Home>Finance>How To Account For The Employee Retention Credit

Finance

How To Account For The Employee Retention Credit

Modified: February 21, 2024

Learn how to effectively account for the Employee Retention Credit in your finance department and maximize tax benefits for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Employee Retention Credit (ERC) is a valuable tax incentive provided by the Internal Revenue Service (IRS) to help businesses retain their employees during challenging economic times. This credit was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in response to the COVID-19 pandemic.

The ERC was designed to provide financial relief to businesses that experienced significant revenue losses or were forced to suspend operations due to COVID-19. By offering this credit, the government aims to encourage employers to keep their workers on payroll, reducing unemployment rates and supporting ongoing economic stability.

To create a seamless and efficient process for businesses, the IRS has provided clear guidelines on who is eligible for the credit, how to calculate it, and how to claim it. This article will guide you through the fundamentals of the Employee Retention Credit and help you understand the steps involved in accounting for this valuable tax incentive.

Before we dive into the details, it’s important to note that the information provided in this article is for general guidance purposes only. Tax laws and regulations are subject to change, and it’s always advisable to consult with a qualified tax professional or an accountant to ensure compliance with the most up-to-date requirements.

In the next sections, we will explore the eligibility requirements, the calculation process, and the necessary documentation for claiming the Employee Retention Credit. By understanding these essential aspects, you will be better equipped to maximize this credit and navigate the complexities of accounting for it within your business.

Eligibility Requirements for the Employee Retention Credit

To qualify for the Employee Retention Credit, businesses must meet certain eligibility criteria set forth by the IRS. Understanding these requirements is crucial in determining if your business is eligible to claim this valuable tax incentive. Let’s explore the key eligibility criteria:

- Affected Operations: To be eligible for the ERC, a business must be either partially or fully suspended due to government orders limiting commerce, travel, or group meetings.

- Significant Decline in Gross Receipts: Alternatively, if a business is not subject to a government order, it may still qualify for the ERC if it experienced a significant decline in gross receipts. The decline must be more than 50% compared to the same quarter in the previous year. Once the decline continues, eligibility remains until gross receipts recover to 80% of the previous year’s quarter.

- Period of Eligibility: The ERC is available for wages paid after March 12, 2020, and before January 1, 2022. However, the specific period of eligibility can vary depending on the business’s circumstances.

- Number of Employees: The eligibility criteria differ based on the number of employees a business has. For businesses with an average of 500 or fewer full-time employees, all wages qualify for the credit. For businesses with more than 500 full-time employees, only wages paid to employees who were not providing services due to the COVID-19-related circumstances qualify.

It’s important to note that certain businesses, such as state and local governments and their instrumentalities, and small businesses that receive Small Business Administration (SBA) loans under the Paycheck Protection Program, may not be eligible for the ERC.

To determine eligibility and calculate the credit, businesses should keep detailed records of their operations, gross receipts, and employee headcounts. Consulting with a tax professional or accountant who is well-versed in ERC guidelines can provide valuable insights and help navigate the process more effectively.

In the following sections, we will delve into the calculations involved in determining the Employee Retention Credit and discuss how businesses can claim it to maximize their potential financial benefits.

Calculating the Employee Retention Credit

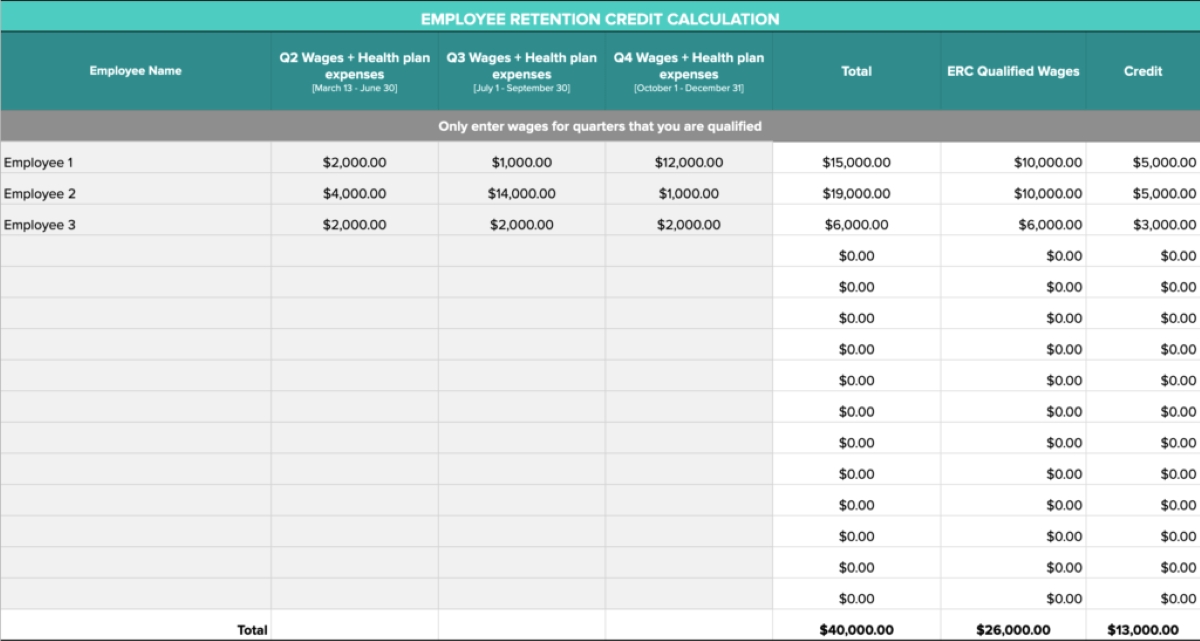

Calculating the Employee Retention Credit involves a precise formula and specific rules outlined by the IRS. By understanding the calculations involved, businesses can determine the amount of credit they are eligible to claim. Let’s explore the key considerations:

Qualified Wages: The Employee Retention Credit is calculated based on the qualified wages paid to employees. Qualified wages differ depending on the number of employees a business has. For businesses with an average of 500 or fewer full-time employees in 2019, all wages paid during the eligible period qualify for the credit. For businesses with more than 500 full-time employees, only wages paid to employees who were not providing services due to COVID-19-related circumstances qualify.

Maximum Credit: The maximum credit per employee is 70% of qualified wages, capped at $10,000 per employee for each quarter. This means the maximum credit per employee per quarter is $7,000. Thus, if a business qualifies for the ERC for all four quarters in a year, the maximum credit per employee is $28,000.

Aggregation Rules: When calculating the Employee Retention Credit, businesses must consider the aggregation rules. If a business is part of a controlled group or has common ownership with other entities, all employees and wages from those entities must be taken into account for calculating the credit.

Offset Against Payroll Taxes: The Employee Retention Credit is refundable and can be used to offset federal payroll taxes, including withheld federal income taxes, the employee portion of Social Security and Medicare taxes, and the employer’s share of Social Security and Medicare taxes.

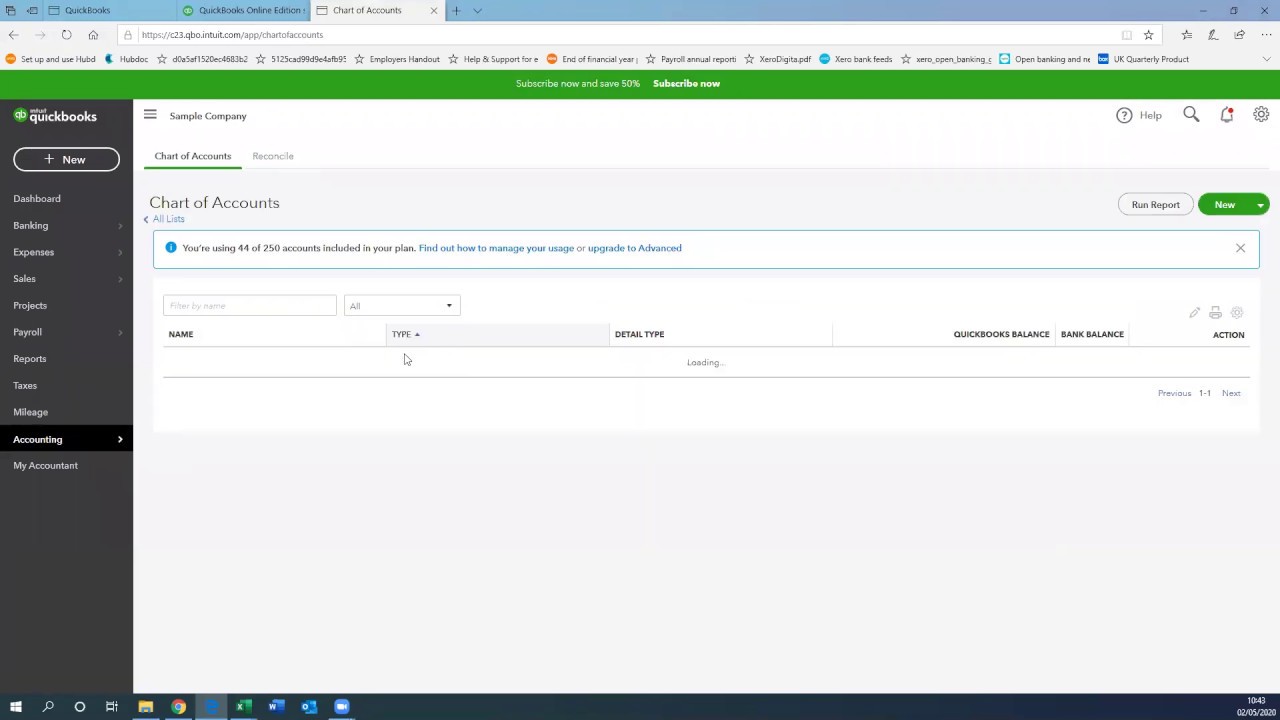

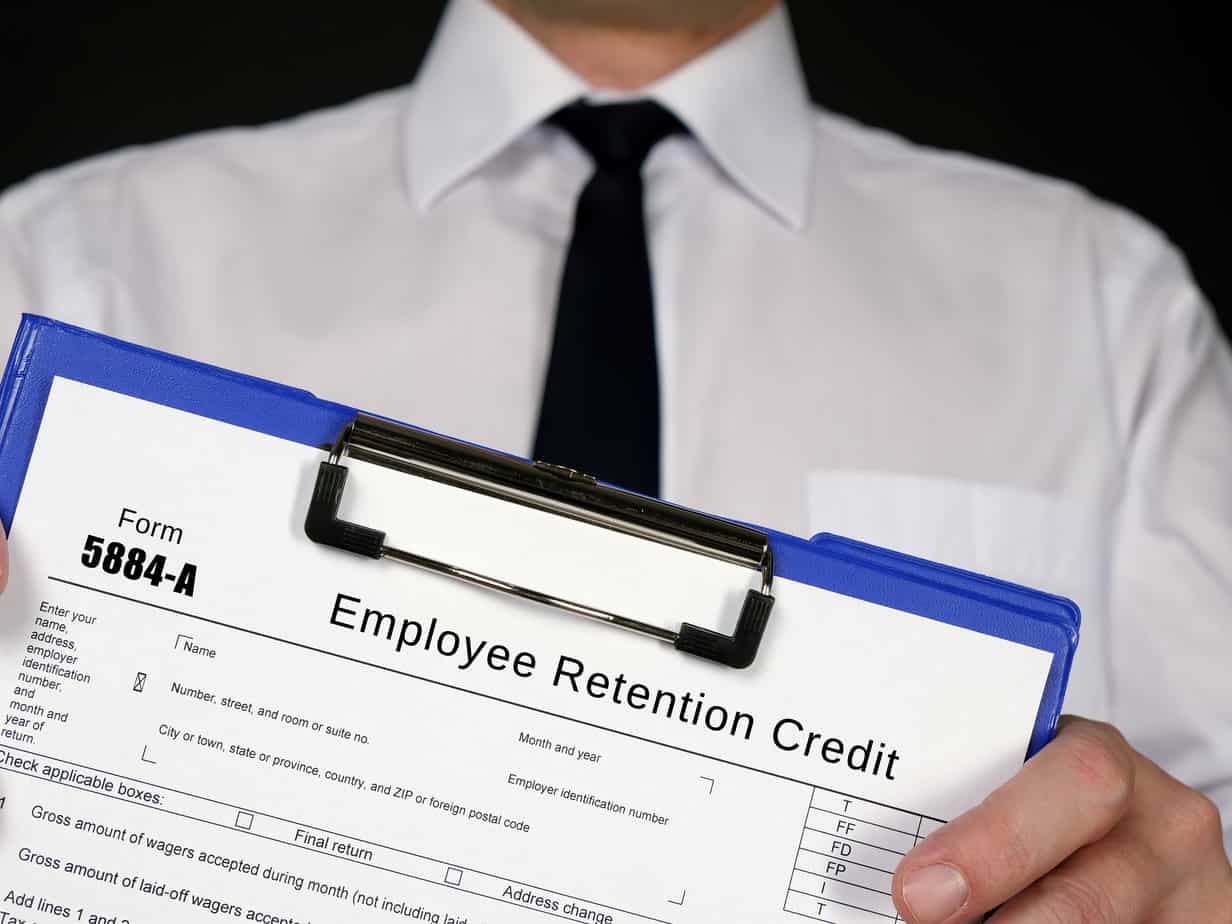

Claiming the Credit: To claim the Employee Retention Credit, businesses must report it on their federal employment tax returns, such as Form 941, Employer’s Quarterly Federal Tax Return. If the credit exceeds the total federal employment taxes due, businesses can request a refund or apply the excess to future tax liabilities.

It’s important to note that the calculations and rules surrounding the Employee Retention Credit can be complex. Seeking guidance from a qualified tax professional or accountant is highly recommended to ensure accuracy and maximize the benefits of this valuable tax incentive.

In the next section, we will discuss the documentation and recordkeeping requirements for businesses claiming the Employee Retention Credit. Adequate documentation is essential to support the credit and withstand potential IRS audits.

Claiming the Employee Retention Credit

Claiming the Employee Retention Credit involves careful documentation and accurate reporting on federal employment tax returns. By following the necessary steps, businesses can ensure they claim the credit correctly and maximize their potential financial benefits. Let’s explore the key considerations for claiming the Employee Retention Credit:

- Recordkeeping: Adequate documentation is crucial when claiming the Employee Retention Credit. Businesses must maintain records that establish eligibility, including proof of the circumstances that led to the partial or full suspension of operations or significant decline in gross receipts. Additionally, businesses should retain records of the qualified wages paid, employee counts, and any supporting documentation that shows compliance with the eligibility requirements.

- Federal Employment Tax Returns: The Employee Retention Credit is claimed on the employer’s federal employment tax return, typically Form 941, Employer’s Quarterly Federal Tax Return. Businesses should report the total qualified wages for each quarter, calculate the corresponding credit amount based on the eligible wages, and deduct the credit from the federal employment taxes owed.

- Documentation Submission: Along with the federal employment tax return, businesses should retain all documentation supporting their eligibility and calculation of the Employee Retention Credit. While the documentation does not need to be submitted with the return, it should be readily available in the event of an IRS audit or request for evidence.

- Amended Returns: If a business discovers an error or missed opportunity to claim the Employee Retention Credit in a previous quarter, they can amend their federal employment tax return and claim the credit retrospectively. However, there are time limits for filing amended returns, so businesses should consult with a tax professional to ensure timely submission.

It’s crucial to note that while businesses can claim the Employee Retention Credit, they cannot double-dip by claiming the same wages for other COVID-19 relief programs such as the Paycheck Protection Program (PPP). The wages used to determine the credit must be excluded from the forgiveness calculation of PPP loans.

Given the complexity of claiming the Employee Retention Credit and the importance of accurate documentation, seeking guidance from a qualified tax professional or accountant is highly recommended. They can provide valuable insights, ensure compliance with IRS guidelines, and help businesses navigate any challenges or concerns related to claiming the credit.

As we conclude this article, it’s important to keep in mind that tax laws and regulations are subject to change. Staying updated with the latest guidance from the IRS and consulting with professionals will ensure businesses remain compliant and take full advantage of the benefits provided by the Employee Retention Credit.

Documentation and Recordkeeping for the Employee Retention Credit

Effective documentation and recordkeeping are essential when claiming the Employee Retention Credit. The IRS requires businesses to maintain accurate records that support their eligibility and calculation of the credit. Not only does proper documentation ensure compliance, but it also helps protect businesses in the event of an audit. Let’s delve into the key considerations for documentation and recordkeeping:

- Eligibility Documentation: Businesses must retain documentation that proves their eligibility for the Employee Retention Credit. This includes government orders that partially or fully suspended operations, evidence of significant decline in gross receipts, and any other supporting documents that establish the qualifying circumstances. Gathering and organizing these documents is vital to effectively claim the credit and present evidence if required by the IRS.

- Payroll and Wage Records: Detailed payroll records are crucial when calculating the Employee Retention Credit. Businesses should maintain records that accurately reflect the wages paid to each employee for the eligible period. These records should include employee names, hours worked (if applicable), pay rates, and any other relevant information that supports the calculation of qualified wages.

- Employee Counts: The number of employees plays a significant role in determining credit eligibility and calculating the credit amount. As such, businesses should maintain records of their employee counts to accurately calculate the credit. These records should include the total number of full-time employees, as well as any additional part-time or temporary employees, if applicable.

- Timeframes: It’s important to keep track of the specific period of eligibility for the Employee Retention Credit. Businesses should document the start and end dates of the eligible timeframe, ensuring accurate reporting on their federal employment tax returns.

- Supporting Documentation: In addition to the specific documentation related to eligibility and calculation, businesses should retain any supporting documents that may be relevant to the Employee Retention Credit. This can include financial statements, bank records, invoices, sales receipts, or any other paperwork that supports the claim for the credit.

While businesses are not required to submit the documentation with their federal employment tax returns, it is crucial to have the documentation readily available in case of an IRS audit or request for evidence. The IRS typically requires businesses to retain records for at least four years, so it’s advisable to maintain organized and accessible records throughout this timeframe.

Consulting with a qualified tax professional or accountant specialized in the Employee Retention Credit can provide additional guidance on the specific documentation requirements for your business. They can help ensure that you are maintaining accurate records and complying with all documentation and recordkeeping obligations set forth by the IRS.

As we conclude, it’s worth emphasizing that while the information provided in this article serves as a general guideline, it’s crucial to consult with a tax professional to ensure compliance with the most up-to-date requirements and regulations regarding the Employee Retention Credit.

Conclusion

The Employee Retention Credit (ERC) provides businesses with a valuable tax incentive to help retain their employees during challenging economic times, particularly in the wake of the COVID-19 pandemic. By navigating the eligibility requirements, calculating the credit accurately, and maintaining proper documentation, businesses can effectively claim and maximize the benefits of this credit.

In this article, we explored the fundamentals of the Employee Retention Credit, starting with the eligibility requirements. We discussed how businesses must meet the criteria of being either partially or fully suspended due to government orders or experiencing a significant decline in gross receipts. We also highlighted the importance of understanding the period of eligibility and the impact of the number of employees on credit calculations.

The next section focused on the calculations involved in determining the Employee Retention Credit. We examined the concept of qualified wages, the maximum credit per employee, and the necessity of considering aggregation rules. It was emphasized that the credit can be offset against federal payroll taxes and claimed on federal employment tax returns.

Furthermore, we discussed the documentation and recordkeeping requirements for the Employee Retention Credit. Proper recordkeeping not only establishes eligibility and supports the calculation of the credit but also protects businesses in case of IRS audits. We highlighted the need to maintain documentation related to eligibility, payroll and wage records, employee counts, and supporting documents that validate the credit claim.

In conclusion, the Employee Retention Credit is a valuable tax incentive that provides financial relief to businesses dealing with the impact of the COVID-19 pandemic. By understanding the eligibility requirements, accurately calculating the credit, and maintaining appropriate documentation, businesses can take advantage of this credit to retain their employees and navigate the economic challenges effectively.

It is crucial to stay updated with the latest guidance from the IRS and consult with a qualified tax professional or accountant who can provide tailored advice based on your specific circumstances. They will ensure compliance and help you make the most of the opportunities presented by the Employee Retention Credit.