Finance

What Can I Do With A 712 Credit Score

Published: October 21, 2023

Discover the possibilities for managing your finances with a 712 credit score. Explore how your credit rating can positively impact your financial decisions and opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- Importance of a 712 Credit Score

- Qualifying for Loans with a 712 Credit Score

- Credit Card Options for Individuals with a 712 Credit Score

- Renting or Buying a Home with a 712 Credit Score

- Insurance Options for Individuals with a 712 Credit Score

- Employment and Career Opportunities with a 712 Credit Score

- Improving and Maintaining a 712 Credit Score

Introduction

A credit score is a three-digit number that represents an individual’s creditworthiness, indicating their ability to manage borrowed money and meet financial obligations. A high credit score not only opens up various financial opportunities but also signifies responsible financial behavior. One such credit score that falls within the range of good to excellent is 712, demonstrating a solid credit standing.

In this article, we will explore the significance of a 712 credit score and the various possibilities it brings. Whether you are considering applying for a loan, renting an apartment, or even seeking employment, having a credit score of 712 can greatly benefit you.

Having a 712 credit score means that you have demonstrated a commendable history of managing your finances and repaying debts on time. This score tells lenders, landlords, insurance providers, and potential employers that you are a low-risk individual, deserving of favorable terms and opportunities.

However, it is important to note that credit scoring models may vary slightly among different lenders or institutions. While a 712 credit score is generally considered good, it is always wise to consult with specific lenders or institutions to understand their criteria and requirements.

Now, let’s delve deeper into the significance of a 712 credit score in various aspects of your financial life.

Understanding Credit Scores

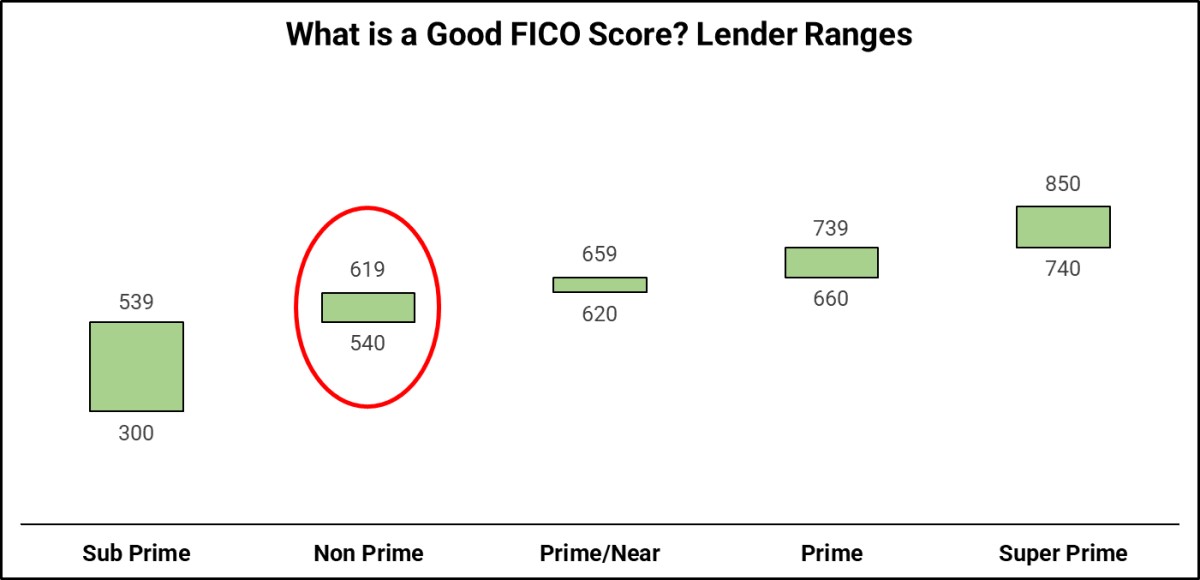

Before we explore the importance of a 712 credit score, let’s first understand how credit scores are calculated and what they represent. Most commonly, credit scores are calculated using the FICO scoring model, which assigns a score between 300 and 850. This score is based on several factors, including:

- Payment history: This accounts for the largest portion of your credit score and reflects whether you make payments on time.

- Credit utilization: This indicates how much of your available credit you are currently using. Keeping your credit utilization low is essential for a good credit score.

- Length of credit history: This considers the age of your credit accounts, including the oldest and average account ages.

- Credit mix: This takes into account the variety of credit types you have, such as credit cards, loans, and mortgages.

- New credit applications: Too many recent credit applications can negatively impact your score, as it may be an indicator of financial distress.

A credit score of 712 demonstrates responsible financial behavior and falls within the range of good to excellent. It signals that you have a track record of making timely payments, managing your credit utilization effectively, and demonstrating stability in your credit history.

Having a good credit score like 712 is crucial because it can significantly impact your financial options and opportunities. Lenders use credit scores to evaluate the level of risk they will assume when lending money to individuals. A higher credit score often translates into lower interest rates, better loan terms, and higher borrowing limits.

In addition to lending institutions, landlords, insurance providers, and even potential employers may consider credit scores to assess an individual’s reliability and trustworthiness. Therefore, having a 712 credit score can open doors to better rental options, lower insurance premiums, and even improved employment prospects.

Now that we have a firm understanding of credit scores, let’s explore the specific benefits and possibilities that come with a 712 credit score.

Importance of a 712 Credit Score

A 712 credit score holds significant importance in various financial aspects of your life. It signifies your responsible financial behavior and can unlock a range of benefits and opportunities.

One of the key advantages of having a 712 credit score is the ability to qualify for loans with favorable terms. Lenders consider individuals with good credit scores as low-risk borrowers, making them eligible for lower interest rates, higher loan amounts, and more flexible repayment options. Whether you’re looking to finance a new car, purchase a home, or invest in a business venture, a 712 credit score can help you secure the necessary funds at a cost-effective rate.

In the realm of credit cards, a 712 credit score puts you in a favorable position. Credit card issuers are more likely to offer you cards with attractive rewards programs, lower interest rates, and higher credit limits. With a good credit score, you can tap into the benefits of cashback, travel points, and other incentives that come with top-tier credit cards.

Renting a home or buying a property is another area where a 712 credit score can make a significant difference. Landlords and property managers often conduct credit checks to assess a potential tenant’s financial responsibility. With a 712 credit score, you are more likely to be approved for your desired rental property and may even negotiate more favorable lease terms. Similarly, when it comes to buying a home, a good credit score can help you secure a mortgage with a competitive interest rate and lower down payment requirements.

Insurance companies also consider credit scores when determining premiums for auto, home, and even life insurance policies. Higher credit scores are associated with lower risks, and therefore, individuals with a 712 credit score may benefit from lower insurance premiums, potentially saving a significant amount of money in the long run.

Furthermore, having a 712 credit score can positively impact your employment prospects. Some employers conduct credit checks during the hiring process to assess a candidate’s financial responsibility and trustworthiness. A good credit score can enhance your professional reputation and give you an edge over other applicants, particularly for roles that involve handling finances or sensitive information.

It’s important to note that while a 712 credit score is commendable, it should not be a reason to become complacent. Maintaining good financial habits, such as paying bills on time, keeping credit utilization low, and managing debts responsibly, is crucial for long-term financial well-being.

In the following sections, we will explore specific opportunities and benefits that come with a 712 credit score, including qualifying for loans, credit card options, housing options, insurance options, and employment prospects.

Qualifying for Loans with a 712 Credit Score

Having a credit score of 712 puts you in a favorable position when it comes to qualifying for loans. Lenders consider individuals with good credit scores as low-risk borrowers, making them eligible for a wide range of loan options with favorable terms and conditions.

With a 712 credit score, you are more likely to be approved for personal loans, auto loans, mortgages, and even business loans. Lenders see your credit score as an indicator of your ability to manage debt responsibly and make timely payments. This increases your chances of securing loans with competitive interest rates, lower fees, and more flexible repayment terms.

When applying for a personal loan, a 712 credit score demonstrates your credibility and financial stability. Lenders may be willing to offer you larger loan amounts and longer repayment periods, allowing you to consolidate high-interest debt, fund home improvements, or cover unexpected expenses.

Similarly, when it comes to auto loans, a 712 credit score can help you get approved for financing at favorable interest rates. You may qualify for lower monthly payments and have the ability to negotiate the purchase price of the vehicle confidently.

For individuals looking to buy a home, a 712 credit score is a positive signal to lenders. With this credit score, you can potentially secure a mortgage with a competitive interest rate, lower down payment requirements, and more favorable terms. It’s important to note, however, that lending criteria can vary between lenders, so it’s always recommended to shop around and compare offers to get the best deal.

If you are an aspiring entrepreneur or a small business owner, a 712 credit score can also increase your chances of obtaining a business loan. Lenders consider your personal credit history when evaluating your business creditworthiness, especially for startups or businesses without an extensive financial track record. Having a good credit score demonstrates your commitment to financial responsibility and can make lenders more willing to provide financing for your business needs.

While a 712 credit score improves your chances of qualifying for loans, it’s important to remember that other factors, such as income and debt-to-income ratio, also play a role in the lending decision. Maintaining a stable income, minimizing debt, and having a well-managed financial profile overall can further strengthen your loan application.

In the next sections, we will explore credit card options, housing options, insurance options, and employment prospects that come with a 712 credit score.

Credit Card Options for Individuals with a 712 Credit Score

Having a credit score of 712 opens up a range of credit card options for you. Credit card issuers categorize individuals with good credit scores as low-risk borrowers, making them eligible for credit cards with attractive rewards programs, lower interest rates, and higher credit limits.

With a 712 credit score, you can qualify for credit cards that offer cashback rewards, travel points, and other enticing benefits. These credit cards often come with higher credit limits, allowing you more flexibility in your spending. You may also enjoy perks such as extended warranties, purchase protection, and access to exclusive events or lounges.

Credit card issuers are more likely to offer you low-interest rate credit cards if you have a good credit score. This means you can save money on interest charges when carrying a balance or financing large purchases. Lower interest rates can significantly reduce the cost of borrowing, providing financial relief and allowing you to pay off your credit card debt more efficiently.

Furthermore, a 712 credit score puts you in a favorable position to qualify for credit cards with no annual fees. These cards can help you save money on recurring charges, allowing you to maximize your spending on purchases and rewards. Keep an eye out for credit cards that offer additional perks like introductory 0% APR periods or balance transfer options, which can help you save on interest charges or consolidate higher-interest credit card debt.

It’s important to note that responsible credit card usage is key to maintaining and improving your credit score. Make sure to pay your credit card bills on time and in full each month to build a positive payment history. Keeping your credit utilization ratio low – the percentage of available credit that you use – is also crucial for maintaining a good credit score. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

Lastly, when considering credit card options, it’s always wise to compare offers from different issuers. Each credit card comes with its own set of terms, rewards, and fees, so take the time to evaluate which card aligns best with your spending habits and financial goals.

In the next sections, we will explore housing options, insurance options, and employment prospects that individuals with a 712 credit score can enjoy.

Renting or Buying a Home with a 712 Credit Score

Having a credit score of 712 can significantly impact your ability to rent or buy a home. Landlords and mortgage lenders use credit scores as a measure of financial responsibility, and a good credit score can open doors to better housing options and more favorable terms.

When it comes to renting a home, landlords often conduct credit checks to assess the risk of potential tenants. With a credit score of 712, you are more likely to be approved for your desired rental property. A good credit score demonstrates your ability to manage your finances responsibly, giving landlords confidence in your ability to pay rent on time. This may also provide an opportunity to negotiate more favorable lease terms, such as a lower security deposit or reduced rent.

On the other hand, if you’re considering buying a home, a 712 credit score can help you secure a mortgage loan with attractive interest rates and favorable terms. Lenders are more willing to offer favorable terms to borrowers with good credit scores, as they demonstrate a lower risk of defaulting on the loan. This can result in lower monthly mortgage payments and potentially save you thousands of dollars over the life of the loan.

Having a good credit score may also impact the down payment requirements when buying a home. While the exact down payment amount depends on several factors, including the type of loan and the lender’s requirements, a higher credit score can make you eligible for loan programs with lower down payment options. This can make home ownership more accessible and affordable.

It’s important to note that while a 712 credit score is generally considered good, other factors such as income, employment history, and overall debt level are also considered by lenders and landlords. Maintaining a stable income and a low debt-to-income ratio can further strengthen your application and increase your chances of securing a rental or mortgage approval.

When navigating the housing market, it’s always helpful to work with experienced real estate professionals and loan officers who can guide you through the process and assist you in finding the best housing options and financing solutions based on your credit score and financial situation.

In the following sections, we will explore insurance options and employment prospects that individuals with a 712 credit score can benefit from.

Insurance Options for Individuals with a 712 Credit Score

Having a credit score of 712 can positively impact your insurance options and potentially lead to lower insurance premiums. Many insurance companies consider credit scores as a factor when determining insurance rates, as studies have shown a correlation between credit scores and insurance risk.

With a good credit score, you are more likely to be viewed as a responsible and low-risk individual by insurance providers. This can result in lower insurance premiums for various types of insurance, including auto insurance, home insurance, and even life insurance.

When it comes to auto insurance, a 712 credit score may make you eligible for discounts and lower premiums. Insurance companies may view individuals with good credit scores as more responsible and less likely to file claims. As a result, they may offer you better rates on your auto insurance policy. It’s important to shop around and request quotes from multiple insurance providers to find the best rate based on your credit score.

Similarly, if you own a home or are in the process of buying one, a good credit score can positively impact your home insurance premiums. Insurance companies consider credit scores as an indicator of financial responsibility and stability, which can lead to lower rates. Be sure to inquire about credits or discounts specifically for individuals with good credit scores when obtaining home insurance quotes.

Even life insurance companies can factor in credit scores when assessing an individual’s risk. While the impact of credit scores on life insurance rates may vary, having a good credit score can potentially help secure more favorable premiums. This is because a higher credit score indicates a lower risk of the policyholder defaulting on premium payments.

It’s important to note that insurance companies may use credit scores differently, and the weight they place on credit scores may vary. Some states have restrictions on how credit scores can be used in insurance pricing, so it’s essential to familiarize yourself with local regulations and understand the specific practices of insurance providers in your area.

Maintaining a good credit score is key to accessing these insurance benefits. Paying bills on time, keeping your credit utilization low, and avoiding excessive credit applications are all factors that contribute to a good credit score. Regularly reviewing your credit report and addressing any inaccuracies can also help ensure that your credit score is accurately represented.

In the next section, we will explore employment and career opportunities that individuals with a 712 credit score can enjoy.

Employment and Career Opportunities with a 712 Credit Score

While it may not be a direct consideration for every job application, your credit score can have an impact on your employment and career opportunities. In some industries and job roles, employers may choose to conduct credit checks as part of their hiring process to assess an applicant’s financial responsibility and level of trustworthiness.

A good credit score of 712 can enhance your professional reputation and give you an edge over other candidates, particularly for positions that involve handling finances or sensitive information. Employers may view a good credit score as an indicator of responsible money management and the ability to handle financial obligations with integrity.

Positions in the financial industry, such as banking, accounting, or financial advisement, often require individuals to have a solid understanding of financial responsibility. A good credit score can demonstrate your ability to manage your own finances effectively, which can be seen as a valuable asset when interacting with clients and making financial decisions on behalf of the company.

In addition, government agencies or positions that require security clearance may consider credit scores in their evaluation process. A good credit score can reflect positively on your character and may contribute to a smoother clearance process or favorable consideration for these positions.

While a credit check during the hiring process is not common for all jobs, it is always beneficial to maintain a good credit score as it portrays financial responsibility and can positively influence employers’ perceptions of you as a candidate. It’s important to note that employers must comply with local laws and regulations regarding credit checks, and they must obtain your consent before conducting such checks.

Regardless of whether credit checks are part of the hiring process, maintaining a good credit score is essential for your financial well-being and personal reputation. It demonstrates that you are responsible in managing your financial commitments, and this responsibility can extend to your work ethic and overall professionalism.

Remember, building and maintaining a good credit score requires making timely payments, keeping your credit utilization low, and managing debts responsibly. Regularly monitoring your credit report and addressing any inaccuracies or discrepancies can also help ensure the accuracy of your credit score.

In the next section, we will explore tips and strategies for improving and maintaining a 712 credit score.

Improving and Maintaining a 712 Credit Score

Having a credit score of 712 is commendable, but there are always opportunities for improvement and strategies to maintain a strong credit profile. Here are some tips to help you enhance and sustain your 712 credit score:

- Pay bills on time: Consistently making your payments on time is crucial for a good credit score. Late payments can negatively impact your score, so set up reminders or automatic payments to ensure you meet all your financial obligations promptly.

- Keep credit utilization low: Aim to keep your credit utilization ratio – the amount of credit you use compared to your total credit limit – below 30%. This shows that you are effectively managing your available credit and not relying too heavily on borrowed funds.

- Manage debt responsibly: Avoid taking on excessive debt and focus on paying off existing debts. Make more than the minimum payments whenever possible to reduce your debt load and show lenders your ability to handle financial responsibilities.

- Monitor your credit report: Regularly review your credit report to ensure its accuracy and identify any errors or fraudulent activity. Report any discrepancies to the credit bureaus and take steps to correct them promptly.

- Limit credit applications: Applying for multiple credit cards or loans within a short period can raise concerns among lenders. It’s best to limit credit applications to necessary ones and avoid any unnecessary inquiries that may negatively impact your credit score.

- Diversify your credit mix: Maintaining a healthy mix of credit types, such as credit cards, loans, and mortgages, can benefit your credit score. Showing that you can handle different types of credit responsibly adds to your creditworthiness.

- Keep old accounts open: Closing old credit accounts can potentially lower your average account age, affecting your credit score. Unless there are compelling reasons, it’s generally advisable to keep old credit accounts open and active, even if you don’t use them frequently.

Remember, improving and maintaining a good credit score is a long-term endeavor. It requires consistent financial discipline and responsible credit management over time. While changes in your credit score may not happen overnight, following these tips will set you on a path towards maintaining a solid credit profile.

Lastly, continue educating yourself about personal finance and credit management. Stay updated on changes in credit regulations and utilize tools and resources available to help you track your credit score and make informed financial decisions.

By adopting these practices, you can not only maintain a 712 credit score but also potentially improve it over time, opening up even more financial opportunities in the future.