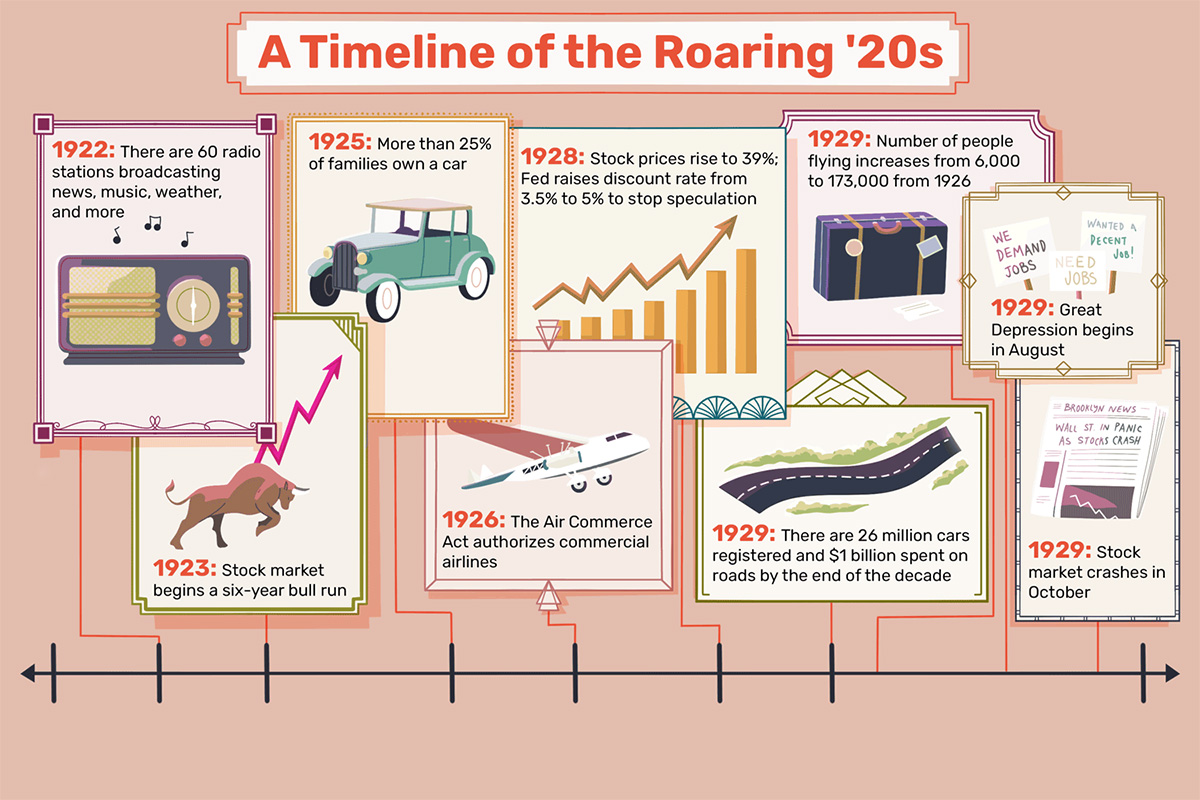

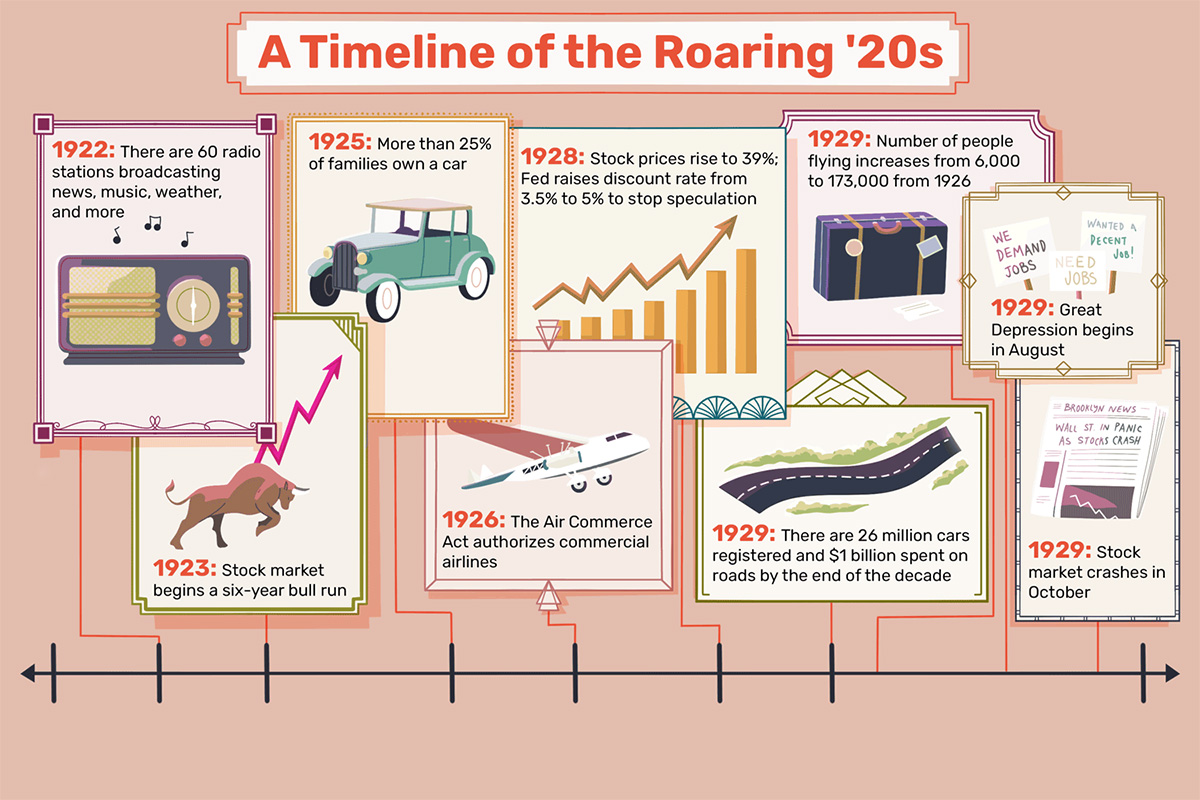

In order to understand the events that unfolded, it is important to first examine the state of the economy in the 1920s. This was a period of significant economic growth and prosperity, often referred to as the Roaring Twenties. The aftermath of World War I led to a surge in industrial production, new consumer goods, and increased consumer spending. The stock market seemed like a symbol of this prosperity, with prices steadily rising.

However, beneath the surface of this flourishing economy, there were several factors that were destabilizing the stock market and setting the stage for its eventual collapse. Speculation and excessive buying, overvaluation of stocks, margin trading, a weak banking system, agricultural crisis, and international economic conditions were some of the key factors that weakened the stock market in the late 1920s.

This article will delve into each of these factors, exploring how they contributed to the crash and their lasting impact on the economy. By understanding these factors, we can gain a better understanding of the events leading up to the stock market crash and the lessons we can learn from this tumultuous period in history.

Economic growth in the 1920s

The 1920s was a decade of tremendous economic growth and prosperity in the United States. After the end of World War I, the country experienced a period of rapid industrialization, technological advancements, and increased consumer spending. This economic boom, often referred to as the Roaring Twenties, created the ideal conditions for the stock market to flourish.

Industrial production soared during this time, with new factories and industries emerging across the country. The automobile industry, in particular, experienced significant growth with the assembly line production pioneered by Henry Ford. This, in turn, led to increased employment opportunities and higher incomes for many Americans.

Technological advancements also played a major role in driving economic growth. The widespread adoption of electricity, advancements in telecommunications, and the emergence of new consumer goods like radios and refrigerators revolutionized daily life and fueled consumer spending.

Consumer confidence was high, and people were willing to invest their money in the stock market, hoping to take advantage of the seemingly endless upward trend in stock prices. The stock market became a symbol of success and prosperity, and many individuals saw it as a way to make quick profits.

The Federal Reserve, the central banking system of the United States, played a role in stimulating economic growth by keeping interest rates low. This facilitated borrowing and encouraged business expansion and investment. However, the low-interest-rate environment also contributed to excessive buying and speculation in the stock market.

Overall, the economic growth of the 1920s laid the foundation for the widespread optimism and enthusiasm in the stock market. However, this rapid expansion also created an environment ripe for instability and excesses, setting the stage for the eventual collapse of the stock market in the late 1920s.

Speculation and Excessive Buying

One of the key factors that weakened the stock market in the late 1920s was speculation and excessive buying. The booming economy and the allure of making quick profits led to a flurry of speculative activity in the stock market.

Speculation, in this context, refers to the practice of buying stocks with the expectation of selling them at a higher price in the near future. Many individuals, including both seasoned investors and inexperienced traders, jumped into the market with the intention of making quick fortunes.

As stock prices continued to rise, fueled by the economic growth and optimism of the time, investors became increasingly confident in the market’s ability to deliver high returns. This led to a self-perpetuating cycle of buying, with investors pouring more and more money into the stock market.

Excessive buying was driven by a belief that stock prices would continue to rise indefinitely, leading to an overvaluation of stocks. Investors were not necessarily focused on the underlying value of the companies they were investing in, but rather on the potential for future profits.

This speculative mania created an artificial demand for stocks, driving prices even higher. As a result, the price-to-earnings ratios of many stocks reached unsustainable levels. This meant that investors were paying a significant premium for stocks compared to the actual earnings of the underlying companies.

Furthermore, the practice of buying stocks on margin became increasingly popular during this time. Margin trading allowed investors to purchase stocks using borrowed money, with the expectation that the profits from the stock market would exceed the interest on the borrowed funds.

While buying stocks on margin could amplify gains in a rising market, it also exposed investors to significant risks. In the event of a market downturn, investors who had purchased stocks on margin would need to repay their loans, potentially leading to forced selling and further exacerbating the decline in stock prices.

In summary, speculation and excessive buying contributed to the instability of the stock market in the late 1920s. The belief in endless price appreciation, overvaluation of stocks, and the widespread use of margin trading created a market that was vulnerable to a rapid decline when sentiment changed.

Overvaluation of Stocks

Another significant factor that weakened the stock market in the late 1920s was the rampant overvaluation of stocks. As investors engaged in speculative buying and the market reached new heights, many stocks became increasingly disconnected from their fundamental value.

During the Roaring Twenties, the stock market experienced a period of unprecedented growth. This led to a widespread belief that stock prices would continue to rise indefinitely, creating unrealistic expectations and driving investors to pay exorbitant prices for shares.

As a result, the price-to-earnings (P/E) ratios of many stocks soared to unjustifiable levels. The P/E ratio compares the price of a stock to its annual earnings per share and is used as a measure of a company’s valuation. In a healthy market, P/E ratios tend to stay within a certain range, reflecting the company’s earning potential.

However, during the late 1920s, P/E ratios reached dizzying heights. Some stocks were being traded at P/E ratios well above their historical averages. This meant that investors were paying far more for a company’s earnings than they would typically be willing to pay.

The overvaluation of stocks was driven by a collective fear of missing out on potential gains. Investors were willing to justify high prices based on the expectation that future earnings would catch up to the inflated valuations. This type of speculative mindset led to a bubble-like market, where prices were no longer reflective of the underlying value of the companies.

Furthermore, the overvaluation of stocks was exacerbated by the lack of regulations and oversight in the stock market at the time. The Securities and Exchange Commission (SEC), which was established to enforce securities laws and protect investors, did not exist until 1934. Without proper oversight, fraudulent activities and market manipulation became more prevalent, contributing to the overvaluation and instability of the market.

Ultimately, the overvaluation of stocks set the stage for a significant market correction. When investors realized that the prices they had paid were not sustainable, panic selling ensued and stock prices plummeted. The overvaluation of stocks was a clear indication that the market had become disconnected from reality, leading to a crash that had devastating consequences.

Margin Trading and Increased Debt

Margin trading, a practice that allows investors to buy stocks using borrowed money, played a significant role in weakening the stock market in the late 1920s. As the market soared to new heights, many investors began leveraging their investments, taking on additional debt to finance their stock purchases.

Margin trading works by allowing investors to buy stocks with a portion of their own funds and borrowing the remaining amount from their broker. This practice offers the potential for greater profits because it allows investors to control a larger number of shares. However, it also magnifies losses if the market goes south.

During the 1920s, margin trading became increasingly popular due to the prevailing belief that the stock market would continue to rise indefinitely. Investors saw it as a way to maximize their returns and capitalize on the seemingly endless upward trend in stock prices.

However, the use of margin trading exposed investors to significant risks. In a declining market, investors who had purchased stocks on margin would find themselves facing margin calls – demands from their brokers to increase the collateral in their accounts due to the decreased value of the stocks.

If investors were unable to meet these margin calls, their brokers would liquidate their positions, selling their shares at potentially unfavorable prices. This forced selling, known as a margin sell-off, put additional downward pressure on stock prices and contributed to the overall decline of the market.

Moreover, as more investors engaged in margin trading, the overall level of debt in the market increased. This created a fragile situation where a small downward movement in the market could trigger a cascade of margin calls and forced selling, further worsening the downward spiral of stock prices.

Additionally, the increased reliance on debt created a vulnerability in the financial system. Banks and financial institutions were heavily exposed to margin loans, as they were the primary lenders in this market. When investors were unable to repay their loans, banks faced significant losses, leading to financial instability.

In summary, margin trading and the resulting increase in debt placed significant pressure on the stock market in the late 1920s. The use of leverage amplified both gains and losses, increasing market volatility and contributing to a downward spiral when sentiment shifted. The subsequent margin calls and forced selling further exacerbated the decline, leading to the eventual crash of the stock market in 1929.

Weak Banking System

The fragile state of the banking system in the late 1920s was another factor that weakened the stock market and contributed to its eventual collapse. The banking system at that time faced numerous challenges that further exacerbated the economic turmoil of the era.

One of the primary issues with the banking system was its lack of regulation and oversight. Prior to the establishment of the Federal Deposit Insurance Corporation (FDIC) in 1933, there was no government guarantee for bank deposits. This lack of protection meant that depositors were at risk of losing their savings if a bank failed.

Furthermore, many banks in the 1920s engaged in speculative activities, investing depositors’ funds in the stock market. This practice, known as “investment banking,” exposed the banks to significant risks, as they became heavily dependent on the performance of the stock market.

When the stock market began to decline in the late 1920s, banks faced substantial losses on their investments and saw the value of their assets decrease. This led to a loss of confidence in the banking system as depositors rushed to withdraw their funds, exacerbating the liquidity crisis.

With the growing panic and the simultaneous withdrawal of funds, banks faced a shortage of available cash reserves to meet the demands of depositors. In an attempt to prevent bank runs, many banks had to recall loans and reduce lending, further stifling economic activity.

Moreover, the weak banking system at that time was also plagued by inadequate capitalization. Banks were often undercapitalized, meaning they didn’t have sufficient funds to cover potential losses. This lack of capital made the banks more vulnerable to economic shocks and increased the likelihood of bank failures.

As banks failed, depositors lost their savings, leading to a loss of confidence in the financial system. This loss of confidence had a ripple effect on the stock market, as investors became wary of holding stocks and sought to liquidate their holdings.

In summary, the weak banking system of the late 1920s, characterized by lack of oversight, speculative investing, inadequate capitalization, and a lack of depositor protection, heightened the instability in the economy. The simultaneous decline in the stock market and withdrawal of funds from banks created a downward spiral, further weakening the stock market and exacerbating the economic crisis of the Great Depression.

Agricultural Crisis

The agricultural sector was a significant contributor to the weakening of the stock market in the late 1920s. During this time, the United States faced an agricultural crisis characterized by declining farm incomes, overproduction, and falling crop prices.

One of the main factors behind the agricultural crisis was the overexpansion of farming during World War I. In order to meet the increased demand for food, farmers took on debt to expand their operations and increase production. However, once the war ended, the demand for agricultural products plummeted.

The sharp decline in demand resulted in a surplus of agricultural commodities such as wheat, cotton, and corn. With an oversupply in the market, prices for these commodities began to drop rapidly. Farmers, who were already burdened with debt, struggled to cover their costs and make a profit.

Compounding the problem, farmers relied heavily on credit to finance their operations. They borrowed money from banks to purchase equipment, seeds, and other inputs necessary for farming. As crop prices declined, farmers found it increasingly difficult to repay their loans, leading to widespread farm bankruptcies.

The agricultural crisis not only affected farmers themselves but also had a domino effect on other sectors of the economy. Many rural banks, heavily invested in the agricultural sector, faced significant losses as farmers defaulted on their loans. As a result, these banks also faced financial distress, leading to a further weakening of the banking system.

Moreover, the decline in farm incomes impacted rural communities. With reduced purchasing power, farmers were unable to spend as much on consumer goods and services. This had a ripple effect on local businesses, leading to closures and job losses.

The agricultural crisis played a role in undermining investor confidence in the stock market. Farmers, facing financial hardships, were forced to liquidate their investments, including stocks, to cover their debts and sustain their operations. This added to the selling pressure in the market and contributed to the downward spiral in stock prices.

In summary, the agricultural crisis of the late 1920s, characterized by declining farm incomes, overproduction, falling crop prices, and widespread farm bankruptcies, had a profound impact on the weakening of the stock market. The crisis not only affected the agricultural sector but also had ripple effects on the banking system and the overall economy.

International Economic Conditions

The state of international economic conditions during the late 1920s played a significant role in weakening the stock market. The interconnectedness of global markets meant that events and economic trends in other countries had a direct impact on the U.S. economy and its financial markets.

One of the key factors that affected the stock market was the aftermath of World War I and the resulting reparations and debts owed by European countries. The Treaty of Versailles, signed in 1919, imposed heavy financial burdens on Germany, including substantial reparations payments. Germany struggled to meet these obligations, which put pressure on its economy and created uncertainty in international markets.

The economic instability in Europe was further exacerbated by the global recession that followed the post-war boom. European countries, including Great Britain, experienced economic downturns that spread to the United States. The slowdown in these economies had a negative impact on U.S. exports, reducing demand for American products and contributing to declining business revenues.

Additionally, protectionist trade policies implemented by various countries, including the U.S., further hindered international trade. The Smoot-Hawley Tariff Act of 1930, for example, increased tariffs on imported goods, leading to retaliatory measures from other countries and further dampening global trade and economic growth.

The collapse of international financial institutions also had a cascading effect on the global economy. In 1931, the Bank of United States, which had significant foreign investments, was among the banks that failed. This event sent shockwaves through financial markets and undermined investor confidence. The failure of the Austrian Creditanstalt in 1931 further intensified the panic and added to the economic downturn.

The deepening economic crisis in Europe and around the world had reverberating effects on the U.S. stock market. As investors became increasingly concerned about the instability in international markets, they started to sell off their holdings in U.S. stocks, exacerbating the downward spiral in stock prices. The interconnectedness of global financial systems meant that the problems in one country quickly spread to others, leading to a contagion effect.

In summary, the international economic conditions of the late 1920s, including the aftermath of World War I, economic downturns in Europe, protectionist trade policies, and the collapse of international financial institutions, were significant factors that weakened the stock market. The interconnected nature of the global economy meant that the problems in one part of the world could quickly spill over and contribute to the overall economic instability and decline in the U.S. stock market.

The Impact of the 1929 Stock Market Crash

The stock market crash of 1929 had far-reaching and lasting impacts on the economy, society, and the financial system. It marked the beginning of the Great Depression, a decade-long period of severe economic downturn that had significant consequences for individuals and businesses alike.

One of the immediate effects of the crash was the massive loss of wealth. As stock prices plummeted, investors saw their portfolios lose substantial value. Many individuals and businesses who had invested heavily in the stock market were suddenly faced with financial ruin.

The collapse of the stock market had a significant impact on consumer confidence. As people saw their investments vanish and uncertainty engulfed the economy, consumer spending declined sharply. This led to a decrease in demand for goods and services, triggering widespread layoffs and unemployment across sectors.

The unemployment rate surged, reaching a peak of 25% during the Great Depression. Millions of Americans lost their jobs, exacerbating the economic hardships and leading to widespread poverty and suffering. The consequences of the crash were felt by individuals and families for years to come.

The 1929 stock market crash also had a profound impact on the banking system. Many banks, heavily invested in the stock market, faced significant losses. As investors rushed to withdraw their funds, banks struggled to meet the demands for cash, leading to widespread bank failures and the loss of people’s savings.

The collapse of the banking system had a devastating effect on the overall economy. Without access to credit, businesses were unable to finance their operations and expand. This resulted in further layoffs and reduced economic activity, deepening the recession and prolonging the recovery process.

The crash had a profound impact on the government’s response to economic crises. It highlighted the need for regulatory reforms to prevent future market crashes and protect the interests of investors. As a result, financial regulations were implemented, including the establishment of the Securities and Exchange Commission (SEC) to regulate the securities industry and restore investor confidence.

The crash also led to widespread skepticism and distrust of the financial markets. Many individuals who had lost their life savings in the crash withdrew from the stock market altogether, choosing to keep their money in safer, less volatile investments or savings accounts. This contributed to a prolonged period of low market participation and slow recovery.

Overall, the 1929 stock market crash and the subsequent Great Depression had a profound impact on society, the economy, and the financial system. It shattered investor confidence, led to widespread unemployment and poverty, and prompted fundamental changes in financial regulations. The effects of the crash were felt for many years, serving as a stark reminder of the dangers of unchecked speculation and the importance of robust financial oversight.

Conclusion

The stock market crash of 1929 and the subsequent Great Depression were defining moments in American history, with far-reaching consequences for the economy, society, and the financial system. A combination of factors contributed to the weakening of the stock market in the late 1920s, leading to its eventual collapse.

The economic growth of the 1920s created an environment of optimism and excessive buying, fueled by speculation in the stock market. Stocks became overvalued, detached from their fundamental value, and fueled by margin trading and increased debt. The weak banking system, coupled with the agricultural crisis and exposure to international economic conditions, added to the instability.

The crash of 1929 resulted in a tremendous loss of wealth and shattered investor confidence. The effects were felt across society, with high unemployment, poverty, and a decline in consumer spending. The banking system suffered, leading to widespread bank failures and the loss of savings.

The events of the crash and the ensuing Great Depression prompted significant regulatory reforms, such as the creation of the SEC, to restore confidence in the financial markets and prevent similar crises in the future. These reforms helped shape the financial system and set the stage for increased oversight and investor protection.

The impact of the crash was long-lasting, with lasting effects on individual investors and the overall economy. It challenged the perception of the stock market as a symbol of prosperity and revealed the dangers of unchecked speculation and market volatility.

The lessons learned from the 1929 stock market crash and the subsequent Great Depression continue to shape financial policies and practices to this day. They remind us of the importance of prudent investing, diversified portfolios, and robust financial regulation.

In conclusion, the stock market crash of 1929 was a pivotal event in American history that had a profound impact on the economy and society. It serves as a reminder for investors, policymakers, and society as a whole to approach the financial markets with caution, prudence, and a commitment to ensuring stability and fairness.