Finance

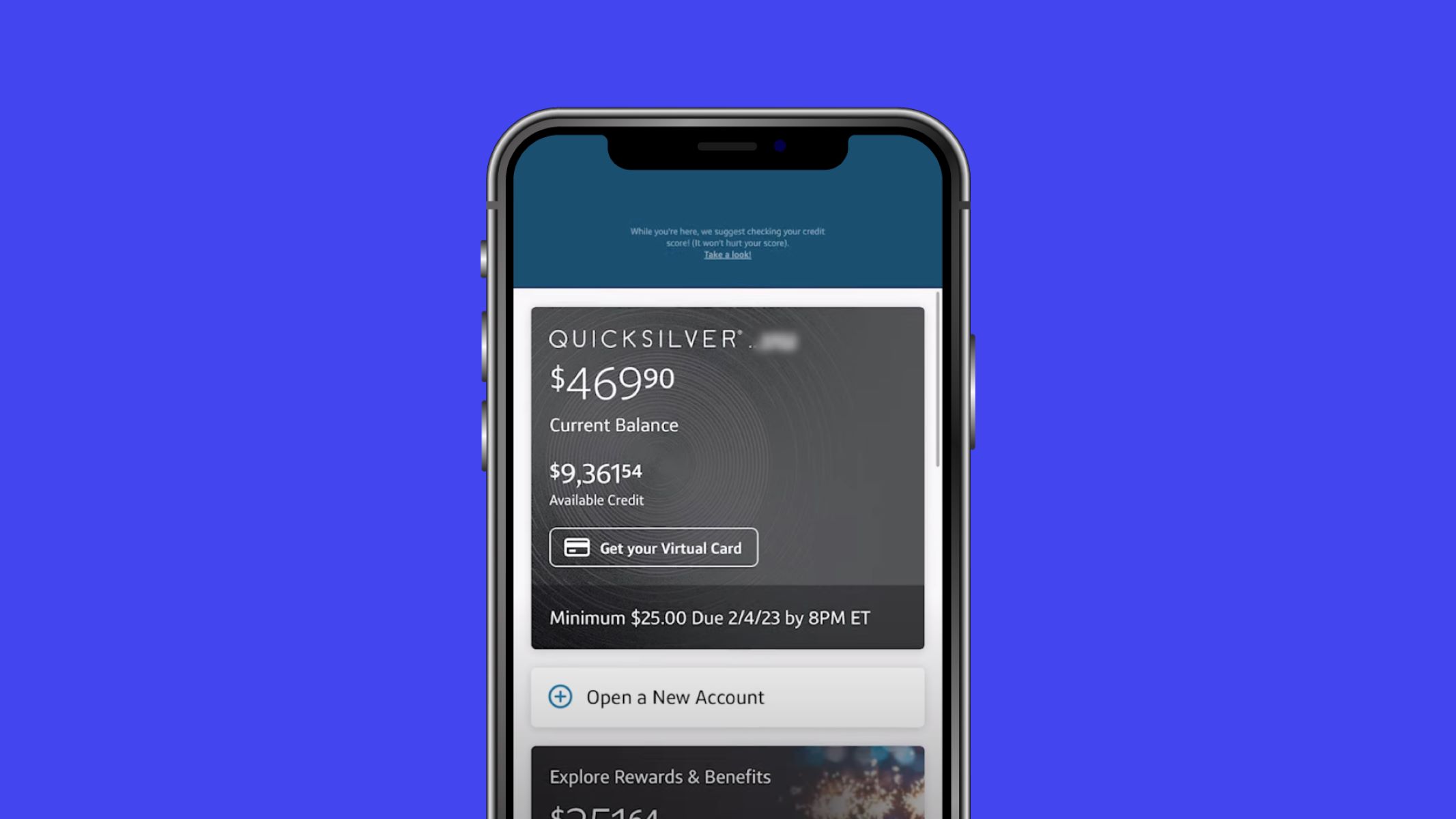

What Is The Best Day To Pay Your Credit Card

Modified: February 21, 2024

Curious about the best day to pay your credit card? Discover expert insights and tips on managing your finances to stay on top of your payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, paying your credit card bill on time is of utmost importance. Not only does it help you avoid costly late fees and interest charges, but it also plays a crucial role in maintaining a healthy credit score. But have you ever wondered if there is an optimal day to pay your credit card? Could it make a difference in how your payments are applied or impact your credit score? In this article, we’ll explore the factors to consider when choosing a payment date and provide strategic tips to determine the best day to pay your credit card.

Before we dive into the details, it’s important to understand that the best payment date may vary depending on your unique financial situation. Factors such as your paycheck schedule, budgeting preferences, and the terms of your credit card issuer can all play a role in determining the ideal day to pay. By considering these factors, you can align your payment date with your cash flow and financial goals.

It’s also worth noting that paying your credit card bill late can have serious consequences. Aside from incurring late fees, it can result in a negative impact on your credit score. Payment history is one of the most significant factors that contribute to your credit score, accounting for about 35% of the FICO® Score calculation. So, the timeliness of your credit card payments plays a pivotal role in maintaining a positive credit history.

Now that we understand the importance of paying your credit card on time, let’s delve into the impact of payment due dates on your credit score and analyze the pros and cons of different payment dates. By the end of this article, you’ll have a clear understanding of how to strategically determine the best day to pay your credit card and optimize your financial well-being.

Factors to Consider When Choosing a Payment Date

Choosing the right payment date for your credit card bill is not a one-size-fits-all situation. It’s important to take into account various factors to ensure that your payment aligns with your financial circumstances. Here are some key factors to consider when determining the best day to pay your credit card:

- Paycheck Schedule: Consider when you receive your income and align your payment date accordingly. If you receive your paycheck on the 15th and 30th of each month, it might be wise to schedule your credit card payment shortly after those dates.

- Due Date: Take note of the due date specified by your credit card issuer. Paying your bill a few days in advance ensures it arrives on time and helps you avoid late fees and penalties.

- Cash Flow: Evaluate your monthly expenses and cash flow to determine the best time to make your credit card payment. If you have more available funds at the beginning of the month, paying your bill early can help you stay on top of your financial obligations.

- Budgeting Preferences: Some people prefer to make all their bill payments at the same time, while others prefer to spread them out throughout the month. Consider your personal budgeting style and preferences when choosing a payment date.

- Interest Charges: If you carry a balance on your credit card, the interest charges can add up quickly. Paying your bill as early as possible reduces the amount of time your balance accrues interest and helps you save money in the long run.

- Automatic Payments: Many credit card issuers offer the option to set up automatic payments. This can be a convenient way to ensure your bill is paid on time each month without having to remember the due date.

By considering these factors, you can determine the payment date that works best for you. It’s essential to choose a date that aligns with your financial goals, minimizes the risk of late payments, and optimizes your cash flow.

The Importance of Paying Your Credit Card on Time

Paying your credit card bill on time is not just a good financial habit, but it also carries significant importance for your overall financial well-being. Here are some reasons why paying your credit card on time is crucial:

- Avoiding Late Fees: One of the most immediate consequences of late payments is incurring hefty late fees. These fees can range from a few dollars to over $35, depending on your credit card issuer’s policies. By paying your bill on time, you can avoid unnecessary expenses and allocate your hard-earned money towards more important financial goals.

- Preventing Interest Charges: If you carry a balance on your credit card, paying your bill by the due date is essential to avoid accruing interest charges. Interest is charged on the outstanding balance, and the longer you carry it, the more you’ll end up paying. By paying on time, you can minimize interest costs and save money.

- Maintaining a Good Credit Score: Your payment history plays a significant role in determining your credit score. Late payments can have a negative impact on your credit score, while consistent on-time payments can help you build and maintain a positive credit history. Over time, this can improve your creditworthiness and make it easier for you to secure loans, mortgages, or lower interest rates in the future.

- Avoiding Collection Actions: Persistently late payments can result in your credit card account being sent to collections. Collection actions can have severe consequences, including damage to your credit score, calls from debt collectors, or even legal actions. By paying your credit card on time, you can avoid these stressful and undesirable situations.

- Building Financial Discipline: Consistently paying your credit card bill on time requires discipline and responsible financial habits. By making timely payments, you develop good financial discipline that transcends beyond credit cards, positively impacting your overall financial well-being.

Remember, paying your credit card bill on time is not just about financial responsibility – it also has tangible benefits, such as saving money, improving your credit score, and reducing stress related to overdue payments. By prioritizing timely payments, you establish a solid foundation for your financial health and set yourself up for long-term success.

The Impact of Payment Due Dates on Your Credit Score

Payment due dates for your credit card have a direct impact on your credit score. Understanding how these due dates affect your credit is crucial for maintaining a healthy credit profile. Here are the key ways in which payment due dates can impact your credit score:

- Timeliness of Payments: One of the most significant factors in determining your credit score is payment history, accounting for about 35% of the FICO® Score calculation. Late payments can have a negative impact on your credit score, while making payments on time can help maintain or improve your score over time.

- Days Past Due: Your credit report includes information about how many days past due your payments are. This information is visible to lenders and can affect their decision to extend credit to you. Consistently making payments past the due date can signal financial instability and may result in a lower credit score.

- Credit Utilization: Payment due dates can also impact your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. Making payments early can reduce your balance and lower your credit utilization, which can have a positive impact on your credit score.

- Credit Age: Payment due dates can affect the age of your credit accounts. The longer you have accounts with a positive payment history, the more established your credit becomes, which can positively impact your credit score. Making timely payments consistently over time can contribute to the longevity of your credit history.

- Delinquencies and Public Records: If your payments are consistently late or go into delinquency, it can result in negative entries on your credit report, such as delinquent accounts or collections. These negative marks can have a severe impact on your credit score and can be challenging to remove once they are reported.

It’s important to note that the impact of payment due dates on your credit score may vary depending on the severity and frequency of late payments. Occasional late payments may have a smaller impact compared to consistently missing due dates. Additionally, the specific scoring models used by credit bureaus may weigh payment history differently. However, as a general rule, paying your credit card bill on time and avoiding late payments is crucial for maintaining a good credit score.

To protect and improve your credit score, it’s essential to prioritize making timely credit card payments. Set reminders, automate payments, or establish a routine that ensures you never miss a payment due date. By doing so, you can maintain a positive payment history and set yourself up for better financial opportunities in the future.

Analyzing the Pros and Cons of Different Payment Dates

When it comes to choosing the best payment date for your credit card, there are several options to consider. Each payment date has its own set of pros and cons that can impact your financial management. Let’s analyze some of the advantages and disadvantages of different payment dates:

- Early in the Billing Cycle: Paying your credit card bill early in the billing cycle can provide several benefits. One advantage is that you reduce the risk of forgetting to make the payment as the due date approaches. Additionally, paying early allows you to minimize interest charges by reducing the time your balance accrues interest. However, a potential downside is that your payment may not align with your monthly income or cash flow, making it harder to manage other expenses.

- On the Due Date: Paying your credit card bill on the due date can simplify your financial management. You can allocate funds for other expenses throughout the billing cycle and make the payment just in time. However, there is a risk of unexpected delays or technical issues that could lead to a late payment. It’s crucial to ensure that you make the payment well before the due date to account for any potential delays.

- After the Due Date: Although it’s generally advisable to pay your credit card bill on or before the due date, there may be instances where you need to make a late payment. Late payments, even if unintentional, can lead to late fees and have a negative impact on your credit score. It’s important to weigh the potential consequences before deciding to make a late payment. If you must make a late payment, communicate with your credit card issuer to explain the situation and explore possible solutions.

- Multiple Payments: Some individuals prefer to make multiple payments throughout the billing cycle, rather than a single payment on a fixed due date. This approach can help keep your credit utilization ratio low and may be suitable if you have a fluctuating income or want to stay on top of your credit card balance. However, it may require more frequent monitoring of your account and can be more time-consuming to manage.

Ultimately, the best payment date for your credit card will depend on your individual financial situation and preferences. It’s important to consider factors such as cash flow, budgeting habits, and the desire to minimize interest charges or late fees. By assessing the pros and cons of different payment dates, you can find a strategy that aligns with your needs and helps you maintain a healthy financial footing.

Strategic Tips for Determining the Best Day to Pay Your Credit Card

Choosing the best day to pay your credit card is not a one-size-fits-all approach. It requires careful consideration of your financial circumstances and goals. Here are some strategic tips to help you determine the best day to pay your credit card:

- Align with Income: Take into account the timing of your income and expenses. If possible, choose a payment date that aligns with when you receive your paycheck. This can help ensure that you have sufficient funds available to cover your credit card payment without straining your budget.

- Consider Cash Flow: Evaluate your monthly cash flow and upcoming expenses. If you tend to have more available funds at the beginning of the month, consider making your credit card payment early to avoid any potential cash flow challenges later on.

- Account for Due Date: Take note of the due date specified by your credit card issuer. Aim to make your payment a few days before the due date to allow for any potential processing delays. This way, you can ensure that your payment is received on time and avoid late fees or negative impacts on your credit history.

- Minimize Interest Charges: If you carry a balance on your credit card, paying early in the billing cycle can help you minimize interest charges. The longer you carry a balance, the more interest you’ll accrue. By paying early, you reduce the average daily balance and save money on interest.

- Automate Payments: Consider setting up automatic payments for your credit card. Most credit card issuers offer this feature, allowing you to schedule your payments in advance. Automating payments ensures that you never miss a due date and can save you time and effort in managing your finances.

- Stay Organized: Maintain a system to track your credit card payments and due dates. Use reminders, calendars, or budgeting apps to help you stay organized and ensure that you never overlook or forget a payment. Being proactive and staying on top of your credit card payments is key to maintaining good financial health.

Remember that the best day to pay your credit card may evolve as your financial situation changes. It’s important to regularly review and reassess your payment strategy to ensure that it aligns with your goals and financial capabilities.

By incorporating these strategic tips into your payment planning, you can optimize your credit card management and maintain a positive financial trajectory. Remember, paying your credit card on time not only helps you avoid fees and interest charges but also contributes to building a strong credit history.

Conclusion

Choosing the best day to pay your credit card is a decision that can have a significant impact on your financial well-being. By considering factors such as your income schedule, cash flow, and budgeting preferences, you can strategically determine the optimal payment date. Making timely credit card payments is crucial for avoiding late fees, minimizing interest charges, and maintaining a positive credit score.

Remember, paying your credit card bill on time demonstrates financial responsibility and helps build a solid credit history. Late payments can result in negative repercussions, including increased fees, higher interest costs, and potentially damaging your credit score. Regularly monitoring your payment due dates, setting up reminders, and automating payments are effective strategies for staying on track.

It’s important to assess the pros and cons of different payment dates and choose a strategy that aligns with your financial goals and circumstances. Whether you prefer paying early, on the due date, or multiple times throughout the month, the key is to find a system that works best for you.

By implementing these strategic tips and staying organized, you can navigate the world of credit card payments with confidence. Prioritize timely payments, minimize interest charges, and maintain a positive credit history to pave the way for a successful financial future.

In conclusion, paying your credit card bill on time is not just a responsibility, but a vital aspect of maintaining financial stability. Choose a payment date that fits your schedule, aligns with your income, and allows you to manage your budget effectively. By doing so, you can avoid unnecessary fees, save money on interest charges, and cultivate a positive credit history that opens doors to future financial opportunities.