Home>Finance>What Comes First: Income Statement Or Balance Sheet?

Finance

What Comes First: Income Statement Or Balance Sheet?

Published: March 2, 2024

Learn the sequence of financial statements in finance. Understand whether the income statement or balance sheet comes first. Gain insights into financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the financial health of a company is crucial for investors, creditors, and management. Two key financial statements, the income statement and the balance sheet, play a pivotal role in providing insights into a company's performance and financial position. The income statement, also known as the profit and loss statement, offers a snapshot of a company's profitability over a specific period, while the balance sheet provides a detailed overview of its assets, liabilities, and shareholders' equity at a given point in time.

These financial statements are essential tools for assessing a company's financial stability, profitability, and operational efficiency. However, a common question that arises is which statement should be analyzed first to gain a comprehensive understanding of a company's financial status. In this article, we will delve into the intricacies of the income statement and the balance sheet, highlighting their significance and shedding light on the order in which they should be reviewed to make informed financial decisions. Let's begin by exploring the fundamental components of the income statement.

Understanding the Income Statement

The income statement provides a summary of a company’s revenues, expenses, and profits over a specific period, typically quarterly or annually. It serves as a vital indicator of a company’s ability to generate profit by increasing revenue, reducing costs, or both. The statement starts with the company’s total revenues and then deducts the cost of goods sold (COGS) to arrive at the gross profit. From there, operating expenses such as salaries, rent, utilities, and marketing costs are subtracted to determine the operating income. After accounting for non-operating income and expenses, the statement arrives at the net income, which represents the company’s profit after all expenses have been deducted.

Investors and analysts closely examine the income statement to assess a company’s revenue trends, cost management, and overall profitability. It provides valuable insights into the company’s ability to generate earnings from its core operations, which is crucial for evaluating its financial performance and potential for growth. Additionally, the income statement allows stakeholders to compare the company’s current performance with previous periods, enabling them to identify trends and assess the effectiveness of management’s strategies and decisions.

Moreover, the income statement plays a crucial role in calculating key financial metrics such as earnings per share (EPS), profit margin, and return on equity (ROE), which are essential for evaluating a company’s financial health and making investment decisions. By analyzing the income statement, stakeholders can gain a comprehensive understanding of a company’s revenue sources, cost structure, and overall profitability, laying the foundation for informed financial analysis and decision-making.

Understanding the Balance Sheet

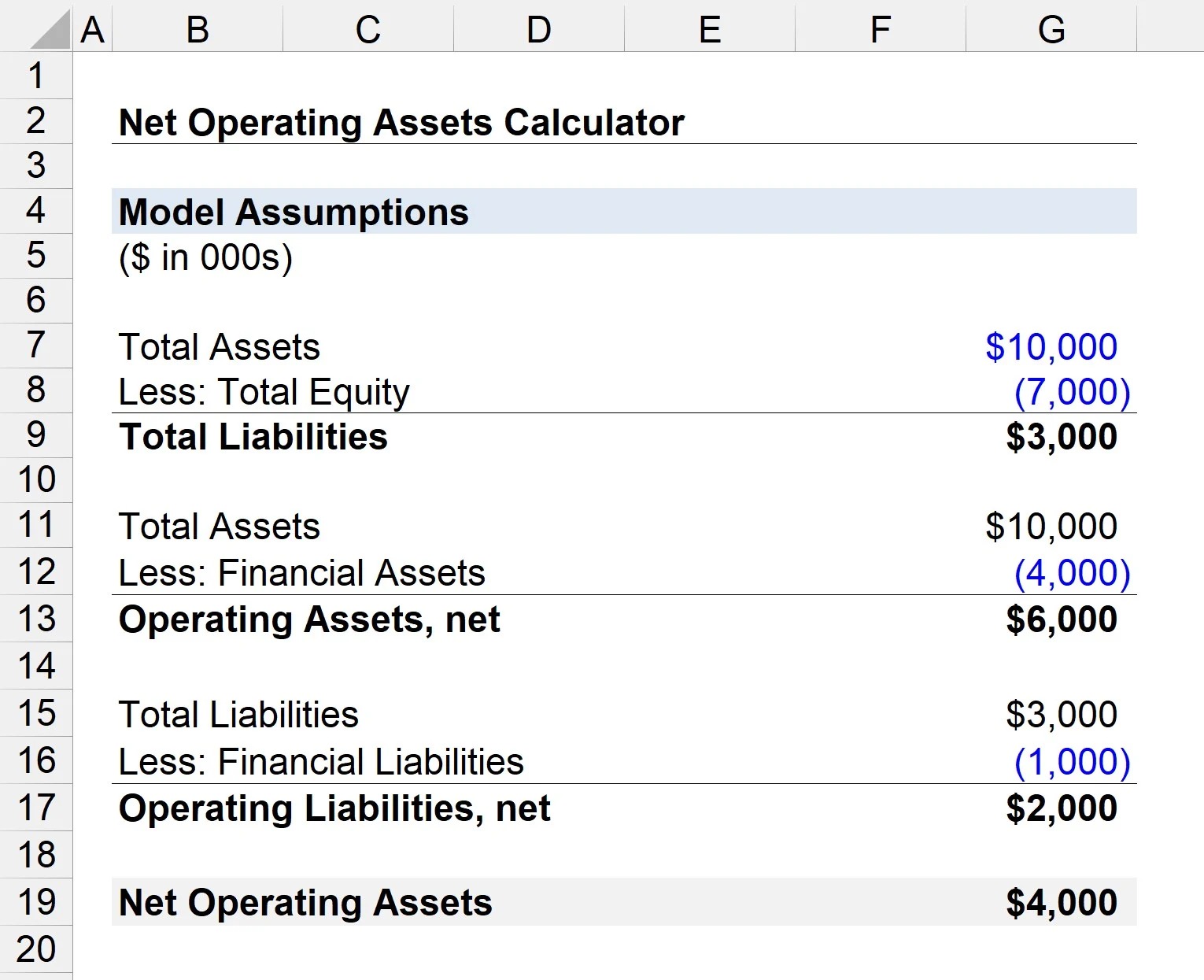

The balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time, typically at the end of a quarter or fiscal year. It presents a detailed overview of the company’s assets, liabilities, and shareholders’ equity, offering valuable insights into its solvency, liquidity, and overall financial health.

Assets, which are categorized as current and non-current, encompass everything the company owns that has value, including cash, accounts receivable, inventory, property, plant, and equipment. Liabilities, similarly categorized as current and non-current, represent the company’s obligations and debts, such as accounts payable, loans, and accrued expenses. Shareholders’ equity reflects the residual interest in the company’s assets after deducting its liabilities and represents the shareholders’ ownership stake in the company.

Analysts and investors rely on the balance sheet to assess a company’s liquidity, leverage, and ability to meet its financial obligations. By analyzing the composition of assets and liabilities, stakeholders can gauge the company’s financial flexibility and risk exposure. Additionally, the balance sheet serves as a foundation for calculating key financial ratios, including the debt-to-equity ratio, current ratio, and return on assets, which are instrumental in evaluating a company’s financial strength and risk profile.

Furthermore, the balance sheet facilitates comparisons between a company’s assets and liabilities, providing insights into its capital structure and working capital management. It also aids in identifying trends in the company’s financial position over time, enabling stakeholders to assess its ability to fund operations, invest in growth opportunities, and withstand economic downturns.

Overall, the balance sheet is a critical financial statement that offers a comprehensive view of a company’s financial resources, obligations, and ownership structure. It serves as a cornerstone for financial analysis and decision-making, providing stakeholders with essential information to evaluate a company’s financial stability and make informed investment and lending decisions.

Importance of the Income Statement

The income statement holds significant importance in financial analysis and decision-making for various stakeholders, including investors, creditors, and management. Its primary role lies in providing a comprehensive overview of a company’s profitability and operational performance over a specific period, offering valuable insights into the company’s revenue-generating capabilities, cost management, and overall financial health.

For investors, the income statement serves as a crucial tool for evaluating a company’s potential for generating returns on their investment. By analyzing revenue trends, gross and net profit margins, and earnings per share (EPS), investors can assess the company’s ability to sustain and grow its profitability, which is essential for making informed investment decisions. Additionally, the income statement enables investors to compare a company’s performance with industry peers and historical data, aiding in the identification of potential investment opportunities and risks.

Creditors and lenders also rely on the income statement to assess a company’s ability to generate sufficient cash flows to meet its debt obligations. By examining the company’s net income, operating cash flows, and profitability ratios, creditors can gauge the company’s capacity to service its debt and evaluate the risk of default. This information is vital for creditors when extending credit or loans to the company, as it influences their lending decisions and terms.

From a management perspective, the income statement plays a pivotal role in evaluating the effectiveness of business operations and strategic decisions. By closely monitoring revenue growth, expense control, and profitability, management can identify areas of strength and weakness within the business, enabling them to make informed adjustments to improve performance and achieve financial objectives. Moreover, the income statement aids in setting realistic financial targets, assessing the impact of cost-saving initiatives, and guiding resource allocation to drive sustainable growth.

Overall, the income statement holds immense importance as a tool for assessing a company’s financial performance, profitability, and potential for growth. It provides stakeholders with critical insights into the company’s revenue sources, cost structure, and operational efficiency, serving as a foundation for informed investment, lending, and strategic decision-making.

Importance of the Balance Sheet

The balance sheet holds significant importance in financial analysis and decision-making, offering valuable insights into a company’s financial position, solvency, and liquidity. It serves as a vital tool for stakeholders, including investors, creditors, and management, providing a comprehensive overview of the company’s assets, liabilities, and shareholders’ equity at a specific point in time.

For investors, the balance sheet plays a crucial role in assessing a company’s financial stability and risk exposure. By analyzing the composition of assets and liabilities, investors can evaluate the company’s ability to meet its financial obligations and withstand economic downturns. Additionally, the balance sheet aids in calculating key financial ratios, such as the debt-to-equity ratio and current ratio, which are instrumental in evaluating the company’s leverage, liquidity, and overall financial health. This information is essential for investors when making investment decisions and assessing the company’s long-term viability.

Creditors and lenders rely on the balance sheet to evaluate the company’s ability to repay debts and manage its financial obligations. By examining the company’s current assets, working capital, and debt levels, creditors can assess the company’s capacity to service its debt and determine the risk of default. This analysis influences the creditors’ decisions when extending credit or loans to the company, impacting the terms and conditions of the lending agreements.

From a management perspective, the balance sheet provides critical insights into the company’s financial resources, capital structure, and working capital management. By monitoring the composition of assets and liabilities, management can assess the company’s liquidity position, capital allocation strategies, and overall financial flexibility. This information is instrumental in guiding strategic decisions related to financing, investment, and operational planning, enabling management to optimize the company’s financial structure and support sustainable growth.

Furthermore, the balance sheet facilitates comparisons of a company’s financial position over time, allowing stakeholders to identify trends, assess the impact of business decisions, and track the company’s financial performance. It serves as a foundation for comprehensive financial analysis, offering stakeholders essential information to evaluate the company’s financial stability, capital adequacy, and ability to fund operations and growth initiatives.

Overall, the balance sheet holds immense importance as a tool for assessing a company’s financial position, solvency, and liquidity. It provides stakeholders with critical insights into the company’s financial resources, obligations, and ownership structure, serving as a cornerstone for informed investment, lending, and strategic decision-making.

Which Comes First: Income Statement or Balance Sheet?

When analyzing a company’s financial performance and position, the question often arises: which financial statement should be reviewed first, the income statement or the balance sheet? The answer lies in understanding the distinct roles of these two financial statements and their complementary nature in providing a comprehensive view of a company’s financial status.

While both the income statement and the balance sheet are essential components of financial reporting, they serve different purposes and offer distinct perspectives on a company’s financial health. The income statement provides a summary of a company’s revenues, expenses, and profitability over a specific period, offering insights into its operational performance and ability to generate earnings. On the other hand, the balance sheet presents a snapshot of the company’s assets, liabilities, and shareholders’ equity at a specific point in time, providing a detailed overview of its financial position and capital structure.

Considering the complementary nature of these financial statements, it is often recommended to begin the financial analysis with the income statement. The income statement offers a dynamic view of the company’s performance over a specific period, highlighting its revenue-generating capabilities, cost management, and overall profitability. By reviewing the income statement first, stakeholders can gain insights into the company’s revenue trends, expense control, and operational efficiency, laying the foundation for a comprehensive assessment of its financial performance.

Once the income statement has been analyzed to understand the company’s profitability and operational efficiency, attention can then be directed to the balance sheet. The balance sheet provides a static view of the company’s financial position at a specific point in time, offering insights into its asset composition, debt levels, and equity structure. By examining the balance sheet, stakeholders can assess the company’s liquidity, leverage, and overall financial stability, gaining a comprehensive understanding of its financial resources and obligations.

By following this sequential approach, starting with the income statement and then proceeding to the balance sheet, stakeholders can gain a holistic view of a company’s financial status. This method allows for a comprehensive analysis of the company’s operational performance, profitability, financial position, and capital structure, providing essential insights for making informed investment, lending, and strategic decisions.

Ultimately, while both the income statement and the balance sheet are integral to financial analysis, the sequential review of these statements, beginning with the income statement and followed by the balance sheet, offers a structured and comprehensive approach to understanding a company’s financial health and performance.

Conclusion

In conclusion, the income statement and the balance sheet are indispensable tools for assessing a company’s financial performance, profitability, and financial position. These financial statements offer distinct yet complementary perspectives, providing stakeholders with essential insights into a company’s operational efficiency, revenue-generating capabilities, capital structure, and overall financial health.

The income statement serves as a dynamic indicator of a company’s profitability over a specific period, offering insights into its revenue trends, expense control, and operational performance. It plays a pivotal role in evaluating a company’s ability to generate earnings from its core operations, making it an essential component of financial analysis for investors, creditors, and management.

On the other hand, the balance sheet offers a static view of a company’s financial position at a specific point in time, presenting a detailed overview of its assets, liabilities, and shareholders’ equity. It provides critical insights into the company’s liquidity, leverage, and financial stability, serving as a cornerstone for assessing its financial resources, obligations, and capital structure.

When considering the order in which these financial statements should be reviewed, it is advisable to start with the income statement followed by the balance sheet. This sequential approach allows stakeholders to gain a comprehensive understanding of a company’s operational performance, profitability, financial position, and capital structure, enabling informed decision-making and strategic planning.

By leveraging the insights provided by the income statement and the balance sheet, stakeholders can make informed investment decisions, assess a company’s ability to meet its financial obligations, and evaluate its potential for sustainable growth. These financial statements serve as fundamental tools for financial analysis and decision-making, empowering stakeholders to navigate the complexities of the financial landscape and make sound investment, lending, and strategic choices.

In essence, the income statement and the balance sheet are not standalone documents but rather integral components of a comprehensive financial reporting framework. By understanding their significance and leveraging their insights, stakeholders can gain a holistic view of a company’s financial health, laying the groundwork for informed and strategic financial analysis and decision-making.