Finance

Retention Tax Definition

Published: January 20, 2024

Our comprehensive guide explains the retention tax definition in finance. Learn how it impacts businesses and individuals in this helpful resource.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Retention Tax Definition: A Comprehensive Guide

Welcome to our FINANCE category, where we dive deep into various topics related to money management, investments, and the overall world of finance. In this blog post, we will be exploring the often misunderstood concept of retention tax and providing you with a comprehensive guide to understand its definition, purpose, and implications.

Key Takeaways:

- Retention tax is a type of tax that is deducted at the source, usually by the payer, and remitted to the government on behalf of the recipient.

- It is commonly used to ensure that tax obligations are met, particularly for non-residents or individuals with specific income types.

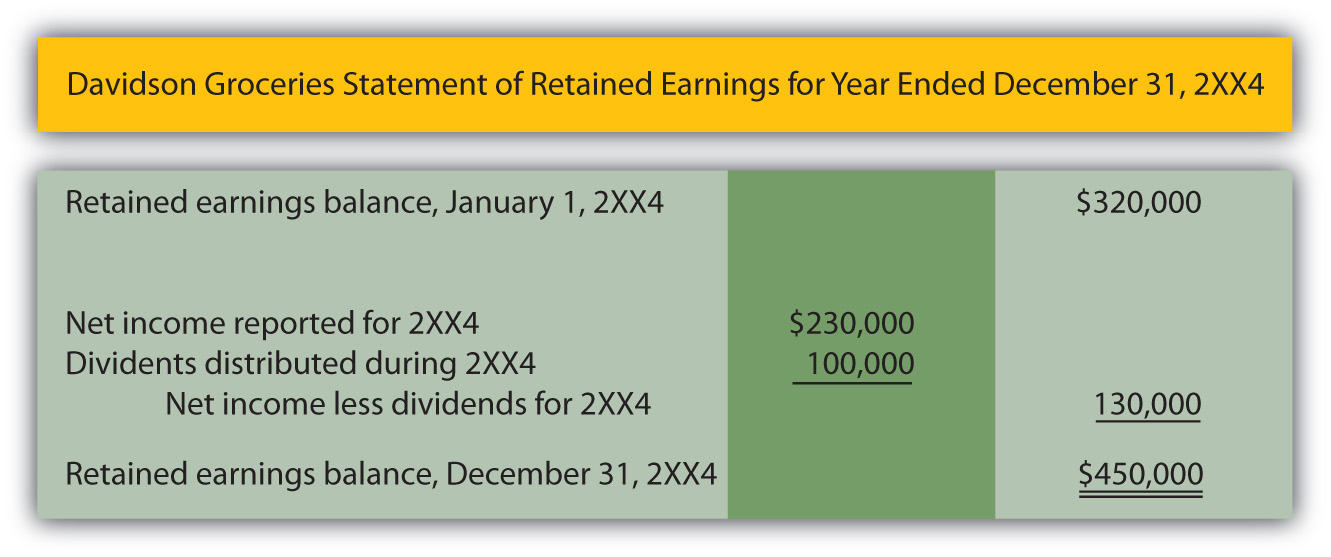

What is Retention Tax?

Retention tax, also known as withholding tax or prepaid tax, is a concept that may sound complex but is actually quite simple. It refers to a portion of tax that is withheld or deducted at the source by the payer of income, such as an employer or financial institution. This amount is then remitted to the government on behalf of the recipient, serving as a way to ensure that tax obligations are met.

Retention tax is usually applied to specific types of income, such as dividends, interest, royalties, or payments made to non-residents. It is important to note that the rate of retention tax can vary depending on the country and the nature of the income being taxed. Different countries have different rules and regulations regarding retention tax, so it is crucial to understand the specific requirements in your jurisdiction.

Why is Retention Tax Important?

Retention tax plays a vital role in the overall tax collection process. It helps governments ensure that tax is collected promptly and accurately, particularly in cases where individuals or entities may be difficult to track or are non-residents. By deducting the tax at the source, the government can have greater control over the payment of taxes, reducing the risk of tax evasion or non-compliance.

Additionally, retention tax helps streamline administrative processes. Rather than relying on individuals to calculate and pay their own taxes, the responsibility falls on the payer of income. This simplifies the tax process, both for individuals and the government, increasing efficiency and reducing the potential for errors.

The Implications of Retention Tax

For individuals or businesses receiving income subject to retention tax, there are a few important implications to consider:

- Reduced Cash Flow: Since retention tax is deducted at the source, the recipient will receive the income net of the tax. This means that the actual amount received will be less than the total amount earned.

- Potential for Tax Refund or Offset: In some cases, individuals or businesses may be able to claim a refund or offset the retention tax against their overall tax liability. This depends on various factors, including the tax laws in the relevant jurisdiction.

It is crucial to consult with a tax professional or seek guidance from the relevant tax authority to understand the specific implications of retention tax based on your circumstances.

In Conclusion

Retaining tax is an integral part of the tax system, serving as a mechanism to ensure that tax obligations are met by deducting the tax at the source. It helps simplify the tax process, increase compliance, and streamline administrative procedures. By comprehending the implications of retention tax, individuals and businesses can better manage their finances and optimize their tax strategies. For more information about retention tax or other finance-related topics, be sure to explore our other blog posts in the FINANCE category.