Home>Finance>Tax Expense: Definition, Calculation, And Effect On Earnings

Finance

Tax Expense: Definition, Calculation, And Effect On Earnings

Published: February 6, 2024

Learn the definition and calculation of tax expense, and how it impacts earnings. Discover key insights on tax expense in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Tax Expense: Definition, Calculation, and Effect on Earnings

When it comes to managing your finances, understanding the concept of tax expense is vital. Whether you’re a business owner or an individual taxpayer, taxes are an essential part of your financial responsibilities. In this blog post, we’ll dive into the world of tax expenses, explore its definition, calculation methods, and most importantly, discuss how it impacts your earnings.

Key Takeaways:

- Tax expense refers to the amount of money an individual or business is obliged to pay to the government as part of their tax liabilities.

- Calculating tax expense requires a comprehensive understanding of tax laws, accounting principles, and different tax rates applicable to various income brackets or business structures.

What is Tax Expense?

Tax expense is an integral part of any financial planning and involves the amount of money a taxpayer owes to the government for income earned or business profits generated. It represents a portion of your earnings that must be set aside to fulfill your tax obligations.

How is Tax Expense Calculated?

The calculation of tax expense relies on several factors such as income type, applicable tax rates, deductions, credits, and exemptions. Here’s a step-by-step breakdown of the calculation process:

- Gather Income Information: Collect all relevant information about your income, including salary, dividends, interest, rental income, business revenues, or any other sources of income.

- Determine Taxable Income: Deduct eligible deductions, exemptions, and allowances to arrive at your taxable income. This can include items such as business expenses, mortgage interest, student loan interest, and other applicable deductions.

- Identify Applicable Tax Rates: Understand the tax rates applicable to your income bracket or business structure. Tax rates may vary depending on factors such as filing status, income level, or type of business entity.

- Calculate Tax Liability: Multiply your taxable income by the corresponding tax rate to determine your total tax liability.

- Consider Credits and Payments: Subtract any tax credits or pre-paid taxes from your total tax liability. This can include credits for dependents, education, or any tax payments made throughout the year.

- Arrive at Net Tax Expense: After considering deductions, exemptions, tax rates, and credits, you will arrive at your net tax expense, which is the amount you owe to the government.

The Impact of Tax Expense on Earnings

The effect of tax expense on earnings varies based on your income level, business structure, and overall financial strategy:

- Reduced Net Income: Tax expense directly reduces your net income, whether as an individual or a business. It is crucial to account for tax expenses when planning your financial goals and budgeting.

- Compliance and Legal Requirements: Failing to accurately calculate and report your tax expense can lead to penalties, fines, or even legal consequences. Staying compliant with tax laws is essential to avoid any financial setbacks.

- Strategic Planning: Understanding your tax expense enables you to make informed financial decisions. This includes utilizing deductions, credits, and exemptions to minimize your tax liability or exploring tax-efficient investment options.

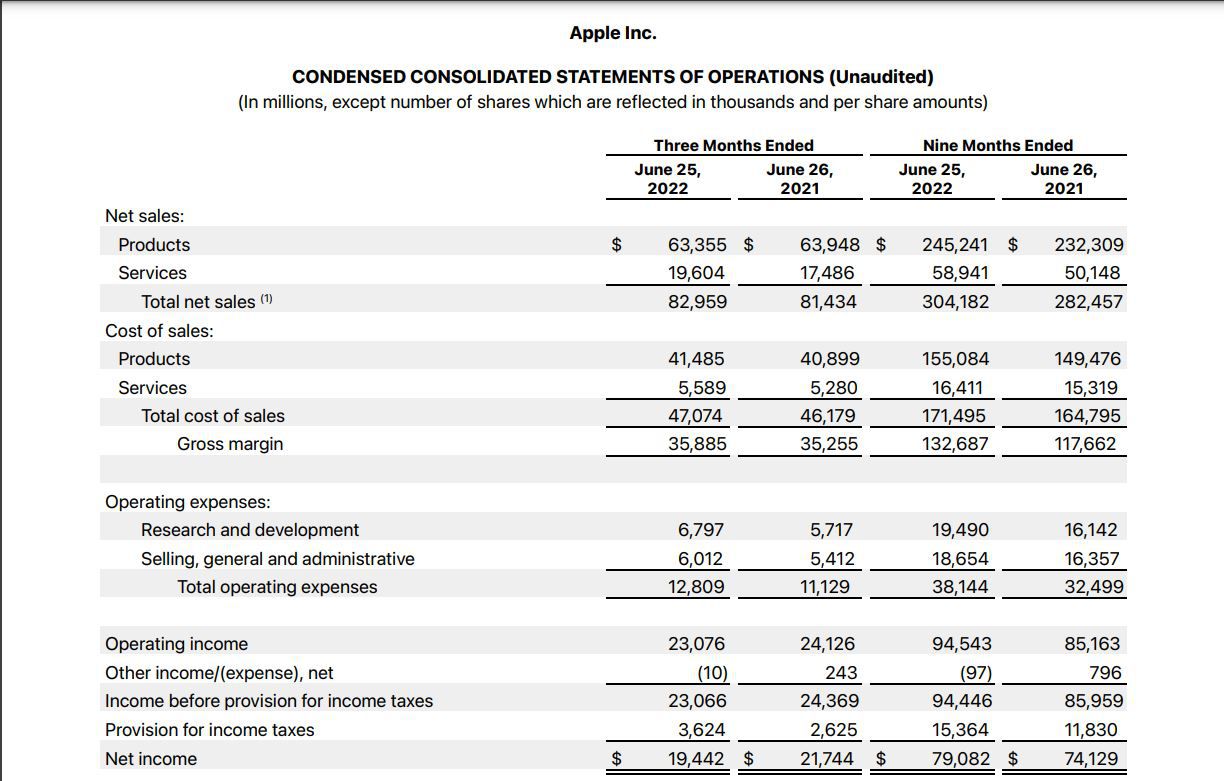

- Financial Reporting: Tax expense impacts financial reports, including income statements and balance sheets. It is essential for businesses to accurately disclose tax expenses to provide a clear picture of their financial performance.

By comprehending how tax expense affects your earnings, you can enhance your financial management skills and make informed decisions to optimize your overall financial well-being.

So, the next time you plan your finances, remember to consider your tax expense, diligently calculate it using the appropriate methods, and leverage tax planning strategies to achieve your financial goals.