Home>Finance>United States Government Life Insurance (USGLI) Definition

Finance

United States Government Life Insurance (USGLI) Definition

Published: February 13, 2024

Looking for the definition of United States Government Life Insurance (USGLI)? Learn more about this finance-related topic and discover how it can benefit you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding United States Government Life Insurance (USGLI)

When it comes to managing your finances, knowledge is key. And one financial instrument that you should be aware of is United States Government Life Insurance, commonly known as USGLI. But what exactly is USGLI, and how does it work? In this blog post, we will provide an in-depth definition of USGLI along with key takeaways to help you understand this important aspect of financial planning.

Key Takeaways:

- United States Government Life Insurance (USGLI) is a life insurance program specifically designed for active and retired members of the military.

- USGLI provides coverage in the form of term life insurance policies, with the option to convert to permanent policies.

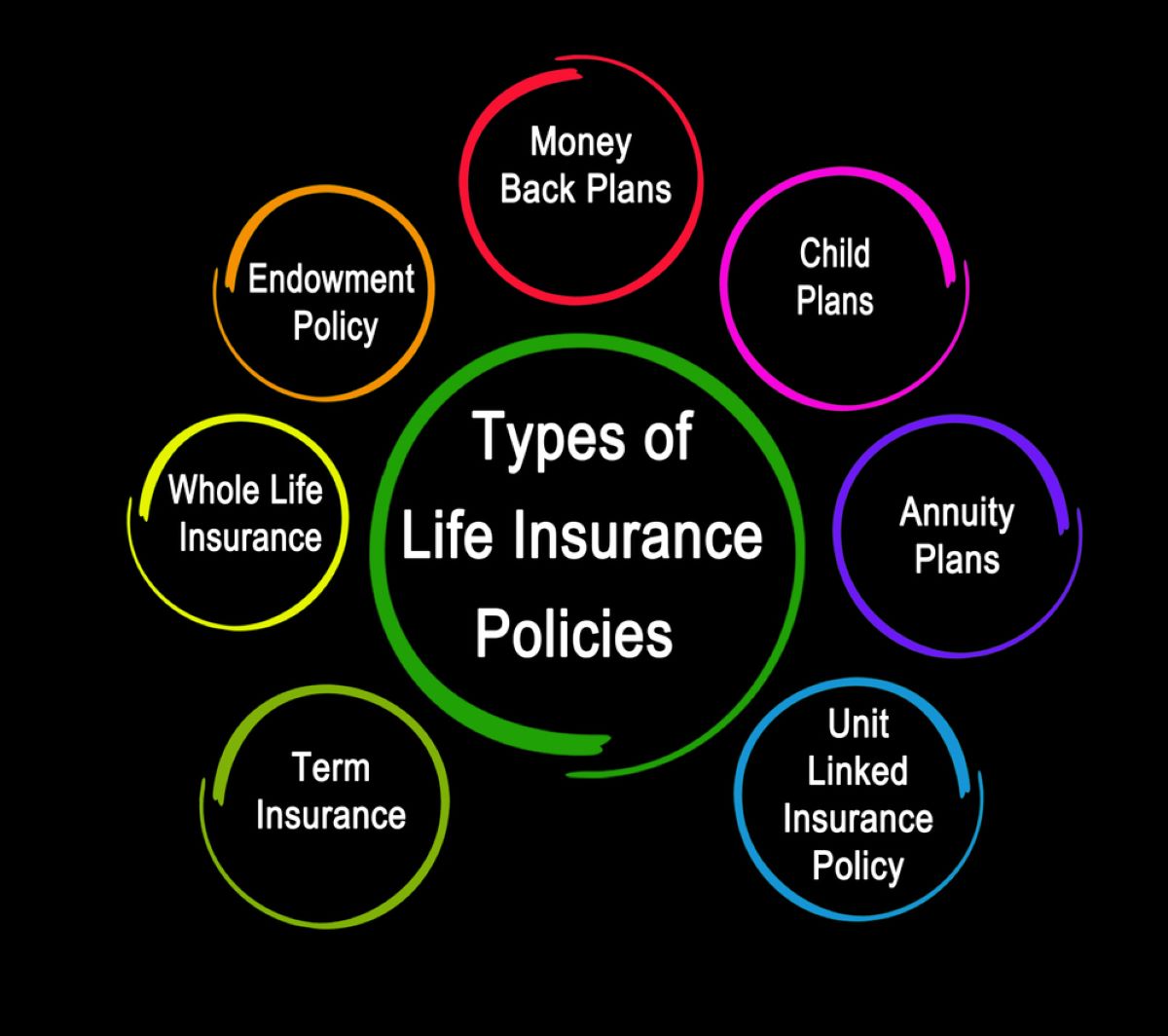

So, what is USGLI? Put simply, USGLI is a life insurance program that is tailored for active and retired members of the military. It provides coverage in the form of term life insurance policies, with the option to convert to permanent policies if desired. USGLI is administered by the Department of Veterans Affairs (VA) and offers insurance protection to individuals who may not have easy access to affordable life insurance options outside the military.

Now that we have defined USGLI let’s take a closer look at its key features and benefits:

Features and Benefits of USGLI:

- Affordable Coverage: One of the primary advantages of USGLI is its affordability. The premium rates for USGLI policies are typically lower compared to similar coverage available in the civilian market. This makes it an attractive option for military personnel and their families.

- Flexible Options: USGLI offers a range of coverage options to suit individual needs. Policyholders have the freedom to choose the coverage amount and duration that aligns with their personal circumstances. Additionally, USGLI policies can be converted to permanent life insurance policies, providing long-term protection and potential cash value accumulation.

- No War or Terrorism Exclusions: USGLI policies provide coverage for military personnel regardless of any involvement in war or acts of terrorism. This ensures that members of the military have peace of mind knowing that their loved ones are protected, even in challenging circumstances.

- Bereavement Counseling: In addition to insurance coverage, USGLI also offers free bereavement counseling services to help policyholders and their families cope with the loss of a loved one. This support can be invaluable during difficult times.

It’s important to note that eligibility for USGLI is restricted to active and retired members of the military, including both the Army and Air Force National Guard. However, it is worth exploring this option if you or a loved one is affiliated with the military as it may provide significant financial protection in the event of an unfortunate circumstance.

In conclusion, United States Government Life Insurance (USGLI) is a specialized life insurance program designed for military personnel, offering affordable coverage with flexible options and additional support services. If you are eligible for USGLI, it is worth considering as part of your overall financial planning strategy. Remember, knowledge is power when it comes to managing your financial future!