Home>Finance>Top 10 Ways To Help You Ensure Financial Security

Finance

Top 10 Ways To Help You Ensure Financial Security

Modified: September 6, 2023

Discover financial security secrets that will help you save money, earn more from your investments, and become financially stable and independent.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

People nowadays forget the importance of financial security. Financial Security is a state of financial independence in which you aren’t worried about your income being enough to cover your expenses.

To help you deal with your finances, we listed the top 10 Ways to help you ensure Financial Security.

Invest In Yourself

With quality education, you will have a higher chance of getting employed, thus, the more education you have, the money you’re likely to earn. One of the best ways to ensure financial security is by investing in yourself.

Building your roots through education and personal growth is one way of attaining financial security. The higher the educational attainment the higher the chances there is to be employed in a high paying industry.

You can broaden your knowledge and refine your expertise on any given subject without draining your wallet. Grab a book, watch a video or online tutorial or listen to a podcast that focuses on the things that you want to learn. Whether you’re interested in learning more about sales, marketing, project management or how to manage money better.

If time is limited, listen to the audio book or podcasts when it’s most convenient for you, such as when you’re waiting to board a flight or when you’re driving to work. Make your commute work in your favor!

Buy An Insurance Plan

Secure term life insurance, health insurance, home insurance, and automobile insurance. A single serious illness or accident can cost a lot, both in medical bills and lost income. The better prepared you are in life, the easier it will be to be tackle any such unfortunate events.

Getting insured with a high coverage is a really big help in times of illness or accidents. An insurance with a lot of coverage can help in hospital bills when sickness or accidents happen. Lastly, find a professional you trust and get your family covered so you can sleep peacefully at night.

Photo from maxpixels.net

Create A Savings Account

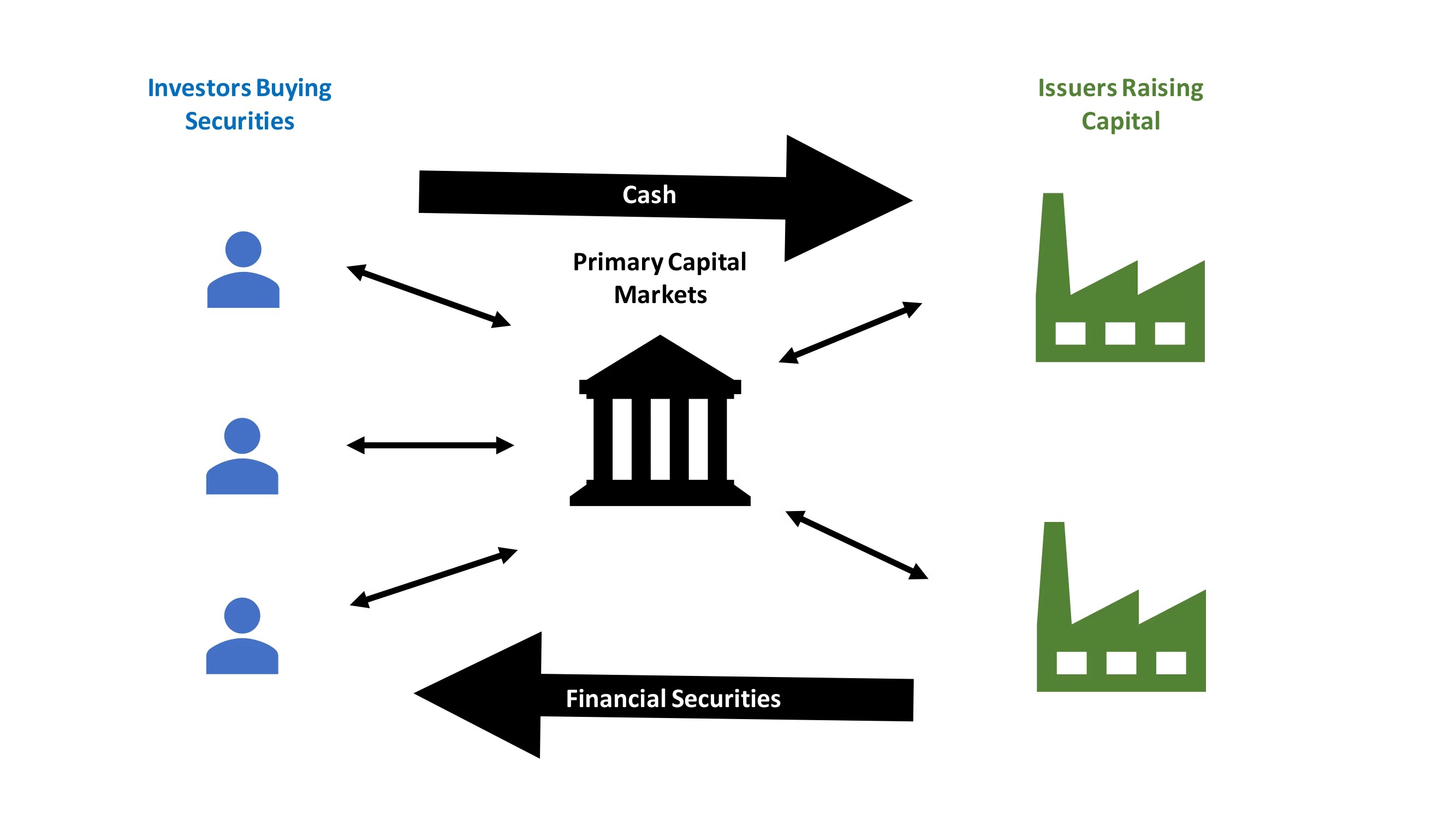

Saving money for the future is one vital aspect of becoming financially secured. A savings account is a deposit account held at a bank or another financial institution where you can deposit a sum of money and get a modest interest rate. It is an interest-bearing deposit account, which serves as one of the safest ways to invest your hard-earned money.

In order to make things easy especially in terms of saving money, you can use the money management formula 10-10-80. You use the 80% for daily budgeting and expenses. Tithe the first 10%of your total income. The last remaining 10% goes to your savings account. This money management formula can help you balance your spending and saving habits. Reinforcing control on spending habits can help you control your urges on buying material things as well as develops your skill for planning and management.

Photos from maxpixels.net

Minimize And Eliminate debt

Debt is money you owe to another party. The first thing to be wary of when minimizing and eliminating debt is the type of debt one owes the bank. Secured debt means the borrower has pledged an asset as collateral for the loan.

Examples of this kind of debt are auto loans and mortgages. Failing to follow the payment schedule and fees gives the creditor the right to seize the asset, for instance repossessing a car or foreclosing on a house.

Unsecured debt, on the other hand, is not backed by an asset. An example of this is credit card debt. This might not be as serious as secured debt, but it doesn’t mean you get off scot-free if you fail to fail to pay it off.

After identifying the kind of debt you have, you should work on prioritizing which debt you are going to pay first. While still in debt, you be careful not to pile up other debts by recklessly borrowing money from another party. It may be a short term fix but will often leave you in a messier situation.

There are debt monitoring mobile apps that can help in keeping tabs on your payment deadlines. Follow the instructions provided by these apps to help you in minimizing your debt and ensuring financial security.

Use Credit Wisely

When using credit cards, make sure you have money to pay for whatever it is you buy. Short term loans can help you build your personal credit for important purchases such as your car or home. The high interest on credit cards can quickly add up and add to your monthly payment. Before using your credit card, make sure you can afford to pay for its monthly fees.

Sometimes, you might not be able to pay your balance in full. It’s okay to have balance on your card, but if you do, be sure that you’re making payments on time each month.

Are paying more than the minimum payment whenever possible, and aiming to keep your balance below around 30 percent of your credit limit at any time? Even if you pay your balance in full each month, getting too close to your credit limit can be a flag to potential lenders.

Photo from pixabay.com

Invest For Retirement

The best way to ensure financial security is to plan ahead. Having good investments can make your retirement a smooth and comfortable one. Budgeting for retirement plans is vital in calculating how much you will be getting out of your investments.

For the success of your retirement investment, you should make sure that you have paid off your mortgage. Eliminating monthly expenses such as mortgages can help in sorting out other factors for your investment.

Investing for retirement is really all about setting yourself up to have enough income when you leave the workforce. That can be achieved in a variety of ways. You might, for example, live off the capital gains you earn by gradually selling off the assets in your retirement portfolio.

Additionally, you might build a sufficiently large portfolio of stocks over time and then simply live off of the dividends it generates. Or you might take some or all your nest egg and buy an annuity. Ideally, you’ll have a variety of income streams in retirement.

Photo from pixabay.com

Get Professional Help

A lot of people who don’t work in the financial industry have little knowledge about how money actually works. There are a lot of choices when it comes to acquiring financial knowledge and advice, but it’s important to find a source you are comfortable with and trust.

Financial advisers can have many specialties, but the basic idea is that they will help you invest your money to reach your financial goals. These goals could include retirement, saving for college, minimizing your tax burden, giving to charity, budgeting, debt reduction, or generating income.

Also to helping achieve your goals, a financial adviser should help you understand the strategies behind these investment decisions so you are better informed.

Budget Wisely

To meet financial security, you should know how to budget wisely. A money management technique can aid your budgeting woes. Senator Elizabeth Warren popularized the so-called ‘50/20/30 budget rule‘ (sometimes labeled ’50-30-20’) in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and divide it to: spending 50% on needs; 30% on wants; and stocking away 20% as savings.

50% – This part of your budget will be allocated to paying the necessary bills for your survival. Electricity bills, mortgages, car payments, insurance, groceries, health care, minimum debt payment and utilities.

30% – The thirty percent of your budget will be allocated to the things that you want. These things are not absolutely essential, but can make your life more enjoyable and entertaining. Think date night, movies at the cinema, and the little luxuries you crave from time to time.

20% – Allocate the last part of your budget to savings.

Savings may also include debt repayment. While smallest payments are part of the “needs” category, any extra payments reduce principal and future interest owed, so they are therefore considered savings.

Find Ways To Increase Your Income

To speed up your quest to financial security, you should find ways to increase your income. Increasing your income can hasten the necessary bill payments and help you focus on saving and investing. Look for other alternatives to the source of your main income to help you meet financial security faster.

Are you a writer, photographer or graphic designer? Perhaps pick up some freelance gigs on the side to boost income. These are just a few examples. Identify your skills and use them to bring in extra cash.

Set Goals

This is to have a clear picture of what you want to do with the money and financial capability you have earned after achieving financial security.

This will help you keep yourself on the right path by identifying annual financial goals and including savings target that will help to stay motivated. Make sure that the goals you set are reasonable and attainable based on the calculations you have made.

Photo from maxpixels.net

Lastly, make sure to follow these tips and seek professional help to assist you in ensuring financial security.