Finance

What Are Some Features Of Online Banking

Published: November 4, 2023

Discover the key features of online banking and how it can simplify your financial management. Stay in control of your finances with secure and convenient online banking services.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

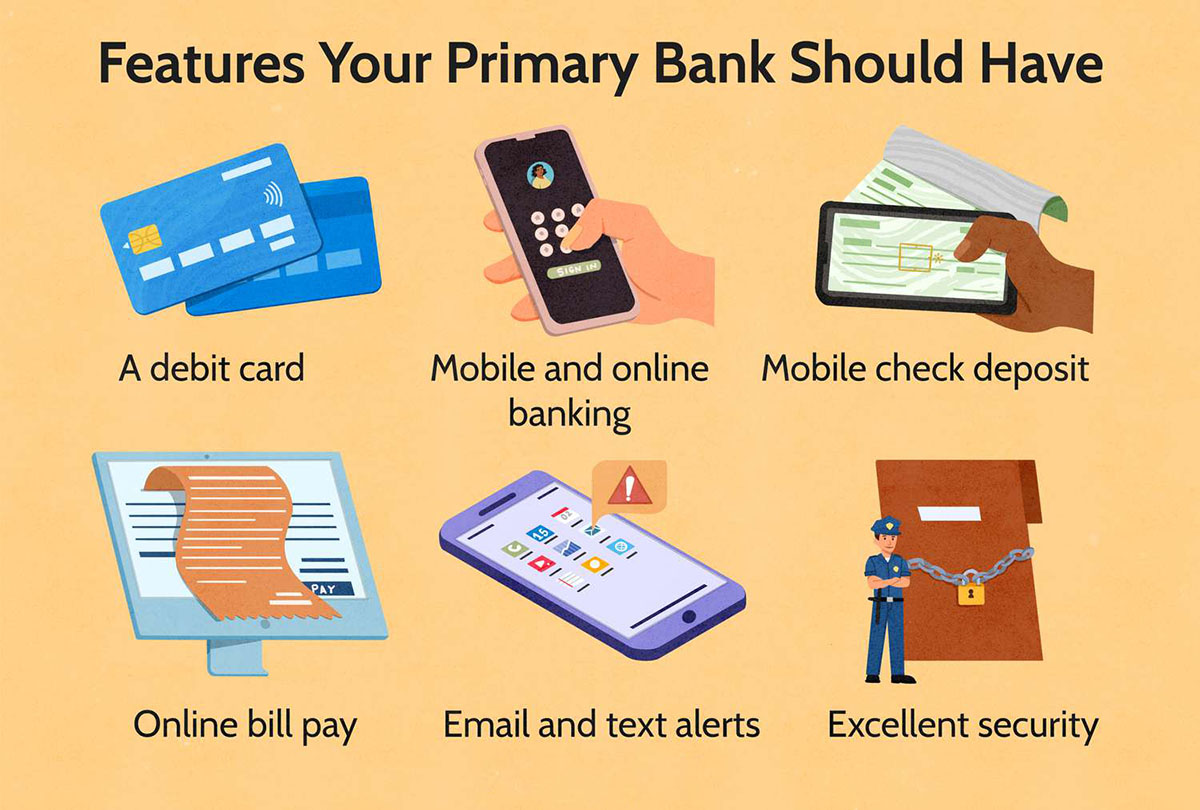

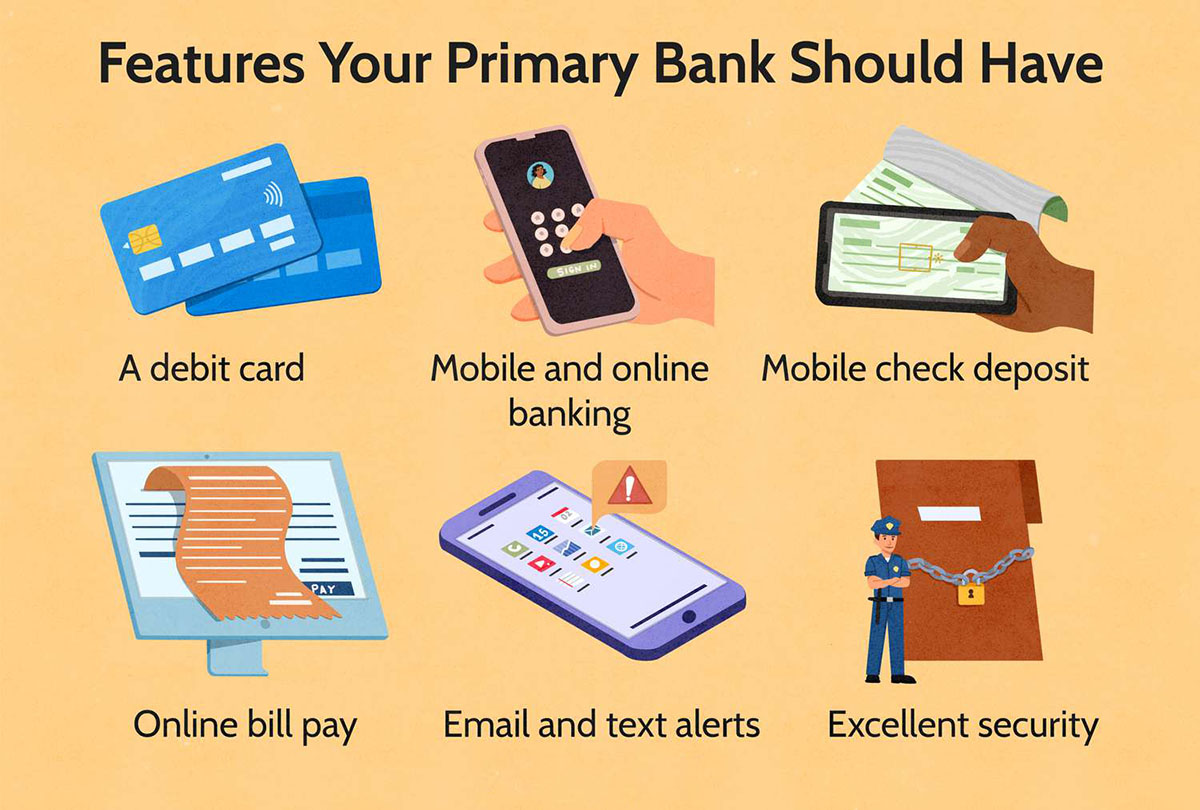

In today’s fast-paced digital age, the world of banking has evolved significantly. Gone are the days of standing in long queues at brick-and-mortar branches, as online banking has revolutionized the way we manage our finances. Online banking provides a range of features and benefits that make it a preferred choice for millions of individuals and businesses worldwide.

Online banking offers convenience and accessibility like never before. With just a few clicks, customers can access their accounts, make transactions, and manage their finances from the comfort of their own homes or offices, anytime and anywhere. This round-the-clock availability eliminates the need to adhere to traditional banking hours and offers unparalleled convenience for users with busy schedules.

One of the key advantages of online banking is the ability to monitor account activity in real-time. Customers can view their account balances, track transaction history, and monitor incoming and outgoing funds effortlessly. This feature enables users to stay on top of their financial position, reducing the possibility of overdrafts or unauthorized transactions.

The capability for fund transfers is another valuable feature of online banking. Whether it’s transferring money between personal accounts, sending funds to family or friends, or making payments to vendors and service providers, online banking provides a secure and efficient platform to execute these transactions. Clients can easily set up recurring transfers or schedule one-time payments, simplifying the process and saving valuable time.

Managing bills and making timely payments has never been easier with online banking. Clients can link their accounts to various billers and schedule automatic payments for utilities, credit cards, loans, and other expenses. This eliminates the need to manually write checks, pay for postage, or worry about missing payment deadlines.

Mobile banking has further expanded the reach of online banking by enabling users to access their accounts on smartphones and tablets. With dedicated mobile banking applications, customers can perform various transactions, view account activity, and receive important notifications on the go. Mobile banking has truly made banking a seamless experience, allowing users to handle their finances anywhere, anytime.

Convenience and Accessibility

One of the standout features of online banking is its unparalleled convenience and accessibility. With online banking, customers no longer have to rely on traditional brick-and-mortar branches to carry out their banking needs. Instead, they can access their accounts and manage their finances from the comfort of their own homes or offices, 24/7.

Gone are the days of rushing to the bank before it closes or waiting in long queues to deposit a check. Online banking allows users to perform a wide range of transactions with just a few clicks. Whether it’s checking account balances, transferring funds, paying bills, or even applying for loans, everything can be done online in a matter of minutes.

Another significant advantage of online banking is the ability to access multiple accounts in one place. Instead of juggling between different banking institutions, users can consolidate all their accounts and manage them from a single online banking platform. This simplifies financial management, making it easier to track expenses, analyze spending patterns, and plan for the future.

Moreover, online banking eliminates geographical barriers. Whether you are at home, traveling, or on a business trip, as long as you have an internet connection, you can access your accounts and carry out transactions. This convenience is particularly beneficial for people who have busy schedules or reside in remote areas, where accessing physical bank branches can be time-consuming and challenging.

In addition, online banking offers a wide range of services beyond the traditional banking transactions. Many online banking platforms provide features such as personal financial management tools, investment tracking, credit score monitoring, and budgeting assistance. These tools empower users to take control of their finances, set financial goals, and make informed financial decisions.

Furthermore, online banking offers a seamless experience across different devices. With the rise of mobile banking applications, customers can access their accounts and perform transactions on smartphones and tablets. This flexibility allows users to manage their finances on the go, making banking even more convenient and accessible.

Overall, the convenience and accessibility offered by online banking have transformed the way people manage their finances. Whether it’s the ability to access accounts anytime and anywhere, consolidate multiple accounts into one platform, or benefit from additional financial management tools, online banking provides a level of convenience that traditional banking simply cannot match.

Account Monitoring

One of the primary benefits of online banking is the ability to monitor your accounts in real-time. With online banking platforms, customers can stay updated on their account balances, track transaction history, and monitor incoming and outgoing funds effortlessly.

Account monitoring allows users to keep a close eye on their financial position. Whether it’s checking if a payment has been credited, verifying if a deposit has been received, or simply keeping track of spending habits, online banking provides real-time information to help users stay financially informed.

With online banking, customers have the convenience of viewing their account balances at any time, without the need to visit a physical bank branch or wait for a monthly statement. This up-to-date information allows users to make timely financial decisions, such as determining if they have sufficient funds for a purchase or assessing their overall financial health.

Tracking transaction history is another crucial aspect of account monitoring. Online banking platforms provide detailed records of past transactions, including deposits, withdrawals, transfers, and payments. This feature helps users keep track of their financial activities, enabling them to reconcile any discrepancies or identify any unauthorized transactions promptly.

Furthermore, online banking allows users to set up customizable alerts and notifications. These alerts can be set for various triggers, such as low account balances, large transactions, or upcoming bill payments. This proactive feature ensures that users are promptly notified of any significant account activities, providing an extra layer of security and control over their finances.

Account monitoring in online banking also enhances financial planning and budgeting. By having access to transaction history and real-time balance information, users can analyze their spending patterns and identify areas where they can cut costs or save money. Online banking platforms may also offer tools to categorize and track expenses, allowing users to create budgets and financial goals.

Overall, account monitoring through online banking empowers users to have a better grasp of their financial situation. The ability to view account balances, track transactions, receive alerts, and analyze spending habits helps users stay in control of their finances, make informed decisions, and achieve their financial goals.

Fund Transfers

Online banking provides a seamless and efficient platform for fund transfers, making it convenient to move money between accounts, send funds to family and friends, and make payments to vendors and service providers.

One of the key advantages of online fund transfers is the speed at which they can be executed. Instead of waiting for a check to clear or relying on traditional money transfer methods, online banking allows users to transfer funds instantly. This feature is particularly valuable in urgent situations, such as sending money to a family member in need or making time-sensitive payments.

With online banking, customers can easily transfer money between their own accounts, even if they are held at different banks. The ability to link accounts and initiate transfers from a single online banking platform streamlines the process and eliminates the need for multiple logins or visits to different banking institutions.

Additionally, online banking facilitates peer-to-peer transfers, allowing users to send money to family, friends, or acquaintances. Whether it’s reimbursing a friend for dinner, splitting bills, or sending money as a gift, online banking platforms often offer convenient features for person-to-person transfers, such as using email addresses or mobile phone numbers as payment identifiers.

For businesses, online banking provides an efficient method for making bulk payments to vendors, suppliers, and employees. Many online banking platforms offer features that allow businesses to upload payment files, automate recurring payments, or even integrate with accounting software. These capabilities save time, reduce manual errors, and streamline the payment process for businesses of all sizes.

Moreover, online banking enhances international fund transfers. Traditional international transfers can be costly and time-consuming, with fees and delays associated with intermediary banks. Online banking platforms often provide competitive exchange rates and lower fees for international transfers, as well as the convenience of initiating and tracking transfers online.

Security is a top concern when it comes to fund transfers, and online banking platforms have implemented robust security measures to protect users’ sensitive information and transactions. Encryption, multi-factor authentication, and fraud detection mechanisms ensure the safety of funds during transfers.

Overall, online banking has revolutionized the process of fund transfers, making it fast, convenient, and secure. Whether it’s transferring money between personal accounts, sending funds to family and friends, or making payments to vendors and service providers, online banking provides a reliable and efficient platform for managing financial transactions.

Bill Payments

Online banking has revolutionized the way we handle bill payments, offering a convenient and efficient method to manage and settle our financial obligations. With just a few clicks, users can link their accounts to various billers and schedule automatic payments, eliminating the need for writing checks, paying for postage, or worrying about missing payment deadlines.

One of the key advantages of online bill payments is the time-saving aspect. Instead of manually writing checks, addressing envelopes, and mailing them, online banking allows users to set up recurring payments for bills such as utilities, credit cards, loans, and other regular expenses. This automated process ensures that payments are made on time, eliminating the risk of late fees or penalties.

Online banking platforms often provide features that allow users to view and manage their billers in one place. This comprehensive view enables users to keep track of their upcoming and past payments, making it easier to stay organized and maintain a record of their financial transactions.

Moreover, online bill payments offer the flexibility to make one-time payments for variable amounts. Whether it’s paying for a unique expense or settling a bill with a different amount each time, users can initiate payments online without the need for checks or cash. This level of convenience is especially beneficial for businesses and individuals who deal with variable bills, such as freelancers and contractors.

Security is a crucial aspect of online bill payments, and online banking platforms prioritize the protection of users’ financial information. Encryption and multi-factor authentication ensure the secure transmission of payment details, reducing the risk of identity theft or fraud.

Furthermore, online banking platforms often provide reminders and alerts for upcoming bills. Users can set up notifications to receive reminders before payment due dates, ensuring that they never miss a payment. This proactive feature helps users stay on top of their bills and maintain a healthy financial standing.

Online bill payments also contribute to reducing paper waste and promoting environmental sustainability. By opting for electronic payments instead of paper checks, users can contribute to a greener future by minimizing paper consumption and reducing carbon emissions associated with traditional mailing practices.

Overall, online bill payments offer a hassle-free and efficient way to manage financial obligations. With the convenience of scheduling recurring payments, flexibility for one-time payments, enhanced security measures, and the ability to stay organized with bill management features, online banking has truly simplified the process of settling bills and managing personal finances.

Mobile Banking

Mobile banking has become a game-changer in the world of online banking, providing users with the convenience and flexibility to manage their finances on the go. With dedicated mobile banking applications, customers can access their accounts, perform transactions, and receive important notifications directly from their smartphones and tablets.

One of the key advantages of mobile banking is the ability to access accounts anytime, anywhere. As long as users have an internet connection, they can securely log in to their mobile banking app and perform a wide range of transactions, eliminating the need to rely on a computer or visit a physical bank branch.

Mobile banking applications provide a seamless and user-friendly interface designed specifically for smaller screens. Users can easily navigate through menus, view account balances, track transaction history, transfer funds, and make bill payments with just a few taps and swipes. This intuitive experience ensures that users can manage their finances effortlessly, even when they are on the move.

Moreover, mobile banking apps offer enhanced security features to protect users’ sensitive information. Biometric authentication methods, such as fingerprint or facial recognition, add an extra layer of security, ensuring that only authorized individuals can access the app and perform transactions. Additionally, mobile banking apps use encryption and other security protocols to safeguard user data during transmission.

Mobile banking is not limited to basic banking transactions. Users can take advantage of additional features and services within the app, such as setting up alerts and notifications for account activities, managing financial goals and budgets, applying for loans, or even finding the nearest bank branch or ATM using location services.

Mobile banking also enables users to deposit checks using the camera on their mobile devices. With the mobile banking app, users can simply take a picture of the check and submit it for deposit, eliminating the need to visit a physical branch or find an ATM.

Furthermore, mobile banking empowers users to have a real-time overview of their finances. Through the app, users can monitor their accounts, track expenses, analyze spending patterns, and even receive insights and recommendations for better financial management. This level of visibility and control allows users to make informed decisions and stay on top of their financial goals.

Mobile banking has transformed the way we interact with our finances, offering unparalleled convenience and accessibility. With the ability to access accounts anytime and anywhere, user-friendly interfaces, enhanced security measures, and additional features to aid financial management, mobile banking has become an essential tool for individuals seeking a seamless and efficient way to manage their finances.

Enhanced Security Measures

When it comes to online banking, one of the top concerns for users is the security of their personal and financial information. Online banking platforms have implemented enhanced security measures to ensure the protection of user data and transactions, giving customers peace of mind while accessing their accounts and making online transactions.

One of the primary security measures employed by online banking platforms is encryption. Encryption is the process of converting sensitive information into a coded format, making it unreadable to unauthorized individuals. This ensures that any data transmitted between the user’s device and the banking server remains secure and confidential.

In addition to encryption, online banking platforms also use multi-factor authentication (MFA) to strengthen account access security. MFA requires users to provide multiple forms of identification to prove their identity, typically including something they know (such as a password), something they have (such as a unique code sent to their mobile device), and sometimes something they are (such as a fingerprint or facial recognition). This extra layer of security makes it significantly more difficult for unauthorized individuals to gain access to user accounts.

To detect and prevent fraudulent activities, online banking platforms employ sophisticated fraud detection mechanisms. These systems use advanced algorithms and machine learning to analyze user behavior and transaction patterns, identifying any suspicious or unusual activities. In the event of a potential fraud, these systems can trigger alerts or temporarily freeze accounts to protect the user’s funds.

Furthermore, online banking platforms often provide users with the ability to customize security settings. This includes enabling or disabling certain features, setting up transaction limits, and managing authorized devices. By allowing users to have control over their security preferences, online banking platforms empower individuals to tailor their security measures to their specific needs and preferences.

Many online banking platforms also provide real-time notifications and alerts for account activities. Users can receive alerts for various triggers, such as large transactions, account balance changes, or login attempts from unrecognized devices. These notifications allow users to be promptly notified of any potential unauthorized access or suspicious activities, enabling them to take immediate action to protect their accounts.

Online banking platforms stay vigilant by regularly updating their security protocols and monitoring industry best practices. They continuously invest in security enhancements to stay ahead of evolving cybersecurity threats and ensure the highest level of protection for their users.

Overall, enhanced security measures implemented by online banking platforms prioritize the safety and integrity of user information and transactions. Through encryption, multi-factor authentication, fraud detection systems, customizable security settings, real-time alerts, and ongoing security updates, online banking platforms strive to provide a secure environment for users to access their accounts and perform transactions with confidence.

Personal Finance Management Tools

Online banking not only provides a convenient way to access and manage accounts, but it also offers a range of personal finance management tools to help users better understand and improve their financial well-being.

One of the key features of personal finance management tools is the ability to track expenses. Online banking platforms often categorize and analyze transactions, allowing users to see where their money is being spent. By visualizing spending patterns, users can identify areas where they may be overspending and make necessary adjustments to their budget.

Moreover, personal finance management tools offer budgeting features that allow users to set financial goals and track their progress. Users can allocate money to different spending categories, such as groceries, transportation, or entertainment, and receive alerts or notifications when they are approaching or exceeding their set budget. This feature helps users stay disciplined and accountable with their spending habits.

Online banking platforms may also provide tools to help users save and invest their money. These tools can help users set savings goals, track progress, and even automate regular transfers into savings accounts or investment portfolios. By having a clear view of their savings progress, users can stay motivated and make informed decisions about their financial future.

Another valuable feature of personal finance management tools is the ability to display and analyze net worth. Users can link external financial accounts, such as investments, loans, or credit cards, to get a comprehensive view of their overall financial health. Being able to see net worth in real-time can provide users with a deeper understanding of their monetary value and assist in making informed financial decisions.

Through personal finance management tools, users can also access credit score monitoring. Online banking platforms often provide information about credit scores, updating users on any changes or fluctuations. This feature allows users to actively manage their creditworthiness and take steps to improve their credit score if needed.

Furthermore, personal finance management tools often provide users with financial insights and recommendations. Through data analysis and machine learning, these tools can suggest personalized tips and strategies to help users save more, invest wisely, and achieve their financial goals. These insights can be invaluable in providing guidance and education to users on how to improve their financial well-being.

Overall, personal finance management tools offered by online banking platforms empower users to take control of their financial lives. Through expense tracking, budgeting features, savings and investment tools, net worth analysis, credit score monitoring, and personalized recommendations, these tools provide users with the knowledge and tools to make informed financial decisions and work towards their financial goals.

Customer Support

Customer support is a critical aspect of online banking, ensuring that users have access to assistance and guidance whenever they need it. Online banking platforms are committed to providing efficient and reliable customer support to address any concerns or queries that users may have.

One of the primary channels of customer support in online banking is through a dedicated customer service helpline. Users can contact customer support representatives via phone or live chat to resolve any issues or seek clarification on various banking matters. These helplines are typically available 24/7, ensuring that assistance is accessible at any time, regardless of the user’s location.

In addition to traditional helplines, online banking platforms often offer comprehensive online help centers or knowledge bases. These resources contain frequently asked questions, step-by-step guides, and informative articles that cover a wide range of banking topics. Users can browse through these resources to find answers to common queries or to learn more about specific features and functionalities offered by the online banking platform.

Many online banking platforms also provide user-friendly interfaces that are designed to be intuitive and easy to navigate. The goal is to minimize the need for customer support by ensuring that users can independently find the information they need or perform transactions seamlessly. However, if users do require assistance while using the online banking platform, there is usually a support button or chat feature available within the interface, connecting users directly to customer support representatives.

Online banking platforms also prioritize security-related inquiries and concerns. Users may encounter situations such as a lost or stolen card, suspected fraudulent activity, or unauthorized transactions. In these cases, online banking platforms have dedicated teams and protocols in place to address and resolve security-related issues promptly. Users can report such incidents through the appropriate channels, such as the customer service helpline or the online banking platform’s secure messaging system.

Furthermore, online banking platforms are often active on social media channels, providing another avenue for customer support and engagement. Users can reach out to the online banking platform’s social media accounts with their questions or concerns, and the support team will respond accordingly. Social media can also be a platform for users to stay updated on any announcements, new features, or changes within the online banking platform.

Overall, online banking platforms strive to provide comprehensive and reliable customer support to ensure a positive user experience. Through helplines, online help centers, user-friendly interfaces, dedicated security teams, and social media engagement, online banking platforms aim to promptly address customer queries and provide the necessary guidance and assistance for users to navigate their online banking journey smoothly.

Conclusion

Online banking has transformed the way we manage our finances, offering a plethora of features and benefits that make it an ideal choice for individuals and businesses. The convenience and accessibility provided by online banking allow users to access their accounts and perform transactions anytime and anywhere. With the ability to monitor account activity in real-time, users can stay informed about their financial position and track their spending habits more effectively.

Fund transfers have become effortless with online banking, enabling users to send money between accounts, make payments to vendors and service providers, and even send funds to family and friends. The speed and security of online fund transfers provide peace of mind and eliminate the need for traditional payment methods.

Online banking also simplifies the process of bill payments, allowing users to set up recurring payments, track payment history, and receive notifications for upcoming bills. This convenience eliminates the hassle of writing checks and ensures timely payments.

With the rise of mobile banking, users can now conveniently manage their finances on smartphones and tablets. Mobile banking applications provide an intuitive interface, enhanced security measures, and additional features to facilitate banking on the go.

Security is a top priority in online banking, and platforms have implemented robust measures, including encryption, multi-factor authentication, and fraud detection systems to protect user data and transactions.

Personal finance management tools offered by online banking platforms empower users to track expenses, set budgets, and analyze their financial health. With these tools, users can make informed financial decisions and work towards their financial goals.

Customer support is readily available in online banking, with helplines, online help centers, user-friendly interfaces, and social media engagement providing assistance and guidance whenever needed.

In conclusion, online banking has revolutionized the way we handle our finances, offering unrivaled convenience, security, and a wide range of features and benefits. Whether it’s monitoring accounts, transferring funds, paying bills, managing personal finances, or accessing customer support, online banking provides a comprehensive, efficient, and user-friendly banking experience for individuals and businesses alike.