Finance

Reinvestment: Definition, Examples, And Risks

Published: January 18, 2024

Learn about reinvestment in finance including its definition, examples, and risks. Understand how reinvesting can help grow your investments and navigate potential pitfalls.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of Reinvestment: Definition, Examples, and Risks

Welcome to our finance blog category! In this article, we will delve into the world of reinvestment, exploring its definition, providing examples, and shedding light on the potential risks involved. So, sit back, grab a cup of coffee, and let’s uncover the power of reinvestment together.

Key Takeaways:

- Reinvestment refers to the process of diverting earned income or profits back into an investment to generate additional returns.

- Two common examples of reinvestment are dividend reinvestment and compound interest reinvestment.

Now, let’s define reinvestment in finance terms. Reinvestment is the act of redirecting the income or profits generated from an investment back into the same investment, with the aim of compounding returns and fostering growth. This capital allocation strategy empowers investors to take advantage of the power of compounding, where the returns generated on the original investment are reinvested to generate even more returns.

Examples of Reinvestment:

To better understand reinvestment, let’s explore a couple of examples:

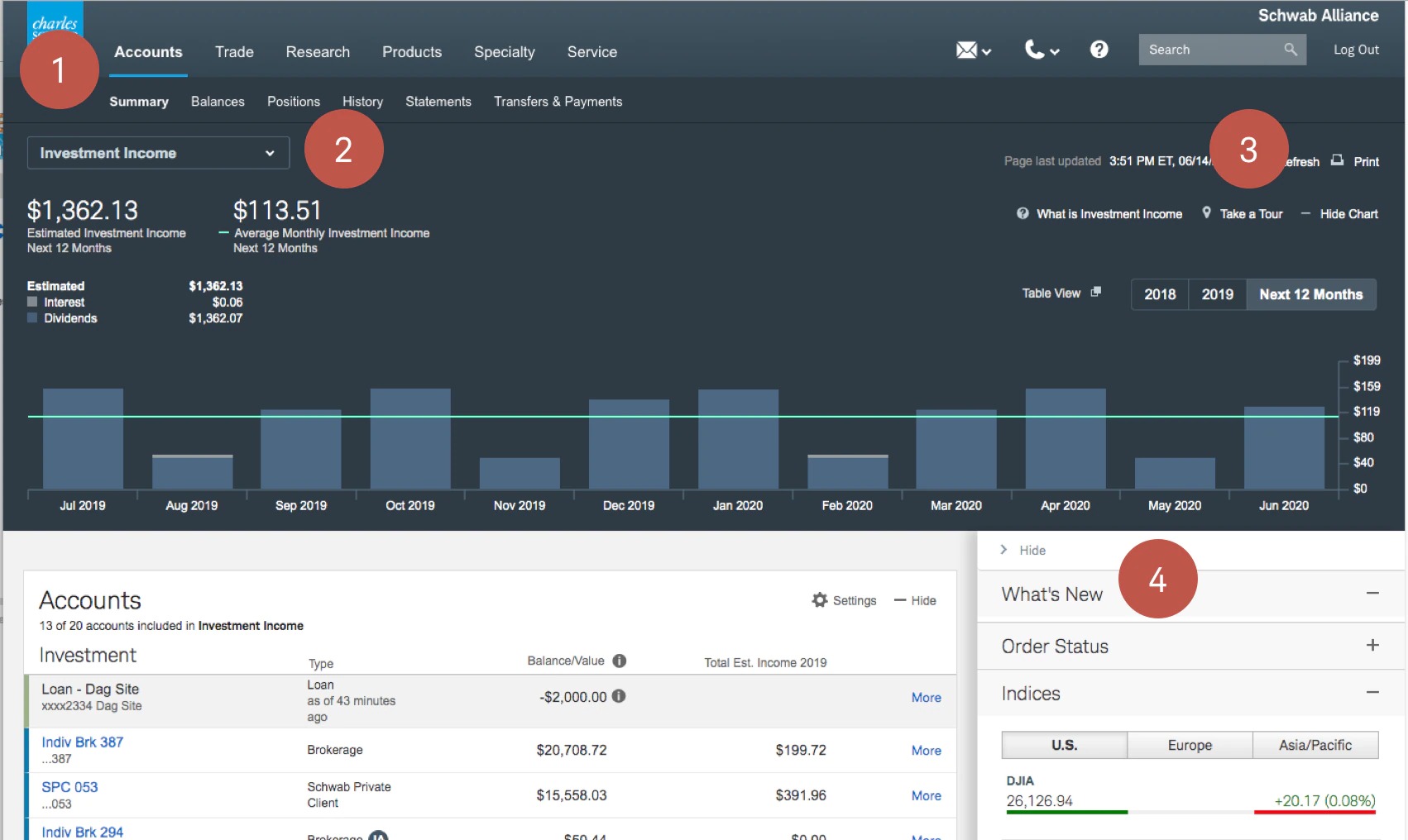

- Dividend Reinvestment: When a company distributes dividends to its shareholders, the recipients have the option to reinvest those dividends back into the company’s stock instead of receiving them as cash. By reinvesting the dividends, shareholders can purchase additional shares, increasing their ownership in the company. Over time, this reinvestment can significantly enhance the shareholder’s portfolio value.

- Compound Interest Reinvestment: Another example of reinvestment is when interest earned on an investment is reinvested back into the investment itself. For instance, if you have a savings account with compound interest, the interest earned on the principal amount is added back into the account, which then earns additional interest. This compounding effect can lead to exponential growth in your savings over time.

The Risks of Reinvestment:

While reinvestment can be a powerful strategy for wealth accumulation, it’s important to consider the associated risks:

- Market Volatility: The performance of the investment market can significantly impact the returns generated through reinvestment. During periods of market volatility, the value of investments may decline, leading to potential losses.

- Lack of Diversification: If all your investment income or profits are directed towards a single investment, you may be exposed to higher risks due to lack of diversification. It’s crucial to carefully assess and diversify your investment portfolio to mitigate this risk.

- Unpredictability: The future performance of investments is inherently unpredictable. While reinvestment aims to maximize returns, there is always a level of uncertainty associated with any investment.

It’s important to consult with a financial advisor or do thorough research before making any investment decisions involving reinvestment. Understanding the risks and seeking professional guidance can help you make informed choices and enhance your financial well-being.

In conclusion, reinvestment can be a powerful tool in growing your wealth and achieving your financial goals. By reinvesting your earnings or profits back into an investment, you can harness the magic of compounding and maximize your returns. However, it’s essential to be mindful of the risks and tread cautiously in the investment landscape. With careful planning, research, and professional guidance, you can use reinvestment to unlock the doors of financial success.