Home>Finance>Robotic Process Automation (RPA): Definition And Benefits

Finance

Robotic Process Automation (RPA): Definition And Benefits

Published: January 21, 2024

Discover how Robotic Process Automation (RPA) can revolutionize finance processes, increase efficiency, and drive cost savings. Unlock the benefits of automation for your financial operations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Robotic Process Automation (RPA): Definition and Benefits

Finance is a vast field that encompasses various aspects of managing money, investments, and financial planning. In today’s digital era, technological advancements have revolutionized the finance industry. One such innovation that has gained significant attention is Robotic Process Automation (RPA). In this blog post, we will explore the definition of RPA and its benefits for businesses in the finance sector.

Key Takeaways:

- Robotic Process Automation (RPA) is a technology that uses software robots or virtual assistants to automate repetitive and rule-based tasks within a business process.

- RPA offers numerous benefits in the finance industry, including increased productivity, cost savings, improved accuracy, enhanced compliance, and improved customer satisfaction.

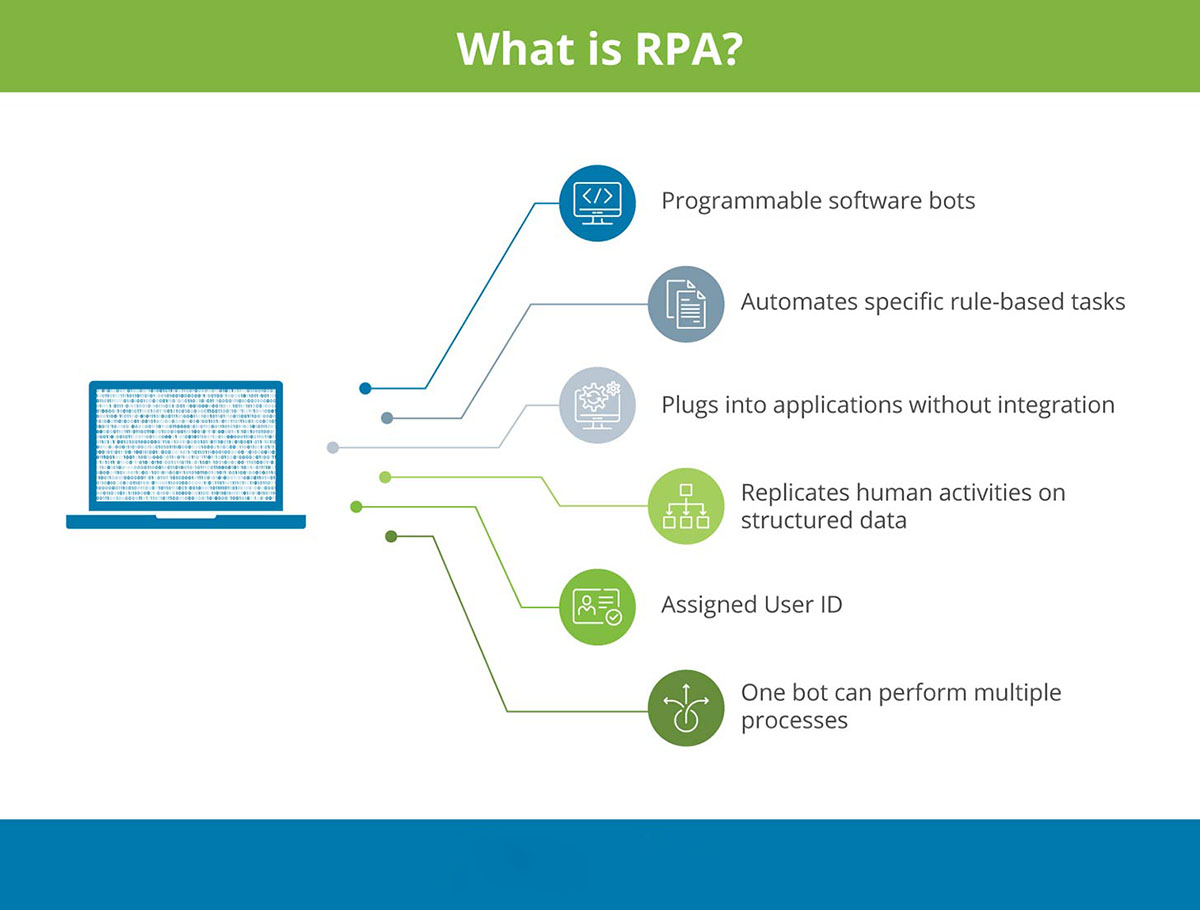

So, what exactly is Robotic Process Automation? RPA refers to the use of software robots or virtual assistants to automate repetitive and rule-based tasks within a business process. These robots are designed to mimic human actions and interact with various software applications, performing tasks such as data entry, data extraction, reconciliation, report generation, and more. RPA brings efficiency and speed to mundane tasks, freeing up human resources to focus on more strategic and complex activities.

Now, let’s dive into the benefits of RPA in the finance industry:

1. Increased Productivity:

RPA enables finance professionals to work alongside virtual assistants that handle repetitive tasks. By automating these routine processes, employees can devote their time to higher-value activities, such as financial analysis, strategic planning, and decision-making. The increased productivity leads to faster turnaround times, improved efficiency, and ultimately, better business outcomes.

2. Cost Savings:

RPA eliminates the need for manual labor to carry out repetitive tasks. By automating these processes with software robots, businesses can significantly reduce operational costs. Companies no longer need to allocate resources for hiring and training employees to perform mundane tasks, leading to substantial cost savings over time.

3. Improved Accuracy:

Humans are prone to errors, especially when it comes to repetitive and monotonous tasks. RPA brings consistency and accuracy to these processes, minimizing the risk of errors and inaccuracies. This enhanced accuracy is crucial in financial tasks where precision is of utmost importance to avoid costly mistakes.

4. Enhanced Compliance:

The finance industry operates under numerous regulations and compliance standards. RPA can ensure adherence to these regulations by automating compliance checks, tracking changes in regulations, and generating audit trails. This automation reduces the risk of non-compliance and penalties, providing peace of mind for businesses in the finance sector.

5. Improved Customer Satisfaction:

Efficient and accurate financial processes directly impact customer satisfaction. With RPA, businesses can provide faster response times, streamline customer onboarding processes, and improve the overall customer experience. By automating tasks like document verification, loan processing, and payment reconciliations, businesses can offer a seamless and hassle-free experience to their customers.

Robotic Process Automation (RPA) is an indispensable tool for modernizing and optimizing finance operations. The technology’s ability to automate repetitive tasks, increase productivity, save costs, improve accuracy, ensure compliance, and enhance customer satisfaction makes it a game-changer for businesses in the finance industry. Embracing RPA can propel finance professionals towards a more efficient and effective future.